June 14, 2023

Blackstone Minerals Limited (ASX:BSX) (“Blackstone” or the “Company”) is pleased to provide an update on the Company’s strengthening government relations in Vietnam.

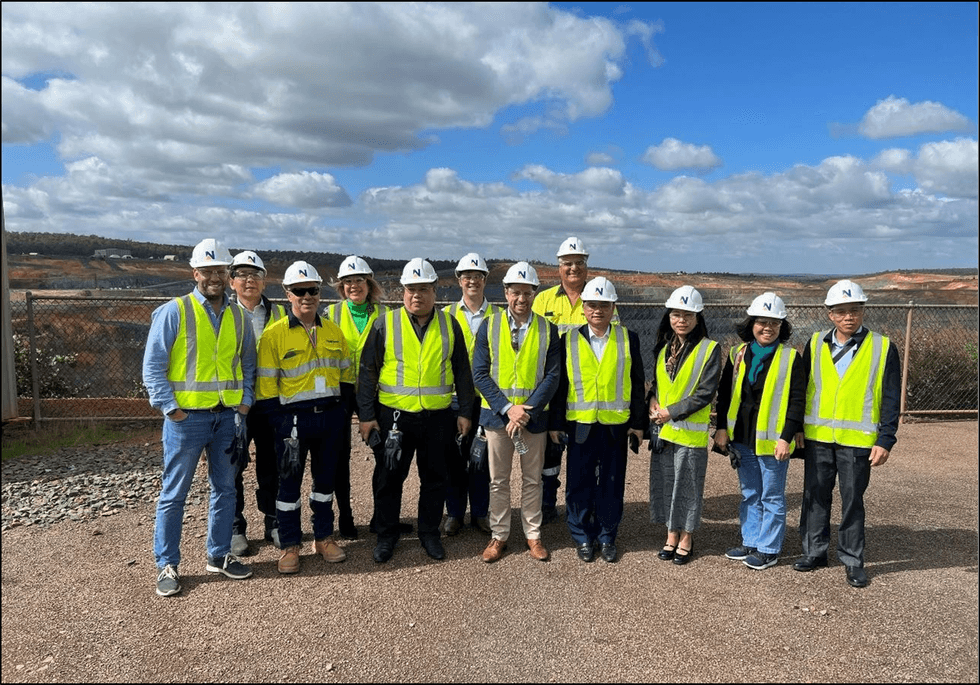

Son La Delegation visits Blackstone in Perth

Blackstone was honoured to host a senior delegation visit from Son La in late April. The visit was organised and funded by the Vietnamese Ministry of Foreign Affairs. The Son La Officials delegation included;

- Dang Ngoc Hau - Son La Peoples Party Committee – Vice Chairman & Chairman of Son La / Blackstone Minerals Working Group

- Phung Kim Son - Son La Department of Natural Resources & Energy (DONRE) – Director

- Cam Duy Hieu - Son La Peoples Party Committee – Economic Department – Head of Department.

Blackstone was pleased to have Ms Thanh Ha Nguyen, the Consul General of Vietnam (Western Australia), and Mr Albert Purnomo, Global Engagement Manager, Austrade also attend the visit.

The objective of the visit was to:

- Improve Vietnamese Authorities’ understanding of our world class mining practices.

- ShowcaseAustralia’shigheststandardofminingsafety&environmental performance.

- Update the delegation on progress Blackstone has made with the piloting work and the Definitive Feasibility Study (DFS).

- Introduce the Son La Delegation to the Department of Mines Industry, Regulation and Safety, Government of Western Australia.

- Visit a world class gold mining operation using leading edge technology to mine safely and efficiently.

- To further strengthen the relationship between Blackstone’s management and the Son La Government.

The visit was well received with the delegation preparing a detailed and complimentary report on Blackstone and the status of mining in Western Australia that was presented to the Son La Provincial Party Committee on their return to Vietnam.

Son La Provincial Party Committee

On Tuesday, 16th May, Blackstone met with the Son La Party Committee to reaffirm our commitments regarding the Ta Khoa Project (TKP) in Son La. Managing Director, Scott Williamson, gave an update on progress regarding partners, funding and the status of the Definitive Feasibility Study. The update was well received with the Vice Party Secretary, Lo Minh Hung confirming the Provinces’ ongoing commitment and support for the project.

Roundtable on Energy and Resources

On Wednesday,17th May, Managing Director, Scott Williamson was invited to attend a roundtable on energy and resources at the Australian Embassy in Hanoi. The event was hosted by Australia’s Ambassador to Vietnam, His Excellency Mr. Andrew Goledzinowski and chaired by the Australian Prime Minister’s Special Envoy for Southeast Asia, Mr Nicholas Moore.

Attendees included representatives of the World Bank, business leaders from both Australia and Vietnam and representatives from the Department of Foreign Affairs and Trade. While the event covered a broad range of topics, two main areas of focus were renewable energy and the exploration and development of mineral resources.

The panel recognised several issues that should be addressed to improve business ties between both countries, most notable of which were restrictive legislation and bureaucratic delays. Through the Special Envoy, the issues tabled will be raised with the top levels of Vietnamese Leadership with the goal of developing workable solutions which will strengthen the relationship and improve trade and investment between Australia and Vietnam.

Mining Law Update

Blackstone Minerals has been invited to participate in a series of workshops being run by the Ministry of Natural Resources and Energy (MONRE) and the General Department of Minerals, Vietnam (GDMV) for the revision and rewriting of Vietnamese Mining and Minerals Law. MONRE is collecting submissions and holding open forums to gather input from across the mining sector. The Vietnamese government is aiming to re-write the current laws to bring them more in line with other successful mining jurisdictions across the globe.

MONRE has also requested assistance from the Australian government via the Department of Foreign Affairs and Trade (DFAT) to provide guidance and support. The Australian Government was previously involved in the drafting of the 1996 Mineral law of Vietnam. Blackstone has been working closely with DFAT to highlight areas for improvement within the current mineral law. DFAT in conjunction with an independent mining law consultant will provide guidance to the Vietnamese government on increasing access to land for exploration, improved taxation and royalty schemes and streamlining the permitting process.

MONRE and GDMV aim to update the Vietnamese Mining Law to align it with other successful mining jurisdictions and to make Vietnam a more attractive destination for foreign direct investment in exploration, mining and mineral processing.

Prime Minister Approves National Power Master Plan

The Prime Minister of Vietnam signed Decision No. 500/QD-TTg dated 15th May 2023 approving the National Electricity Development Master Plan for the period of 2021 - 2030, with a vision to 2050 (Power Master Plan VIII). Included in this National Electrical Development Master Plan are the Power and Infrastructure requirements for the Ta Khoa Refinery. This is a significant milestone in that the Vietnam Government formally acknowledges the Electricity infrastructure requirements for our project which is a critical part of the licensing and permitting process.

Click here for the full ASX Release

This article includes content from Blackstone Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BSX:AU

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

25 July 2025

Blackstone Minerals

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia

A diversified developer of battery-grade nickel and copper-gold assets in Southeast Asia Keep Reading...

27 January

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 December 2025

Managing Director Resignation and Board Changes

Blackstone Minerals (BSX:AU) has announced Managing Director Resignation and Board ChangesDownload the PDF here. Keep Reading...

24 October 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Blackstone Minerals (BSX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 August 2025

BSX Secures JV Partner & Funding for Ta Khoa Nickel Project

Blackstone Minerals (BSX:AU) has announced BSX Secures JV Partner & Funding for Ta Khoa Nickel ProjectDownload the PDF here. Keep Reading...

25 August 2025

Trading Halt

Blackstone Minerals (BSX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

3h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to begin... Keep Reading...

11h

Fathom Announces Completion of Gochager Lake Winter Trail and Expected Start of Winter Drill Program

Fathom Nickel Inc. (CSE: FNI,OTC:FNICF) (FSE: 6Q5) (OTCQB: FNICF) ('Fathom", or the "Company") is pleased to announce the completion of the winter trail, and mobilization of drilling and ancillary equipment to the Gochager Lake project. Drilling of the 3,000-to-4,000-meter program is expected to... Keep Reading...

22h

Ni-Co Energy Inc. Files Preliminary Prospectus for Proposed Initial Public Offering

Ni-Co Energy Inc. (“Ni-Co Energy” or the “Company”) is pleased to announce that it has filed a preliminary prospectus (the “Preliminary Prospectus”) with the securities regulatory authorities in the provinces of Québec, Ontario, Alberta, and British Columbia in connection with its proposed... Keep Reading...

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

Latest News

Sign up to get your FREE

Blackstone Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00