December 04, 2024

GreenTech Metals Ltd (ASX: GRE) (GreenTech or the Company) is pleased to announce a second stage drill program at the Whundo Cu-Zn project in the West Pilbara region, which is anticipated to commence in the coming weeks.

Highlights

- GreenTech has finalised plans for the second stage drill program comprising up to 4,000m of diamond core drilling at its 100% owned Whundo Cu-Zn project in the West Pilbara

- The stage 2 program aims to confirm potential for significant resource expansion at the Whundo cluster of VMS style Cu-Zn deposits

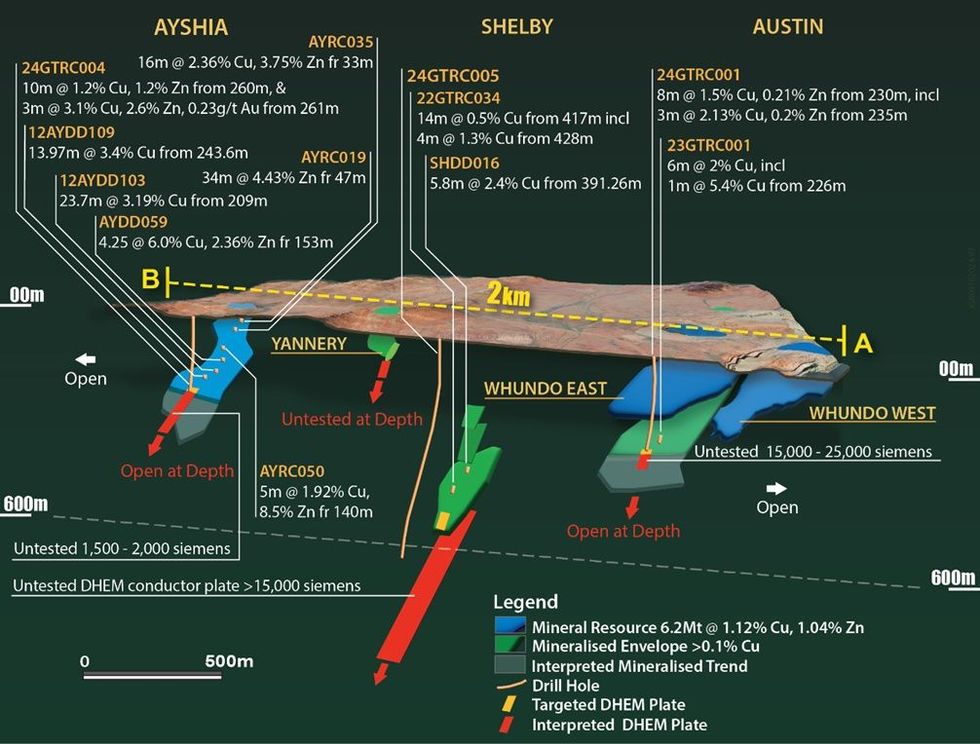

- Drilling will focus on extending the under-explored mineralised shoots at Austin, Shelby, Yannery and Ayshia

- Drilling to be followed by downhole electromagnetic (DHEM) surveys aimed at identifying further extensions to the Cu-Zn mineralised shoots

- Identified DHEM conductor targets associated with the known mineralised shoots present potential to significantly increase existing Cu-Zn resources

- Drilling contractor Topdrill has been engaged to commence in the coming weeks

- Drilling is funded by recently completed $2.3M placement, $1M drill for equity agreement with Topdrill and an EIS grant of up to $140,000 from the WA Government1

GreenTech’s Executive Director, Tom Reddicliffe, commented: “Following hot on the heels of a successful first stage of drilling, this next campaign will get underway this year to further test potential extensions to the mineralised shoots comprising the Whundo VMS cluster. In particular, we eagerly await the outcome of testing the exceptional Shelby conductor which eclipses other targets in the field with respect to its scale. This target is a clear standout and will be a priority to be drilled. Given the nature of VMS clusters, and the multiple opportunities for resource growth we believe a project with around 10-15Mt would make a significant difference to the economics of the Whundo Copper project and represents a potentially achievable target for exploration going forward.”

The program aims to confirm potential for significant resource expansion at the Whundo cluster of VMS style Cu-Zn deposits and is a follow-up to the successful first program of 1,710m completed in July 2024.

This second drill campaign will comprise up to 4,000m of diamond core drilling, with follow- up downhole electromagnetic (DHEM) surveys planned for selected holes. The results of the DHEM surveys will assist in the planning of follow-up drill holes which may be drilled as part of this program.

Whundo VMS Field

The Whundo Project comprises six known mineralised Cu-Zn shoots, typically plunging to the north at 30 – 40 degrees. These mineralised shoots, known as Whundo East, Whundo West, Austin, Shelby, Yannery and Ayshia, occur within a defined generally northeast trending zone over a strike of 2km. A further combined 2km of this prospective zone remains open to both the west and the east of the known mineralisation within the tenement. The close spatial relationship between the known mineralised shoots with respect to plunge and thickness of mineralisation suggest these are potentially part of a large VMS type mineralising event which remains open along strike and at depth.

Click here for the full ASX Release

This article includes content from GreenTech Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GRE:AU

The Conversation (0)

23h

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00