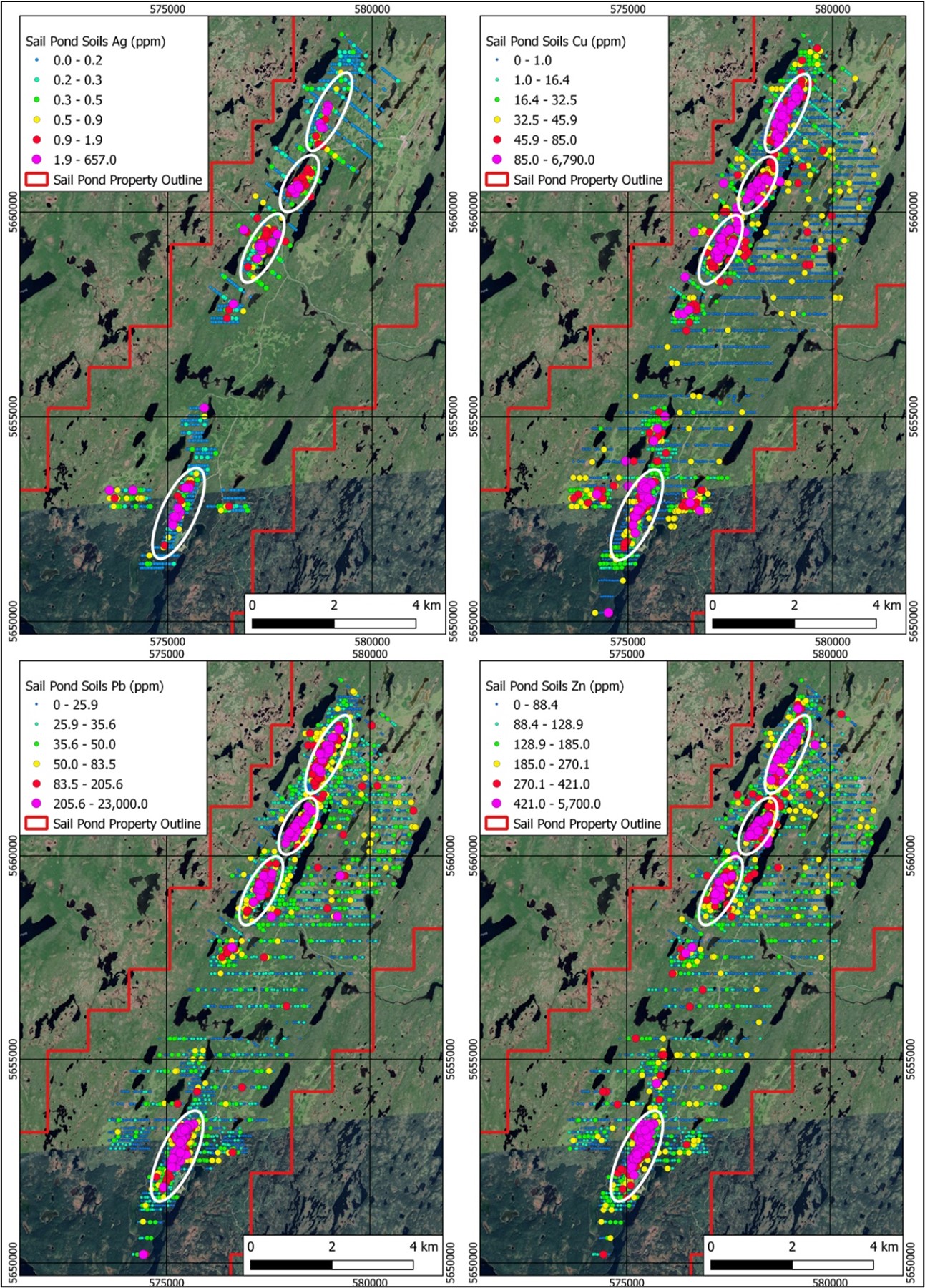

Sterling Metals Corp. ("Sterling" or the "Company") (TSXV:SAG) is very pleased to report on the results of the 2020 soil sampling program from its Sail Pond Silver Project ("Sail Pond" or the "Project") located on the Great Northern Peninsula of Newfoundland. The multi-element soil results, as illustrated in Figure 1, confirm the presence and expand upon the Company's expectations of multi-kilometer scale linear silver, copper, zinc and lead soil anomalies in the central core of the Project which coincides with, and expands upon, areas of known mineralization in outcrop

Kelly Malcolm, P.Geo., Technical Advisor to Sterling, commented, "With the results in hand of our 2020 soil sampling program, Sterling is now in a better position to drill the Sail Pond project. In addition to receiving the 2020 soil samples results with a maximum value of 657 g/t Ag, the large linear anomalies shown in Figure 1 indicate a robust kilometric hydrothermal silver-rich polymetallic system. Utilizing the soil data in conjunction with multiple geophysical surveys, geological mapping, prospecting, and trenching data we believe that Sterling has identified a potential district-scale mineralized system and are very much looking forward to getting drills on the Project and testing the high-priority targets."

Figure 1: Soil sampling results on the Sail Pond Project for silver, copper, lead, and zinc. Note the large linear coincident anomalies (circled in white) defining the North and South Zones on the Project. These maps represent a compilation of current (2020 program) and historical (1982 and 2017 programs) soil sample data. Individual element results are broken down by the 60th, 80th, 90th, 95th, and 98th percentile of all soil samples taken on the Project. Ag data was not collected in the 2017 survey.

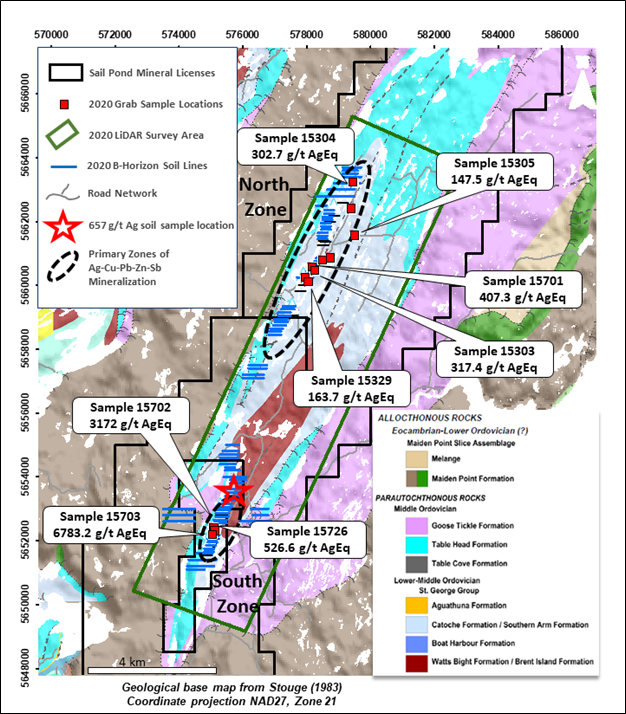

Following the acquisition of the Project in October 2020 from Altius Resources (TSX:ALS) and receiving the required exploration work permits, the Company initiated a work program of prospecting, soil sampling, and a 60 km2 LiDAR survey covering the most prospective geology (Figure 2). The results reported herein focus on the soil sampling portion of the 2020 exploration program whose primary goals were to infill, expand and substantiate historical soil sampling programs. Compilation of the 2020 and historical soil sample results for Ag, Cu, Pb, and Zn has identified three significant zones in the northern portion of the project and one significant zone in the southern portion. As shown in Figure 1, each of Ag, Cu, Pb, Zn, as well as As, Cd, and Sb (which are not shown), display a strong spatial correlation.

During this year's soil program, 1475 B-horizon soils were collected at 25 meter spaced intervals on east-west orientated lines. Figure 2 shows the location of the soil samples as well as the rock sampling results from the 2020 work program as announced on January 6, 2021. Table 1 provides a summary of the soil assay results. Soil sample 17891, collected in the southern portion of the survey area (UTM coordinates 575,370mE, 5,653,053mN; NAD27, Zone 21) and within 50 meters from exposed quartz-carbonate altered dolostone contained 657 g/t Ag along with 0.68 % Cu, 2.3 % Pb and 0.57 % Zn.

Table 1: Summary statistics for the 2020 soil program. Number of samples, excluding standards, is 1,474.

Ag_ppm | Cu_ppm | Pb_ppm | Zn_ppm | |

Maximum | 657 | 6790 | 23000 | 5700 |

Minimum | 0.1 | 8 | ||

Average | 0.75 | 29.99 | 63.6 | 147.04 |

Figure 2: Location of 2020 B-horizon soil sample sites (blue lines) as well as select results from the 2020 prospecting program (as announced January 6, 2021), underlain by geology as mapped by Stouge, 1983.

Sterling, along with Goldspot Discoveries Inc. (TSX-V:SPOT), is currently in the process of reviewing and compiling data from the 2020 programs, including its recent LiDAR survey as well as soil samples, prospecting, trenching, geological mapping, and a multitude of geophysical surveys. Goldspot uses machine learning and artificial intelligence to integrate data sets and provide definitive drill targets. Contingent on permitting and drill contractor availability, Sterling expects to begin its fully funded maiden diamond drilling program in early summer of 2021.

Qualified Person

Roderick Smith, M.Sc., P.Geo., Chief Geologist of Altius Resources Inc., and a Qualified Person within the meaning of National Instrument 43-101 Standards of Disclosure for Minerals Projects, has reviewed and approved the technical information presented herein.

All soil and QA-QC samples were prepped and analyzed at Eastern Analytical Ltd, an ISO 17025 certified company, based in Springdale, Newfoundland and Labrador. For each sample, a 200 mg subsample was totally dissolved in four acids and analyzed by ICP-0ES to acquire multi-element determinations. For select elements that exceeded the upper limits of detection (Ag, Cu, Pb, Zn, et cetera) using the ICP-OES method, a multi-acid digestion method followed by atomic absorption analysis was utilized. Suitable pulp standards were systematically inserted into the sample stream to ensure quality assurance and control.

About the Company

Sterling Metals is a mineral exploration company focused on Canadian exploration opportunities. The company is currently exploring for silver and base metals at the Sail Pond project in Northwestern Newfoundland. Sterling has the option to acquire 100% of the 13,500 Ha Project.

For more information, please contact:

Sterling Metals Corp.

Mathew Wilson, President & CEO

Tel: (416) 643-7630

Email: info@sterlingmetals.ca

Website: www.sterlingmetals.ca

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains certain "forward-looking information" within the meaning of applicable securities laws. Forward looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "may", "will", "would", "potential", "proposed" and other similar words, or statements that certain events or conditions "may" or "will" occur. These statements are only predictions. Forward-looking information is based on the opinions and estimates of management at the date the information is provided, and is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. For a description of the risks and uncertainties facing the Company and its business and affairs, readers should refer to the Company's Management's Discussion and Analysis. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change, unless required by law. The reader is cautioned not to place undue reliance on forward-looking information.

SOURCE: Sterling Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/629299/Sterling-Metals-Reports-on-Soil-Sampling-Results-from-the-Sail-Pond-Silver-Project-Newfoundland-with-a-Maximum-Assay-Result-of-657-gt-Silver