Forum Energy Metals Corp. (TSXV: FMC) (OTCQB: FDCFF) ("Forum" or "Company") announces the final set of assay results from Rio Tinto Exploration Canada's ("Rio Tinto" or "RTEC") summer drill program at the Rafuse target on Forum's 100% owned Janice Lake coppersilver project in Saskatchewan (Figure 1).

RTEC reports that it has spent $14 million in exploration expenditures to date, which exceeds the $10 million required to earn a 51% interest in the Janice Lake project. Rio Tinto does not plan an exploration program for the 2022 budget year. A $100,000 cash payment to Forum is due on or before May, 2022 to complete its 51% earn-in obligation.

Rick Mazur, President & CEO reports, "Rio Tinto's $14 million in drilling and regional exploration has added tremendous value to the Janice Lake project, most notably at the Janice and Jansem targets where drilling has significantly expanded high grade copper mineralization. Forum's diversified energy metals portfolio will focus on our extensive uranium property portfolio in Q1 2022, including plans to begin drilling at our 100% owned Wollaston uranium property nearby the Orano and Cameco uranium mills in the eastern Athabasca Basin."

Exploration Summary

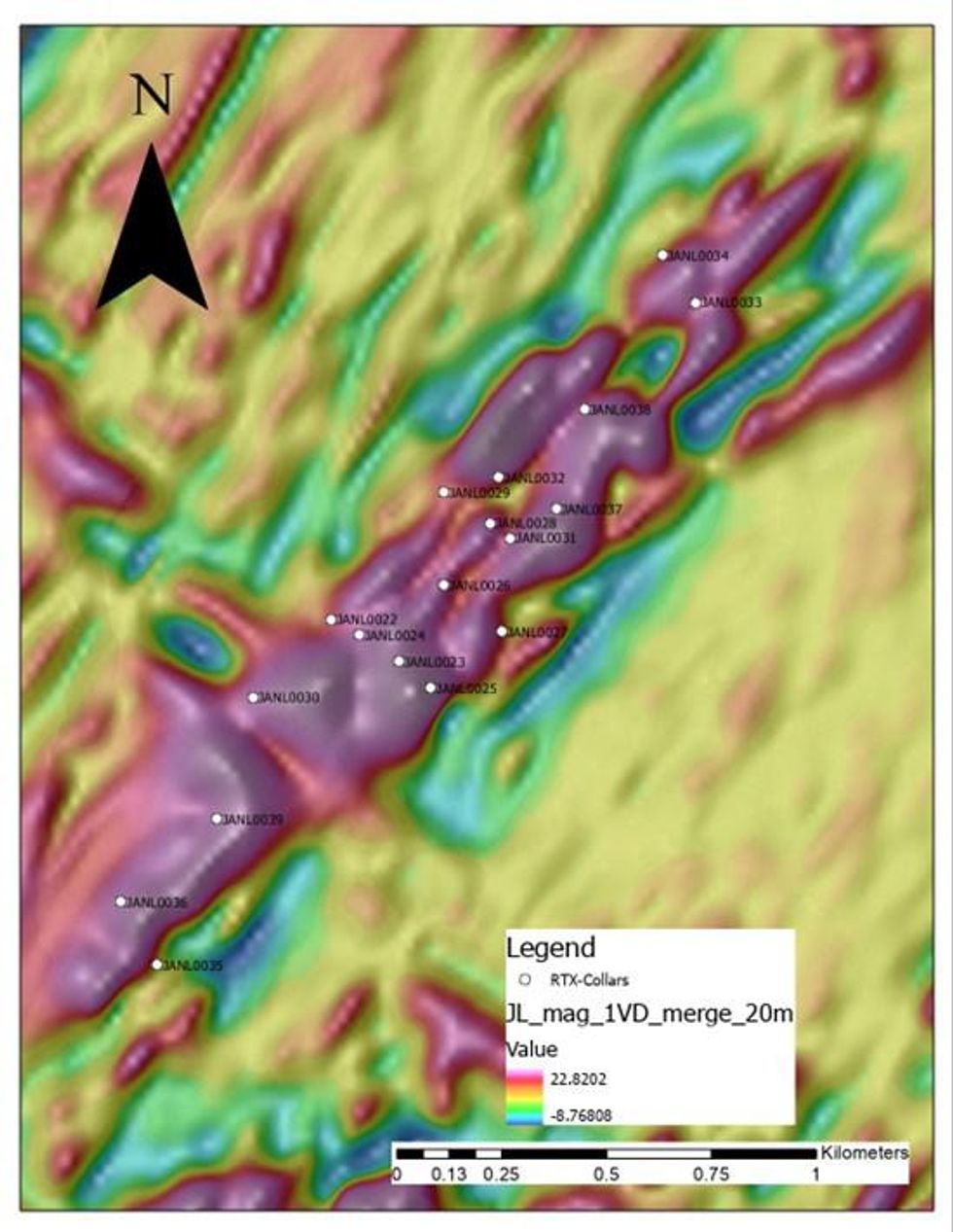

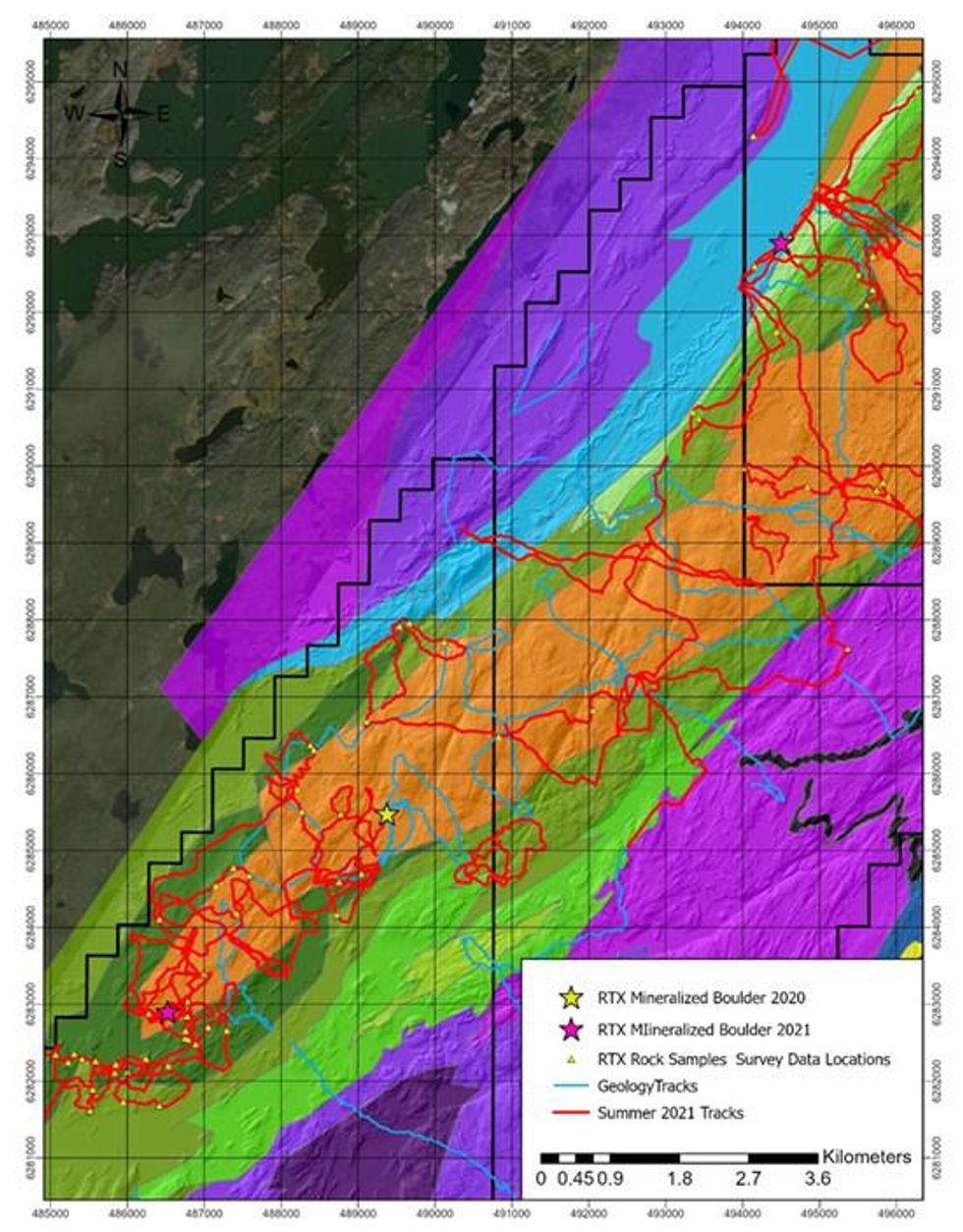

To date, RTEC has drilled thirty-nine holes on the property totalling 10,033 metres on four targets- Jansem, Janice, Kaz and Rafuse. Drill results on the Rafuse target are shown in Table 1 and Table 2. In addition, extensive geophysical, geochemical and geological surveys over the 52 km extent of the Wollaston Sedimentary Copperbelt has identified new areas for potential copper mineralization. Prospecting has identified copper boulders as high as 3.8% copper and 3.7 g/t silver, 25 to 30 kilometres to the southwest of the Janice and Jansem targets (Figure 2).

Results from the last five holes on the Rafuse target are:

- JANL0035 - Nil

- JANL0036 - Nil

- JANL0037 -0.15% Cu and 1.63 g/t Ag and 0.41% Pb over 42.25 metres from 221.25m to 263.5m, including 0.19% Cu and 1.94 g/t Ag and 0.51% Pb over 30.9 metres from 232.6m to 263.5m.

- JANL0038 - 0.16% Cu and 2.77 g/t Ag and 0.18% Pb over 15.4 metres from 95.6m to 111m, including 0.25% Cu and 4.93 g/t Ag and 0.34% Pb over 7.5m from 95.6m to 103.1m, 0.19% Pb over 1.37 metres from 134.8m to 135.75m, 1.09 g/t Ag and 0.43% Pb over 1.2 metres from 157.8m to 159m

- JANL0039 - 1.28 g/t Ag and 0.14% Pb over 2.6 metres from 154.2m to 156.8m

Hole JANL0028 drilled in the winter program intersected 0.86% copper and 8.02 g/t silver over 14 metres from 246m to 260m, including 6m of 1.67% copper and 13.6 g/t silver from 254.1 to 260.1m (see news release dated June 9, 2021). Hole JANL0028, JANL0032 and JANL0037 have intersected structurally controlled mineralization that is oxidized at depth.

Figure 1: Plan Map of the Rafuse Target. Background is from the airborne magnetic survey, with red colours indicating magnetic highs. Holes JANL0022 to 0030 were drilled by RTEC during the winter of 2021 and Holes JANL0031 to 0039 were drilled in the summer of 2021. See News Releases dated May 25, 2021, June 9, 2021 and October 28, 2021

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/4908/105201_3fbd4c5304e62ad1_003full.jpg

Table 1: Diamond Drill Hole Statistics for 2021.

| Hole ID | Easting | Northing | Dip | Azimuth | Length (m) |

| JANL0022 | 502173 | 6306311 | -70 | 305 | 221 |

| JANL0023 | 502334 | 6306210 | -75 | 130 | 264 |

| JANL0024 | 502239 | 6306273 | -70 | 125 | 306 |

| JANL0025 | 502411 | 6306146 | -70 | 130 | 171 |

| JANL0026 | 502433 | 6306392 | -65 | 135 | 234 |

| JANL0027 | 502580 | 6306281 | -65 | 315 | 258 |

| JANL0028 | 502553 | 6306540 | -72 | 122 | 294 |

| JANL0029 | 502441 | 6306613 | -65 | 125 | 300 |

| JANL0030 | 501987 | 6306125 | -60 | 130 | 282 |

| JANL0031 | 502601 | 6306505 | -60 | 130 | 300 |

| JANL0032 | 502573 | 6306648 | -60 | 125 | 330 |

| JANL0033 | 503042 | 6307066 | -60 | 130 | 273 |

| JANL0034 | 502962 | 6307177 | -60 | 120 | 213 |

| JANL0035 | 501759 | 6305487 | -60 | 135 | 249 |

| JANL0036 | 501673 | 6305637 | -60 | 130 | 267 |

| JANL0037 | 502709 | 6306574 | -60 | 310 | 321 |

| JANL0038 | 502778 | 6306811 | -60 | 115 | 321 |

| JANL0039 | 501901 | 6305834 | -60 | 125 | 273 |

Table 2: Assay Results from 2021 Rafuse Winter and Summer Drill Programs

| Hole ID | Easting | Northing | Length | Dip/Azimuth | From (m) | To (m) | Thickness | Cu (%) | Ag (g/t) | Pb (%) | Zn (%) |

| JANL0023 | 502334 | 6306210 | 264 | -75/130 | 19.00 | 67.00 | 48.00 | 0.32 | 2.04 | - | - |

| including | 19.00 | 36.15 | 17.15 | 0.59 | 3.96 | - | - | ||||

| including | 33.00 | 36.15 | 3.15 | 1.78 | 9.25 | - | - | ||||

| 53.00 | 69.00 | 16.00 | 0.29 | 1.47 | - | - | |||||

| JANL0024 | 502239 | 6306273 | 306 | -70/125 | 71.50 | 148.00 | 76.50 | 0.28 | 2.00 | - | - |

| 188.00 | 206.00 | 18.00 | 0.20 | 1.58 | - | - | |||||

| 297.00 | 306.00 | 9.00 | 0.07 | 0.84 | 0.05 | 0.14 | |||||

| JANL0025 | 502411 | 6306146 | 171 | -70/130 | 21.00 | 29.00 | 8.00 | 0.16 | 1.75 | - | - |

| JANL0026 | 502433 | 6306392 | 234 | -65/135 | 39.66 | 52.00 | 12.34 | 0.25 | 2.05 | - | - |

| JANL0027 | 502580 | 6306281 | 258 | -65/315 | 208.00 | 210.00 | 2.00 | 0.25 | 2.85 | - | - |

| 224.00 | 226.33 | 2.33 | 0.17 | 1.74 | - | - | |||||

| JANL0028 | 502553 | 6306540 | 294 | -72/122 | 40.09 | 41.23 | 1.14 | 0.33 | 2.12 | - | - |

| 210.00 | 229.00 | 19.00 | - | - | 0.13 | 0.19 | |||||

| including | 223.00 | 229.00 | 6.00 | 0.03 | 0.71 | 0.29 | 0.22 | ||||

| 246.05 | 260.06 | 14.01 | 0.86 | 8.02 | 1.76 | 0.16 | |||||

| including | 254.09 | 260.06 | 5.97 | 1.67 | 13.62 | 1.93 | 0.14 | ||||

| JANL0029 | 502441 | 6306613 | 300 | -65/125 | 3.00 | 46.00 | 43.00 | 0.06 | 0.83 | - | - |

| 294.00 | 300.00 | 6.00 | 0.03 | 0.47 | 0.24 | 0.06 | |||||

| JANL0030 | 501987 | 6306125 | 282 | -60/130 | 155.00 | 157.59 | 2.59 | 0.11 | 1.10 | - | - |

| 172.00 | 211.00 | 39.00 | 0.27 | 3.08 | - | - | |||||

| JANL0031 | 502601 | 6306505 | 300 | -60/130 | 10.16 | 12.15 | 1.99 | 0.12 | 1.36 | - | - |

| 271.90 | 273.00 | 1.10 | - | 2.96 | - | - | |||||

| JANL0032 | 502573 | 6306648 | 330 | -60/125 | 89.89 | 131.00 | 41.11 | 0.04 | 1.03 | 0.07 | - |

| including | 89.89 | 115.00 | 25.11 | 0.07 | 1.57 | 0.10 | - | ||||

| including | 89.89 | 97.43 | 7.54 | 0.19 | 4.04 | 0.11 | - | ||||

| 92.00 | 109.41 | 17.41 | 0.06 | 1.62 | 0.12 | - | |||||

| 217.56 | 277.55 | 59.99 | - | - | - | 0.13 | |||||

| 235.00 | 279.00 | 44.00 | 0.23 | 1.62 | 0.35 | 0.14 | |||||

| including | 235.00 | 257.00 | 22.00 | 0.08 | 0.60 | 0.16 | 0.09 | ||||

| including | 265.00 | 279.00 | 14.00 | 0.59 | 4.04 | 0.83 | 0.23 | ||||

| including | 235.00 | 243.00 | 8.00 | 0.06 | 0.66 | 0.30 | 0.15 | ||||

| including | 247.00 | 257.00 | 10.00 | 0.13 | 0.67 | 0.02 | 0.06 | ||||

| including | 273.00 | 279.00 | 6.00 | 1.21 | 7.59 | 0.89 | 0.18 | ||||

| JANL0033 | 503042 | 6307066 | 273 | -60/130 | 42.20 | 49.00 | 6.80 | 0.29 | 3.01 | - | - |

| JANL0034 | 502962 | 6307177 | 213 | -60/120 | 19.30 | 27.44 | 8.14 | 0.09 | 1.22 | - | - |

| 74.90 | 93.70 | 18.80 | 0.14 | 2.12 | 0.20 | 0.18 | |||||

| including | 74.90 | 86.00 | 11.10 | 0.19 | 2.68 | 0.25 | 0.26 | ||||

| including | 88.00 | 93.70 | 5.70 | 0.08 | 1.73 | 0.16 | - | ||||

| 173.90 | 180.40 | 6.50 | 0.10 | 1.01 | - | - | |||||

| JANL0035 | 501759 | 6305487 | 249 | -60/135 | 86.10 | 88.30 | 2.20 | - | - | - | 0.13 |

| JANL0037 | 502709 | 6306574 | 321 | -60/310 | 18.00 | 30.00 | 12.00 | - | - | 0.11 | - |

| 221.25 | 263.50 | 42.25 | 0.15 | 1.63 | 0.41 | - | |||||

| including | 232.60 | 263.50 | 30.90 | 0.19 | 1.94 | 0.51 | - | ||||

| including | 232.60 | 246.00 | 13.40 | 0.10 | 2.72 | 1.14 | - | ||||

| including | 247.70 | 258.00 | 10.30 | 0.40 | 2.01 | - | - | ||||

| JANL0038 | 502778 | 6306811 | 321 | -60/115 | 95.60 | 111.00 | 15.40 | 0.16 | 2.77 | 0.18 | - |

| including | 95.60 | 103.10 | 7.50 | 0.25 | 4.93 | 0.34 | - | ||||

| 134.38 | 135.75 | 1.37 | - | - | 0.19 | - | |||||

| 157.80 | 159.00 | 1.20 | 0.05 | 1.09 | 0.43 | - | |||||

| JANL0039 | 501901 | 6305834 | 273 | -60/125 | 154.20 | 156.80 | 2.60 | 0.04 | 1.28 | 0.14 | - |

Figure 2: Prospecting and mapping Program 2021- Concentrated in an area 25km southwest of the drilling area where a 3.8% copper boulder was found by prospecting in 2020.

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/4908/105201_3fbd4c5304e62ad1_006full.jpg

Quality Control/ Quality Assurance

Core samples were sawed in half, keeping the half with the reference line for orientated core in the box. Samples averaged 2 metres in length through the mineralized zone, 4 metres in length in the unmineralized zone, however these lengths varied depending on stratigraphy, alteration or mineralization. Standards were introduced after every 20th sample, using a high grade, low grade or unmineralized, depending on the surrounding core. Duplicates were also introduced on every 20th sample, quartering the core. Blanks were used for the first sample of the hole and at the beginning and end of a mineralized interval, using certified rose quartz. A 4-acid digestion was used on the samples at ALS lab in Vancouver, followed by analysis by ICP-MS (the ME-MS61L package).

Ken Wheatley, P.Geo., Forum's VP, Exploration and Qualified Person under National Instrument 43-101, has verified the data as per NI43-101 Clause 3.2 and has reviewed and approved the contents of this news release.

About Forum Energy Metals

Forum Energy Metals Corp. (TSXV: FMC) has three 100% owned energy metal projects that were drilled in 2021 by the Company and its major mining company partners Rio Tinto and Orano for copper/silver, uranium and nickel/platinum/palladium in Saskatchewan, Canada's Number One Rated mining province for exploration and development. Forum is well funded and plans an aggressive drilling campaign in 2022. In addition, Forum has a portfolio of seven drill ready uranium projects and a strategic land position in the Idaho Cobalt Belt. For further information: www.forumenergymetals.com

ON BEHALF OF THE BOARD OF DIRECTORS

Richard J. Mazur, P.Geo.

President & CEO

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information contact:

NORTH AMERICA

Rick Mazur, P.Geo., President & CEO

mazur@forumenergymetals.com

Tel: 778-772-3100

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/105201