(All dollar amounts are in United States Dollars unless otherwise indicated)

Nova Royalty Corp. (" Nova " or the " Company ") (TSXV: NOVR) (OTCQB: NOVRF) is pleased to announce that it has entered into a royalty purchase agreement (the " Agreement ") with Macocozac, S.A. de C.V. (the " Seller ") pursuant to which Nova will acquire an existing 1.0% net smelter return royalty (the " Royalty ") on the Aranzazu copper-gold-silver mine in Zacatecas, Mexico (" Aranzazu "), for $9.0 million comprised of $8.0 million in cash and $1.0 million in common shares of Nova (the " Transaction "). Aranzazu is 100% owned by Aura Minerals Inc. (TSX: ORA) (" Aura ").

Alex Tsukernik , Nova's President and CEO, commented, "Aura Minerals has clearly demonstrated Aranzazu's potential as a low-cost, long-life, mid-size copper mine. We are excited to acquire this royalty at a time of such strong production and resource growth at the asset. Aranzazu is Nova's first cash flowing royalty and is a natural fit with our existing portfolio of premier copper and nickel development assets".

Royalty Highlights

- Aura's full year 2021 production guidance and current commodity prices imply payments under the Royalty of approximately $1.5 million ; the Royalty covers copper, gold, and silver production (1)

- Addition of top mining jurisdiction Mexico continuing to diversify the portfolio across the Americas

- Addition of highly experienced mid-tier multi-national counterparty that owns and operates gold and copper mines in Honduras , Brazil , and Mexico

- Aranzazu is expected to produce between 22.8 and 27.5 Mlbs CuEq during the second half of 2021 (2)

- Aura's guidance suggests significant potential for further expansion and/or mine life extension, with over 48,900 meters of drilling planned to support Aura management's goal of doubling future production capacity

Aranzazu

Aranzazu is a copper-gold-silver deposit located within the Municipality of Concepcion del Oro in the State of Zacatecas, Mexico , approximately 250km to the southwest of the city of Zacatecas . The current mine at Aranzazu has been in operation since 1962, with documented evidence of mining in the area dating back nearly 500 years. Aura is the sole owner and operator of Aranzazu, having assumed ownership in 2010. In 2014, Aura closed the mine to re-engineer and re-develop various aspects of the operation. The mine reopened in 2018 and attained commercial production in December 2018 , since which time Aura has continually improved the efficiency of the operation.

The Aranzazu operation comprises an underground mine using long hole open stoping and an on-site plant, which produces copper concentrate with gold and silver by-product via conventional flotation processing. Aura recently achieved a throughput expansion at Aranzazu, increasing capacity by approximately 30% to 100,000 tons/month. Operations at Aranzazu achieved this expanded capacity in Q2 2021.

Aura disclosed that Aranzazu produced 9.5 Mlbs CuEq at cash costs of $1.90 /lb CuEq during Q2 2021 and 11.7 Mlbs CuEq at cash costs of $1.46 /lb CuEq during Q1 2021.

Aura further disclosed the production guidance range for Aranzazu for the second half of 2021 is calculated as 22.8 and 27.5 Mlbs CuEq. (2)

As of December 31, 2020 , Aura disclosed the mineral resource and reserve estimates for Aranzazu as: (3)

December 31, 2020 Mineral Resource Estimate

| | Tonnes | Grade | Contained Metal (Kt) | ||||

| Classification | Kt | Cu (%) | Au (g/t) | Ag (g/t) | Cu (Klbs) | Au (koz) | Ag (koz) |

| Measured | 9,544 | 1.47 | 1.14 | 20.75 | 310,167 | 350 | 6,367 |

| Indicated | 2,483 | 1.27 | 1.04 | 18.63 | 69,408 | 83 | 1,487 |

| Measured & Indicated | 12,027 | 1.43 | 1.12 | 20.31 | 379,575 | 433 | 7,854 |

| Inferred | 3,497 | 1.45 | 0.98 | 19.82 | 111,816 | 110 | 2,229 |

December 31, 2020 Mineral Reserve Estimate

| | Tonnes | Grade | Contained Metal (Kt) | ||||

| Classification | Kt | Cu (%) | Au (g/t) | Ag (g/t) | Cu (Klbs) | Au (koz) | Ag (koz) |

| Proven | 5,424 | 1.36 | 1.02 | 18.29 | 162,705 | 178 | 3,189 |

| Probable | 850 | 1.33 | 1.03 | 19.23 | 24,924 | 28 | 525 |

| Proven & Probable | 6,274 | 1.36 | 1.02 | 18.41 | 187,629 | 206 | 3,714 |

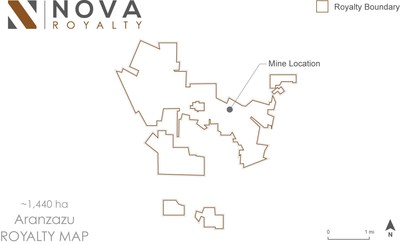

The Royalty covers an area of approximately 1,440 hectares, which includes the location of the existing underground mine and the entire mineral resource and reserve estimates for Aranzazu. A map of the Royalty area is shown below.

Transaction Details

The aggregate purchase price for the Transaction includes $8.0 million in cash and $1.0 million in common shares of Nova (" Consideration Shares "), based on the 10-day volume weighted average trading price (" VWAP ") on the TSX Venture Exchange (" TSXV ") of Consideration Shares prior to the closing date of the Transaction. The Company intends to file a prospectus supplement to its base shelf prospectus dated October 30, 2020 to qualify the distribution of the Consideration Shares to the Seller.

The owner of the Royalty is entitled to 1.0% of the net smelter returns on all products sold at Aranzazu, less certain allowable deductions, provided that the monthly average price per pound of copper, as quoted by the London Metals Exchange, equals or exceeds $2.00 /lb. Aranzazu currently receives revenue from the sale of copper concentrate, including payment for gold and silver by-products, all of which is subject to the Royalty.

Under the terms of the Agreement, Nova will be entitled to 100% of the payments from the Royalty corresponding to the net smelter returns generated at Aranzazu following June 30, 2021 . Nova expects to receive Royalty payments on a semi-annual basis in accordance with the terms of the Royalty. The Seller is entitled to economic benefits on Royalty payments that accrue from July 1, 2021 up to the (" Closing Date "), which is currently anticipated to be August 27, 2021 . Nova is fulfilling that obligation by paying approximately $200,000 in cash in addition to the $9.0 million purchase price for the Royalty on the Closing Date. The Transaction is subject to customary closing conditions, including the acceptance of the TSXV with respect to the issuance of the share consideration, and the Consideration Shares will contain contractual restrictions on trading in accordance with the terms of the Agreement.

Qualified Person

Technical information contained in this news release originates in the public disclosure set out above and has been reviewed and approved by Christian Rios , AIPG Certified Professional Geologist, Advisor to Nova and a Qualified Person as defined in National Instrument 43-101, Standards of Disclosure for Mineral Projects.

About Nova

Nova is a royalty company focused on providing investors with exposure to the key building blocks of clean energy – copper and nickel. The Company is headquartered in Vancouver, British Columbia and is listed on the TSXV under the trading symbol "NOVR" and on the US OTCQB under the ticker "NOVRF".

ON BEHALF OF Nova Royalty CORP.,

(signed) "Alex Tsukernik"

President and Chief Executive Officer

Phone: (604) 696-4241

Email: info@novaroyalty.com

Website: www.novaroyalty.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Notes:

| (1) | Royalty payments calculated based on Aura production guidance for Aranzazu for 2021 and the following commodity price assumptions - copper price: $4.30/lb, gold price: $1,780/oz, silver price: $23.80/oz. |

| (2) | Refer to Aura Q2 2021 Results Release and Guidance 2021 Update and Management's Discussion and Analysis for the three and six months ended June 30, 2021 . Copper Equivalent production was calculated based on gold equivalent ounce guidance, gold equivalent ounce production for the six months ended June 30, 2021, and commodity price assumptions used in gold equivalent ounce calculations disclosed by Aura. |

| (3) | Refer to Aura Annual Information Form for the year ended December 31, 2020 , dated March 31, 2021. |

TECHNICAL AND THIRD-PARTY INFORMATION

Except where otherwise stated, the disclosure in this press release relating to the Aranzazu mine is based on information publicly disclosed by Aura, as the owner and operator of the property and information/data available in the public domain as at the date hereof and none of this information has been independently verified by Nova. Specifically, as a royalty holder, Nova has limited, if any, access to the property subject to the Royalty. Although Nova does not have any knowledge that such information may not be accurate, there can be no assurance that such third party information is complete or accurate. Some information publicly reported by the operator may relate to a larger property than the area covered by the Royalty. Nova's royalty interests often cover less than 100% and sometimes only a portion of the publicly reported mineral reserves, mineral resources and production of a property.

Cautionary Note Regarding Forward-Looking Statements

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information in this press release includes, but is not limited to, exploration and expansion potential, production, recoveries and other anticipated or possible future developments on the Aranzazu mine, current commodity prices, the payment frequency of the under the Royalty, the acceptance by the TSXV of the Transaction, current and potential future estimates of mineral reserves and resources; future commercial production from the Aranzazu mine or other designated areas; and the attainment of any required regulatory approval to the acquisitions of the Royalty. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Nova to control or predict, that may cause Nova's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including, but not limited to, the risk factors set out under the heading "Risk Factors" in the Company's annual information form dated April 30, 2021 available for review on the Company's profile at www.sedar.com . Such forward-looking information represents management's best judgment based on information currently available. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

SOURCE Nova Royalty Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/August2021/16/c9610.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/August2021/16/c9610.html