Overview

Ontario is a world-class mining jurisdiction known for its mining-friendly government, robust infrastructure and skilled local workforce. This Canadian province contains several prolific mining districts including the Abitibi Greenstone Belt and the Ring of Fire.

The Ontario government recently implemented several programs and measures to encourage investment in exploration and infrastructure related to the development of green/battery metals in Ontario, with a specific focus on the Ring of Fire. This region is one of Ontario's most promising mineral development opportunities and is known for high-grade cobalt, nickel, copper and platinum deposits.

The Abitibi Greenstone Belt, on the other hand, is considered to be one of the world's most valuable gold mining districts and the most productive gold-producing region in Canada. Since the 1990s, the geological marvel has yielded over 180 million ounces of gold and millions more in specialty and industrial metals. Several multi-million-ounce gold deposits present prospective mining companies with unparalleled exploration potential in the Abitibi.

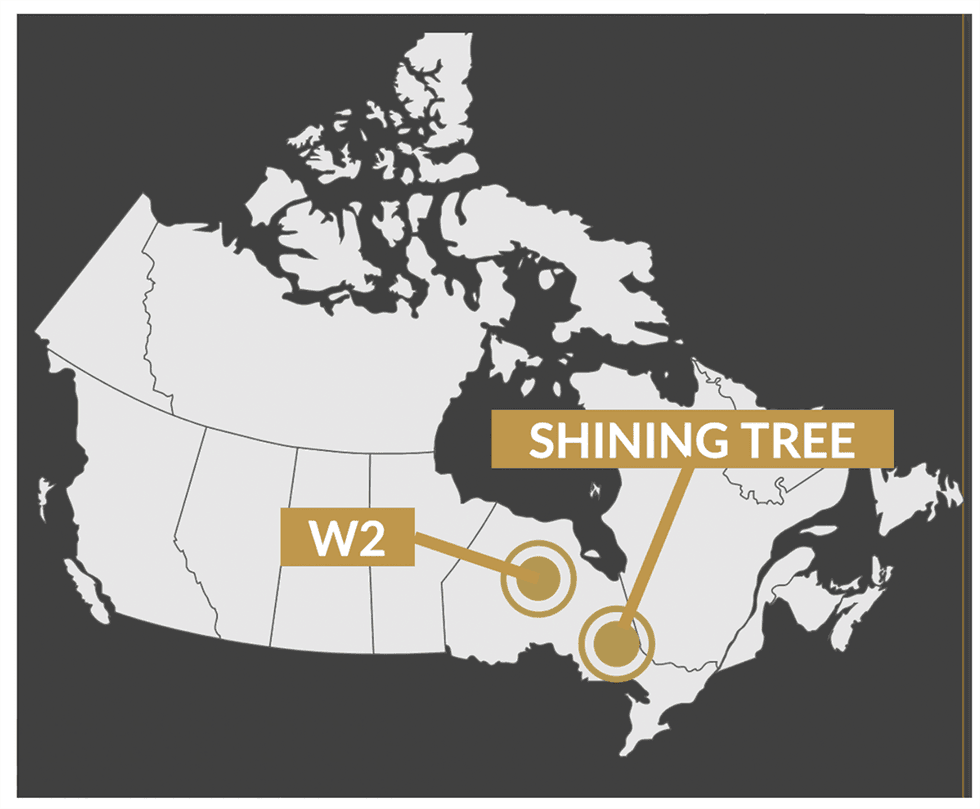

Platinex (CSE:PTX) is a junior exploration and development mining company with two district-scale opportunities targeting gold, copper, nickel and PGEs. The company’s flagship project is its 100-percent owned Shining Tree gold project near the prolific Abitibi Greenstone Belt in Ontario. The company recently acquired 100 percent in two claims in the Leonard Township, which lie within Target Area #5 at Shining Tree.

Additionally, Platinex has acquired 100 percent of the W2 Copper-Nickel-PGE project (formerly Lansdowne House) located in Ontario’s promising Ring of Fire. Both projects are in the discovery phase and have district-scale blue sky potential.

At the W2 Copper Nickel PGE Project, the company also recently closed an option agreement with two arm's length parties, through which it has the right to acquire a 100 percent interest in fifty-two unpatented mining claims. The claims are within the boundary of the company's existing land package.

W2 has seen past drilling by Inco and more recently Aurora Platinum/FNX; and Shining Tree was a historical, small-scale gold producer. The company also has a royalty portfolio that provides additional opportunities for revenue growth.

The Shining Tree gold project is a consolidation of 21,720 hectares adjacent to the Côté Gold-Gosselin development project owned by IAMGOLD and the 2.3-million-ounce Juby gold deposit hosted by Aris Gold Corp. (TSX:ARIS). Additionally, the Shining Tree property intersects the same north-south fault with the West Timmins mine and the Ridout-Tyrrell deformation zone.

The property hosts some 20 historic gold prospects with several underexplored areas across the prominent land package. Platinex recently acquired an additional 1,372 hectares adjoining its Shining Tree project, comprising 63 mining claims. The company also acquired the past producing mine from Alamos Gold and has a small non-43 101 historical resources.

Located within the Ring of Fire, the W2 project contains promising deposits of copper, nickel and PGEs that provide Platinex with a diverse mineral portfolio to capitalize on multiple commodities markets. Previous owners have already conducted approximately US$5 million in exploration expenditures, including nearly 9,000 meters of drilling. Past near-surface drilling demonstrated a significant wide zone of continuous copper-nickel mineralization and a lower zone of PGE mineralization. Within these wide zones of up to 200 metres, there are higher grade sections of copper-nickel followed by a second horizon of PGE-copper-nickel. A few examples include:

- LH-01-05 and LH-01-06 are 4 km apart with no intervening drill holes. The apparent correlation of widely spaced holes suggests a high level of continuity in the copper-nickel-PGE

- Two wide intersections include LH-01-05 with 151.6 m at 0.57 percent copper equivalent (CuEq) or 0.971 g/t PdEq and LH-01-06 with 220.6 m at 0.56 percent CuEq or 0.956 g/t palladium equivalent (PdEq) mineralization

- Holes LH-01-02, LH-01-05 and LH-01-06 were assayed for PGEs and copper-nickel zone further at depth.

- LH-01-02 42 m at 1.756 g/t PdEq (up to 3 percent Copper, 1 percent Nickel, 1 g/t PGE)

- LH-01-05 17 m at 1.86 g/t PdEq

- LH-01-06 81.3 m at 1.196 g/t PdEq

- Copper and Nickel only - Hole 54017 61 m at 1.01 percent CuEq incl. 13.1 m of 2.06 percent CuEq and Hole 49182 20.91 m at 1.63 percent CuEq.

Platinex also operates a robust royalty portfolio, which provides gold, PGE, nickel, copper and chromium exposure. Key royalties include a 2.5 percent NSR royalty on production from the former Big Trout Lake property in northwestern Ontario. This asset is one of Canada's largest known PGE and chromium deposits.

On December 29, 2022, Platinex acquired 100 percent of the Muskrat Dam Critical Minerals Project located in Northwestern Ontario, approximately 125 kilometers northeast of Frontier Lithium's PAK lithium project and 125 kilometers northwest of Newmont's Musselwhite gold mine. The project comprises six property blocks covering a combined area of 12,934 hectares in the highly prospective Muskrat Dam Lake and Rottenfish River greenstone belts. Initial exploration at the project will focus on the 7,025-hectare Axe Lake property, which shows the potential to host lithium-bearing pegmatites.

To assist in the development of the Muskrat Dam project, Platinex has formed a technical advisory committee, whose members include lithium expert Dr. Fred Breaks, who discovered the two largest lithium-rich rare-element deposits in Ontario: Separation Rapids Pegmatite of Avalon Advanced Materials Corp. and Pakeagama Lake Pegmatite of Frontier Lithium; and Ike Osmani, who is also a technical advisor on the Shining Tree and W2 programs. Both Breaks and Osmani are experts in the geology of Northwestern Ontario and have knowledge of the Muskrat Dam Project area.

Platinex has a solid capital structure with C$8 million market cap and a C$1 million cash position with no debt.

World-class management and a top-tier technical team lead Platinex. Their track record of success and extensive experience in mining, capital markets and finance sectors prime the company for tremendous economic growth and high-grade discovery potential. Greg Ferron, CEO, has over 20 years of experience within the mining industry and capital markets ranging from project development to investor relations. Graham Warren, CFO, brings 30 years of experience in the resource industry, domestically and internationally.

Company Highlights

- Platinex Inc. is a mineral exploration company focused on acquiring, exploring and developing highly prospective mineral projects across mining-friendly jurisdictions.

- The company has created the most extensive gold-focused property package in the Shining Tree District with its 100-percent-owned Shining Tree gold project. The property spans 23,219 hectares southwest of the prolific Abitibi Greenstone Belt in Ontario.

- With district-scale potential, the Shining Tree gold project sits strategically between the Côté Gold-Gosselin development project owned by IAMGOLD and the 2.3-million-ounce Juby gold deposit hosted by Aris Gold Corp.

- Platinex has acquired the W2 Copper-Nickel-PGE project in the Ring of Fire, a region that’s quickly emerging as one of the most promising districts for critical minerals. The project includes six distinct claims providing unique opportunities for exposure to different markets.

- The company completed the acquisition of 100 percent of the Muskrat Dam Critical Minerals Project in Northwestern Ontario.

- Platinex also has an impressive royalty portfolio on gold, PGE and base metal properties in Canada and Chile. This collection includes a 2.5 percent NSR royalty on production from the former Big Trout Lake property, one of Canada's largest known PGE and chromium deposits.

- The company has a solid capital structure with C$8 million market cap and a C$1 million cash position.

- An experienced management team with diverse backgrounds builds confidence in the company’s ability to reach its development goals.

Get access to more exclusive Gold Investing Stock profiles here