March 12, 2024

Australian battery minerals explorer, Firetail Resources Limited (“Firetail” or the “Company”) (ASX: FTL) is pleased to provide an update on the maiden diamond drilling (DD) program at the Picha Copper Project in Peru.

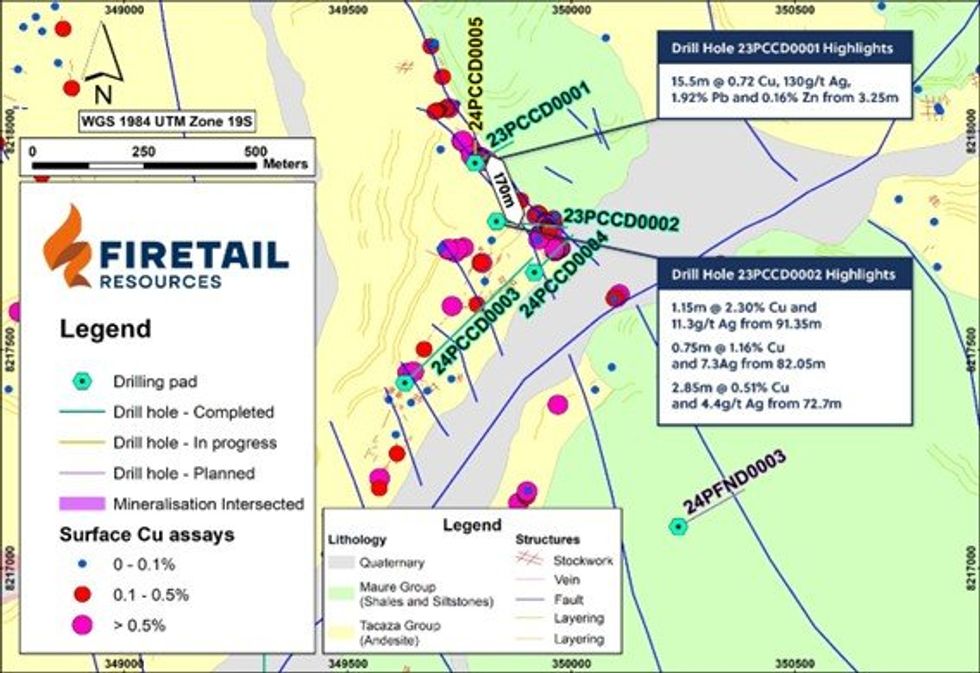

Assay results have been received from drill hole 23PCCD0002 at the Cumbre Coya target, which has intersected the same mineralised structure as the first drill hole (23PCCD0001) thereby confirming the mineralised structure extends over 170m in strike length and is open in all directions.

Highlights include:

- Mineralised structure at Cumbre Coya now extended to at least 170m strike length and is open in all directions.

- Same structure has been mapped at surface, extending for at least 500m strike length.

- This NW-SE trending structural corridor is interpreted to be the same as that intersected in the previous drill hole at Cumbre Coya1 (23PCCD0001) which returned 15.5m @ 0.72% Cu and 130g/t Ag from 3.25m

Executive Chairman, Brett Grosvenor, commented:

"The latest results from our Cumbre Coya target at Picha are starting to demonstrate the potential of scale and what a special project this could be. The confirmation of the continuation of the mineralisation over 170m with the structure open in all directions gives us huge encouragment for what we may have here.

“We continue to be excited about the potential at Picha, and these latest results are a validation of all the hard work by the team in advancing this project.

“Work continues on site as we move into the latter part of the drill program, and we eagerly await the next results to to further develop our understanding of this system.”

Click here for the full ASX Release

This article includes content from Firetail Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FTL:AU

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00