(TheNewswire)

November 27 th 2022 TheNewswire Pickering, ON - Renforth Resources Inc. (CSE:RFR) (OTC:RFHRF) (FSE:9RR) ("Renforth" or the "Company") is pleased to advise shareholders that channels cut within the 3 stripped trenches at Lalonde, which are being undercut in the current drill program, did intersect surface battery metals mineralization as measured in the field and confirmed by the assay laboratory.

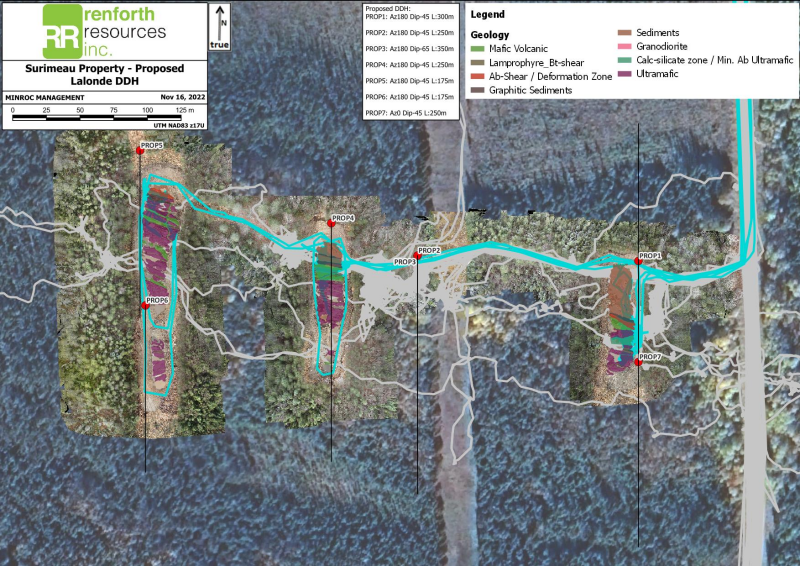

In addition to this, Renforth wishes to advise shareholders that 3 drill holes, Prop5 (SUR-22-30), Prop4 (SUR-22-31) and Prop2 (SUR-22-31), have been completed at Lalonde in the ongoing Surimeau drill program, successfully intersecting the surface mineralization in the undercutting drill hole. Each hole drilled starting in the sediments to the north, drilled through the mineralized/ultramafic package to the point of contact with the sediments in the south. As each hole intersected the complete package, a second southern or undercut hole was not required (as previously planned), therefore, those metres will be used to the east, based upon the analysis of the 2021 geophysical survey data which Renforth has just received, inserted below.

Lalonde Area Initial Proposed Drill Holes

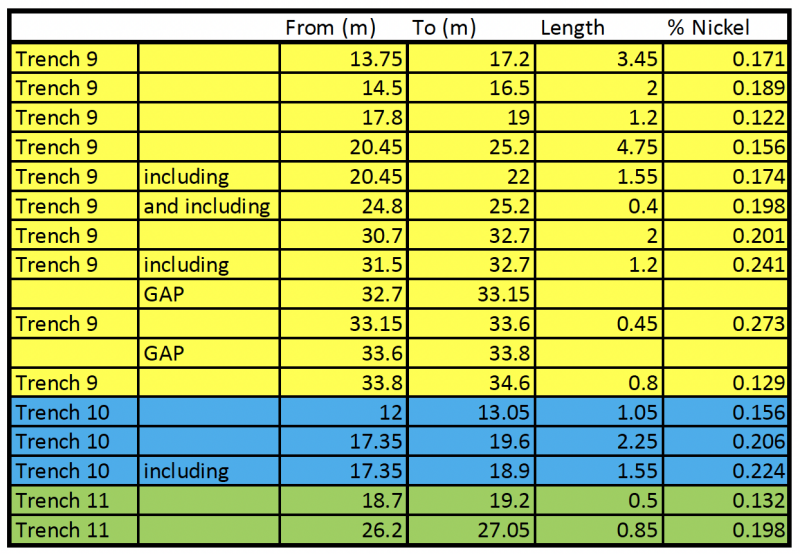

Nickel Values in Trenching

In each of the 3 trenches stripped at Lalonde one channel was cut and sampled, when accessible. Unfortunately, sample gaps occur in Trench 9, within the best mineralized zone, potentially artificially breaking up the mineralized interval due to access issues, namely flooding with water making it impossible to obtain samples.

It is Renforth's interpretation that, in each of the 3 channels cut within the trenches that are perpendicular to the magnetic anomaly at Lalonde, each surface mineralized "shoulder" of the anomaly was intersected, successfully yielding ultramafic nickel mineralization.

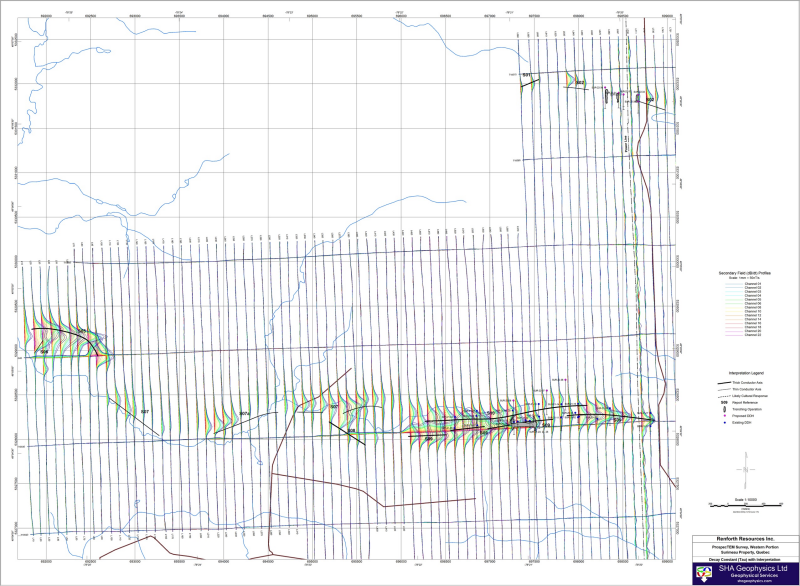

Geophysical Analysis

Renforth commissioned an analysis and interpretation of the geophysical data obtained during the airborne survey which Renforth flew over the Victoria mineralized system and a portion of the Lalonde mineralized system. One of the products of this analysis was a conductivity map, showing conductive anomalies within the overall magnetic anomaly at Victoria and Lalonde. This sort of analysis is interesting as, for example, copper is conductive but not magnetic, the magnetic anomaly that stretches over ~20km at Victoria, and ~9km at Lalonde, depicts the ultramafic intrusive, which we know to be carrying nickel/cobalt and some amount of PGEs. Additionally, while nickel is conductive it is much less conductive than copper, it is reasonable to assume that copper would perform better in an analysis of conductivity. Within the location of the ultramafic we do see a graphitic shale that is copper/zinc bearing, along with calc-silicate alteration carrying the same mineralization, however, the magnetic anomaly does not reflect these structures, there is potential that the conductivity map does. We will be testing this hypothesis.

Surimeau Conductivity Map (Decay Constant with Picked Anomalies)

The map above locates the stripping (at Victoria and Lalonde) and the drilling (at Victoria) to date relative to the conductive anomalies, along with the proposed drill holes. The receipt of this information has caused Renforth's geologists to modify planned, and to add, drill holes targeting the conductive anomaly. It is interesting to note that the stripping, and a lot of the drilling, to date at both Victoria and Lalonde, all of which intersected the ultramafic and some amount of nickel mineralization, has largely missed the conductive anomalies.

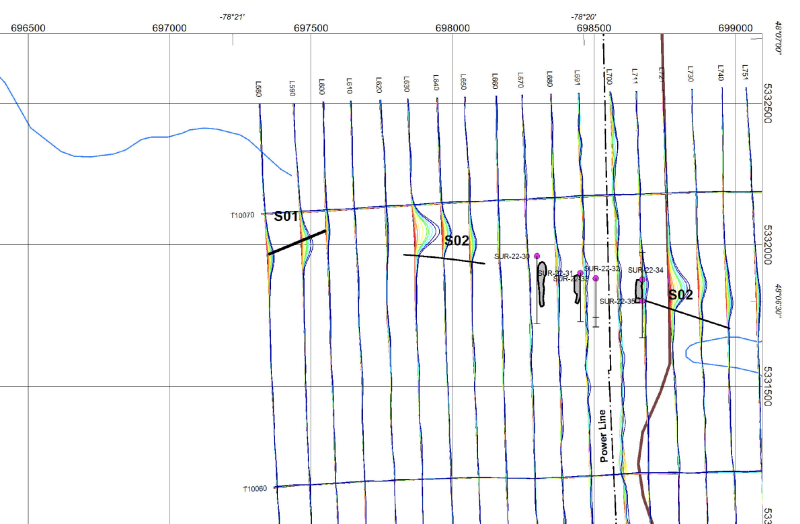

Zoomed in Lalonde Detail

Zooming in on the Lalonde section of the map indicates that the conductivity anomaly is strongest where the road intersects Lalonde, this suggests that the stripping and drilling to date was too far west, with regard to conductivity and potential copper mineralization. However, despite the lack of a conductive anomaly, nickel mineralization has been intersected on surface and in drill holes in the area worked. As Renforth works at Lalonde, which has little to almost no useful historical information to guide exploration, it is becoming clear that while the mineralization is very similar to Victoria it is not identical, with possibly more copper/zinc intersected in the current drilling than at Victoria.

Technical disclosure in this press release has been reviewed and approved by Francis R. Newton OGQ a "qualified person" pursuant to NI 43-101.

For further information please contact:

Nicole Brewster

President and Chief Executive Officer

C:416-818-1393

E: nicole@renforthresources.com

#Unit 1B – 955 Brock Road, Pickering ON L1W 2X9

Follow Renforth on Facebook, LinkedIn and Instagram!

About Renforth

Renforth is focused on Quebec's newest battery metals district, our wholly owned ~330 km 2 Surimeau District Property, which hosts several known areas of polymetallic "battery metals" mineralization, each with various levels of exploration, as well as a significant amount of unexplored ground. Victoria West has been drilled over a strike length of 2.2km, within a 5km long mineralized structure, proving nickel, copper, zinc and cobalt mineralization, in the western end of a 20km magnetic anomaly. The Huston target, during initial reconnaissance, resulted in a grab sample grading 1.9% Ni, 1.38% Cu, 1170 ppm Co and 4 g/t Ag. Additionally, the Lalonde, Surimeau and Colonie Targets are all polymetallic mineralized occurrences which, along with various gold showings, comprise the areas of potential of this NSR free property.

In addition to the Surimeau District battery metals property Renforth wholly owns the Parbec Gold deposit, a surface gold deposit contiguous to the Canadian Malartic Mine property in Malartic, Quebec. In 2020/21 Renforth completed 15,569m of drilling which successfully twinned certain historic holes, filled in gaps in the resource model with newly discovered gold mineralization and extended mineralization deeper. Based upon the success of this significant drill program the Company considers the spring 2020 MRE, with a resource estimate of 104,000 indicated ounces of gold at a grade of 1.78 g/t Au and 177,000 inferred ounces of gold at a grade of 1.78 g/t Au to be out of date. With the new data gained Renforth will undertake to complete the first ever structural study of the mineralization at Parbec, as well as additional total metallic assay work in order to better contextualize the nugget effect on the gold mineralization.

Renforth also holds the Nixon-Bartleman property, west of Timmins Ontario, with gold present on surface over a strike length of ~500m.

No securities regulatory authority has approved or disapproved of the contents of this news release.

Forward Looking Statements

This news release contains forward-looking statements and information under applicable securities laws. All statements, other than statements of historical fact, are forward looking. Forward-looking statements are frequently identified by such words as ‘may', ‘will', ‘plan', ‘expect', ‘believe', ‘anticipate', ‘estimate', ‘intend' and similar words referring to future events and results. Such statements and information are based on the current opinions and expectations of management. All forward-looking information is inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including the speculative nature of mineral exploration and development, fluctuating commodity prices, the risks of obtaining necessary approvals, licenses and permits and the availability of financing, as described in more detail in the Company's securities filings available at www.sedar.com. Actual events or results may differ materially from those projected in the forward-looking statements and the reader is cautioned against placing undue reliance thereon. Forward-looking information speaks only as of the date on which it is provided and the Company assumes no obligation to revise or update these forward-looking statements except as required by applicable law.

Copyright (c) 2022 TheNewswire - All rights reserved.