August 26, 2024

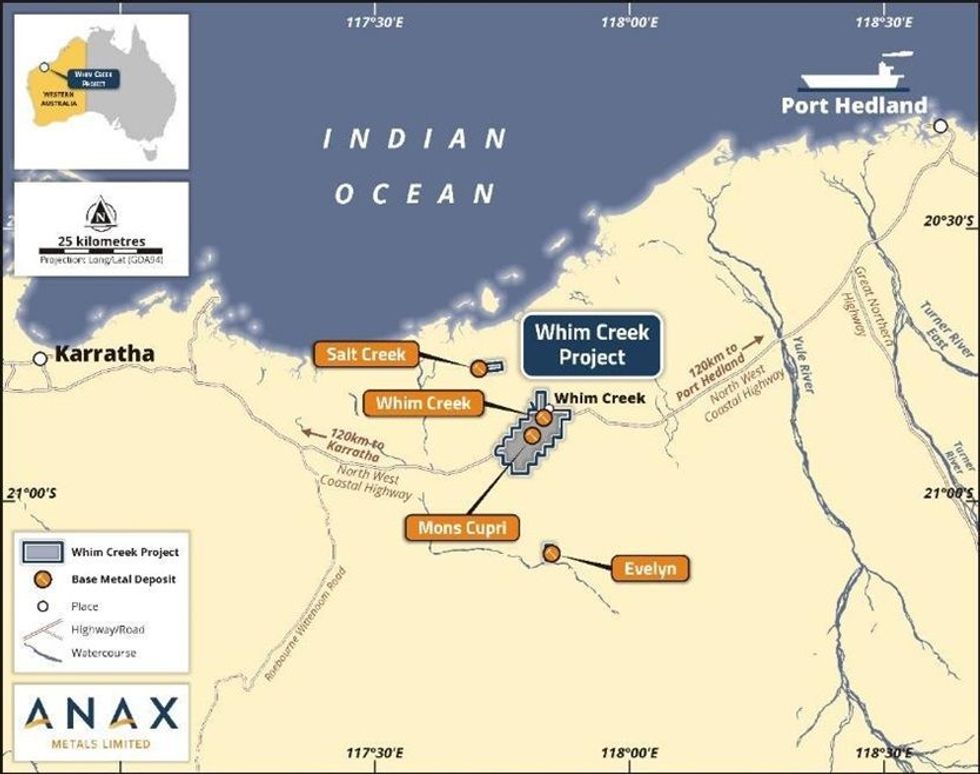

Anax Metals Limited (ASX: ANX, Anax, or the Company) is pleased to provide an update on drilling at the Evelyn deposit (Evelyn), part of the Whim Creek Project, located 115km southwest of Port Hedland (Figure 1).

- Preliminary continuous XRF scanning results confirm high-grade copper-zinc intersections

- Diamond drilling now completed with visually-observed sulphide mineralisation intersected in all holes

- Samples submitted for laboratory analysis with results expected in September

- Evelyn regional exploration programme commenced aimed at identifying Evelyn- type high-grade VMS base metal deposits

- Auger sampling and geophysics planned ahead of RC-drilling of high priority targets

Anax’s Managing Director, Geoff Laing commented: “These results again demonstrate the high-grade nature of this VMS deposit, and we are pleased with the outcomes of this drilling campaign. The team will continue to focus on leveraged growth outcomes at Whim Creek and we look forward to providing ongoing updates on the near mine exploration along with our regional consolidation strategy”

The Company has received results from continuous XRF-scanning of the first two holes, and these have confirmed the high-grade nature of the visual intersections. 1

CAUTIONARY STATEMENT ON CONTINUOUS XRF SCANNING RESULTS

Core was processed through the Minalyzer CS (Minalyzer) continuous XRF scanning unit in Perth. Six trays of calibration core samples were submitted with the new drilling, but no high-grade mineralisation was available. The results presented in this announcement are therefore considered partially calibrated as the upper limit of likely assays are not represented in the calibration core. The XRF results that are subject of this report will be submitted for laboratory assay and some variation from the results presented herein should be expected. Further information about Minalyzer is provided at the end of this announcement.

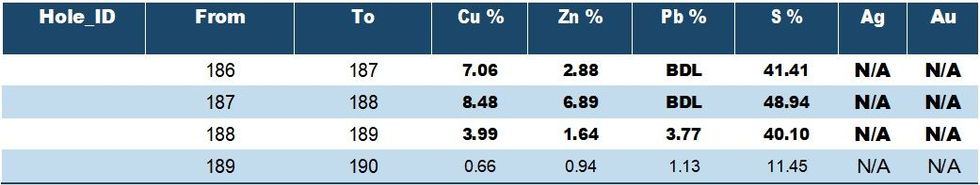

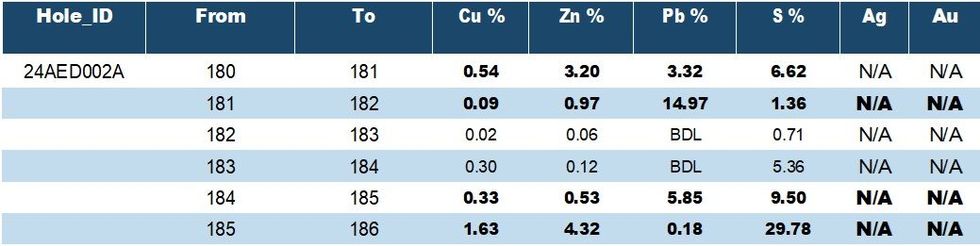

The best visual intersection from the drilling programme previously reported1 is from Hole 24AED002A which encountered a strongly mineralised zone between 176.45 and 189.9m (Figure 2).1 Preliminary results from Minalyzer continuous XRF-scanner have confirmed the high-grade nature of the intersection (Table 1).

In addition, Evelyn mineralisation typically contains significant gold and silver enrichment. However, the continuous XRF-scanner is unable to accurately quantify gold and silver grades, and these are therefore not reported. Laboratory analyses will include gold and silver assays, and results for precious metals will be reported once received.

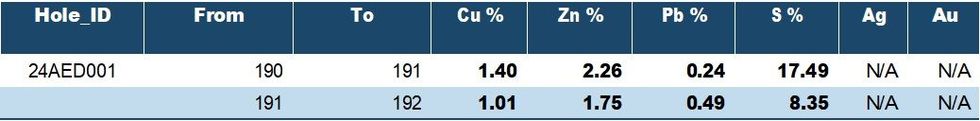

Hole 24AED001 was designed to intersect the high-grade shoot below previous drill hole, JER074, which intersected 13m @ 2.56% Cu, 4.98% Zn, 1.92 g/t Au and 41 g/t Ag.2 The hole deviated in a southerly direction from its planned intersection position and clipped the base of the shoot. Preliminary results from continuous XRF scanning are shown below in Table 2. Laboratory analyses will include gold and silver assays, and results will be reported once received.

The final two holes of the diamond drilling programme at Evelyn have now been completed. Both 22AED003 and 222AED004 encountered sulphide mineralisation in the anticipated positions, including localised sections of strong copper and/or zinc mineralisation (Figure 3).

Cautionary Statement: Certain information in this announcement may contain references to visual results. The Company draws attention to the inherent uncertainty in reporting visual results. Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Both 24AED003 and 24AED004 encountered sulphide mineralisation, but they did not intersect the mineralised horizon at the planned target zones due to excessive swing to the south. The possibility for down-plunge resource extensions remains (Figure 4), and the Company anticipates that areas of potential resource growth will be tested in future with Reverse Circulation (RC) drilling. Summary logs for 24AED003 and 004 are provided below in Table 3 and Table 4.

Geotechnical logging of the first two diamond holes have completed. Encouragingly, the hanging wall mafic unit in which the decline at Evelyn will be developed, appears very competent containing minimal fractures or foliation.

Click here for the full ASX Release

This article includes content from Anax Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ANX:AU

The Conversation (0)

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

02 July 2025

Anax withdraws from arbitration

Anax Metals Limited (ANX:AU) has announced Anax withdraws from arbitrationDownload the PDF here. Keep Reading...

05 May 2025

ANX secures commitment for funding from cornerstone investor

Anax Metals Limited (ANX:AU) has announced ANX secures commitment for funding from cornerstone investorDownload the PDF here. Keep Reading...

01 May 2025

Trading Halt

Anax Metals Limited (ANX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00