March 27, 2023

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to announce the signing of a binding agreement to earn-in to the highly prospective Alfa Project (“Afla”), consolidating the broader Palma Volcanogenic Massive Sulphide (VMS) belt. The Afla Project is located adjacent to Alvo’s Palma Project and covers a strategic southern portion of the target host rocks of the VMS sequence.

HIGHLIGHTS

- Binding agreement to earn-in to the Afla Cu/Zn Project, consolidating the southern portion of the highly prospective Palma VMS belt

- The Afla Project was partially covered by a VTEM survey, and multiple conductors have been identified which appear similar to conductors that host significant VMS mineralisation at Palma

- The Brazilian Geological Survey (CPRM) conducted regional stream sediment sampling and soils sampling across the area highlighting several highly anomalous prospects

- Earn-in transaction has no upfront cash payments and will utilise Alvo’s existing exploration team to deliver the 1,000m of diamond drilling within 18 months of the agreement to earn the initial 60% of the project

- Ability to earn up to 100% of the project dependant on additional exploration and contract milestones

Alvo has the team, the tools and expertise to conduct a cost-effective exploration program across the Afla Project.

Rob Smakman, Alvo’s Managing Director commented on the Afla Project:

"We have secured the Afla Project due to its prospectivity and strategic location. It’s a significant area that increases our control over the VMS district, an enviable land package for a junior anywhere in the world and we are confident that integrating exploration at Afla with our existing CY2023 plans will be seamless. Field work on the ground will start immediately, focussed on the already identified targets. We will continue our systematic approach to prioritisation of the multiple greenfields targets to the point of being drill-ready.

“We have built an expert in-house team that is motivated and focussed on making new discoveries. We have leading edge in-house exploration tools available and continue to enhance our knowledge of the typical type and style of mineralisation in the district. We are really excited that we will be integrating the Afla Project into our exploration plans.”

Afla Cu/Zn Project

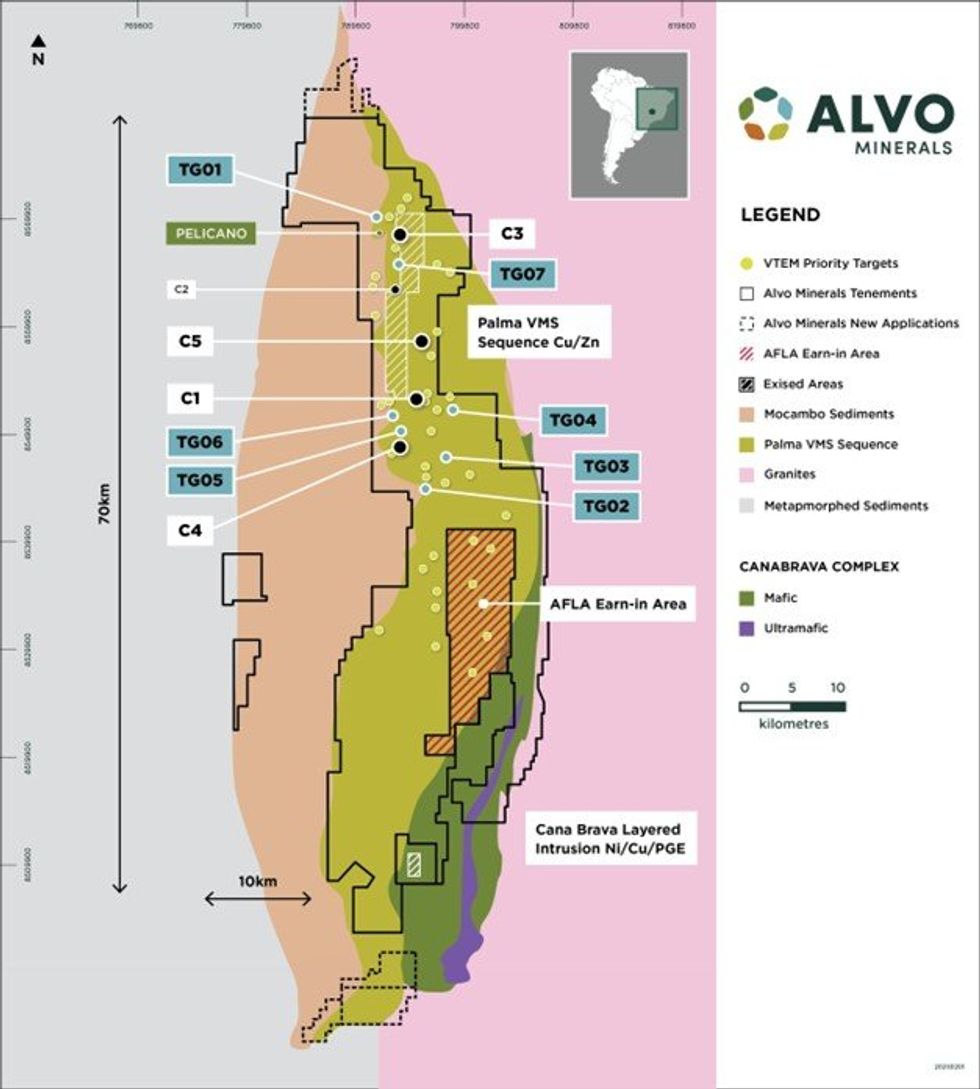

Alvo has signed a binding deal with AFLA INVESTIMENTOS E PARTICIPAÇÕES LTDA, (“Afla Investimentos”) a Brazilian company with interests in gold and limestone mining, agriculture, and real estate. The Afla Project includes 5 granted exploration licenses covering a total area of 9,758Ha (98km2), located adjacent to both Alvo’s Palma VMS Project and Alvo’s Ni/Cu/PGE Project at Cana Brava (see Figure 1). The Project is considered predominantly prospective for VMS style (Cu, Zn, Pb, Ag, Au) mineralisation.

Prior to Afla Investimentos taking control of the project in 2018, the area was explored by the Brazilian subsidiary of BHP (Colorado Exploration circa 1980’s), Glencore (early 2000’s) and Nexa in 2008. No historical data from these companies is currently available, however a recent due diligence field visit noted historical drill-core believed to be from when BHP was exploring the area.

Alvo is pursuing the historical information which may exist in the Mines Department, however there is no guarantee that this information will be available.

The Geological survey of Brazil (CPRM) completed a regional Stream Sediment survey which covered the Afla Project ground and indicated anomalous catchments of Cu, Zn and Pb. The CPRM also completed several soil sampling and mapping traverses also confirming anomalous Cu and Zn.

In 2008, Votorantim Exploration (now Nexa) flew a VTEM survey covering most of the Afla ground. This is the same survey that covers much of the Palma project and the source of multiple conductive targets currently being followed up by the Alvo exploration team. Alvo’s consultants have highlighted 5 individual conductors on the Afla ground that warrant follow up (see Figure 1).

The work by the CPRM and the VTEM survey is a great starting point for Alvo’s exploration strategy.

Integrating Afla into the Palma Regional Exploration Strategy

Alvo is undertaking an extensive regional exploration program across the Palma project which covers over 780km2 (including the Afla Project increases this tenure to ~875 km2) of contiguous and highly prospective ground in a known VMS district. The district has been largely unexplored for over 30 years since the first discovery in the 1970s and presents an extraordinary opportunity to make new discoveries by applying modern and systematic exploration techniques.

VMS deposits typically occur in clusters, where multiple deposits are located in similar geological districts. These districts can host a number of VMS deposits that range in size from less than 1Mt to exceeding 100Mt.

Exploration work is underway across multiple prospects with the aim of advancing prospects to drill-ready status. Field activities including geological mapping, soil sampling, Auger drilling (“Auger”), Induced Polarisation Surveys (“IP”) and Fixed Loop electromagnetic surveys (“FLEM”) are underway. These activities are being undertaken concurrently within the district on various prospects identified by the Company from historical work completed to date.

Importantly, the Company’s key equipment purchases allow for flexible, fast and efficient exploration which is significantly less expensive than typical contracted exploration as the only material expense is labour and maintenance.

The Afla project areas have been integrated into the Palma project plan and exploration will proceed across the new areas according to the current schedule in place. Alvo expects that the time required to complete the earn- in is sufficient assuming the first pass exploration is successful.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

18h

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00