July 02, 2023

Galan Lithium Limited (ASX: GLN) (Galan or the Company) is very pleased to announce the results of its Phase 1 Definitive Feasibility (DFS) for its 100% owned Hombre Muerto West (HMW) Project in Catamarca Province, Argentina.

Highlights:

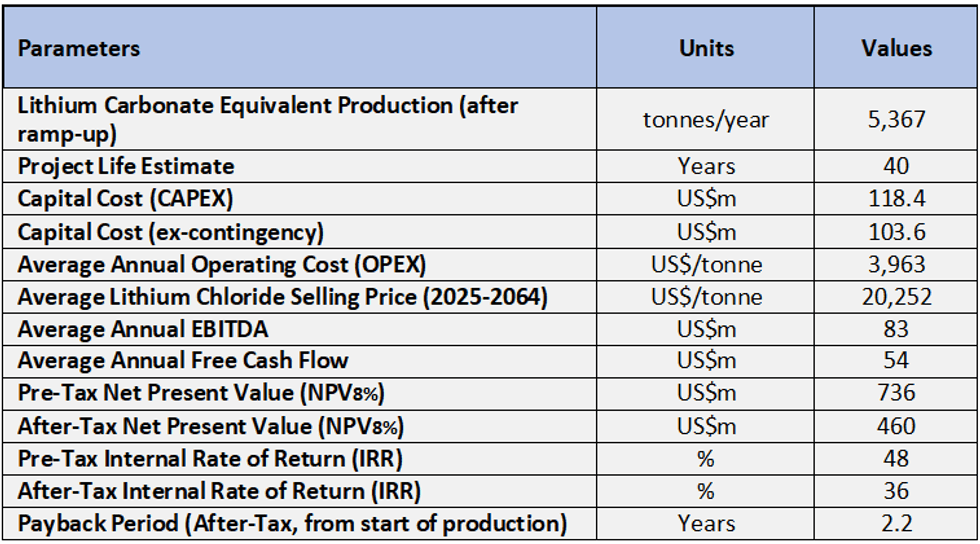

- Phase 1 DFS delivers compelling economics from an initial 5.37ktpa LCE operation at HMW; targeting a high quality, 6% concentrated lithium chloride product (equivalent to 12.9% Li2O or 31.9% LCE) in H1, 2025.

- Phase 1 on its own delivers a post-tax NPV8% of US$460m, IRR of 36% and free cash flow of US$54m per year, facilitating Galan’s funding for further expansions.

- Capex before contingency of US$104m and opex of US$3,963/t of recoverable LCE contained in concentrated lithium chloride product; Phase 1 costing in the first half of world lithium cost curve.

- Approximate 2 year payback from commencement of production.

- Minimal fresh water and power required for lithium chloride production.

- Phase 1 provides an exceptional foundation for significant economic upside in the Phase 2 DFS (20ktpa LCE), due in September 2023; with Phase 2 production expected in 2026.

- Initial Phase 1 development permits granted; top-soil removal, camp expansion and other earthworks have commenced, allowing the project to maintain schedule for first production in H1 2025.

- Procurement of long lead construction items underway.

The HMW DFS Phase 1 delivers an annual production rate of 5,367 recoverable tonnes of lithium carbonate equivalent (LCE), contained in a concentrated lithium chloride product for a period of 40 years. The Phase 1 DFS results and analysis provided outstanding outcomes that demonstrated the HMW Project was a very competitive and highly compelling project in the lithium brine industry, with significant upside.

As previously announced, the DFS was separated into two phases. This initial Phase 1 of the DFS focuses on the production of a lithium chloride concentrate, as governed by the production permits. The DFS optimisation work continues and will culminate in the release of a Phase 2 DFS in September 2023, addressing full 20ktpa LCE production rate.

Galan’s Managing Director Juan Pablo (JP) Vargas de la Vega commented:

“We are delighted by the compelling economics produced from just the first phase of the HMW DFS. The re-evaluation of the DFS process and long-term production strategy will now deliver a high-quality lithium chloride product into the market which will provide Galan with strong early cash-flows. The numbers speak for themselves with an approximate 2-year payback and a project NPV that represents more than twice our current market cap. Thanks to our loyal project team for their tireless commitment to the Galan cause.”

Cautionary Statements

The Definitive Feasibility Study (DFS) referred to in this announcement is based upon a JORC Code Compliant Mineral Resource Estimate (ASX: HMW Project Resource Increases to 6.6Mt LCE @ 880mg/l Li: 1 May 2023) (inclusive of the updated Proven and Probable Ore Reserve referred to in this announcement). Galan confirms that there are no Inferred Resources included in the DFS production schedule and that the schedule is comprised 100% of Ore Reserves.

The Mineral Resources underpinning the Ore Reserve and production target in the DFS have been prepared by a competent person in accordance with the requirements of the JORC Code (2012). The Competent Person’s Statement(s) are found in the section of this ASX release titled “Competent Person’s Statement(s). For full details of the Mineral Resources estimate, please refer to the body of this announcement. Galan confirms that it is not aware of any new information or data that materially affects the information included in this release. All material assumptions and technical parameters underpinning the estimates in the ASX release continue to apply and have not materially changed.

Process and engineering designs for the DFS were developed to support capital and operating estimates to an accuracy of -10% to +15%. Key assumptions that the DFS was based on (including those defined as Material Assumptions under ASX Listing Rule 5.9.1) are outlined in the body of this announcement and Appendix 1. Galan believes the production target, forecast financial information derived from that target and other forward-looking statements included in this announcement are based on reasonable grounds.

Several key steps need to be completed in order to bring the Hombre Muerto West Project into production. Many of these steps are referred to in this announcement. Investors should note that if there are delays associated with completion of those steps, outcomes may not yield the expected results (including the timing and quantum of estimated revenues and cash flows). The economic outcomes associated with the DFS are based on certain assumptions made for commodity prices, exchange rates and other economic variables, which are not within the Company’s control and subject to change. Changes in such assumptions may have a material impact on the economic outcomes.

To achieve the range of outcomes indicated in the DFS, funding will likely be required. There is no certainty that Galan will be able to source the amount of funding when required. It is also possible that such funding may only be available on terms that may be dilutive to or otherwise affect the value of Galan’s shares. It is also possible that Galan could pursue other value realisation strategies such as an off-take with prepayment, sale, partial sale or joint venture of the Hombre Muerto West Project.

Some of the statements appearing in this announcement may be in the nature of forward-looking statements. Such statements are only predictions and are subject to inherent risks and uncertainties. Those risks and uncertainties include factors and risks specific to the industries in which Galan Lithium Limited operates and proposes to operate as well as general economic conditions, prevailing exchange rates and interest rates and conditions in the financial markets, among other things. Actual events or results may differ materially from the events or results expressed or implied in any forward- looking statement. No forward-looking statement is a guarantee or representation as to future performance or any other future matters, which will be influenced by several factors and subject to various uncertainties and contingencies, many of which will be outside Galan Lithium Limited’s control. Galan Lithium Limited does not undertake any obligation to update publicly or release any revisions to these forward-looking statements to reflect events or circumstances after today's date or to reflect the occurrence of unanticipated events. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions or conclusions contained in this announcement. To the maximum extent permitted by law, none of Galan Lithium Limited, its directors, employees, advisors, or agents, nor any other person, accepts any liability for any loss arising from the use of the information contained in this announcement. You are cautioned not to place undue reliance on any forward-looking statement. The forward-looking statements in this announcement reflect views held only as at the date of this announcement.

Definitive Feasibility Study (DFS)

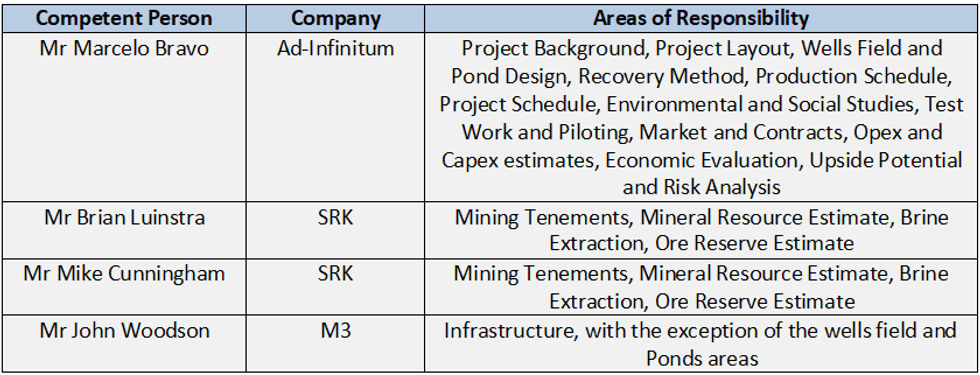

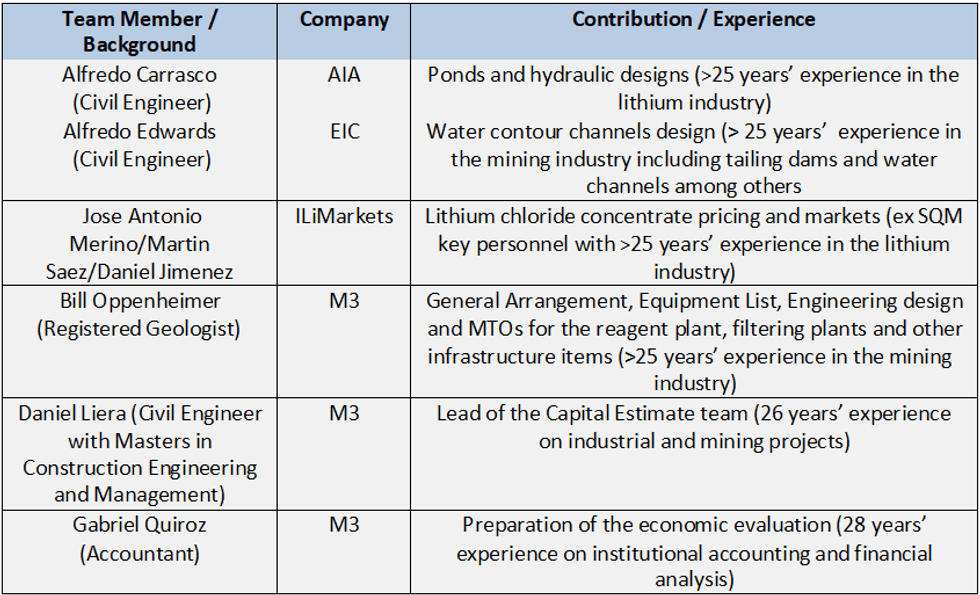

The preparation of the Phase 1 DFS was carried out by several consultants. The Mineral Resource and Ore Reserve estimates were prepared by SRK Consulting (SRK), the lithium recovery method was designed by Ad-Infinitum and the pond designs and water contour channels were developed by AIA Engineering and Consulting Services International (AIA) and EIC Engineering (EIC) respectively. Both are specialised engineering firms with sound previous experience with similar projects. M3 Engineering and Technology Corporation (M3) were responsible for reviewing and documenting the recovery method and the civil material take-off quantities for ponds and water contour channels, as well as developing the engineering design of the reagents and filtering plant. M3 also developed the Project’s layout, infrastructure designs, capital cost and operating costs estimates and economic evaluation. The price estimates of the lithium carbonate and lithium chloride concentrate were developed by Wood Mackenzie and iLiMarkets respectively. Key financial highlights are presented in Table 1.

Tables 2 and 3 display the key HMW Project Phase 1 DFS team members including the responsibilities of the Competent Persons (CPs).

Mineral Resource Estimate

The most recent HMW Mineral Resource estimate was announced to the market on 1 May 2023 (Refer ASX Announcement entitled “Galan’s 100% Owned HMW Project Resource Increases to 6.6MT LCE @ 880 mg/l Li (72% in Measured Category)”. It incorporated geological and geochemical information obtained from nineteen (19) drillholes totalling 5,918 metres within the Pata Pila, Rana de Sal, Casa del Inca (III & IV), Del Condor, Pucara del Salar, Delmira, Don Martin and Santa Barbara tenements (see figure 1). A total of 610 brine assays were used as a foundation of the estimation, all of which were analysed at Alex Stewart International (Alex Stewart) laboratory in Jujuy. The QA/QC program includes duplicates, triplicates, and standards. In total, 325 QA/QC samples were considered using Alex Stewart (duplicates) and SGS in Argentina (triplicates) as the umpired laboratory.

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLN:AU

The Conversation (0)

20 April 2025

Galan Lithium

Developing high-grade lithium brine projects in Argentina

Developing high-grade lithium brine projects in Argentina Keep Reading...

24 August 2025

Successful Due Diligence Ends - $20M Placement To Proceed

Galan Lithium (GLN:AU) has announced Successful Due Diligence Ends - $20m Placement To ProceedDownload the PDF here. Keep Reading...

01 August 2025

Final At-The-Market Raise for 2025

Galan Lithium (GLN:AU) has announced Final At-The-Market Raise for 2025Download the PDF here. Keep Reading...

30 July 2025

Quarterly Activities and Cash Flow Report

Galan Lithium (GLN:AU) has announced Quarterly Activities and Cash Flow ReportDownload the PDF here. Keep Reading...

25 July 2025

Incentive Regime for HMW Project in Argentina

Galan Lithium (GLN:AU) has announced Incentive Regime for HMW Project in ArgentinaDownload the PDF here. Keep Reading...

24 July 2025

Trading Halt

Galan Lithium (GLN:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00