September 14, 2022

Blackstone Minerals Limited (“Blackstone” or the “Company”) is pleased to announce that the results from an independent Life Cycle Assessment (LCA), conducted by LCA Practitioners Minviro (www.minviro.com), underpin our vision to develop an industry leading, low CO2 emission nickel sulphide project to supply into the growing lithium-ion battery industry. The results support ongoing partnership and funding efforts by validating the Ta Khoa Project (TKP) design as the route with the lowest life cycle CO2 emissions compared to emerging and existing NCM811 precursor cathode active material production routes.

Minviro, who are also responsible for the completion of Tesla’s LCA in their 2021 Impact Report (https://www.tesla.com/ns_videos/2021-tesla-impact-report.pdf) and other industry peers1, were appointed by Blackstone to conduct an LCA on the production of Nickel-Cobalt-Manganese (NCM) precursor cathode active material (pCAM) at TKP. The study, which was conducted according to the requirements of ISO-14040:2006 and ISO-14044:2006, used data from Pre-feasibility Studies (PFS) published for the downstream Ta Khoa Refinery Project (TKR) (refer ASX announcement 26 July 2021) and upstream Ta Khoa Nickel Project (TKN) (refer ASX announcement 28 February 2022).

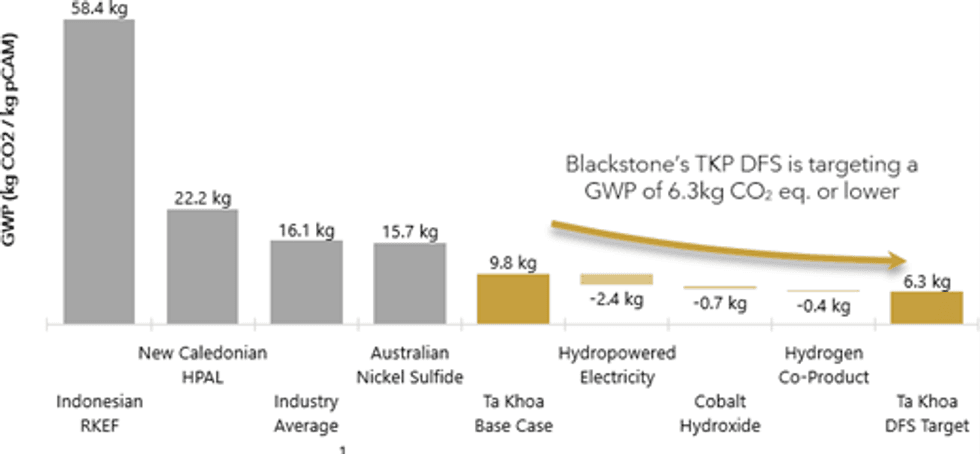

The Ta Khoa LCA study confirmed a result of 9.8 kg CO2 eq. per kg pCAM from the Company’s TKP in Vietnam, which is substantially lower than existing production pathways in terms of Global Warming Potential (GWP), with known opportunities to reduce even further to 6.3kg CO2 eq. per kg pCAM (refer Figure 1).

Figure 1: Summary of LCA GWP Results (Scope 1, 2 and 3 GHG Emissions)

As part of the accreditation process, the LCA was subject to a third party review by a panel of three industry experts. Chaired by Dr Viktor Kouloumpis, the panel included a representative from the Nickel Institute´s Public Policy team and an independent nickel metallurgical consultant.

While the Base Case GWP result of 9.8 kg CO2 eq. per kg pCAM is an excellent result, Blackstone is targeting zero emissions, and is evaluating the following options to further reduce the Ta Khoa GWP.

Figure 2: Distribution of Scope 1, 2 and 3 Emissions

Hydropower

While Blackstone has access to low CO2 impact hydropower produced in Vietnam, the LCA process and global carbon accounting standards will not recognise this until Blackstone secures a Power Purchase Agreement (PPA) with a power supplier. Blackstone is currently working to secure a PPA for hydropower which will then credit Blackstone with a 2.4 kg CO2 eq. per kg pCAM reduction in GWP.

Cobalt Hydroxide

Cobalt Sulphate supply contributes 1.3kg CO2 eq. per kg pCAM and Blackstone is seeking other Cobalt Sulphate from alternative lower GWP suppliers. Much of the GWP associated with the cobalt sulphate feedstock is attributed to the sulphate refining stages. Blackstone is looking to secure a lower quality cobalt hydroxide product which will then be refined in the TKR. This could yield a reduction in GWP of 0.7kg CO2 eq. per kg pCAM.

Hydrogen Co-production

Blackstone continues to explore the option of producing TKR’s oxygen via electrolysis of water. This process would yield a green hydrogen by-product with the potential to reduce the GWP of 0.4 kg CO2 eq. per kg pCAM.

Other potential reduction measures under analysis but that are yet to be quantified include:

- Preference for low carbon footprint third party concentrate supply;

- Carbon mineralisation of dry stacked tailings;

- TKR direct CO2 emissions capture (potential for up to 1kg CO2 eq. per kg pCAM reduction);

- Further electrification of mining, concentrating and refining processes;

- Low carbon ammonium nitrate supply; and

- Carbon off-set projects.

Blackstone chose GWP as the primary focus of the LCA as this is the common standard to compare environmental impact. Other results summarised in the attached Minviro LCA summary report include the Project’s impact on land and water given the sensitivity of the region and immediate vicinity of the Project. The results of the study will be used to inform environmentally informed decision making in design, construction, inputs and processes.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 February

Blackstone Minerals

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines

Advancing the Mankayan copper-gold project, a world-class copper-gold project in the Philippines Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

25 February

Oregon: America’s Premier Domestic Nickel Opportunity

The global race for critical minerals has begun. As the US stares down a future of massive industrial shifts, the strategy is clear: secure the supply chain or get left behind. Demand for nickel is hitting overdrive, fueled by its role in electric vehicle (EV) batteries, high-strength stainless... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

24 February

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

23 February

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00