June 14, 2023

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to announce the commencement of the maiden drill program at the recently acquired Bluebush REE Project (“Bluebush”), located on the northern half of the Serra Dourada granite, host of the Serra Verde Ionic Clay REE deposit (“Serra Verde”) (see Figure 1). Serra Verde boasts a Mineral Resource1 of 911Mt @ 1,200ppm Total Rare Earth Oxide (“TREO”) and a Mineral reserve of 350Mt @ 1,500ppm TREO, and is believed to be the only Ionic Clay project in construction outside of China.

HIGHLIGHTS

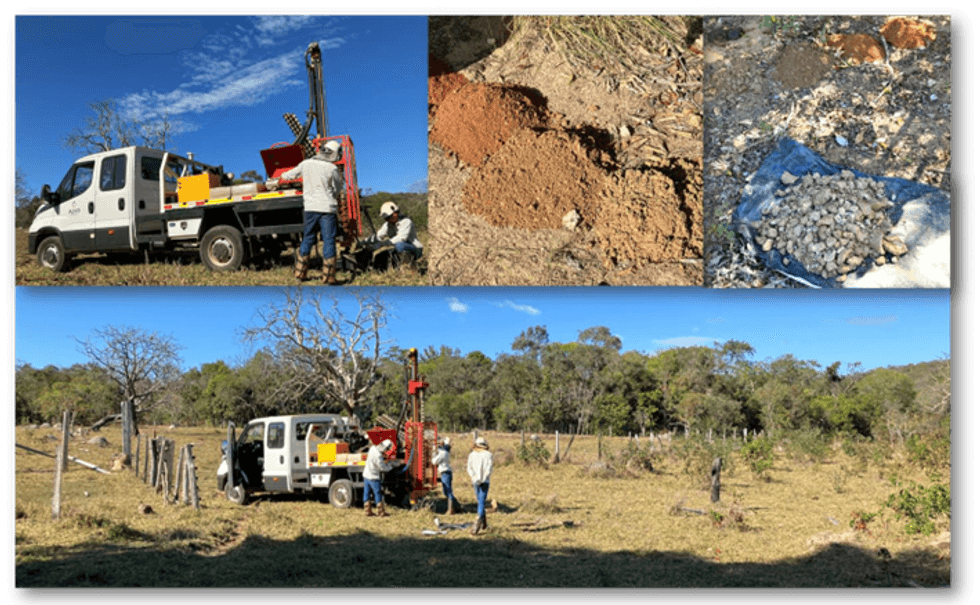

- Maiden auger drill program commences at the recently acquired Bluebush Rare Earth Element (“REE”)

- Project located in Central Brazil, utilising Alvo’s in-house truck mounted auger rig.

- Auger drilling will be focused on testing the depth and lateral extensions of existing mineralisation as well as extensive sampling of the saprolite to confirm ionic clay mineralisation.

- Early-stage exploration work completed by the vendors has confirmed high-grade REEs at shallow levels with values up to 4,500ppm TREO in alluvials and 2,350ppm TREO in saprolite (clay).

- Saprolite results recorded a very high magnet rare earth split averaging 35% (MREO/TREO)

- Historical auger drilling focused on surface alluvials with an average hole of 3.6m

- Alvo truck mounted auger drill rig has capacity up to 30m depth

- Drilling will commence at the Fazendinha, Ferradura and Boa Vista prospects, where previous drilling intercepted REE mineralisation from surface to end of hole (EOH), including:

- 5m @ 1,139ppm TREO (36% MREO) auger ERRO072AGR from 1m to EOH (Fazendinha)

- 13m @ 928ppm TREO (33% MREO) auger ERRO017AGR from 0m to EOH (Ferradura)

- 6m @ 1,188ppm TREO (37% MREO) auger ERRO273AGR from 1m* (Boa Vista 01)

- Alvo will use its auger drilling expertise that has seen 666 auger holes for 6,044m completed at the Palma VMS Project since mid-January 2023. Previous owners drilled a total of 258 auger holes for approximately 930m.

Rob Smakman, Alvo’s Managing Director commented on the Bluebush Project:

“When we listed on the ASX in October 2021 we commenced our maiden diamond-drill program at the Palma VMS Project within three days, now we are commencing our maiden auger drill program at the Bluebush REE Project within a week of the acquisition. We haven’t slowed down since IPO and aren’t planning on it.

“The auger drill program is the first phase of due diligence as we test the depth profile of the REE mineralisation hosted in the saprolite (clay) and send samples to the laboratory to confirm Bluebush is a true ionic clay deposit. We are confident in the likelihood of the results as Serra Verde to the south is on the same granite formation and exhibits similar characteristics of REE mineralisation identified by the previous owners of Bluebush.”

The maiden drill program will initially commence at northern prospects Fazendinha and Ferradura (see Figure 2), that intercepted rare earth mineralisation from surface to end of hole (EOH), including2:

- 5m @ 1,139ppm TREO (36% MREO) auger ERRO072AGR from 1m to EOH (Fazendinha)

- 13m @ 928ppm TREO (33% MREO) auger ERRO017AGR from 0m to EOH (Ferradura)

- 6m @ 1,188ppm TREO (37% MREO) auger ERRO273AGR from 1m* (Boa Vista 01)

The owners of Bluebush drilled a total of 258 auger holes for approximately 930m (average 3.6m depth) (see Figure 3). The auger drilling would often stop once the saprolite clay horizon was intercepted as the primary targets were the alluvials (and partly due to restrictions of the handheld equipment) and as such, the routine sampling of these horizons often ended in mineralisation.

Alvo will utilise its in-house auger drilling expertise that has seen it drill 666 auger holes for 6,044m since mid- January 2023 completed at the Palma VMS Project to rapidly progress the Bluebush REE Project.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00