March 26, 2024

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to provide an operational update on the mining restart at its 100% owned Cloncurry Copper Project (CCP).

HIGHLIGHTS

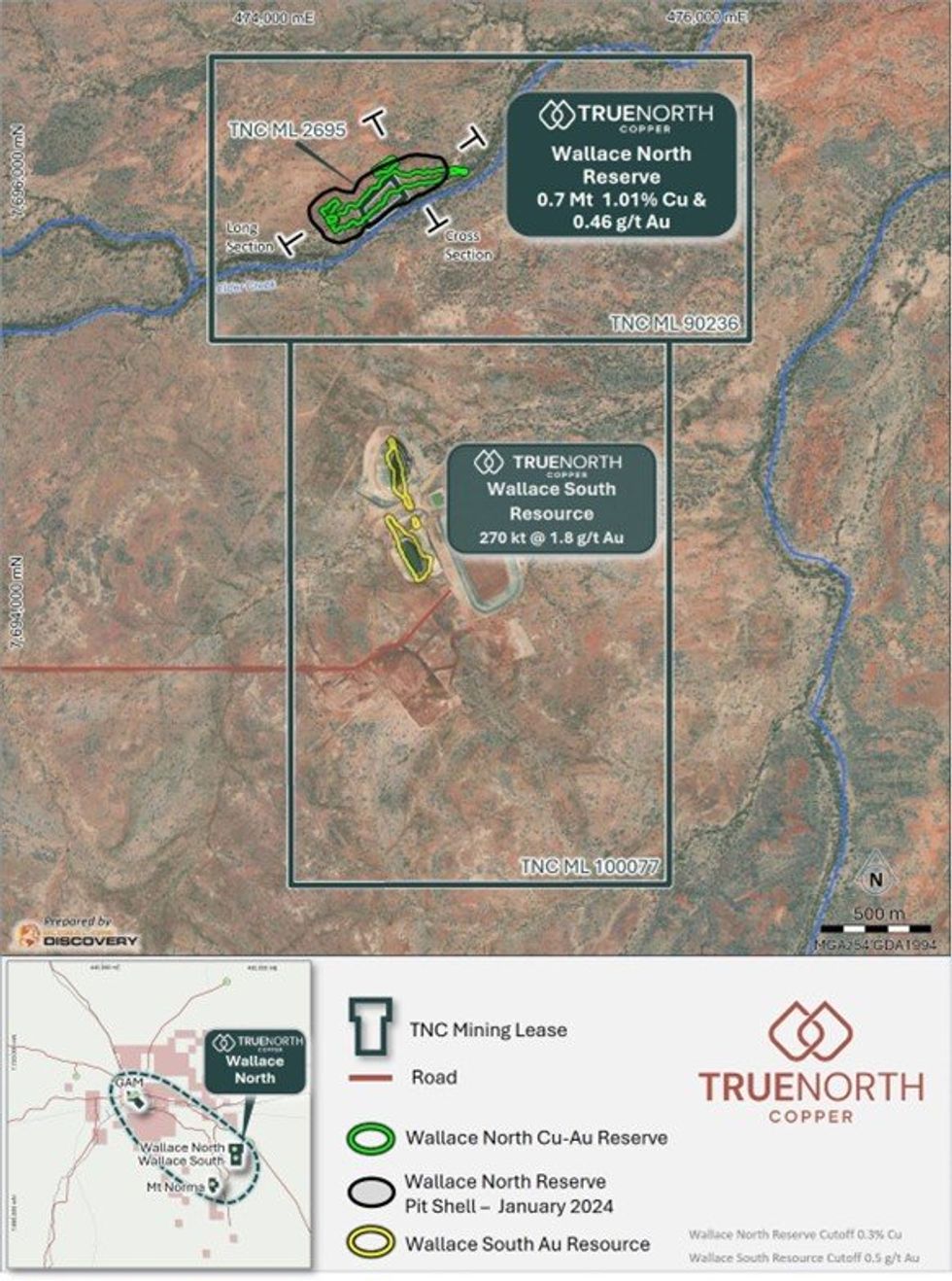

- TNC will commence mining ore at Wallace North in early Q4 FY24 (see Figure 2).

- Mining preparation at Wallace North progressed in March 2024 (as access and mine areas dried after monsoonal rainfall events in February and early March) including the following:

- Mobilisation of mining equipment and support infrastructure to the Wallace North project site (see Figures 4 & 5).

- Preparation of existing access and haulage roads for upcoming mining activities (see Figure 3).

- Completion of short-term mine scheduling by technical service teams.

- Onboarding of skilled mining fleet operators.

- The mining ramp-up will initially build ore stockpiles, with haulage expected to start in mid-May 2024. Oxide ore will be transported by road train to the Cloncurry Operations Hub's heap leach. Sulphide ore will be transported to a nearby concentrator for toll treatment under TNC's toll-milling agreement with Glencore International AG1 (Glencore).

- The CCP currently incorporates the Great Australia Mine Reserve3 (includes Great Australia Mine [GAM], Taipan and Orphan Shear deposits) and the Wallace North Reserve4 totalling 4.7Mt grading 0.80% Cu and 0.13g/t Au containing 37.5kt of copper and 20.0koz of gold (see Figure 1) at a strip ratio of 4.22.

- The CCP restart plan confirms positive project economics including mine revenue of A$367M with free cash flow of A$111M, and a pre-tax NPV10 of A$88M over a 4.6 year mine life, at USD$8,500/t Cu price and USD$1,850/oz Au price (0.7 A$:USD exchange rate)2.

COMMENT

True North Copper’s Managing Director, Marty Costello said:

“This is an exciting and transformative phase for TNC. Thanks to the hard work of our Mining Operations Team we are prepared and ready to deliver on our Cloncurry Copper Project Mining Restart Plan with mining commencing at Wallace North in early Q4 FY24.

CCP project economics confirm a robust mining operation that is low risk and low-cost. Projected mine revenue is A$367M with a free cash flow of A$111M.

Our plans to develop Mt Oxide into our next mine continue as we finalise the Vero mineral resource re-estimation and optimisation study.”

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

17h

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00