Surge Exploration CEO: Mergers and Acquisitions in British Columbia’s Golden Triangle on the Rise

Surge Exploration CEO Tim Fernback joined the Investing News Network to talk about mergers and acquisitions near the company’s properties in British Columbia.

According to Surge Exploration (TSXV:SUR,OTCQB:SURJF,FWB:DJ5C) CEO Tim Fernback, interest in gold exploration properties is on the rise in British Columbia, especially in the Golden Triangle.

This can be seen in the numerous examples that Fernback provided in the interview below. He believes that the increase in activity in these prolific mining regions is due to the rise in gold prices and the exceptional drilling results in the area.

In 2018, Surge Exploration decided to acquire gold properties in British Columbia in a region known for its copper and gold content. The company settled on three projects in the Omineca, Golden Triangle and Quesnel trough regions. According to Fernback, Surge Exploration’s acquisition model has proven to be a good one as the company’s neighbors are highly active on their properties and have received “great results.”

These excellent results are driving attention to these three regions in British Columbia. Companies like Teck Resources (TSX:TECK.A,NYSE:TECK) and mining industry leaders like Eric Sprott have invested in Surge Exploration’s neighbors. Osisko Gold Royalties (TSX:OR) has also made a bid to acquire Barkerville Gold Mines (TSXV:BGM), a company valued at C$338 million that is beside Surge Exploration’s property near Barkerville, BC.

Fernback also touched on the rising price of gold. He believes that the uncertainty of the US dollar will lead to more interest and money being invested in the gold space, as gold is a natural hedge to the US dollar. Overall, Fernback believes that the interest in the gold market will continue to rise into the new year due to the US elections taking place in November 2020.

Below is a transcript of our interview with Surge Exploration CEO Tim Fernback. It has been edited for clarity and brevity.

Investing News Network: Please provide our investor audience with an overview of Surge Exploration and its gold properties in British Columbia.

Surge Exploration CEO Tim Fernback: In 2018, we made a strategic decision to acquire gold properties in Northwest and Central British Columbia in regions known for copper and gold mining in the past. We have management and advisors that are very experienced in gold mining in the province. We have targeted areas that we feel have the most potential, like the Omineca, Golden Triangle and Caribou Mining regions.

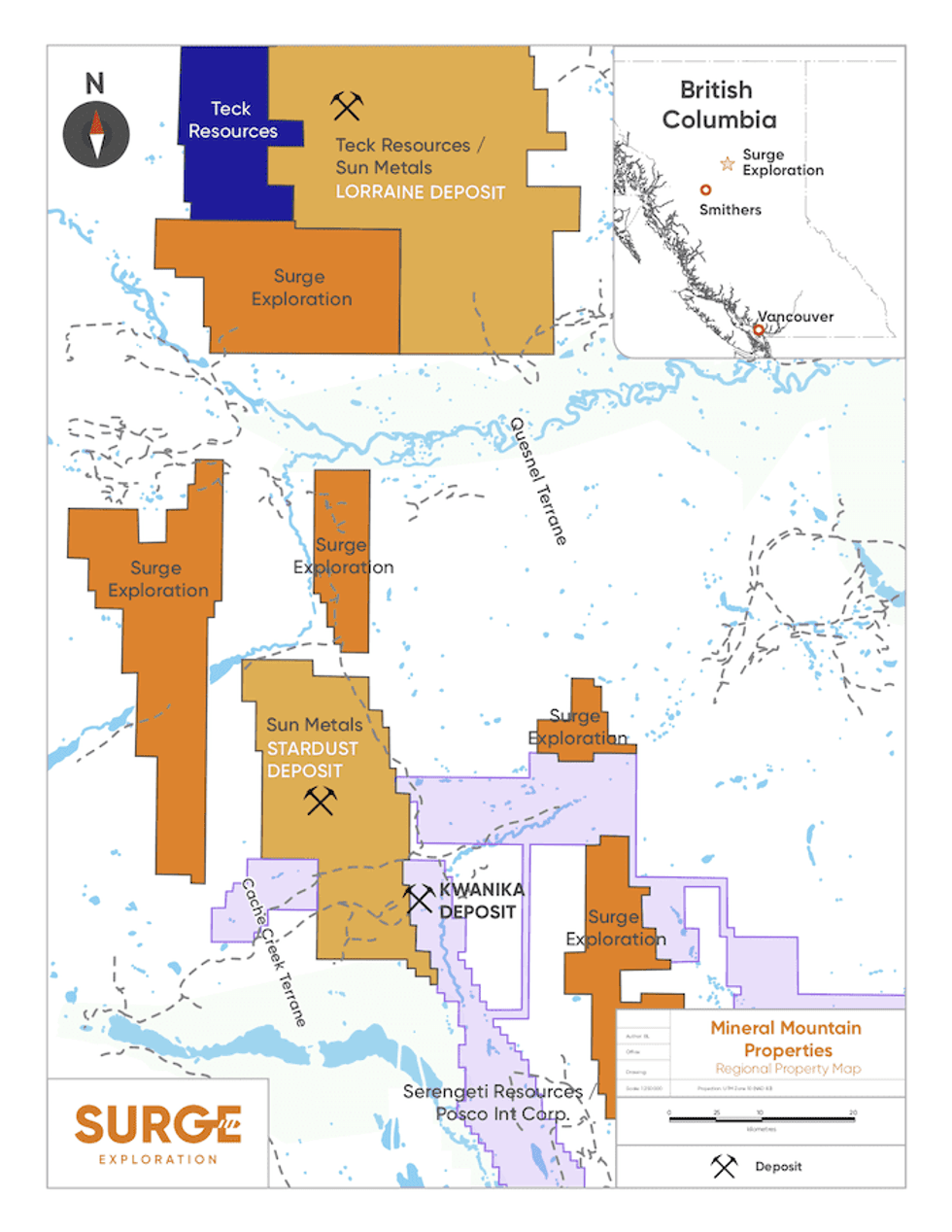

We’ve proven our model because our neighbors at each of our three properties have been incredibly active and have received excellent results from their exploration activities. Our 265 square kilometer Mineral Mountain property is in the Omineca gold region, which is north of Prince George, British Columbia. Neighboring properties in the area are owned by Serengeti Resources (TSXV:SIR) and Sun Metals (TSXV:SUNM) and have deposits identified on them.

Teck Resources is a significant investor in Sun Metals. They also have an additional property beside our Mineral Mountain claims that is jointly owned by Teck Resources and Sun Metals centered around the Lorraine gold deposit. We think that we’re in the right region. We have identified our exploration plan, completed preliminary exploration on our properties and are putting together a detailed exploration plan for next year.

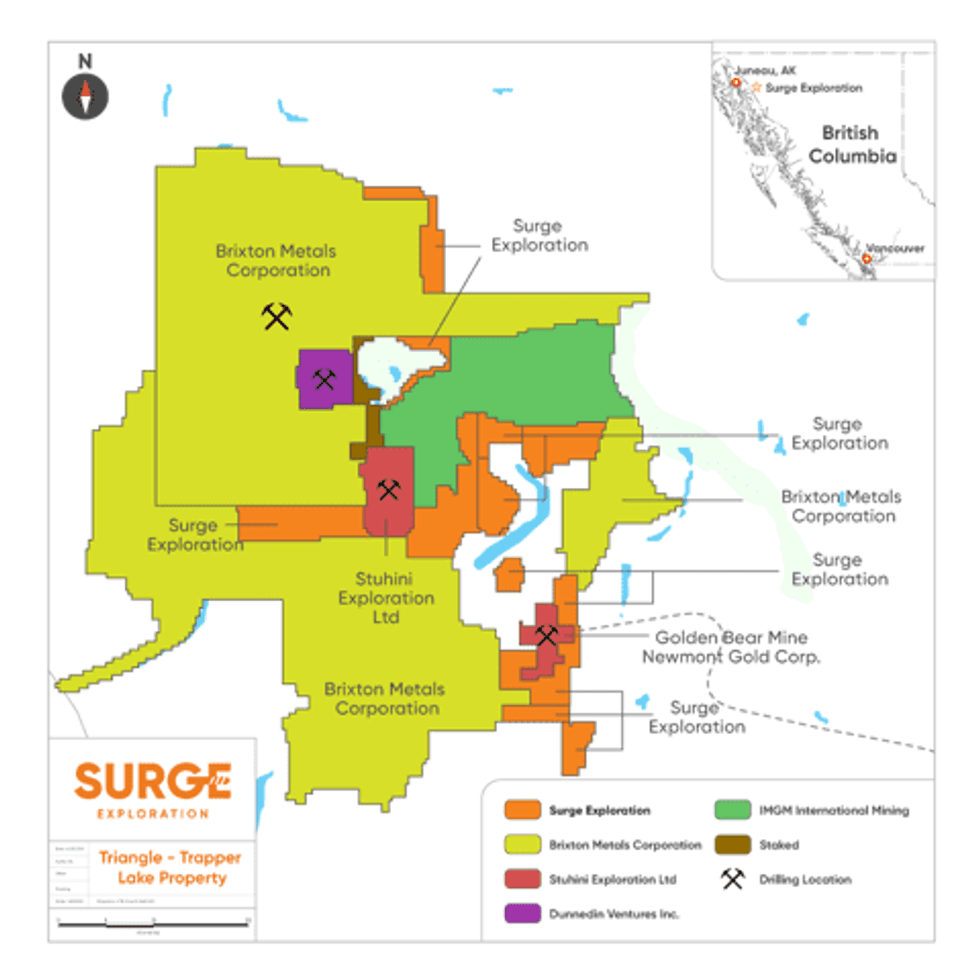

We have also staked ground and are working on the Trapper Lake project in BC’s Golden Triangle. We’ve staked a 213 square kilometer property near Brixton Metals (TSXV:BBB) and Stuhini Exploration (TSXV:STU). Newmont Goldcorp (TSX:NGT,NYSE:NEM) also owns the past-producing Golden Bear mine. Our properties are on trend with the deposits at Brixton and Stuhini and the Golden Bear mine. We like this area quite a bit. Brixton has had some great gold results with huge intersections of 1.97 grams per tonne (g/t) gold equivalent over 554 meters, and Eric Sprott has recently put a sizable amount of money into both Brixton and Stuhini.

We have completed some early exploration on our properties and have reviewed the past exploration data, so we’re ready to go into the new year with our exploration program. The Golden Triangle has seen a lot of interest from other juniors. We believe that the northwest corner of the Golden Triangle is the area to focus on as it hosts Brixton Metals and other major gold mines. We’ve gone all-in on this area.

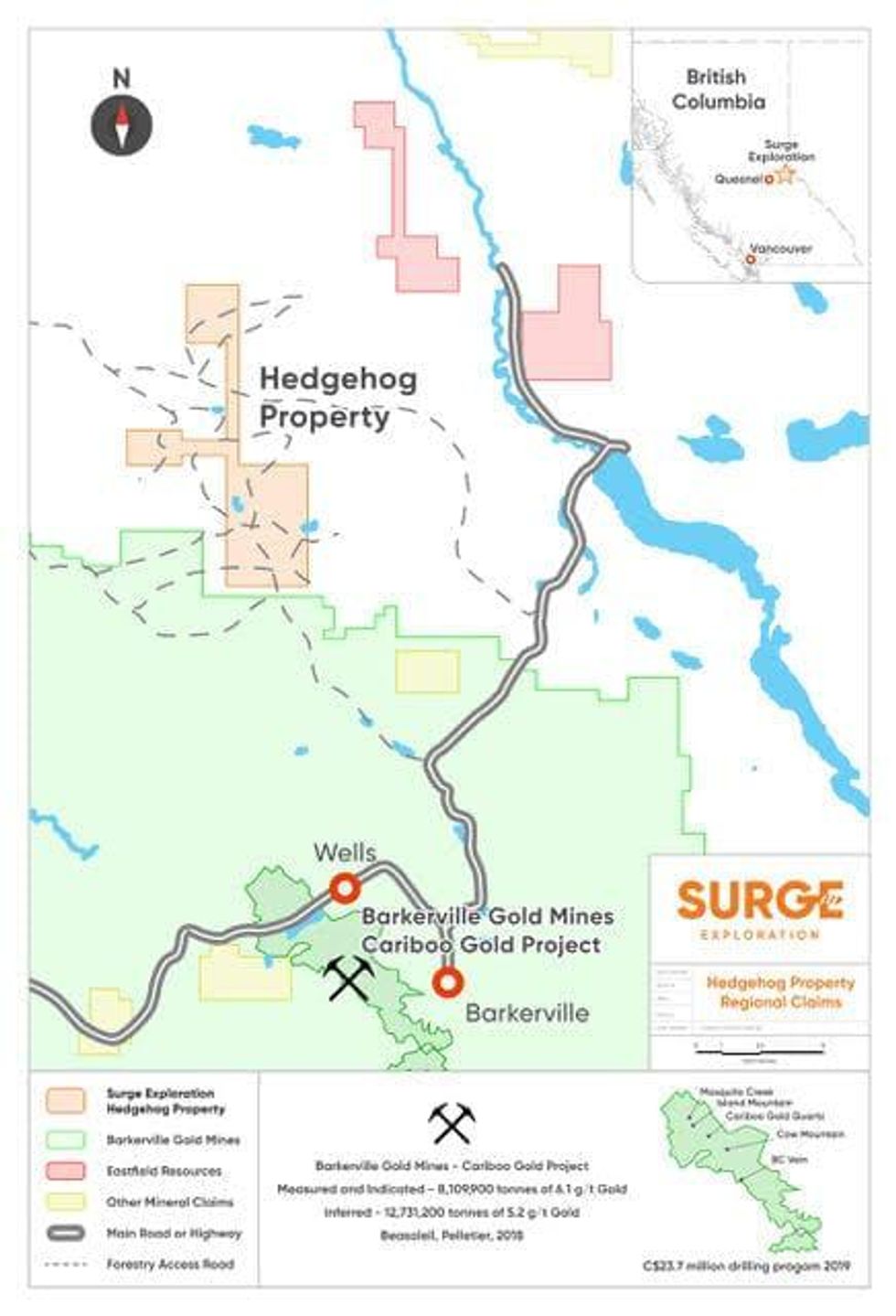

We have another property closer to Barkerville, BC, another historical gold area in central British Columbia. We’ve acquired a project from Eastfield Resources (TSXV:ETF), and it’s right beside the Barkerville gold mine. The property adjoins Barkerville Gold Mines’ Cariboo project, and we’re approximately 10 kilometers from the center of the Cariboo deposit. Barkerville Gold has put approximately C$24 million in exploration on its property this year alone. They have a resource of 2.4 million ounces grading 5.6 g/t gold. We think that we’re on trend with that deposit.

Bill Morton has been one of our advisors for years and is also an advisor for Sun Metals. He knows the area quite well and is bullish on the region. We believe that we’ve got a good set of claims in the north-central and northwest regions of British Columbia.

INN: Could you please provide an update on the Stardust project?

TF: The Stardust project is close to our Mineral Mountain claims. Last year, Sun Metals spent C$5 million in drilling, and they’re spending about C$5 million in drilling again this year and just realized another C$6 million in flow-through funds for 2020. They have been releasing results with good gold and copper numbers at the Stardust claim. Sun Metals intersected over 100 meters grading roughly 5 percent copper equivalent, which is pretty mind-blowing in terms of copper and gold in British Columbia. They’ve been conducting directional drilling around their claim. I think they have three drill rigs on the property currently, and drilling is ongoing. They are releasing results all the time.

Our properties are near the Stardust claim, but the Kwanika and Lorraine deposits are also in the same area. We believe that an area play may develop as there are quite a few active explorers, like ourselves, in the region. We’re happy to see the results of our neighbors, but we’re more excited to see what our results will be once we get the bulk of our exploration done next year.

The difference between Stardust and Hedgehog is that Barkerville Gold has a vast land position and a defined resource on their deposit. We are 10 kilometers from the center of the Barkerville Gold Mines deposit, which the company is currently expanding. I would say that there’s a high probability of it becoming a mine.

There has been historical mining going on in this area for over 100 years. Osisko owns about 18 percent of Barkerville Gold and has recently made a bid to acquire the rest of the company, which would value Barkerville Gold at C$338 million. Our property is adjacent to Barkerville’s property. We believe that there is a lot of potential on our land based on what is happening around us. The Barkerville area has seen over 100 years of gold mining, and there are small gold mines all over the place. The Barkerville Gold property is an advanced property that’s going into development. I think it’s a great setting for our land position but also for neighboring properties.

Osisko is valuing the company at C$338 million and wants to take over the entire thing. I think this is excellent news. The fact that Sun Metals is doing well and that Teck Resource is a big believer in the Mineral Mountain property is also good news for us. Eric Sprott buying into Brixton and Stuhini, our neighbors in the Golden Triangle, is also good news for us. All three of our properties have great things happening in and around them.

INN: How has the price of gold affected Surge’s operations?

TF: The price of gold has increased over the last year. I believe that it’s gone over the investment inflection point as people are becoming more interested in gold. In the past month it has softened, but that’s what happens with commodity prices. It goes up quite a bit, and then it pulls back slightly.

I think, long-term, that gold will experience a solid uptick in price. This bodes well for investment interest in our company and properties, which we believe are positioned to exploit rising gold prices. I think there’s going to be uncertainty in the US dollar going into the US November 2020 presidential elections, which could benefit gold as the commodity is used as a natural hedge to the dollar. In the short- and long-term, I think we’ll also see improved gold commodity prices from where we are today.

INN: Have there been more mergers and acquisitions in the Golden Triangle as gold prices rise? What is happening with the staking rush near your Triple Lake project beside Brixton’s Thorn project?

TF: There have been many mergers and acquisitions in the Golden Triangle. British Columbia as a whole has seen quite a few large transactions, such as Osisko’s bid for Barkerville Gold. Where we are in the Golden Triangle, however, has seen a bit of a staking rush. Brixton has recently doubled its land claims in the area of the Thorn property, and we have also added to the size of our property as well. Newmont Goldcorp’s Golden Bear mine has captured a lot of interest lately. I think that we’re the second-largest landholder in the area, aside from Brixton. As I mentioned, Eric Sprott has invested C$4 million in Brixton and has put a sizeable amount into Stuhini. We’re near all of those properties and the Golden Bear mine.

INN: What is next for Surge, and how does that fit into the company’s long-term goals?

TF: We are planning multiple exploration programs for our British Columbian gold and copper properties. We have completed the base work, surface sampling and trenching and have started to identify potential drill targets. At Hedgehog, for example, we’re finishing up our large rock and soil sampling program. We’re also getting material back from the assay lab, which will help us confirm our plans for the next stage of exploration.

We’re using the same systematic approach to Mineral Mountain and our other properties in the Golden Triangle. It’s an important phase for the company, and we intend to show results from that exploration. Hopefully, we’ll be on the ground and exploring our other properties next year as we finish up this year at Hedgehog.

We also have a series of cobalt-focused properties in Ontario that we consider to be gems in our portfolio. They have a historical cobalt resource on a high-grade cobalt deposit. The cobalt commodity price hit its highest point a year ago. It’s now starting to trend upwards again but it hasn’t fully recovered yet.

As the electric vehicle (EV) revolution continues, and more people buy EVs, the use of cobalt in batteries will go up. We think there will be a growing demand for the metal, and we’re well-positioned to meet that demand. Our property is close to First Cobalt (TSXV:FCC,OTCQX:FTSSF), which is opening a cobalt refinery in the area. We have finalized agreements with Glencore (LSE:GLEN), the world’s largest cobalt producer, to offtake our properties. We have purchased properties from Glencore in the past as well.

Glencore is also financing the opening of First Cobalt’s refinery. I think that cobalt will be a big news story in the future. Commodity prices are down right now, but we believe that our cobalt projects will be a significant asset for the company.

This interview is sponsored by Surge Exploration (TSXV:SUR,OTCQB:SURJF,FWB:DJ5C). This interview provides information which was sourced by the Investing News Network (INN) and approved by Surge Exploration in order to help investors learn more about the company. Surge Exploration is a client of INN. The company’s campaign fees pay for INN to create and update this interview.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Surge Exploration and seek advice from a qualified investment advisor.

This interview may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, receipt of property titles, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. The issuer relies upon litigation protection for forward-looking statements. Investing in companies comes with uncertainties as market values can fluctuate.