- WORLD EDITIONAustraliaNorth AmericaWorld

July 21, 2024

CleanTech Lithium PLC (AIM:CTL, Frankfurt:T2N, OTCQX:CTLHF), an exploration and development company advancing sustainable lithium projects in Chile, announces completion of the first stage of production from the Company´s DLE pilot plant operations and results from successful downstream process test work to produce battery-grade lithium carbonate by process partners in North America.

Highlights:

- An initial volume of 88m3 of concentrated eluate, which is the lithium carbonate equivalent (LCE) of approx. one tonne, has been produced from the Company´s DLE pilot plant in Copiapó, Chile over an operating period of 384 hours with 14 cycles completed

- This completes the first stage of production from the DLE pilot plant

- Results show the DLE adsorbent achieved a lithium recovery rate of approximately 95% from the brine, with total recovery (adsorption plus desorption) achieving approximately 88%

- Impurity rejection rates were very high producing a low impurity eluate conducive to the downstream conversion process.

- The concentrated eluate is being shipped in four batches to the facilities of Conductive Energy in Chicago, USA, for conversion into battery grade lithium carbonate

Shipment | Eluate Volume | Eluate Li Grade | LCE (kg) | Shipment Status |

1 | 24m3 | 2008 mg/L | 257 | Arrived process facility |

2 | 24m3 | 2360 mg/L | 301 | In Shipment |

3 | 24m3 | 2325 mg/L | 297 | In shipment |

4 | 17.5m3 | 2464 mg/L | 230 | At departure port |

Targeted | 90m3 | 2000 mg/L | 1022 | |

Total Achieved | 88m3 | 2289 mg/L | 1085 |

Table 1: Status of concentrated eluate from pilot plant first stage production

- Conductive Energy completed test-work on a 200L sample of concentrated eluate shipped in May 2024 to optimise the downstream process before receiving the larger volume shipments

- The conversion test-work produced multiple samples of lithium carbonate with 99.75% lithium carbonate purity demonstrating that the process achieves targets and is repeatable

- The result is a first confirmation that a process has been developed that will efficiently produce battery-grade lithium for the Laguna Verde project from pilot scale DLE eluate

- CleanTech Lithium continues to be a leader in exploration and development of DLE based projects in Chile and this pilot scale production will provide large test samples of lithium carbonate to potential offtake partners seeking product qualification.

- Subject to the completion of the re-injection well in September, the reserve report for Laguna Verde is scheduled to be completed by Montgomery and Associates in October 2024.

Steve Kesler, Executive Chairman and Interim CEO, of CleanTech Lithium PLC, said:

"We are very pleased by these results as it shows we can produce battery-grade lithium with low impurities from our Laguna Verde brine project. Working with our partners on the downstream process, Forward Water and Conductive Energy, we can now demonstrate the entire DLE process from brine to final lithium product.

"The optimised downstream process will now be applied to the initial volume of 88m3 of concentrated eluate, or approximately 1 tonne of LCE, produced from the first stage of production from our DLE pilot plant. This will produce significant test sample volumes of battery-grade lithium carbonate for commencement of testing with potential strategic partners. This is important whilst the Chilean government is reviewing the feasibility of lithium projects to identify the most advanced companies in Chile and if they are to reach their target of having three to four new lithium projects in development by 2026."

Further Information

Pilot Plant in Copiapó First Stage Production Completed

The Company´s DLE pilot plant is in Copiapó, Chile, approximately 275km from Laguna Verde. The plant finished commissioning in late March 2024 and up until mid-June a total volume of 1196m3 of brine from the Laguna Verde project was processed in the plant with a total of 14 cycles completed. Each cycle represents a volume of brine being fed first through filtration to remove suspended solids, then into DLE columns which are filled with adsorbent designed to be selective for lithium molecules. Lithium, as lithium chloride, is adsorbed from the brine, before desorption with water to create a purified lithium chloride eluate. A reverse osmosis (RO) unit at the DLE pilot plant then concentrates the eluate by extracting approximately 75% of the water to form a concentrated eluate.

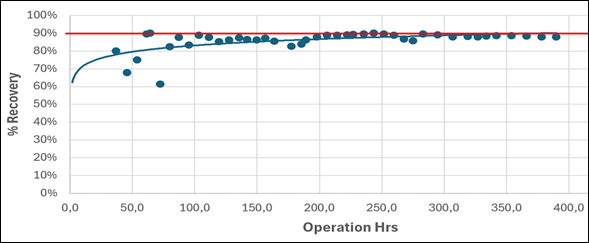

Averaged across the 14 cycles, the recovery rate achieved by adsorption of lithium by the adsorbent was 95% and the recovery rate of desorption from the adsorbent was 93%. The total recovery rate averaged 88% and was highly consistent as shown in Figure 1. The temperature of the brine and desorption water, using the average ambient temperature in Copiapó during the March to June period of operation, was in the range of 20oC to 25oC, which did not significantly affect the recovery achieved.

Figure 1: Pilot Plant Total Recovery Rate

The eluate production rate was relatively stable after the initial ramp up period achieving an average of 2.8 kg LCE per hour. The design of the plant is 1 tonne per month of LCE based on designed monthly operating schedule of 360 hours. Due to budget and volume considerations, the plant was run for 384 hours for the first stage of planned operation producing a total of 1.085 tonnes of LCE as eluate. Based on the hourly production rate this met and exceeded the design capacity of the plant.

Figure 2: Pilot Plant Production Rate (Kg LCE/hr in Eluate)

Selectivity of the adsorbent is another key performance parameter for a DLE operation. DLE primarily acts as a purification stage, recovering lithium chloride from the brine whilst rejecting other impurities. For all the major ions in the brine, apart from boron, the rejection rate was very high as shown in Fig. 3 below. More cycles will further validate this performance. The quality of the eluate was consistent over the first stage of production with the low level of impurities facilitating downstream conversion.

Figure 3: DLE Performance - Rejection of Major Impurities

After completion of the DLE stage, the eluate is concentrated using a reverse osmosis (RO) unit at the pilot plant. On completion of both stages the lithium grade in the purified lithium chloride eluate is over ten times higher than the feed brine. The concentrated eluate was then loaded into a flexitank in a standard shipping container and transported to the port of Caldera for shipment to North America.

Downstream Processing into Battery Grade Lithium Carbonate: Test-work Completed

For the conversion of the concentrated lithium chloride eluate into battery grade lithium carbonate, CleanTech Lithium has engaged a leading lithium processing company, Conductive Energy, based in Alberta, Canada, which has facilities in Chicago, USA, with key downstream processing units shown in Figure 4 below. The status of the concentrated eluate shipment is shown in Table 1 with processing to commence in August 2024.

|

|

Figure 4: Conductive Energy Carbonation Reactor Tank and Equipment for Washing, Filtering & Drying

In May 2024 CTL air-freighted a 200L sample of concentrated eluate from the pilot plant to Conductive Energy to undertake test-work to optimise the conversion process. The process steps are shown in Figure 5, involving a further stage of RO, before using Forward Osmosis (FO) to achieve a very high level of concentration. Ion exchange (IX) is used to remove calcium, magnesium, and boron. The final steps are carbonation and then washing, filtration and drying to produce a battery grade product. Conductive Energy´s approach is to simplify the process that achieves maximum yield by minimizing process steps and, where losses occur, produce fluids that are easily recycled to further maximize yield.

Figure 5: Conductive Energy Conversion Process

Reverse Osmosis and Forward Osmosis

The increase in eluate and lithium concentration in the R/O and F/O stages are shown in Table 2 below. R/O is effective for concentration until Total Dissolved Solids (TDS) reach the level of approximately 60,000 - 70,000 TDS, after which it is increasingly energy intensive and costly. F/O is highly effective in further concentration to the required lithium grade for carbonation, in this case 18,000mg Li/L (or 1.8% Lithium). The F/O unit is provided by Forward Water Technology, another Canadian company based in Ontario. F/O achieves a high concentration factor with much lower energy use than the alternative of using a mechanical evaporator, while being highly suitable for utilising solar thermal as the energy source to power the F/O process.

Parameter | Unit | Concentrated Eluate | R/O Concentrate | F/O Concentrate |

Lithium (Li) | mg/L | 2,194 | 5,700 | 18,000 |

Chloride (Cl) | mg/L | 11,039 | 37,000 | 110,000 |

Boron (B) | mg/L | 411 | 850 | 1,700 |

Calcium (Ca) | mg/L | 7 | 29 | 85 |

Magnesium (Mg) | mg/L | 14 | 50 | 150 |

Sodium (Na) | mg/L | 134 | 400 | 1,400 |

Sulphate (SO4) | mg/L | 103 | 120 | 330 |

Total Dissolve Solids (TDS) | mg/L | 19,260 | 62,000 | 190,000 |

Volume | L | 215.5 | 66.3 | 13.9 |

Reduction in Volume | % | 69.3% | 93.5% | |

Laboratory | ALS Chile | Lambton.Scientific | Lambton.Scientific |

Table 2: Results from concentration of Laguna Verde eluate through R/O followed by F/O

Ion Exchange to Remove Impurities

Ion exchange (IX) was used for removal of calcium and magnesium, which achieved 85% and 87% reductions respectively. While feed concentrations were low, 100% of barium and manganese were also removed in the same process. Additional optimization is possible with potential for further calcium removal. Lithium loss was low at 3%.

Conductive then applied its optimised IX for removal of boron. This was highly effective achieving >99.5% removal of boron. However, there was a 22% loss of lithium to the regeneration fluid. This would be recaptured by recycling the regeneration fluid to the F/O feed which was not implemented for this small-scale test-work. The lithium loss from the boron IX is expected to be reduced (recovered) to a steady state loss rate of about 3%.

Carbonation and Battery Grade Lithium Sample

The carbonation test-work achieved an exceptional yield of 96% of the theoretical maximum. The final product, after the wash procedure, was 99.75% lithium carbonate purity as shown in Table 3. Further optimisation of the washing stage is planned in order to reduce impurities to the greatest extent possible and therefore maximise the value of the battery grade product.

|

|

Table 3: Process test-work lithium carbonate sample purity Fig. 6: Test-work sample

Additional Operations

Laguna Verde Reserve Report Update

The next stage of resource evaluation at the Laguna Verde project is to produce an updated JORC compliant resource and a reserve report based on converting a portion of resources into reserves. The management of the resource evaluation programme and reserve report is led by Montgomery and Associates, a leading hydrogeology consultant with extensive experience in resource evaluation of lithium brine projects in Chile and Argentina. Reserve estimation will feed directly into the Pre-Feasibility Study which is targeted for later this year.

The reserve calculation requires the completion of pumping tests and a re-injection well at the project which is scheduled for September 2024, when drilling equipment can be re-mobilised after the current winter break in operations. Subject to the completion of the re-injection well in September, the reserve report is scheduled to be completed by Montgomery and Associates in October 2024.

Competent Persons

The following professional acts as qualified person, as defined in the AIM Note for Mining, Oil and Gas Companies (June 2009) and JORC Code (2012):

Marcelo Bravo: Chemical Engineer (Universidad Católica del Norte), has a Master's Degree in Engineering Sciences major in Mineral Processing, Universidad de Antofagasta. He currently works as a Senior Process Consulting Engineer at the Ad-Infinitum company. Mr Bravo has relevant experience in researching and developing potassium, lithium carbonate, and solar evapo-concentration design processes in Chile, Argentina, and Bolivia. Mr Bravo, who has reviewed and approved the information contained in the chapters relevant to his expertise contained in this announcement, is registered with No. 412 in the public registry of Competent Persons in Mining Resources and Reserves per the Law of Persons Competent and its Regulations in force in Chile. Mr Bravo has sufficient experience relevant to the metallurgical tests and the type of subsequent processing of the extracted brines under consideration and to the activity being carried out to qualify as a competent person, as defined in the JORC Code. Mr Bravo consents to the inclusion in the press release of the matters based on his information in the form and context in which it appears.

The information communicated within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulations (EU) No 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. Upon publication of this announcement, this inside information is now considered to be in the public domain. The person who arranged for the release of this announcement on behalf of the Company was Gordon Stein, Director and CFO.

CTLHF

Sign up to get your FREE

CleanTech Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

10 November 2025

CleanTech Lithium

Premium lithium projects located in established mining districts to meet battery and EV demand

Premium lithium projects located in established mining districts to meet battery and EV demand Keep Reading...

30 October 2024

CleanTech Lithium PLC Announces Notice of AGM

CleanTech Lithium PLC Notice of Annual General Meeting CleanTech Lithium PLC (AIM:CTL)(Frankfurt:T2N)(OTCQX:CTLHF) ("CleanTech Lithium" or the "Company"), an exploration and development company advancing sustainable lithium projects in Chile, will hold its Annual General Meeting ("AGM") at the... Keep Reading...

30 September 2024

CleanTech Lithium PLC Announces Interim Results

Interim Results for six-month period ending 30 June 2024 CleanTech Lithium PLC (AIM:CTL)(Frankfurt:T2N)(OTCQX:CTLHF), an exploration and development companyadvancing sustainable lithium projects in Chile for the clean energy transition, is pleased to announce its unaudited Interim Results for... Keep Reading...

27 September 2024

CleanTech Lithium PLC Announces CEOL Update

Chilean Government prioritises Laguna Verde for CEOL CleanTech Lithium PLC (AIM:CTL)(Frankfurt:T2N)(OTCQX:CTLHF), an exploration and development company advancing lithium projects in Chile for the clean energy transition, reports an announcement by the Chilean Government on the Expressions of... Keep Reading...

11 September 2024

CleanTech Lithium PLC Announces Community Support for Laguna Verde Project

Indigenous community leader publicly endorses Laguna Verde project at key mining seminar in Santiago, Chile CleanTech Lithium PLC (AIM:CTL)(Frankfurt:T2N)(OTCQX:CTLHF), an exploration and development company advancing sustainable lithium projects in Chile, participated in the Centre for Copper... Keep Reading...

27 August 2024

CleanTech Lithium PLC Announces Transfer of Loan Notes at Regal Funds

CleanTech Lithium PLC (AIM:CTL)(Frankfurt:T2N)(OTCQX:CTLHF), an exploration and development company advancing sustainable lithium projects in Chile, announces the transfer of AUD Loan Notes (Loan Notes) from one Regal Funds1 associate to another Regal Funds associate On 1 July 2024, the Company... Keep Reading...

27 February

UK Enters Commercial Lithium Production with Geothermal Plant Launch

The UK has entered commercial lithium production for the first time as Geothermal Engineering Ltd (GEL) began operations in its plant at Cornwall, anchoring the government's hopes of a domestic battery metals supply chain.The Redruth-based facility marks the country’s first commercial-scale... Keep Reading...

26 February

Zimbabwe Imposes Immediate Ban on Raw Mineral and Lithium Exports

Zimbabwe has imposed an immediate ban on exports of all raw minerals and lithium concentrates, halting shipments already in transit as the government tightens control over the country’s mining sector.Mines and Mining Development Minister Polite Kambamura announced Wednesday that the suspension... Keep Reading...

19 February

Top Australian Mining Stocks This Week: Lithium Valley Results Boost Gold Mountain

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.Mining giant BHP (ASX:BHP,NYSE:BHP,LSE:BHP) reported strong half-year copper results, saying that its copper operations accounted for... Keep Reading...

17 February

Howard Klein Doubles Down on Strategic Lithium Reserve as Project Vault Takes Shape

Before the Trump administration revealed plans for Project Vault, Howard Klein, co-founder and partner at RK Equity, proposed the idea of a strategic lithium reserve. “The goal of a strategic lithium reserve is to stabilize prices and allow the industry to develop,” he told the Investing News... Keep Reading...

17 February

Sigma Lithium Makes New Lithium Fines Sale, Unlocks US$96 Million Credit Facility

Sigma Lithium (TSXV:SGML,NASDAQ:SGML) has secured another large-scale sale of high-purity lithium fines and activated a production-backed revolving credit facility as it ramps up operations in Brazil.The lithium producer announced it has agreed to sell 150,000 metric tons (MT) of high-purity... Keep Reading...

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

Latest News

Sign up to get your FREE

CleanTech Lithium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00