C3 Metals Inc. (TSXV: CCCM) (OTCQB: CUAUF) ("C3 Metals" or the "Company") is pleased to announce the 2022 exploration program at the Company's Jasperoide Project is well underway with a larger drill rig expected on site early February to replace a smaller capacity rig. A Hybrid Controlled Source Audio-Magnetotelluric ("Hybrid CSAMT") survey test was completed over the Montaña de Cobre and the Cresta Verde zones, which has identified probable feeder structures linked to a potential causative copper-gold porphyry system at depth. The larger drill rig has the depth capacity to test these targets. The existing rig will continue drilling on the Montaña de Cobre zone to further extend and evaluate the oxide copper-gold deposit delineated to date until it is changed out.

Survey highlights:

- Newly acquired Hybrid CSAMT geophysical data indicates a potential causative intrusion at depth central to mineralization at the Montaña de Cobre and Cresta Verde zones

- Strong resistivity features are identified at the intersection of the regional-scale Benoni and Constancia Faults which transect the large-scale Las Bambas and Constancia copper mines respectively

- 3D geophysical modelling highlights a potential cluster of intrusive bodies linked to mineralizing fault conduits confirming earlier geological models for Jasperoide

- The Hybrid CSAMT survey has been extended to rapidly cover the entire area permitted for exploration and drilling over the next month

- A second deeper capacity drill rig is being mobilized to site to test these compelling concealed copper-gold porphyry and stacked skarn targets

Steve Hughes, Vice President, Exploration of C3 Metals commented,

"Hybrid CSAMT is recognized by the industry as an excellent geophysics tool to identify structures that mineralizing fluids systems exploit, and can provide reliable data to a depth of over 1,500 metres or more. This trial survey has been immensely successful at delineating deep-seated, large-scale feeder structures at Jasperoide. Feeder structures, mineralized porphyry fragments and mineralization / alteration styles are important vectors that provide further evidence that a potential large-scale porphyry system occurs at depth. We look forward to testing deeper levels of the system with the arrival of a bigger rig in early February."

Kevin Tomlinson, President and CEO of C3 Metals added,

"Our 2021 program demonstrated the potential for high-grade, copper-gold deposits at Jasperoide. Now, with the oversubscribed +$19 million financing recently in hand, we have the treasury to not only expand the known high-grade deposit but to drill for the "elephant", a potential billion ton porphyry copper deposit. The combination of a growing near surface high-grade, copper-gold oxide skarn deposit and multiple large-scale porphyry copper targets provides C3 Metals with a compelling opportunity to grow an exciting new mid-tier copper company."

Hybrid Controlled Source Audio-Magnetotelluric Survey

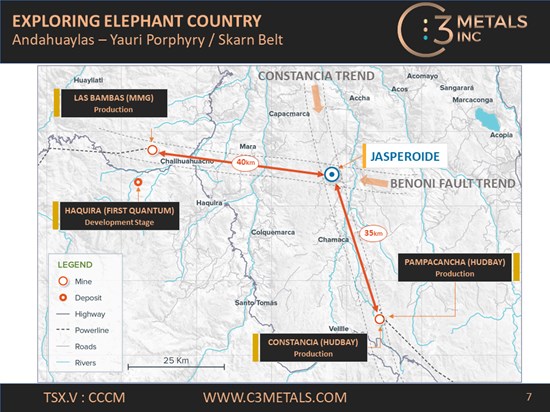

A Hybrid CSAMT geophysical survey was undertaken and completed in December 2021 to augment previously completed ground IP, geochemical, geological, airborne magnetic and radiometric surveys. HSAMT is used as an exploration tool to identify resistive and conductive features that typically correlate to structure, zones of silicification and clay alteration, to depths of over 2 kilometres. Data from the survey has outlined regionally important structures which appear to relate to the large, nearby copper deposits at Constancia and Las Bambas (Figure 1).

Figure 1: Jasperoide location map showing important deposits and structural trends

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/2661/109792_6edd09f9d443a839_001full.jpg

Inversion of the Jasperoide Hybrid CSAMT data outlines multiple deep and shallow resistive and conductive features (Figure 2). Two well-defined NNW-SSE trending linear and contiguous resistive features (+100m in width) are coincident with the Constancia Fault which trends from the Constancia copper mine 35km to the southeast and is an important structural feature at Jasperoide. Both resistive features are sub-vertical and bisect the Benoni Fault, an important east-west trending structural feature which appears to trend toward the Las Bambas copper mine 40km to the west (Figures 1 and 2). Hydrothermal alteration and geophysical features within the footprint of the large resistive features are also potentially indicative of a concealed causative porphyry.

The linear resistive features are kilometre-size in scale and show significant depth extent, coalescing at depth to where a concealed mineralized porphyry centre is interpreted. Pseudo sections for lines L600 and T3600 clearly illustrate sub-vertical resistive features and a larger resistive feature at depth (Figure 2) which the Company will test with the larger rig.

Survey Parameters

The Hybrid CSAMT survey was carried out by Geofisica TMC, a company based in Val D'Or Quebec with divisions operating in Mexico and the United States. Data points were collected on grid lines oriented ENE-WSW and NNW-SSE using 100m and 200m station spacings, covering an area of approximately 2.5km x 1.5km. Overall, data quality is considered well above average and no stations were affected by power lines, steep terrain, houses or roads.

Results were compiled into sections, grid maps and a 3D Voxel model. Inversion sections were gridded using the Kriging method at a cell size of 25 metres. Readings are statistically averaged based upon adjacent points to produce an associated value for each cell. Geofisica TMC provide high confidence in readings to a depth of 1,500 metres and readings to 2,500 metres in some locations are also considered valid.

Figure 2: Hybrid CSAMT geophysical survey data for 3900m elevation and stations on satellite imagery.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/2661/109792_6edd09f9d443a839_002full.jpg

Figure 3: (Left) Hybrid CSAMT geophysical survey data for line T3600. (Right) Hybrid CSAMT geophysical survey data for line L600. Refer to Figure 2 for line locations.

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/2661/109792_6edd09f9d443a839_003full.jpg

Near Term Forward Strategy

The Company is expediting the expansion of the Hybrid CSAMT survey to cover the entire permitted area, which is expected to take a month to complete. Drilling continues on the northern part of the Montaña de Cobre zone where grid soils defined a large copper in soil anomaly that has never been drill tested. After drilling is completed at the Montaña de Cobre zone, the rig will be moved to the Cresta Verde zone to test a large resistive feature proximal to the massive sulphides and mineralized skarn intersected in drill hole JAS4350-02.

The larger rig capable of testing for stacked skarns and the potential porphyry system to depth is scheduled to arrive shortly. This rig will test multiple porphyry targets identified by the Hybrid CSAMT survey at both the Montaña de Cobre and the Cresta Verde zones, including sub-vertical resistive features which represent high potential targets for sizeable epithermal gold-copper systems.

For additional information, contact:

Kevin Tomlinson

President & CEO

ktomlinson@c3metals.com

Alec Rowlands

Vice President, Investor Relations

+1 416 572 2512

arowlands@c3metals.com

ABOUT C3 Metals Inc.

C3 Metals Inc. is a junior minerals exploration company focused on creating substantive value for its shareholders through the discovery and development of large copper and gold deposits. The Company's flagship project is the 57km2 Jasperoide high-grade copper-gold skarn and porphyry system located in the prolific Andahuaylas-Yauri Porphyry-Skarn belt of Southern Peru. Mineralization at Jasperoide is hosted in a similar geological setting to the nearby major mining operations at Las Bambas (MMG), Constancia (Hudbay) and Antapaccay (Glencore). C3 Metals also holds a 100% interest in five licenses covering 207km2 of highly prospective copper-gold terrain in Jamaica and an interest in two porphyry copper-gold properties within the Cascade Magmatic Arc in southwestern British Columbia: a 100% ownership in the Mackenzie project covering 125 km2 and a 2% royalty in Tocvan's Rogers Creek project.

Related Link: www.c3metals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

QP Statement

Stephen Hughes, P.Geo. is Vice President Exploration and a Director for C3 Metals and is a Qualified Person as defined by National Instrument 43-101. Mr. Hughes has reviewed the technical information in this news release and approves the written disclosure contained herein.

COVID-19 Protocols

The Company continues to implement its COVID-19 safety protocols at site to ensure the safety of employees and the communities surrounding the Jasperoide project area.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. In particular, this release contains forward-looking information relating to, among other things, the exploration operations of the Company and the timing which could be affected by the current global COVID-19 pandemic. Those assumptions and factors are based on information currently available to the Company. Although such statements are based on reasonable assumptions of the Company's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions and the COVID-19 pandemic, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this release is made as of the date hereof, and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/109792