Usha Resources Ltd. ("USHA" or the "Company") (TSX-V:USHA)(OTCQB:USHAF) is pleased to announce that it has entered into a mineral property option agreement (the "Option Agreement" or "Transaction") with Ares Strategic Mining Inc. (the "Vendor") of Vancouver, British Columbia, whereby the Company has been granted the exclusive option to acquire a 100% interest in 140 mineral claims located in Jackpot Lake, Clark County, Nevada (the "Property

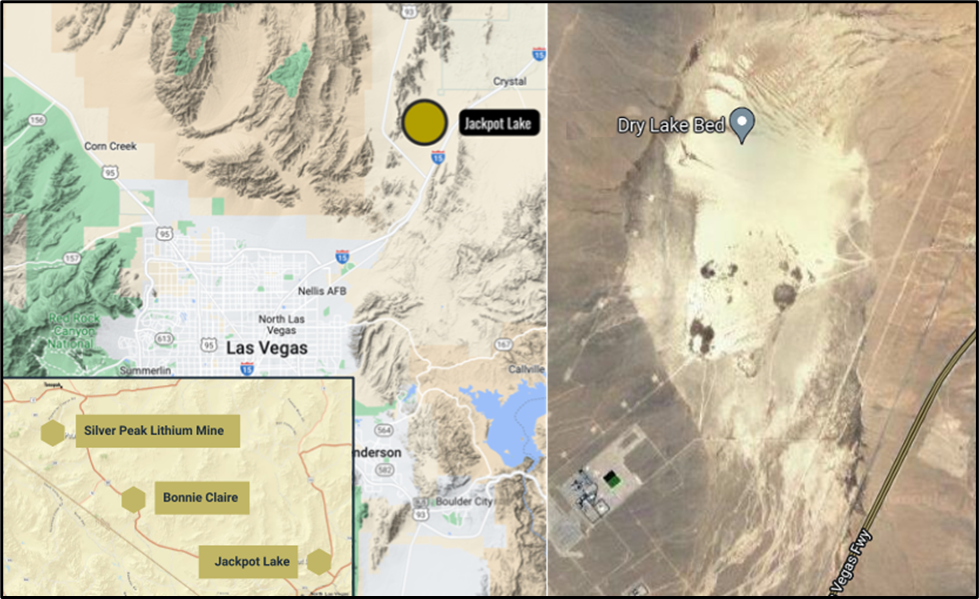

The Property is located within Clark County, 35 kilometres northeast of Las Vegas, Nevada, and is comprised of 140 mineral claims that total 2,800 acres. The project is exploring a "playa" which appears to be within a closed basin that may contain potentially lithium-rich brines. The geologic model is similar to that of Albemarle's Silver Peak Nevada Lithium Mine which has operated continuously since 1966, and Iconic Mineral's Bonnie Claire Project, which recently released a Preliminary Economic Assessment report (PEA) that indicates 40-year mine with an after-tax NPV8% of 1.5 billion, where sediments from lithium‑rich surrounding source rocks accumulate and fill the deposit leading to a potential concentration of lithium brine due to successive evaporation and concentration events.

Figure 1 - Left, location of Jackpot Lake. Right, aerial image of the "playa".

The project is considered to be "drill-ready" based on the following work which has successfully delineated a 5 x 2 kilometre anomaly within a closed basin that suggests the presence of a highly concentrated brine:

- 129 core samples collected by the USGS with an average lithium value of 175 ppm with a high of 550 ppm and spectrographic and atomic-absorption analyses of 135 stream sediment samples confirming the potential for lithium mineral deposits.

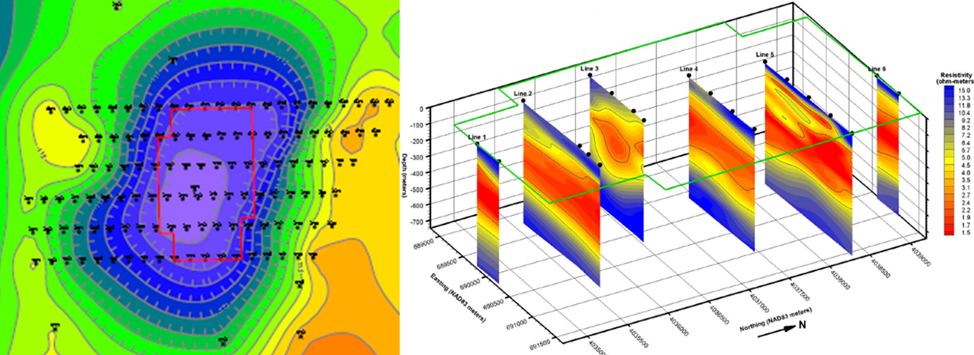

- Gravitational surveying which has identified a closed basin, critical for ensuring brines remain within the basin without dilution from external water sources.

- Geophysical modelling based upon gravitational and controlled source audio magnetotellurics/magnetotellurics (CSAMT/MT) surveys has provided evidence of highly concentrated brines which are relatively near the surface. The CSAMT survey results of the Jackpot Lake Project demonstrate a large consistent body of very low resistivity - consistent with highly concentrated brine behavior - throughout the property, predominantly above bedrock depths of 625 meters.

The CSAMT Survey and report was conducted and prepared by Hasbrouck Geophysics, who has extensive experience of both surveying and data processing for brine-bearing basin environments across the southwestern U.S.

Figure 2- Left, gravitational surveying outlined the footprint of the Jackpot lithium brine anomaly. Right, CSMAT survey slices showing a cross-section of the anomaly illustrating the highly enriched brines throughout the property in red.

Based on the above, the Company intends on completing an aggressive exploration program by drilling both shallow and deep holes to test the targets outlined by the CSAMT Survey at possible higher concentration brine zones with the goal of completing a 43-101 resource estimate by Q4 of 2022.

Deepak Varshney, CEO of Usha Resources, stated, "We are thrilled to add Jackpot Lake to our growing portfolio of "green" projects and thank Ares for partnering with us to move this project forward. Our goal is to identify high-quality projects that are near or drill-ready with high-upside that can be achieved through the completion of relatively inexpensive work programs. Lithium brine deposits have a significant cost advantage over lithium clay deposits in that lithium mineralization is much less difficult and much less expensive to process. They can also be explored through smaller drilling programs that can result in the Company identifying resource estimates much more economically. The addition of Jackpot means that 2022 will be an extremely active period for USHA with three planned drill programs giving our shareholders a number of potential catalysts across our various projects."

James Walker, CEO of Ares Strategic Mining, stated, "We are pleased to have USHA as a partner for Jackpot. Our goal was to find a well-structured and capitalized company that could move the project forward and look forward to supporting USHA as shareholders and strategic partners."

The Transaction

Under the terms of the Transaction, USHA will be able to acquire a 100% interest in the Property in exchange for the following consideration:

- $75,000 payable within five days from receiving approval from the TSX Venture Exchange (the "Exchange").

- $500,000 payable in common shares (the "Shares") of the Company within five days from the date of Exchange approval, to be issued at a deemed value at the greater of the 10-day VWAP or Discounted Market Price;

- $225,000 payable through a combination of cash or Shares of the Company (at the discretion of the Company), up to a maximum of 1,500,000 Shares, on the six-month anniversary date, to be issued at a deemed value at the greater of the 10-day VWAP or Discounted Market Price; and

- $225,000 payable through a combination of cash or Shares of the Company (at the discretion of the Company), up to a maximum of 1,500,000 Shares, on the twelve-month anniversary date, to be issued at a deemed value at the greater of the 10-day VWAP or Discounted Market Price.

Additionally, the Company will be required to complete no less than $1,000,000 worth of Expenditures on the Claims within two years unless the Option has been exercised in full.

The Vendor will return a 1% Gross Overriding Royalty (the "GORR"), subject to a buyback provision by the Company, whereby the Company may acquire, at any time, one-half of the GORR for $1,000,000.

The Option Agreement and the transactions contemplated therein, including the issuance of the Shares, is subject to the approval of the Exchange. All securities issued in connection with the Transaction will be subject to a four-month-and-one-day statutory hold period.

Qualified Person

The technical content of this news release has been reviewed and approved by Mr. Helgi Sigurgeirson, P.Geo., a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101").

About Usha Resources Ltd.

Usha Resources Ltd. is a Canadian mineral acquisition and exploration company based in Vancouver, BC, Canada. Usha is exploring for commercially exploitable mineral deposits and is currently focused on deposits located in Northwest Ontario, Canada and the Lost Basin Gold Mining District in Mohave County, Arizona, U.S.A. Usha increases shareholder value through the acquisition and exploration of quality precious and base metal properties and the application of advanced state-of-the-art exploration methods. Usha's portfolio of strategic properties provides diversification and mitigates investment risk.

We seek Safe Harbor.

Usha Resources LTD.

"Deepak Varshney" CEO and Director

For more information, please phone James Berard, Investor Relations, 778-228-2314, email info@usharesources.com, or visit www.usharesources.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements:

This news release may include "forward-looking information" under applicable Canadian securities legislation. Such forward-looking information reflects management's current beliefs and are based on a number of estimates and/or assumptions made by and information currently available to the Company that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors that may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Readers are cautioned that such forward-looking information are neither promises nor guarantees and are subject to known and unknown risks and uncertainties including, but not limited to, general business, economic, competitive, political and social uncertainties, uncertain and volatile equity and capital markets, lack of available capital, actual results of exploration activities, environmental risks, future prices of base and other metals, operating risks, accidents, labour issues, delays in obtaining governmental approvals and permits, and other risks in the mining industry.

The Company is presently an exploration stage company. Exploration is highly speculative in nature, involves many risks, requires substantial expenditures, and may not result in the discovery of mineral deposits that can be mined profitably. Furthermore, the Company currently has no reserves on any of its properties. As a result, there can be no assurance that such forward-looking statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements.

SOURCE: Usha Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/695414/Usha-Resources-Acquires-Drill-Ready-Lithium-Project-in-Nevada