- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

September 11, 2024

Aura Energy Limited (ASX: AEE, AIM: AURA) (“Aura” or “the Company”) is pleased to present the updated production target improves economics at Tiris Uranium Project.

KEY POINTS:

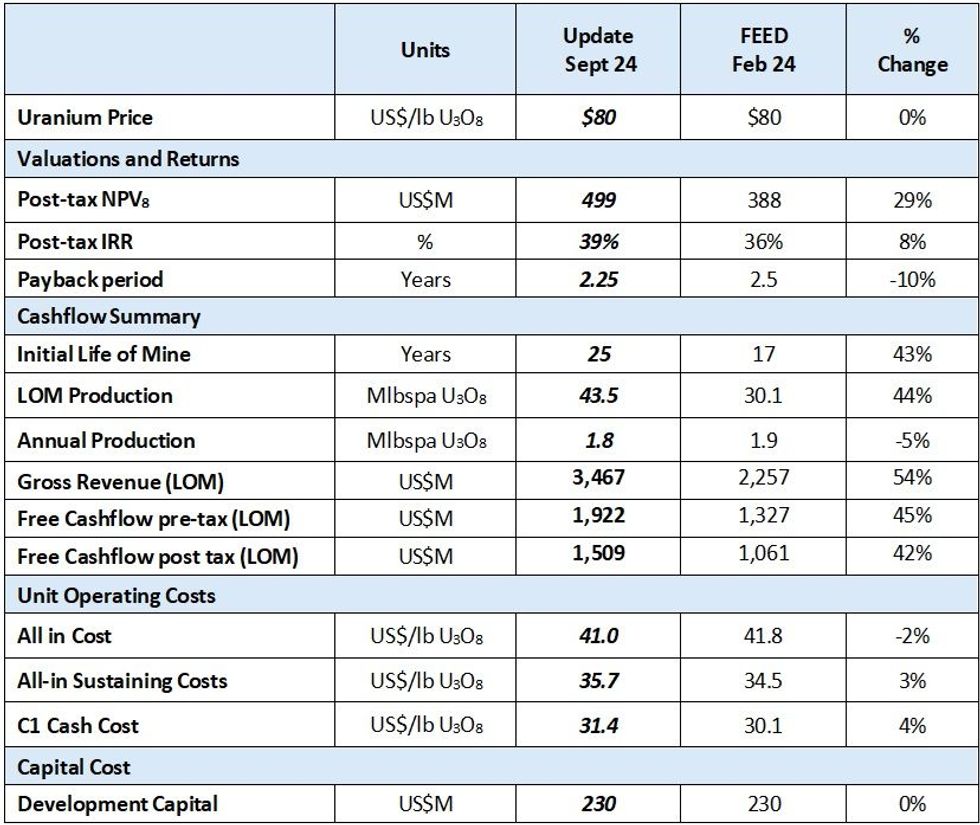

- The February 2024 Front End Engineering Design (“FEED”)1 study production target and economics has been updated using the recently expanded 91.3Mlbs U3O8 Mineral Resource2 at the Tiris Uranium Project in Mauritania

- Production Target Update increased the total Project U3O8 life of mine production by 44% to 43.5Mlbs U3O8 and extended the mine life from 17 years to 25 years

- Project economics have also significantly improved:

- NPV8% of US$499 million (A$734 million) an increase of 29%

- IRR of 39% post tax and payback only 2.25 years

- Life of Mine post tax cash flows of US$1,509 million an increase of 42%

Aura’s Managing Director and CEO, Andrew Grove commented:

"The updated economics from the Production Target Update clearly show the very significant value inherent at Tiris as Aura Energy rapidly progress towards the funding and development of the Project. The US$4.5 million drilling program undertaken earlier this year not only delivered a 55% increase In Mineral Resources3 but has also demonstrated over US$100 million of additional Project NPV, now standing at US$499 million. It is our strong belief that there is still very significant potential to continue to add to the Mineral Resource and Reserve inventory around Tiris East and across the whole northern Mauritanian region, within the 13,000km2 of tenements that Aura has under application4.

With the current large scale of the Mineral Resource Estimate inventory and future resource growth potential, the prospect for significant increase in the uranium production rate from Tiris once in production is very real and we are working on assessing, analysing and shortly presenting the results from the work currently being undertaken.

The updated Production Target study has not only increased the mine life and significantly improved the project economics but has simplified and de-risked the early mining sequence and brought forward some uranium production by 21% in the first year, and by 9% over the first five years compared to the FEED study5. These improved metrics will further support the funding process which is currently underway with indicative offers due this quarter.

The Company is rapidly working towards achieving the Final Investment Decision by the end of the current quarter with many activities underway including water drilling, engagement with EPCM contractors and operational readiness preparations. And we look forward to providing further updates on progress.”

Key highlights and outcomes of the updated Production Target:

The update to the production target for the FEED study5 has allowed revenue to be moved forward in the mining schedule and also increased the overall life of mine.

- Robust base case project financial economics demonstrated by post-tax NPV8 of US$499M (A$734M) with IRR of 39%, and a 2.25-year payback at realised uranium price of US$80/lb U3O8

- At uranium prices of US$100/lb U3O8 the economics increase to post-tax NPV8 of US$779M (A$1,145M) with IRR of 55%

- Initial mine life increased from 17 years to 25 years, producing an average 1.8Mlbspa U3O8 from the 2.0Mlbspa U3O8 capacity process plant

- Life of Mine (“LOM”) uranium production increased from 30.1Mlbs U3O8 to 43.5Mlbs U3O8

- 93% Measured and Indicated Mineral Resources in mining schedule during the first four years, LOM Inferred material totals 33% mostly beyond ten years in the mining schedule

- The open pit mining is a simple, low-risk, shallow, free digging operation without the need for crushing and grinding

- Beneficiation delivers a high-grade leach feed averaging 2,217ppm U3O8 increasing from 1,997ppm U3O8 (over first 5 years) and overall remains approximately the same at 1,752ppm U3O8 from 1,743ppm U3O8 (LOM) at a very low average cost of US$9.16/lb U3O8

- AISC has increased to US$35.7/lb U3O8, an escalation of 3% on the 2024 FEED estimate5, largely due to a minor increase in waste to ore strip ratio from 0.7 to 0.8 waste to ore tonnes

- CAPEX of US$230M, was not re-evaluated in this update and remained unchanged from the FEED study7

- Uranium production planned within 18 months of Final Investment Decision

- Modular design provides opportunities for further capital efficient expansion and scalability

- The construction and operation of the Tiris Uranium Project will deliver significant and ongoing benefits to the people of Mauritania

Modular design provides opportunities for further capital efficient expansion and scalability

The update to the Production Target based on the successful exploration drilling program to update the Mineral Resource Estimate6 confirms the value in continued growth of the Tiris Project. The modular circuit design shown in Figure 1 allows flexibility in production scheduling and potential for rapid and simple expansion of production capacity.

Click here for the full ASX Release

This article includes content from Aura Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AEE:AU

The Conversation (0)

02 June 2023

Aura Energy

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future

Fast-tracking the Tiris Uranium Project to support a clean, decarbonized future Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00