- WORLD EDITIONAustraliaNorth AmericaWorld

July 08, 2024

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) refers to the non-renounceable entitlement issue of 1 fully paid ordinary share in the capital of the Company (Share) for every one Share held be eligible shareholders at an issue price of $0.008 per Share together with one free attaching option to acquire one Share (exercisable at $0.018 on or before the date that is three years from the issue date) (Option) for every one Share applied for and issued to raise up to $1,625,589 (Entitlement Offer), as set out in the Prospectus dated 21 June 2024.

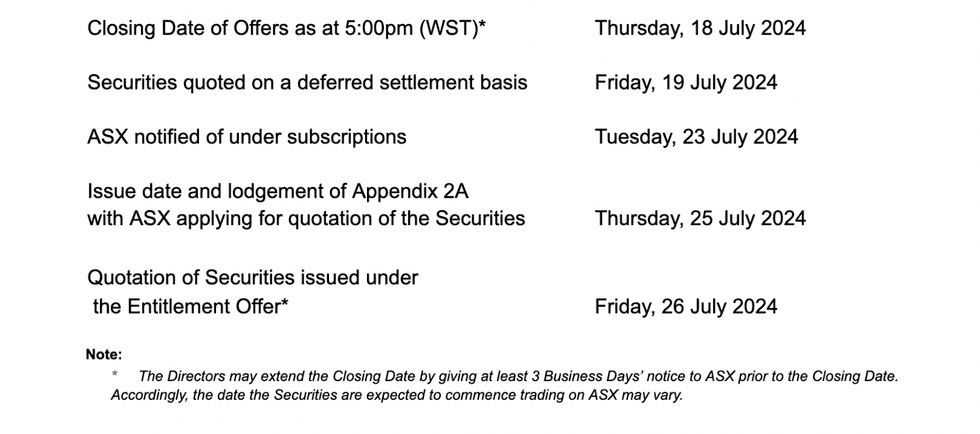

The Company advises that the Closing Date of the Entitlement Offer has been extended to 5:00pm (WST) on Thursday, 18 July 2024.

The Closing Date has been extended to ensure all eligible shareholders have an opportunity to participate in the Entitlement Offer, having regard to the delayed mailing process in Australia and New Zealand, and the impact this may have on eligible shareholders accessing physical documentation.

The revised timetable for the Entitlement Offer is shown below:

Further details of the Entitlement Offer, including details on how to accept the Entitlement Offer and key risks associated with an investment in the Company are set out in the Prospectus. Applications for new Shares and free attaching Option under the Entitlement Offer may only be made by completing the Entitlement and Acceptance Form which accompanies the Prospectus. Shareholders eligible to participate in the Entitlement Offer should read the Prospectus carefully and consult their professional advisers as necessary.

This announcement has been authorised for release by Mr Allan Kelly, Executive Chairman, on behalf of the Board of Miramar Resources Limited.

Click here for the full ASX Release

This article includes content from Miramar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-investinggold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

12h

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00