April 07, 2024

Description:

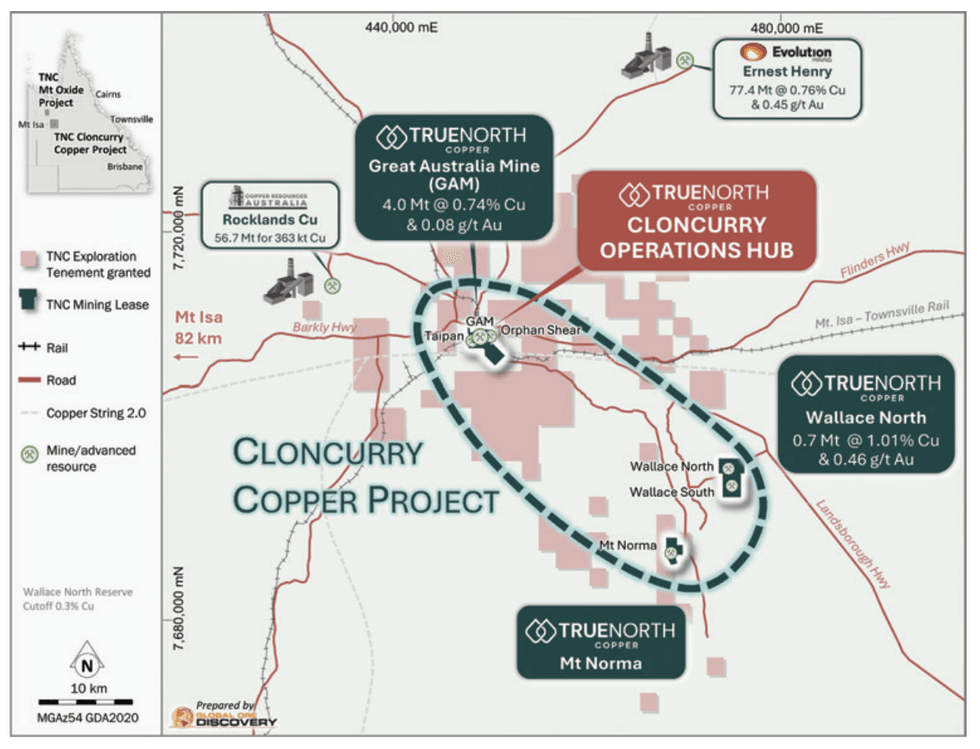

True North Copper (ASX:TNC) offers investors strong risk-adjusted returns from current prices and several upside from its Cloncurry copper project, according to a report published by Australian market research firm Morgans.

With its portfolio of complementary copper assets in a world-class mining district in Australia, Morgans’ analyst Tom Sartor believes the value of in-situ copper at TNC’s assets will increase in line with the copper market.

“We like TNC’s: 1) multi-year production/cash flow potential; 2) self-funding potential; 3) mine life/exploration upside; and 4) higher grade development prospect at Mt Oxide,” the report said.

TNC has announced it will commence mining ore at Wallace North in the fourth quarter of 2024, following the company’s mining restart study for the Cloncurry copper project (CCP). In January 2024, TNC secured an offtake agreement with Glencore and a US$28-million dollar loan facility from Nebari Natural Resources Fund.

“Execution of the CCP re-start to plan is company-defining in 2024 as TNC has an opportunity to achieve self-funding status and allay market fear of liquidity risk,” wrote Sartor in the report.

Highlights of the report:

- Upsides include multi-year production and cash flow potential from CCP mine restart; self-funding potential; mine life expansion potential and exploration upside; and higher grade development prospect at TNC’s Mt Oxide project.

- TNC’s aim to become a self-funding, NorthWest Queensland-focused copper producer-developer remains intact. In fact, several value-adds since the reverse takeover, including CCP de-risking, orebody confidence and exploration success are being overlooked as liquidity dominates market attention.

- Price catalysts include successful CCP mining/tolling re-start and demonstration of CCP commerciality and positive cash generation by late 2024. The Morgans report notes it expects “quarterly cash outflows to continue through 2024 as the ramp-up of revenues will take time to catch-up to and overtake expenses linked to the mining contractor ramp-up, pre-stripping and logistics required to unlock it.”

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

14h

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drilling Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia is taking part in a ministerial meeting hosted by the US aimed at exploring a strategic critical minerals... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00