Lead Price Forecast: Top Trends for Lead in 2026

What’s the lead forecast for 2026? Read on to find out what happened to the metal in 2025 and what factors will move the market in the year ahead.

Lead prices were volatile in 2025 amid investor uncertainty and factors like tariff threats.

The base metal is primarily consumed by lead-acid batteries, but is also used to produce radiation shielding, weights and, in the defense sector, ammunition. More recently it's seen increased demand from the electric vehicle (EV) sector as a low-voltage auxiliary power source for lighting, windows and other essential systems.

Because lead isn’t usually mined as a primary metal, its supply is tied to other metals like zinc, silver and copper, making the lead price highly dependent on demand for these other metals — and by extension, fairly volatile.

How did lead perform in 2025?

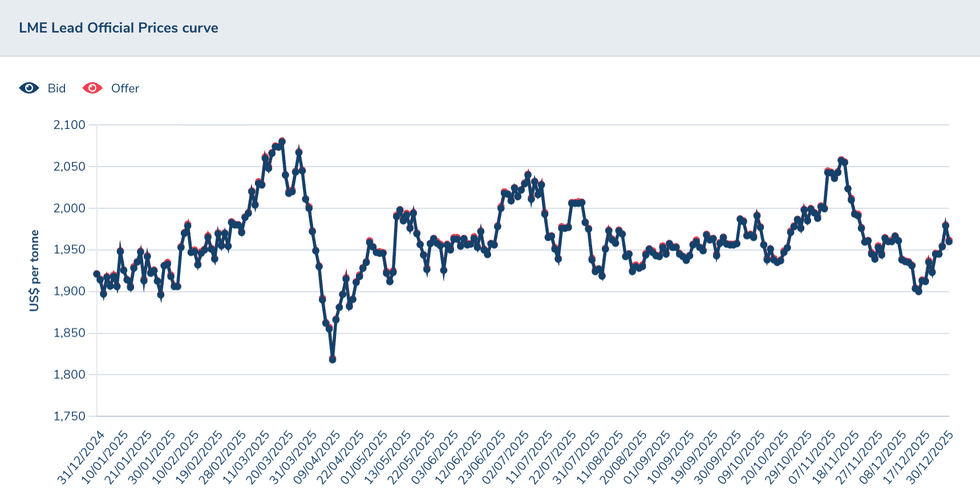

Continuous contracts for lead on the London Metal Exchange (LME) started 2025 at US$1,921.44 per metric ton (MT) and saw steady upward momentum in Q1, rising as high as US$2,090.48 on March 18.

According to Shanghai Metals Market, lead's early 2025 rise was supported by the end of the Chinese New Year holiday, as well as increased activity in the supply chain, which led to a limited increase in demand for lead ingot purchases. This activity coincided with destocking of lead inventories in western markets, which further fueled the price.

Lead continued to trade above US$2,000 for the remainder of March, but the start of April saw its price floor fall out — the metal hit its 2025 low of US$1,829.75 on April 9 amid a broader rout in commodities markets. This came after US President Donald Trump's “Liberation Day” tariff announcement on April 2.

LME lead price, 2025.

Chart via the LME.

Shanghai Metals Market notes that the tariff announcement came during the traditional off season for lead, with battery producers reducing production and weakening overall demand for the metal.

However, the lead price had rebounded as of the end of April, with rising demand driving down inventories in downstream industries. By the end of Q2, lead was once again trading above US$1,900.

Trade concerns remained present, and although lead ultimately wasn't included in reciprocal tariffs, considerable uncertainty dampened sentiment during the metal's normally peak August-to-September period.

During the year's third quarter, a significant 45,150 MT delivery to LME warehouses in November pushed total volume to 266,125 MT, leading to a collapse in the lead price amid oversupply concerns.

Lead stabilized in the US$1,930 to US$2,050 range as the year drew to a close, spiking to US$2,078.84 on November 12 and to US$1,910.48 on December 12.

What trends will move the lead market in 2026?

According to the International Lead and Zinc Study Group (ILZSG), global demand for refined lead is expected to increase by 0.9 percent to 13.37 million MT in 2026 after rising 1.8 percent in 2025.

In an October report, the organization projects a 6.6 percent rise in US lead demand for 2025, driven by higher domestic battery production. The ILZSG is also expecting greater 2025 lead usage in the Czech Republic, Germany, Poland and the UK, with a 1.8 percent gain in demand across the European Union.

However, a rise in Chinese demand in the first half of 2025, supported by a government trade-in policy for cars and e-bikes, was offset by lower exports of lead-acid batteries, which fueled demand growth of just 0.9 percent.

Many of these same factors are expected to carry over into 2026, with gains in Europe, Vietnam and the US expected to be offset by a forecast 1.7 percent decrease in Chinese demand.

On the supply side, mining output is expected to increase 2.2 percent to 4.67 million MT in 2026, with a 2.5 percent rise from Chinese operations, along with further gains from Europe and output recoveries in Australia and the US.

Refined supply is forecast to increase by 1 percent to 13.47 million MT over the next year, with gains from smelters in Brazil, India and Kazakhstan partially offset by lower production in China and the UK.

Overall, the ILZSG is expecting the lead surplus to grow to 102,000 MT in 2026.

Lead price forecast for 2026

According to a report from market intelligence firm Mordor Intelligence, lead-acid batteries are set to see increasing demand from data centers and 5G applications, where they are used as back-up power systems. The firm is calling for a 0.4 percent compound annual growth rate (CAGR) over the next two to four years.

In terms of EV sector demand, Mordor sees a 0.3 percent CAGR over the next two years as low-speed EVs like rickshaws and golf carts gain greater uptake in emerging markets in Southeast Asia.

Lead's supply side could be affected by changing dynamics in the silver market.

In a December 12 article, Fastmarkets notes that a high silver price is prompting producers to accelerate project development timelines, pointing to Silver Mountain Resources' (TSXV:AGMR,OTCQB:AGMRF) Reliquias project, which is expected to enter commercial production in Q3 2026.

As far as 2026 goes, Fastmarkets is expecting balance in the refined lead metal market, with little supply growth and the price rangebound at around the US$2,000 mark.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.