January 28, 2024

Elevate Uranium Ltd (ASX: EL8) (“Elevate Uranium” or “the Company”) is pleased to present its Quarterly Activities and Cash Flow Report.

Koppies Project

- Updated Koppies JORC Mineral Resource Estimate (“MRE”) increased the Company’s global uranium resources to 142 Mlb U3O8

- The MRE increase represented a 136% increase in the Koppies resource and a 42% increase in the Company’s Namibian resources

- The mineralisation is shallow with95% of the resource within 15 metres of surface

- Three drill rigs completed a total of 620 holes for 17,457 metres

- Four drill rigs commenced operation in mid-January with a fifth drill rig scheduled to commence later in the quarter

- Resource drilling continues with the next update expected in March 2024

Koppies Resource Update

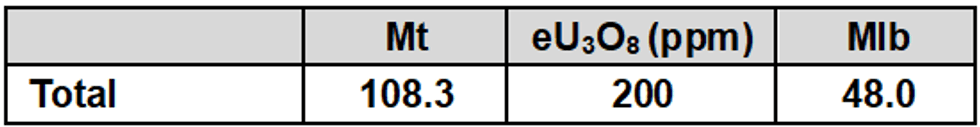

During the December Quarter, the Company announced an updated JORC Inferred Mineral Resource Estimate (“MRE”) of 48 Mlb eU3O8 for its Koppies Uranium Project in Namibia.

Updated Koppies JORC (2012) Inferred Mineral Resource Estimate at 100 ppm Cut-off Grade

This significant upgrade of the Koppies MRE has also increased the Company’s total global uranium resources to 142 Mlb, see Resource Table 3.

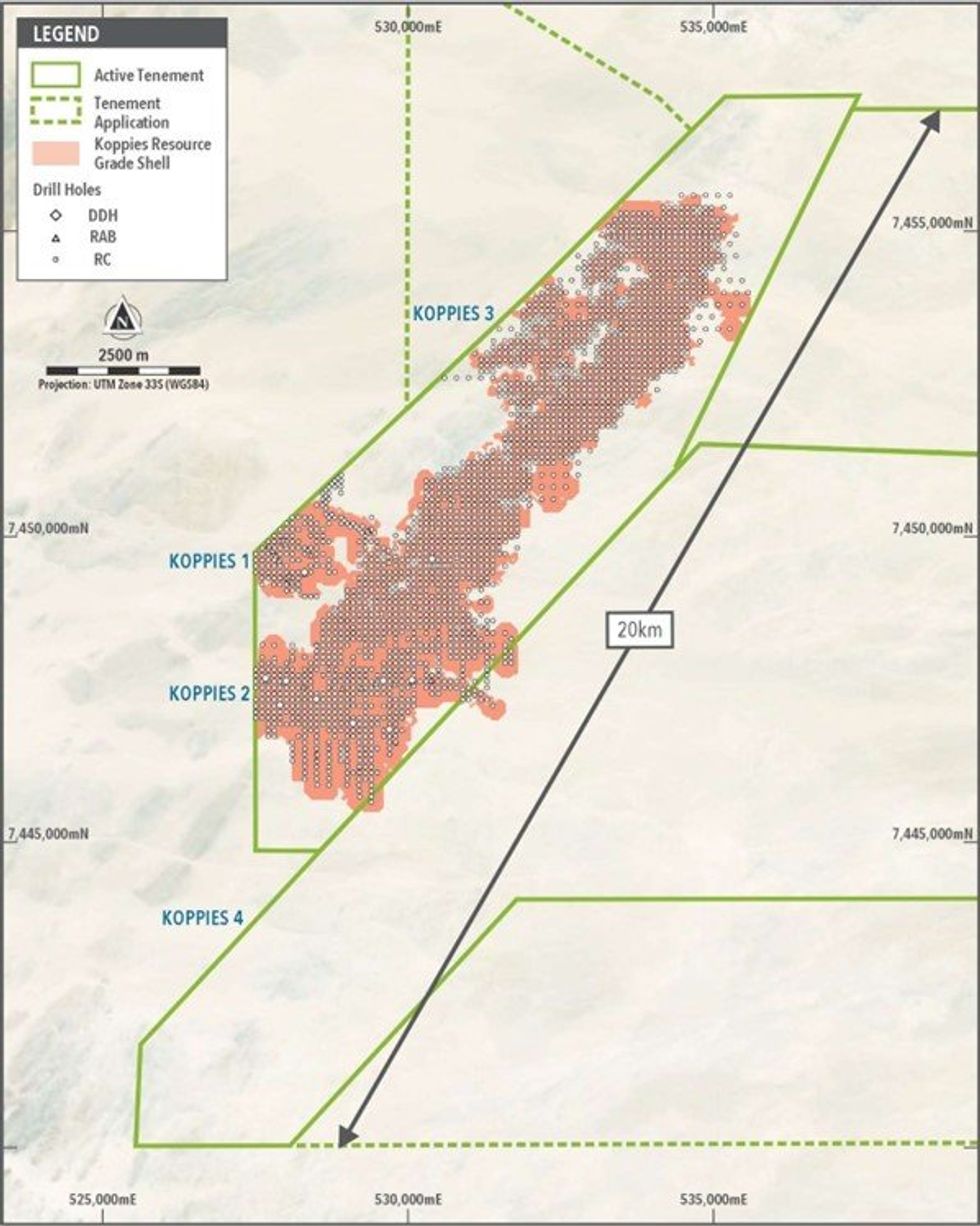

Figure 1 shows the current surface extent of the MRE, as well as all the drilling completed and included in the November 2023 resource update.

Figure 2 indicates how the mineralisation is distributed by depth throughout the MRE. Mineralisation is shallow, with 95% of the total mineral resource being within approximately 15 metres of the surface, and 50% of the resource within approximately 6 metres of the surface. These physical parameters support the potential for a low strip ratio, low-cost mining operation at Koppies.

Click here for the full ASX Release

This article includes content from Elevate Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EL8:AU

The Conversation (0)

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00