July 03, 2022

Celsius Resources Limited (“Celsius” or “the Company”) is pleased to announce it has received outstanding large scale and high-grade assay results from the ongoing drilling program at its flagship MCB copper-gold project, held under its Philippine subsidiary Makilala Mining Company, Inc. (“MMCI”).

Highlights

- Intersection of 611.4m @ 1.39% copper and 0.75g/t gold from 32.5m (1.67% CuEq*).

- Multiple internal higher-grade results confirmed:

- 150.85m @ 1.90% copper and 1.57g/t gold from 207.15m (2.55% CuEq*),

- 234.45m @ 1.90% copper and 0.87g/t gold from 391.55m (2.22%CuEq*) and,

- 77.55m @ 2.47% copper and 2.12 g/t gold from 232.10m (3.34%CuEq*)

The results are in line with other recent drilling results from holes MCB-036 and MCB-037 (see CLA announcements dated 13 December 2021 and 23 May 2022, respectively) confirming the presence of an extensive shallow higher-grade position. MCB-038 continued on further to confirm and expand the position of two additional higher-grade zones which have a horizontal orientation within a larger and broader lower grade envelop.

The results from MCB-038 were designed to improve the confidence level of the existing Mineral Resource in addition to focusing on defining further higher-grade positions for the purpose of enhancing the feasibility study.

Celsius Executive Chairman, Mr. Martin Buckingham said:

“The results from MCB-038 are exceptional, and we believe reflect the quality of the MCB deposit.”

“We still have a few more diamond drill holes to come which are planned to further define the shallow and easy to access higher-grade copper at MCB. The drilling results over the past 6 months have identified important additions to copper mineralisation and we are looking forward to understanding the impact of these results as we move into our JORC Update resource estimate and feasibility studies in the second half of this year.”

“These large intersections have substantial gold credits to result in very high CuEq values after allowing for the estimated recoveries of both the copper and gold.”

*The reporting of copper equivalent values (CuEq) was based on long term predicted copper prices of US$4.0lb, gold price of US$1,695/oz, and with copper and gold recoveries of 94.2% and 79%, respectively as defined in the reported Scoping Study for the MCB Project (see CLA announcement on 1 December 2021). Assumed copper and gold price predictions will vary with market conditions and this will be re-evaluated in future feasibility studies.

MCB COPPER-GOLD PROJECT

The MCB Copper-Gold Project (MCB) is located in the Cordillera Administrative Region in the Philippines, approximately 320 kilometres north of Manila (Figure 1). It is the flagship project within the Makilala portfolio which also contains other key prospects in the pipeline for permit renewal/extension.

A maiden JORC compliant Mineral Resource Estimate was declared for the MCB Project in January 2021, comprising 313.8 million tonnes @ 0.48% copper and 0.15 g/t gold, for 1.5 million tonnes of contained copper and 1.47 million ounces of gold, of which 290.3 million tonnes @ 0.48% copper and 0.15 g/t gold is classified as Indicated and 23.5 million tonnes @ 0.48% copper and 0.10 g/t gold is classified as Inferred.

A Scoping Study for the MCB Project was announced by CLA on 1 December 2021, which identified the potential for the development of a copper-gold operation with a 25-year mine life. The scoping study was based on an underground mining operation and processing facility to produce a saleable copper-gold concentrate.

Highlights from the Scoping study include a Post tax NPV (8%) of US$464m and IRR of 35%, assuming a copper price of US$4.00/lb and gold price of US$1,695/oz. Initial capital expenditure is estimated to be US$253m with a payback period of approximately 2.7 years. The designed mine production is matched to a 2.28Mtpa processing plant which will treat ore with an estimated average grade of 1.14% copper and 0.54g/t gold for the first 10 years of planned production with a C1 cash costs at just US$0.73/lb copper, net gold credits.

Figure 1. Location of the MCB Project in the province of Kalinga, Northern Luzon, Philippines.

RESULTS FROM MCB-038

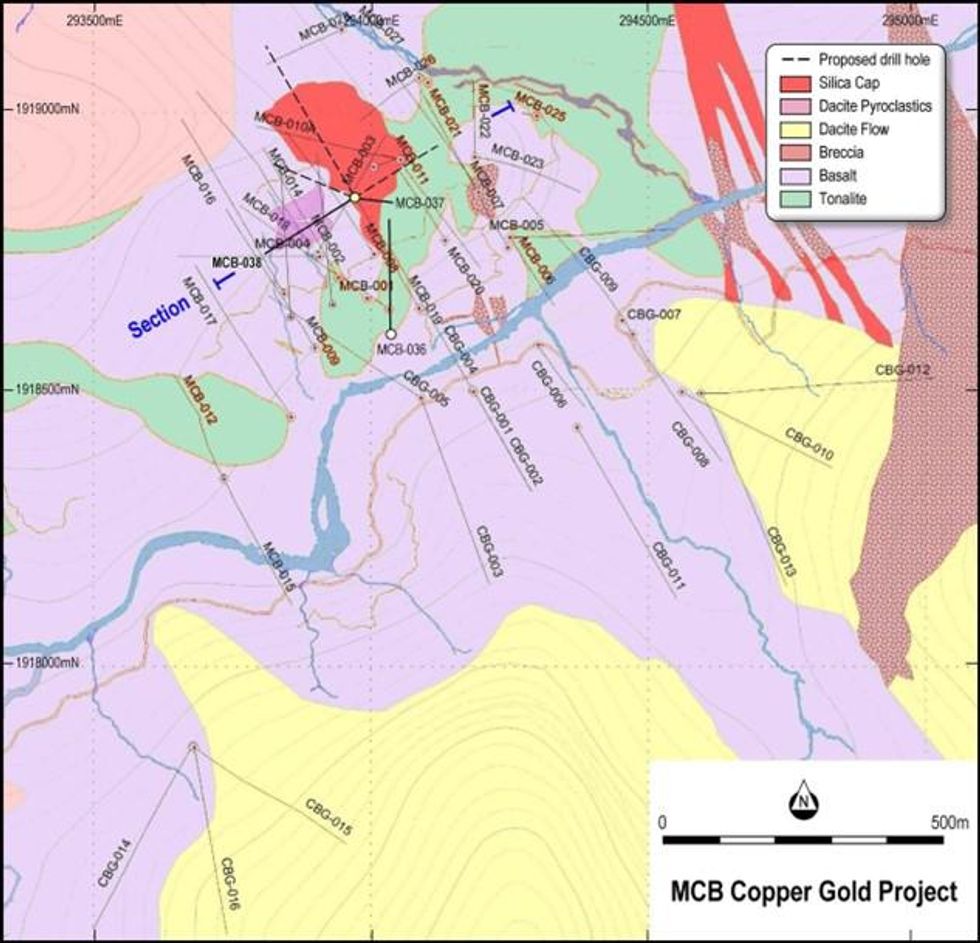

Drill hole MCB-038 was drilled to further confirm the interpretation that further shallow high grade positions exist as a relatively flat body extending into the surrounding host rocks and away from a genetically related Tonalite Intrusive rock (see Figures 2 and 3).

This drill hole was positioned to also intersect the previously defined deeper high-grade positions which are also interpreted to have a near to horizontal orientation. The high-grade positions exist within a larger lower grade envelope of lower grade copper mineralisation which is near to vertical in orientation and striking around 50 degrees from due north.

The geological observations in the drill core in addition to the assay results received have confirmed that there exists a number of higher-grade positions as predicted.

Figure 2. Location of MCB-038 drill Hole relative to recent and historical diamond drilling at MCB.

The broader interpreted envelope of the copper mineralisation is also substantially large with almost the entire intersection containing copper mineralisation above a lower cut-off of approximately 0.2% Cu.

The higher-grade positions are reported to a nominal cut-off of approximately 0.5% copper. The significant intersections based on the assay results received from MCB-038 are detailed in Table 1. MCB – 039 has been terminated 409.3 meters on July 1st with core preparation and assaying currently ongoing. This hole was designed to further extend and confirm the potential position of shallow higher-grade copper mineralisation which could enhance the planned scoping studies for the MCB deposit.

Click here for the full ASX Release

This article includes content from Balkan Mining (ASX:BMM), licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

4h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

4h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00