December 18, 2023

Culpeo Minerals Limited (“Culpeo” or the “Company”) (ASX:CPO, OTCQB:CPORF) is pleased to report significant widths of visible copper mineralisation have been intersected at very shallow depth at the El Quillay Prospect, Fortuna Project (the Project), Chile.

HIGHLIGHTS

- Broad zone of shallow visible copper mineralisation intersected over 40m from 15m downhole in CMEQD002 and over 23m from 20m downhole in CMEQD001.

- Intersected copper mineralisation in both diamond holes remains open in all directions.

- Expands potential of the El Quillay corridor where outcropping copper mineralisation and historical mining is present over a strike length >3km.

- Samples to be dispatched for laboratory analysis, with assay results expected in January 2024.

Culpeo Minerals’ Managing Director, Max Tuesley, commented:

“It is a fantastic result to immediately intersect visible copper so near to surface with our first two diamond holes at El Quillay North. This validates our initial work and confirms the prospectivity of this very exciting target. It also highlights the vast potential of the extensive El Quillay mineralised corridor, dominated by a wide, approximately 3km long zone, of outcropping copper mineralisation, the majority of which remains undrilled.”

We were always excited by what we saw on the ground at El Quillay North, which is now confirmed by the multiple zones of visible copper mineralisation in the drill core. Mineralisation is spatially associated with specular haematite and albite alteration, interpreted to be the part of an Iron Oxide Copper-Gold (IOCG) hydrothermal system.”

EL QUILLAY NORTH DRILLING PROGRAM

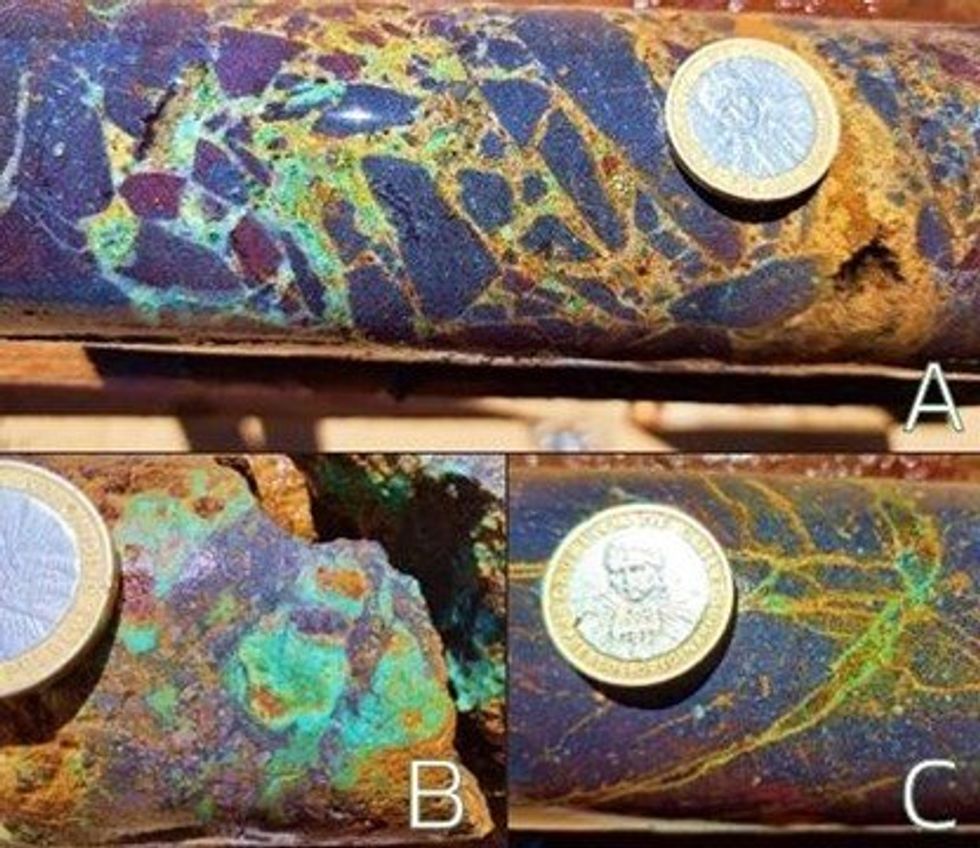

Broad 40m zone of copper mineralisation has been intersected from 15m, including an approximate 25m downhole zone of very strong copper sulphide mineralisation from 30m (CMEQD002). This provides visual confirmation that the high-grade copper-gold mineralisation recognised from historic underground sampling (refer ASX announcement 11 September 2023) extends down plunge and remains open in all directions.

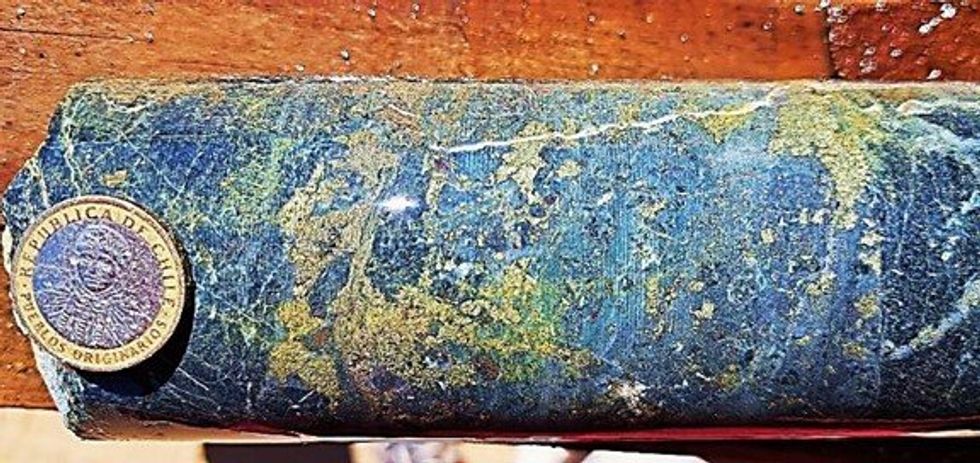

Visual estimates of copper sulphides logged in CMEQD002 are presented in Table 1 (photos presented in Figures 2 and 3).

Culpeo notes this is based on a visual inspection only and the samples are yet to be assayed or analysed. The Company anticipates the release of assay results in respect of the visual estimates to occur on or around mid-January 2024.

Note: In relation to the disclosure of visual mineralisation, the Company cautions that visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Assay results are required to determine the actual widths and grade of the visible mineralisation. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

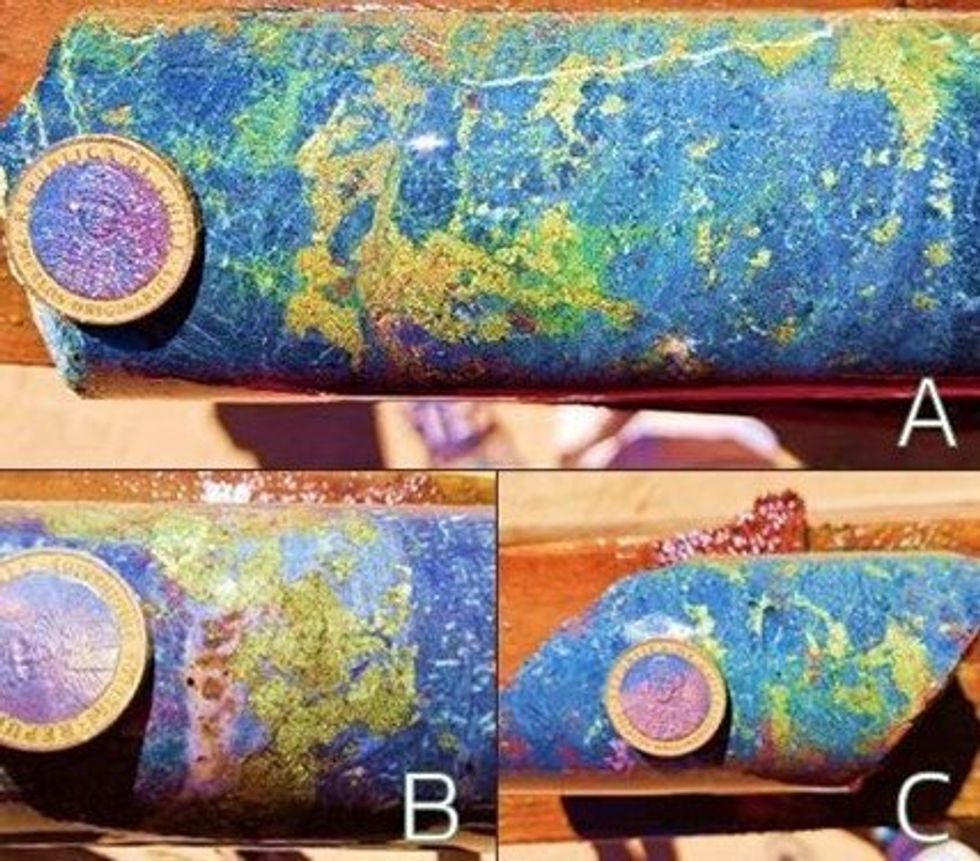

A 23m zone of copper mineralisation from 20m down hole has also been intersected in diamond hole CMEQD001. Post mineralisation faulting was logged at 36m downhole and future drilling will target offsets to mineralisation to the east and west. Visual estimates of copper sulphides logged in CMEQD001 are presented in Table 2.

In both holes the near surface mineralisation was dominated by malachite and chrysocolla. In the primary zone the main copper mineralisation was in the form of chalcopyrite and to a lesser extent bornite.

Click here for the full ASX Release

This article includes content from Culpeo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CPO:AU

The Conversation (0)

03 April 2024

Culpeo Minerals

Exploring High-grade Outcropping Copper-Gold Projects in Chile

Exploring High-grade Outcropping Copper-Gold Projects in Chile Keep Reading...

16h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00