August 19, 2024

Chariot Corporation Limited (ASX:CC9) (“Chariot” or the “Company”) is pleased to announce that it’s K-feldspar testing program conducted at its Black Mountain hard rock lithium project (“Black Mountain”) has confirmed the moderately to highly fractionated state of the outcropping LCT pegmatites at the project.

HIGHLIGHTS:

- Analysis of the Rb content in K-feldspar crystals collected from outcropping pegmatites at Black Mountain confirms the moderately to highly fractionated state of the outcropping lithium-caesium-tantalum (LCT) pegmatites

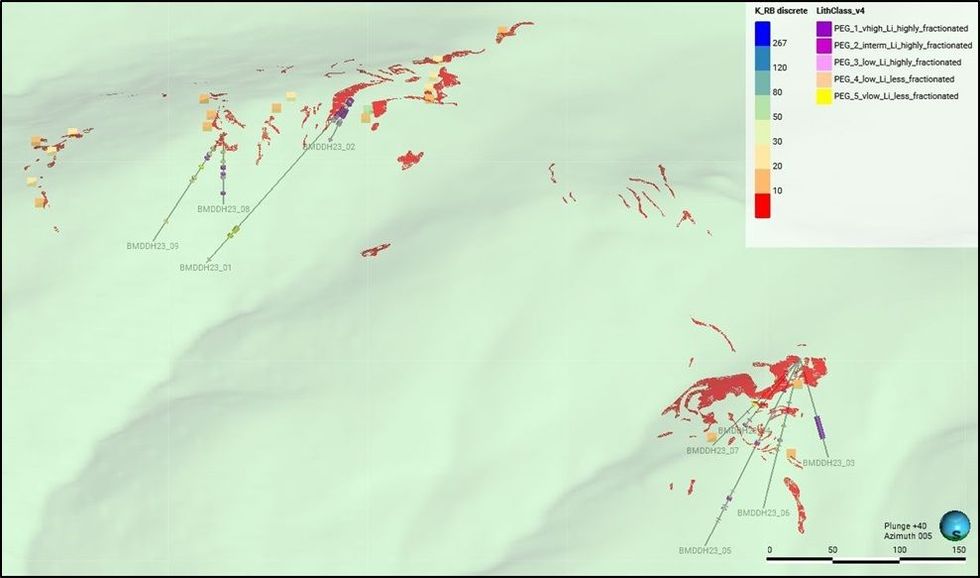

- The K-feldspar potassium to rubidium (K:Rb) ratios of less than 30 are concentrated in the southern group of pegmatites, confirming that they remain the most prospective for lithium mineralization and, accordingly, are now the primary targets for future drilling

- The results of this work have demonstrated to the Company that K-feldspar testing can quickly and cost-effectively distinguish fractionated LCT pegmatites prospective for lithium mineralisation from unmineralised pegmatites and, accordingly, will be used at Chariot’s other projects in the U.S.A.

Chariot has identified a fractionation trend within the property, with fractionation increasing towards the south and the presence of moderate-to-highly fractionated LCT pegmatites in the central and southern pegmatite clusters at Black Mountain (“Southern Target Area”).

A pXRF (portable X-ray fluorescence) device was used on 218 potassium-feldspar (“K-feldspar”) samples collected from the outcropping pegmatites at Black Mountain.

Many of these samples also displayed anomalous caesium (Cs) and tantalum (Ta) values, further supporting the existence of LCT pegmatites in the area.

The Company will expand its drilling plans and drill test the Southern Target Area.

Chariot engaged Environmental Resources Management (ERM) to assist with an orientation sampling program at the Black Mountain project to:

1) determine fractionation states of pegmatites by sampling the K-feldspar minerals;

2) identify any fractionation trends (based on K/Rb ratios), in order to define and rank zones for further drill testing; and

3) test for LCT-pegmatite suite elements (Cs, Rb, Ta, and Sn), as further indication of LCT type pegmatites.

The results of this work demonstrate the effectiveness of using K-feldspar testing to distinguish prospective lithium mineralized LCT pegmatites from less fractionated pegmatites. K-feldspar testing has enabled the Company cost-effectively to sharpen the focus of its exploration activities at Black Mountain and will also be used to focus exploration at the Company’s other projects. K-feldspar sampling is currently being conducted at the Copper Mountain and South Pass projects in Wyoming U.S.A.

Figure 1: Black Mountain Leapfrog model showing the mapped pegmatites over the DEM, downhole pegmatite intersections and outcrop K/Rb fractionation data. Oblique view looking northeast.

Fractionation State of the Pegmatites

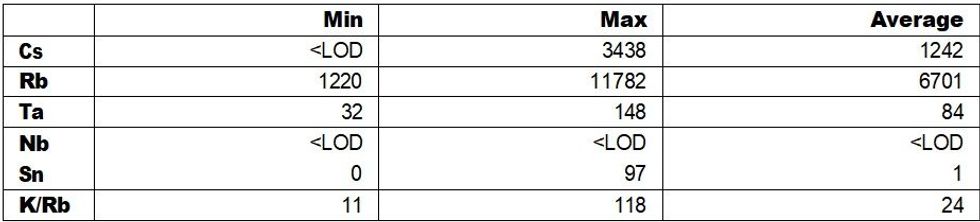

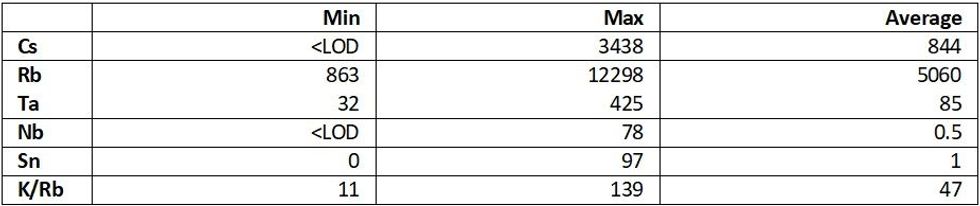

ERM’s experience and global dataset of K-feldspar K/Rb fractionation data indicates that pegmatites with a K/Rb value of less than 30, have the highest potential to host lithium mineralization (see also Chariot’s ASX announcement dated 19 June 20241). It was determined that the K-feldspar fractionation data from the Black Mountain pegmatites (see Table 1) are consistent with moderately to highly fractionated pegmatites with significant potential for LCT mineralization.

The pXRF analyses of K-feldspar (see Table 1) show elevated content of LCT-pegmatite suite elements (Cs, Rb, Ta, and Sn) and moderate to high fractionation states.

The Black Mountain pegmatites located in the project’s Southern Target Area exhibited K/Rb ratios averaging 24 and are associated with high-grade lithium mineralization encountered at surface and in drill holes. This drill data was provided by the Company in its ASX announcement dated 3 May 20242. The data indicates that the sampled pegmatites are all LCT-type.

Click here for the full ASX Release

This article includes content from Chariot Corporation, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CC9:AU

The Conversation (0)

07 February 2025

Chariot Corporation

Largest lithium exploration land holdings in the US

Largest lithium exploration land holdings in the US Keep Reading...

27 March 2025

Second Amendment to Black Mountain Purchase Option

Chariot Corporation (CC9:AU) has announced Second Amendment to Black Mountain Purchase OptionDownload the PDF here. Keep Reading...

26 March 2025

Convertible Note Financing of up to A$2.0 Million

Chariot Corporation (CC9:AU) has announced Convertible Note Financing of up to A$2.0 MillionDownload the PDF here. Keep Reading...

18 February 2025

High-Potential WA Lithium & Gold Tenements Secured

Chariot Corporation (CC9:AU) has announced High-Potential WA Lithium & Gold Tenements SecuredDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Chariot Corporation (CC9:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

26 November 2024

Black Mountain Phase 2 Program has Commenced

Chariot Corporation (CC9:AU) has announced Black Mountain Phase 2 Program has CommencedDownload the PDF here. Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00