- WORLD EDITIONAustraliaNorth AmericaWorld

March 29, 2022

Renforth Resources Inc. (CSE:RFR) (CNSX:RFR.CN) (OTC:RFHRF) (FSE:9RR) ("Renforth" or the "Company") is pleased to inform shareholders of the assay results from the 1,203m drilled in 7 holes within the 275m strike length of the stripped area at Victoria West, one of several mineralized areas within our >300 km 2 Surimeau District Property in NW Quebec. SUR-21-28 was drilled for 234m at a dip of -80 as an undercut of SUR-21-26 and SUR-21-27 in the western end of the stripped area, between two historic trenches now within the stripped area. SUR-21-28 assayed 3.46% Ni and 491 ppm Co over 1.5m between 196.5 and 198m down the hole as presented in the table below, within a broad mineralized zone of 170.55m, between 40.9 and 211.45m down the hole which averaged 0.16% Ni and 100.2 ppm Co . Within this broad zone of mineralization there are higher grade sub-zones, as seen in this and other holes drilled in the December program, in this case the zone between 187.5 and 199.5m down the hole, a length of 12m, averaged 0.54% Ni and 138.7 ppm Co , encapsulating the 3.46% Nickel value. Renforth's current interpretation of the mineralization seen at Victoria West is that there are higher grade bands of mineralization within the extent of the mineralized magnetic ultramafic body. The exceptional 3.49% Ni value points to the high grade potential present at Victoria West, which has only seen 5,626m of drilling by Renforth over 2.2km of strike within the known 6km strike length of Victoria West, in the western end of a 20km long magnetic feature also mineralized at its eastern end.

"I am very happy with these results, they support our interest in Surimeau, an interest which only continues to grow. We will soon drill again as we work to define not "whether" there are battery metals within the 6km km long Victoria West area, but instead, answer the question of just how well endowed with battery metals this "hiding in plain sight" discovery really is. We will also be prospecting, following up on the presence of lithium and REEs documented at Surimeau. I expect this property will continue to deliver excitement to Renforth's shareholders for the foreseeable future" states Nicole Brewster, President and CEO of Renforth.

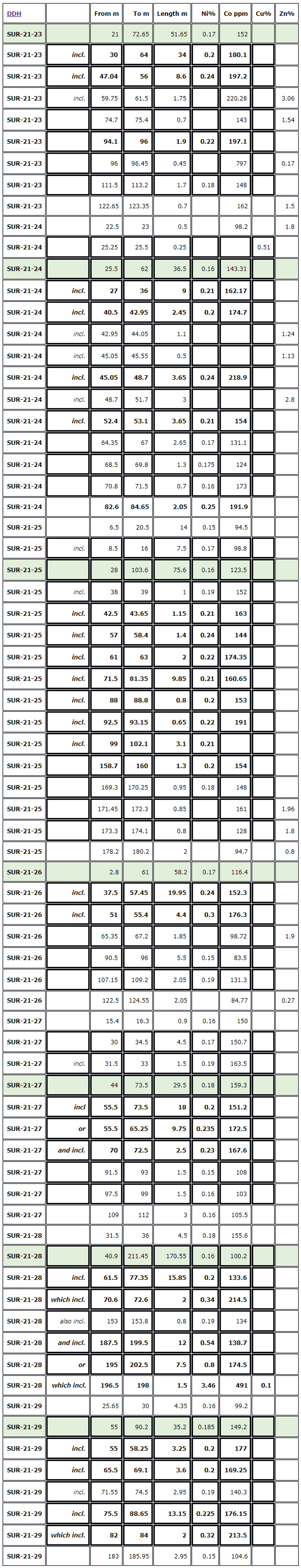

December 2021 Assay Results

Presented below are the assay results for the 7 holes drilled in December. These are colour coded in order to show, in green, the broader, lower grade mineralized intervals. Within these the contained higher grade zones are given, those above an average of 0.2% Ni are in red.

*Assay results are as measured in the core box. Not true width, true widths are not currently known

Technical disclosure in this press release has been reviewed and approved by Francis R. Newton P.Geo (OGQ#2129), a "qualified person" pursuant to NI 43-101.

For further information please contact:

Renforth Resources Inc.

Nicole Brewster

President and Chief Executive Officer

C:416-818-1393

E: nicole@renforthresources.com

#Unit 1B - 955 Brock Road, Pickering ON L1W 2X9

Follow Renforth on Facebook, LinkedIn and Instagram!

About Renforth

Renforth wholly owns the ~260 km 2 Surimeau District Property, which hosts numerous areas of polymetallic and gold mineralization, each with various levels of exploration, as well as a significant amount of unexplored ground. Victoria West has been drilled over a strike length of 2.2km, within a 5km long mineralized structure, proving nickel, copper, zinc and cobalt mineralization, in the western end of a 20km magnetic anomaly. The Huston target, during initial reconnaissance, resulted in a grab sample grading 1.9% Ni, 1.38% Cu, 1170 ppm Co and 4 g/t Ag. In addition to this the Lalonde, Surimeau and Colonie Targets are all polymetallic mineralized occurrences which, along with various gold showings, comprise the areas of potential of this NSR free property.

In addition to the Surimeau District battery metals property Renforth wholly owns the Parbec Gold deposit, a surface gold deposit contiguous to the Canadian Malartic Mine property in Malartic, Quebec. In 2020/21 Renforth completed 15,569m of drilling which successfully twinned certain historic holes, filled in gaps in the resource model with newly discovered gold mineralization and extended mineralization deeper. Based upon the success of this significant drill program the Company considers the spring 2020 MRE, with a resource estimate of 104,000 indicated ounces of gold at a grade of 1.78 g/t Au and 177,000 inferred ounces of gold at a grade of 1.78 g/t Au to be out of date. With the new data gained Renforth will undertake to complete the first ever structural study of the mineralization at Parbec, as well as additional total metallic assay work in order to better contextualize the nugget effect on the gold mineralization.

Renforth also holds the Malartic West property, the site of a copper/silver discovery, and Nixon-Bartleman, west of Timmins Ontario, with gold present on surface over a strike length of ~500m.

No securities regulatory authority has approved or disapproved of the contents of this news release.

Forward Looking Statements

This news release contains forward-looking statements and information under applicable securities laws. All statements, other than statements of historical fact, are forward looking. Forward-looking statements are frequently identified by such words as 'may', 'will', 'plan', 'expect', 'believe', 'anticipate', 'estimate', 'intend' and similar words referring to future events and results. Such statements and information are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the risks of obtaining necessary approvals, licenses and permits and the availability of financing, as described in more detail in the Company's securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and the reader is cautioned against placing undue reliance thereon. Forward-looking information speaks only as of the date on which it is provided and the Company assumes no obligation to revise or update these forward-looking statements except as required by applicable law.

RFR:CC

The Conversation (0)

07 March 2022

Renforth Resources

District Scale Battery Metals Discovery in Quebec Backed by the Parbec Gold Deposit

District Scale Battery Metals Discovery in Quebec Backed by the Parbec Gold Deposit Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00