August 21, 2024

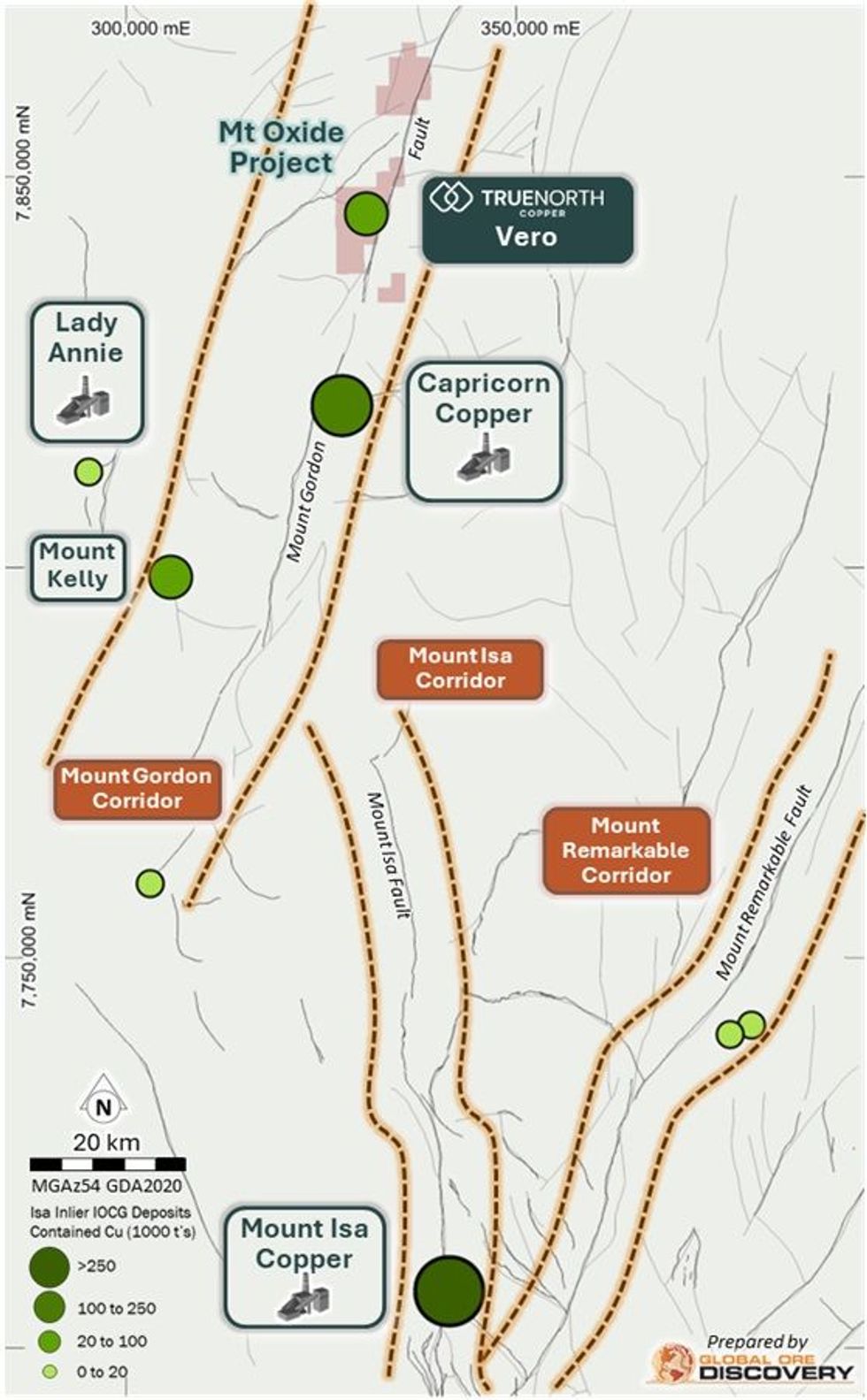

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce results from the ongoing geophysical survey at Vero and Camp Gossans, part of TNC’s Mt Oxide Project, 140km north of Mt Isa in Queensland. The survey has been supported by a $300,000 Queensland Government Collaborate Exploration Initiative (CEI) Grant.

HIGHLIGHTS

- Two MIMDAS Induced Polarisation (IP) and Magnetotelluric (MT) lines successfully completed at Vero and at Camp Gossans which has highlighted a number of geophysical anomalies that are unexplored.

- At Vero the results demonstrate excellent correlation between the resource mineralisation and MIMDAS chargeability highs, providing confidence in the technique to identify targets in the district.

- Two chargeability high responses have been identified at Camp Gossans less than 100m beneath the outcropping geochemically anomalous Alpha and Beta Gossan targets.

- A third, undrilled chargeability anomaly was identified 250m northwest of Camp Gossans beneath a previously unmapped 400m long, northeast striking, hematite altered fault breccia at a new target called Black Marlin.

- A further 275m wide and up to 350m deep chargeability anomaly was identified 1km east of Vero.

- The geophysical survey continues and is currently focused on testing several highly promising copper targets north along strike of Vero at Ivena North, Aquila and Mt Gordon2.

- The new geophysics will be integrated with ongoing mapping and surface geochemical sampling campaigns to identify and prioritise future drill targets.

COMMENT

True North Copper’s Managing Director, Bevan Jones said:

Our exploration efforts at Mt Oxide are yielding great results. The recent survey, supported by the CEI grant, has yielded anomalies that closely match our existing Vero copper, silver, and cobalt resources, providing us confidence to use this method to identify new targets across the area.

Exciting new drilling targets have been identified at Camp Gossans and Vero and we have also found new potential mineralised structures like Black Marlin. The deep seeking MT survey at Vero has found an anomaly that suggests the main mineralised zone could extend more than 1km deeper than our current drilling. With multiple high quality drill targets coming together, our Mt Oxide Project is conceptually building into a potentially significant copper mineralised district of which Vero is just one deposit.

Mt Oxide MIMDAS Survey Results Summary

In late July 2024, TNC announced it had commenced its leading edge MIMDAS Induced Polarisation (IP), Resistivity and Magnetotellurics (MT) geophysical survey (MIMDAS survey) at Mt Oxide3. Partial funding for the survey was granted to TNC in Round 8 of the Collaborative Exploration Initiative (CEI), with TNC receiving $300k of funding to undertake the survey (Figure 7). The MIMDAS survey aims to test for sulphide mineralisation developed below numerous recently mapped leached gossan zones and build an improved understanding of the regional scale structural and geological architecture.

TNC is pleased to announce the results from the first two completed lines. One line for 2.5 line-km over the Cu-Ag-Co Vero Resource (Vero) (15.03Mt at 1.46% Cu & 10.59g/t Ag for a contained 220kt Cu & 5.13Moz Ag4 Indicated and Inferred resource and a separate 9.15 Mt at 0.23% Co total combined Measured, Indicated & Inferred resource5) and one line for 1.9 line-km over the highly prospective Camp Gossans prospect (Figure 2).

At Vero, there is excellent correlation between the Cu-Ag-Co resource mineralisation and MIMDAS chargeability, providing confidence to use this technique to identify targets throughout the district (Figure 2 & Figure 3). In addition to the anomalies associated with the resource, the survey has identified a 275m wide and up to 350m deep 25mV/V chargeability anomaly located 1km east of Vero. The chargeability anomaly is associated with mapped structures and potential splays of the regionally significant crustal scale Mt Gordon Fault.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

4h

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

7h

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00