Enertopia CEO: EVs Are Driving Lithium Market Growth

Enertopia CEO Robert McAllister provides insight on the lithium market and how claystone projects in Nevada might supply demand growth.

Enertopia (CSE:TOP,OTCQB:ENRT) CEO Robert McAllister believes there is significant potential in the Clayton Valley, Nevada claystone projects, such as the one held by the company.

In the interview below, McAllister addressed the recent positive assay results from Enertopia’s Clayton Valley project and provided insight into the company’s next steps. He also outlined the role that demand for electric vehicles (EVs) has played in the growth of the lithium market.

Below is a transcript of our interview with Enertopia CEO Robert McAllister. It has been edited for clarity and brevity.

Investing News Network: Please give our investor audience an overview of Enertopia and its Clayton Valley project in Nevada.

Enertopia CEO Robert McAllister: Enertopia decided in 2016 that the lithium space offered the opportunity to create shareholder value by being in a sector with incredible growth prospects, particularly with the growing adoption of EVs now and over several decades to come.

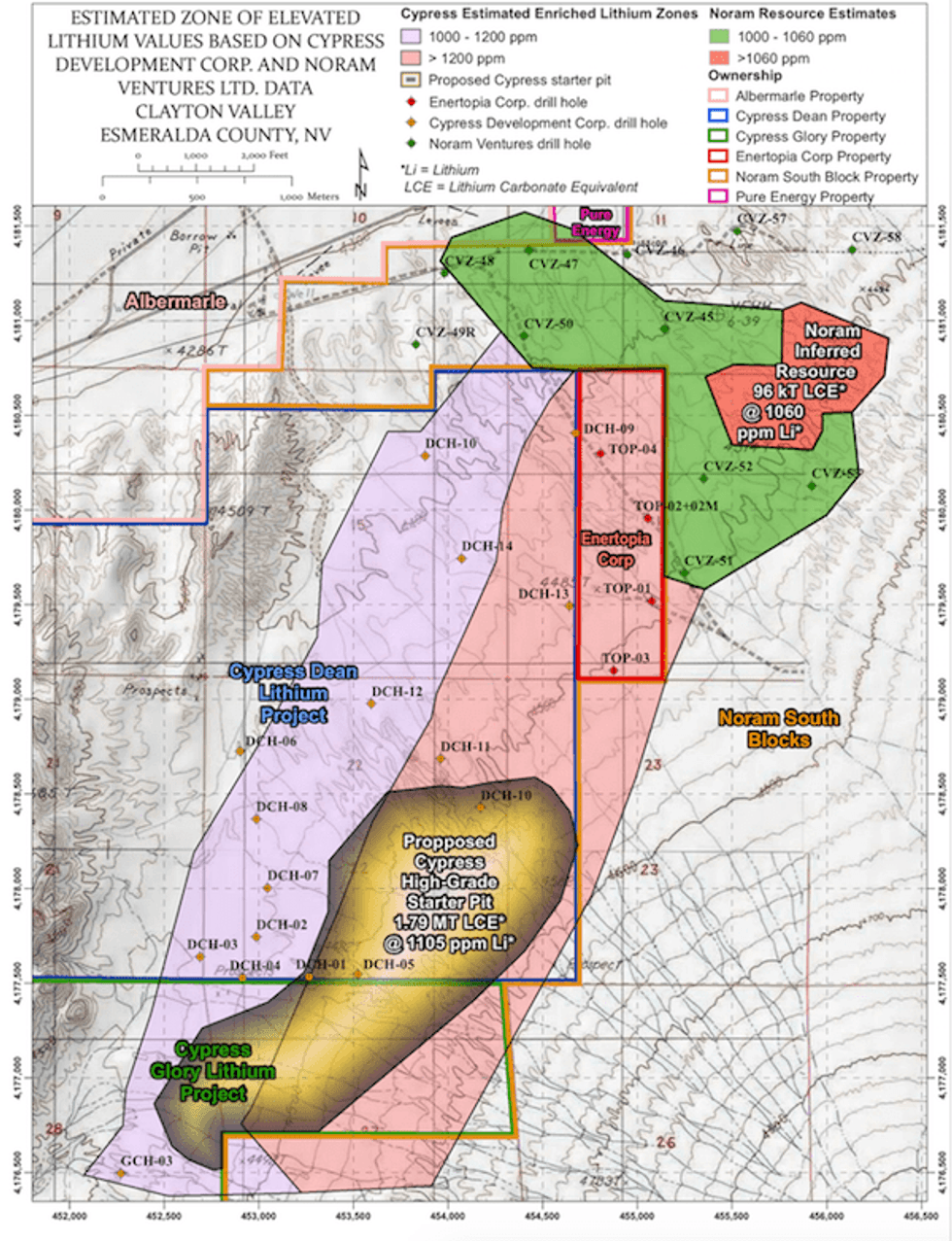

When doing our regional reconnaissance, we found a piece of land that had not been staked in the Clayton Valley. Even more unusual, a third party had drilled a hole nearby the open land that returned 281 feet of over 1,000 ppm lithium. This led us to stake the property and we did surface sampling that returned results from 500 ppm to over 4,000 ppm lithium.

INN: Please tell us about the significance of having your projects nearby existing resources.

RM: Mining is normally an expensive business and the farther one is from civilization the higher the cost is for exploration work and the ultimate buildout of a mine. Fortunately for us and our shareholders, our project is only 2.5 miles off a paved highway, with half of the distance on the well-kept gravel road used by Albermarle (NYSE:ALB), the only lithium producer in the United States. To have a road-accessible project with power a few hundred meters away is a big positive. Throw in a long history of silver, gold and, more recently, lithium mining and it is a great place to be.

INN: What is the significance of the recently released assays from the project? What does it mean for the project moving forward?

RM: The assays confirmed that our project is underlain by enriched lithium claystone over several hundred feet. For example, hole TOP-04 intersected 262 feet of 1,208 ppm lithium. The lithium mineralization is still open at depth at a cutoff grade above 1,000 ppm and future drilling using a larger core diameter will be recommended. Hole TOP-04 ended in mineralization of 1,480 ppm lithium over the last five feet at a depth of 297 feet.

We know from looking at both the Cypress and Noram NI 43-101 resource reports, one can come up with a pretty quick resource calculation based on grade, thickness and area extent. For example, Noram completed a shallow drill program that averaged 1,060 ppm lithium down to approximately 50 feet and it covered an area of approximately 112 acres. Based on these numbers, a NI 43-101 compliant resource of 17 million tonnes of 1,060 ppm lithium was reported, which works out to just over 96,000 tonnes of LCE (lithium carbonate equivalent). Investors can fairly easily come up with an estimate of the lithium mineralization and subsequent LCE’s that are possible in the area.

Going forward in 2019, the detailed mapping and assay correlation will allow us to do the detailed solution analysis that we need to create a detailed understanding of the lithium mineralization and potential recovery methods. To me this is the most exciting part of the project as we believe this will lead to the best decision on how to proceed in moving the project forward.

INN: What are your views on the lithium market and how it is being impacted by the growth of electric vehicles?

RM: The main driver of growth in the lithium market today is clearly the accelerating adoption of EVs. So far, demand growth for EV’s has been at the top of all the projected demand curves. On the supply side there has been considerable chatter of too many mines coming into production. From what I have seen, this is likely overstated for the not so simple reason that producing and refining lithium has everything to do with the specific chemistry that the lithium has been deposited into. This can then lead into expensive cost overruns sometimes in excess of 30 percent of original CAPEX targets.

INN: What is next for Enertopia and how does that fit into the company’s long-term plans?

RA: In general terms for 2019, our solution testing continues to lead us in learning about different ways to try and isolate the lithium ion. This in turn has opened the door to what we believe could be low CAPEX possibilities in ultimately unlocking the value of the lithium in the claystones at Clayton Valley. The lithium sector is only getting bigger and more important. In this case, time is on our side to make sure we do it right. We all must remember we are early day’s in many respects with the work being done on the claystones at Clayton Valley.

Mining analyst’s have put valuation’s on producing spodumene and brine producers and developers of anywhere from over $100 to over $400 per tonne of LCE in the ground. But they simply cannot put these valuations today on the claystone projects as there are no producing claystone projects. As such, valuations of our peers in the area with NI 43-101’s resources are in dollars per tonne.

I thought one of the best pieces of news for the industry last year was the PEA that Cypress Development (TSXV:CYP,FWB:C1Z1,OCTQB:CYDVF) put out showcasing that the claystones could be mined using conventional mining practices. This validates that lithium-enriched claystones at Clayton Valley were unique in that the lithium could be potentially recovered economically.

CEO interviews are part of investor education campaigns for clients advertising on the Investing News Network. Important news is contextualized by CEOs, and the resulting interviews are disseminated to the Investing News Network audience because they have value to market watchers.

The Investing News Network interviews a CEO for an understanding of their perspective on the company, the investment potential of the company and market news related to the company. The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities.