January 28, 2025

Wyoming Rare Earth Project Positioned to Meet U.S. Critical Mineral Needs

American Rare Earths (ASX: ARR | OTCQX: ARRNF | ADR: AMRRY) ("ARR" or "the Company") and its wholly owned subsidiary Wyoming Rare (USA) Inc. ("WRI") are pleased to announce a major milestone resource update for the Halleck Creek Rare Earth Project in Wyoming. The updated JORC-compliant Mineral Resource Estimates (MRE) further establish Halleck Creek as one of the largest rare earth deposits in North America and underscore ARR’s continued progress in unlocking its potential as a strategic U.S. asset.

Highlights

- Halleck Creek Total Mineral Resource Estimate increased by 12.2% to 2.63 billion tonnes at 3,926 ppm Total Rare Earth Oxides (TREO).

- Red Mountain Area within Halleck Creek saw a 29.7% growth in resources, increasing to 1.24 billion tonnes, with an 8.3% uplift in grade to 3,252 ppm TREO.

- Cowboy State Mine, representing the first phase of project development within Red Mountain, grew by 29.4% to 543 million tonnes, with a 2.7% increase in TREO grade to 3,438 ppm.

- The deposit remains open at depth and along strike, offering significant upside potential, with the mineral resource estimate covering approximately 16% of the greater Halleck Creek project surface area.

The Halleck Creek resource now exceeds 2.63 billion tonnes, representing a significant 12.2% increase over the previous estimate. This growth highlights the transformational scalability of the project, which remains open at depth and along strike.

The Cowboy State Mine, located within the Red Mountain area, continues to deliver robust resource growth and remains central to ARR’s development strategy. Its location on Wyoming State land provides a streamlined permitting process, accelerating ARR’s ability to unlock the project’s full value. The project’s favorable geology and near-surface mineralization support the potential for a low-cost open-pit mining operation, while ongoing metallurgical test work continues to demonstrate the potential for efficient processing of rare earths. These results reinforce ARR’s ability to support the U.S. government’s efforts to secure domestic critical mineral independence, reducing reliance on imports and supporting economic growth and national security objectives.

Chris Gibbs, CEO of American Rare Earths, commented:

"This resource update demonstrates the continued growth, scale, and strategic importance of Halleck Creek as a cornerstone project for the U.S. rare earth supply chain. With the deposit still open at depth, and along strike, the upside potential is truly remarkable. With the Halleck Creek mineral resource estimate covering approximately 16% of the greater Halleck Creek project surface area, we believe opportunities exist to expand mineral resource estimates with additional exploration."

“The expanded resources will strengthen the project's economics as we finalise the updated Scoping Study, which is set for release shortly, and continue integrating this data into the Pre-Feasibility Study, scheduled for completion later this year. Halleck Creek is positioned to become one of the most significant rare earth assets in North America, supporting U.S. critical mineral independence and economic growth.”

Next Steps and Path Forward

The updated resource model and mine plans will have a positive impact on Halleck Creek’s project economics, further enhancing its strategic importance. ARR is currently integrating the updated resource and high-grade data into the Scoping Study, which was originally released in March 2024. The updated study is nearing completion and will be released in February 2025.

In parallel, ongoing metallurgical test work continues to deliver promising results, highlighting the potential for cost- efficient processing at Halleck Creek. As outlined in the 2024 Scoping Study, approximately 90% of the gangue (waste) material can be removed during gravity and magnetic separation, significantly increasing REE grades through physical separation methods prior to leaching, which significantly reduces operational costs. Optimisation of these processing techniques is ongoing, and further results will be announced as the next round of metallurgical testing is completed in the March 2025 quarter.

In addition, the updated resource estimates will be incorporated into the ongoing Pre-Feasibility Study (PFS), which remains on track for completion later this year. The PFS will provide a more detailed evaluation of Halleck Creek’s technical and economic potential, supporting ARR’s phased approach to development and commercial production.

Technical Summary

Summary of Key Material Information used to Estimate the Mineral Resources

The updates to the geological models and Mineral Resource Estimates (MRE) were completed by Odessa Resources Pty. Ltd. on behalf of ARR. The updated MRE has been prepared in accordance with the 2012 JORC Code.

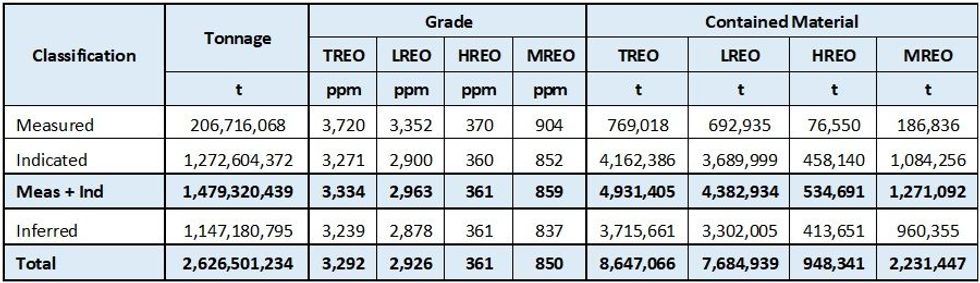

The results from the 2024 exploration drilling program at the Cowboy State Mine (CSM) area of Red Mountain, combined with additional surface sampling and geological mapping at Halleck Creek, have increased the in-situ resource estimates to 2.63 billion tonnes at an average grade of 3,292 ppm TREO (Table 1). This represents a 12.2% increase in in-situ tonnage compared to the January 2024 resource estimate for the entire Halleck Creek Rare Earth Project (Figure 4).

The Halleck Creek rare earth project comprises two primary resource areas: Overton Mountain, located to the north, and Red Mountain, to the south (Figure 5). Within the Red Mountain area lies the Cowboy State Mine (CSM), a subarea where WRI is focusing its development efforts. The state of Wyoming owns both the surface and mineral rights within the CSM area, which are leased by WRI. This Wyoming ownership provides WRI with a streamlined permitting pathway through the state.

In 2024, WRI conducted drilling operations in the CSM area. The additional drill holes and assay data enabled the expansion of resource areas and provided detailed geological characterization of the rare earth-bearing Red Mountain pluton within the Red Mountain and CSM areas. As a result, the updated resource estimates apply to the Red Mountain and CSM areas. The Mineral Resource Estimate (MRE) for Overton Mountain remains unchanged.

Click here for the full ASX Release

This article includes content from American Rare Earths Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 February 2025

American Rare Earths Limited

Advancing one of the largest REE deposits in North America

Advancing one of the largest REE deposits in North America Keep Reading...

26 February

Top Australian Mining Stocks This Week: European Resources Soars on Rare Earth Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Gold, lithium and copper companies continue to dominate our top ASX stocks of the week. This week, the Northern Territory's Minister... Keep Reading...

25 February

China's Rare Earths Export Ban Hits Japanese Defense Sector

China has moved to freeze exports of rare earth magnets and other critical materials to dozens of major Japanese companies, with the measures to take effect immediately.China’s commerce ministry said Tuesday (February 24) that it will suspend shipments of so-called “dual-use” goods — referring... Keep Reading...

24 February

Application to Trade on OTCQB Market

Altona Rare Earths plc (LSE: REE), the critical raw materials exploration and development company focused on Africa, is pleased to announce that it has applied for its ordinary shares to be admitted to trading on the OTCQB Venture Market in the United States ( "OTCQB").The Company has submitted... Keep Reading...

24 February

Brazil, India Ink Rare Earths Pact to Expand Supply Chain Cooperation

Brazil and India have signed a new agreement to deepen cooperation on rare earths and critical minerals as both countries seek to strengthen supply chains and reduce reliance on trading partners.The non-binding memorandum of understanding, sealed on February 21 during Brazilian President Luiz... Keep Reading...

22 February

LKY Commences Diamond Drilling at Desert Antimony Mine

Locksley Resources (LKY:AU) has announced LKY Commences Diamond Drilling at Desert Antimony MineDownload the PDF here. Keep Reading...

20 February

Cellulose Breakthrough Could Simplify Rare Earths Separation

A team of researchers at Penn State have developed a plant-based nanomaterial capable of selectively extracting dysprosium from rare earth mixtures, according to a recent report.The findings published in the study detail how the team engineered a modified form of cellulose capable of isolating... Keep Reading...

Latest News

Sign up to get your FREE

American Rare Earths Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00