February 04, 2024

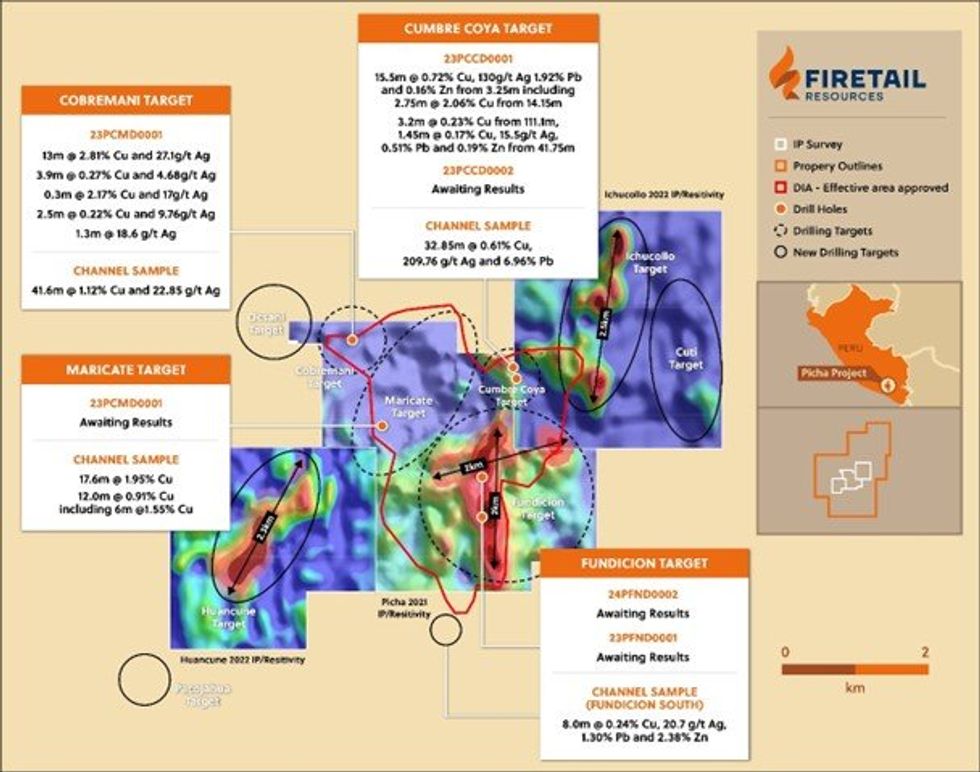

Australian battery minerals explorer, Firetail Resources Limited (“Firetail” or the “Company”) (ASX: FTL) is pleased to provide an update on the maiden diamond drilling (DD) program at the Picha Copper Project in Peru.

Assay results have been received from the first drill hole at the Cumbre Coya target, 23PCCD0001, confirming mineralisation in the area.

Subsequent to these positive results, further drilling has been completed at Cumbre Coya with a second hole located around 120m south of 23PCCD0001, drilled to a depth of 341m with visible mineralisation observed in the form of malachite, chalcocite and azurite.

Highlights include:

- Cumbre Coya Target: Drill hole 23PCCD0001 includes:

- 15.5m @ 0.72% Cu, 130g/t Ag 1.92% Pb and 0.16% Zn from 3.25m

- including 1.70m @ 0.50% Cu, 500g/t Ag and 5.9% Pb from 9.6m

- and 2.75m @ 2.06% Cu from 14.15m

- 3.2m @ 0.23% Cu from 111.1m,

- 1.45m @ 0.17% Cu, 15.5g/t Ag, 0.51% Pb and 0.19% Zn from 41.75m

- 15.5m @ 0.72% Cu, 130g/t Ag 1.92% Pb and 0.16% Zn from 3.25m

- Follow-up drillhole at Cumbre Coya target – Drillhole 23PCCD0002 completed to a depth of 341.4m, with visible secondary copper mineralisation in the form of malachite, chalcocite and azurite in veins and breccias between 63m and 102m.

- Drilling of sixth drill hole in maiden drilling program is now underway with three of the first five holes having intersected significant copper and silver mineralisation.

Drillling of the planned ~5,000m diamond program is continuing with several more drill holes planned at the identified targets. Firetail expects the drill program to be completed in April. Further assays are expected regularly during the remainder of the drilling campaign.

Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations (see Table 1).

Executive Chairman, Brett Grosvenor, commented:

“What a great way to start the new year. These latest assays continue to validate the presence of a mineralised system in Picha. With these type of results we now have some comfort that a super gene secondary mineralisation exists at the Cumbre Coya Target.

“Whilst our in country team continues to complete the drill program, and we eagerly anticipate further assays of this nature to come through as we uncover the opportunity of this potential deposit.

“We look forward to bringing consistent news and market updates over the coming months as we finalise our maiden drill campaign towards the end of April.”

Cumbre Coya Target

Two drill holes have been completed at the Cumbre Coya Target (collar details provided in Table 2). Assay results have now been received for the first hole, 23PCCD0001 which was designed to test a surface geochemistry anomaly which included a channel sample of 32.85m @ 0.61% Cu, 209g/t Ag and 6.96% Pb1.

Click here for the full ASX Release

This article includes content from Firetail Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FTL:AU

The Conversation (0)

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00