July 12, 2022

Significant progress made on exploration drilling, metallurgical testwork and defining additional resources within the Lynn Lake Mining Centre

Corazon Mining Limited (ASX: CZN) (Corazon or Company) is pleased to provide an update on activities at its flagship project, the 100%-owned Lynn Lake Nickel-Copper- Cobalt Sulphide Project (Lynn Lake or Project) in the province of Manitoba, Canada.

Key Highlights

- Exploration drilling continuing at Fraser Lake Complex testing geophysical anomalies within the Motriuk ultramafic intrusion - encouraging nickel and copper sulphide mineralisation intersected

- New detailed geological modelling underway at the Lynn Lake Mining Centre to identify additional near surface resource potential not included in previous resource estimates or mining studies

- Metallurgical testwork on lower-grade mineralisation from the mining centre is underway – incorporating innovative “ore-sorting” technology as an upgrading option

Corazon’s ongoing focus is the pursuit of the potential redevelopment of Lynn Lake’s historical nickel sulphide Mining Centre towards production, and the targeted exploration for new nickel-copper-cobalt sulphide deposits within the Project area.

At the Mining Centre, the Company is assessing the potential to benefit from the extensive low-grade sulphide mineralisation surrounding known deposits and identifying relatively untested extensions to the current resources (within the upper levels of the mine surrounds).

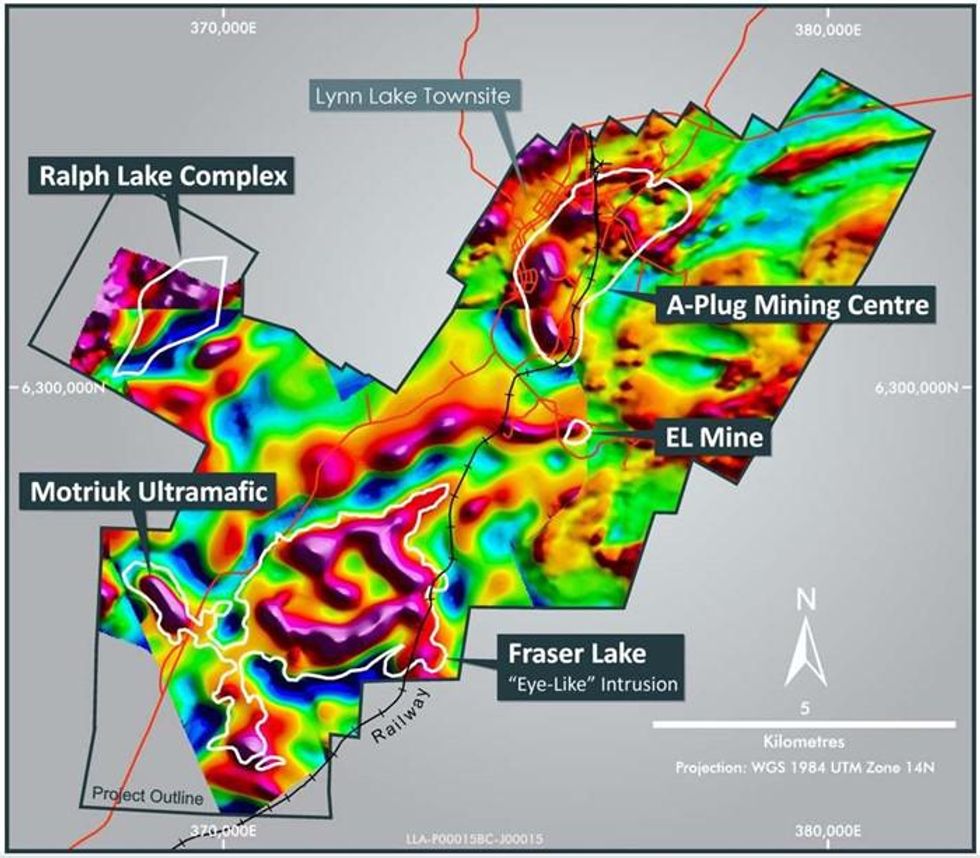

Metallurgical testwork on lower grade material is currently underway and new 3D models of structure, rock type and geophysical surveys for the A-Plug Mining Centre (Figure 1) are being utilised to define potential areas for exploration and resource definition drilling.

Exploration drilling is ongoing at the Fraser Lake Complex (FLC) (Figure 1), testing geophysical targets (ASX announcement 11 April 2022). Encouraging nickel and copper sulphide mineralisation has been intersected at the Motriuk intrusion (ASX announcement 7 June 2022). The existence of visible pentlandite (nickel sulphide) in blebs and the potential for these sulphides to accumulate at depth, provide a compelling target for the drilling currently in progress.

Figure 1 – Lynn Lake Project - MobileMT survey magnetic susceptibility inversion depth slice at 50m below surface - over a GeoTem total-field regional aeromagnetic image, with the area of the gravity high target outlined.

Fraser Lake Complex Exploration Drilling

Exploration drilling at the Fraser Lake Complex is continuing, following early encouraging results from drilling at the Motriuk Ultramafic (ASX announcement 7 June 2022).

Progress of the drilling has been slow, with the drilling contractor needing to revert to one shift per day, due to the limited availability of personnel. This is an industry-wide issue due to both the effects of the Covid-19 pandemic and the seasonal demands for exploration personnel.

Currently, there is a 10-day scheduled break in drilling, which is due to recommence on the 22nd of July 2022. With an all-inclusive per-metre rate for this drilling program, Corazon bears no additional cost for drilling down-time or slow meterage.

In mid-June 2022, senior Company personnel traveled to site to review the progress of the drilling, including the sulphides intersected at Motriuk (ASX announcement 7 June 2022). While the amount of sulphide mineralisation reported was low (typically 1-5% of volume) and as such the expectations for the nickel content is also low, the existence of visible pentlandite is very encouraging. The Motriuk Complex historically has been considered nickel-deficient compared to the average for such ultramafic rock (pyroxenites and peridotites). It is assumed the nickel was extracted from the melt as sulphide (pentlandite) during the magma’s transportation to Motriuk, or in-situ.

The Motriuk Ultramafic body is “keel-like” in shape, with a base that has been defined by geophysics. The current drilling is targeting the base of this intrusion, which has a dense and magnetic geophysical signature.

Updates regarding this drilling will be provided in due course.

Click here for the full ASX release

This article includes content from Corazon Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CZN:AU

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

26 August 2025

Corazon Mining

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets.

A high-grade gold explorer in a proven Australian gold province, with a strategic portfolio of battery and base metal assets. Keep Reading...

04 February

4km Gold Anomaly Defined at Two Pools

Corazon Mining (CZN:AU) has announced 4km Gold Anomaly Defined at Two PoolsDownload the PDF here. Keep Reading...

28 January

Quarterly Appendix 5B Cash Flow Report

Corazon Mining (CZN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Quarterly Activities Report

Corazon Mining (CZN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

24 November 2025

Execution of Land Access Agreement

Corazon Mining (CZN:AU) has announced Execution of Land Access AgreementDownload the PDF here. Keep Reading...

10 November 2025

Two Pools Gold Project Update

Corazon Mining (CZN:AU) has announced Two Pools Gold Project updateDownload the PDF here. Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Corazon Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00