- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

March 13, 2024

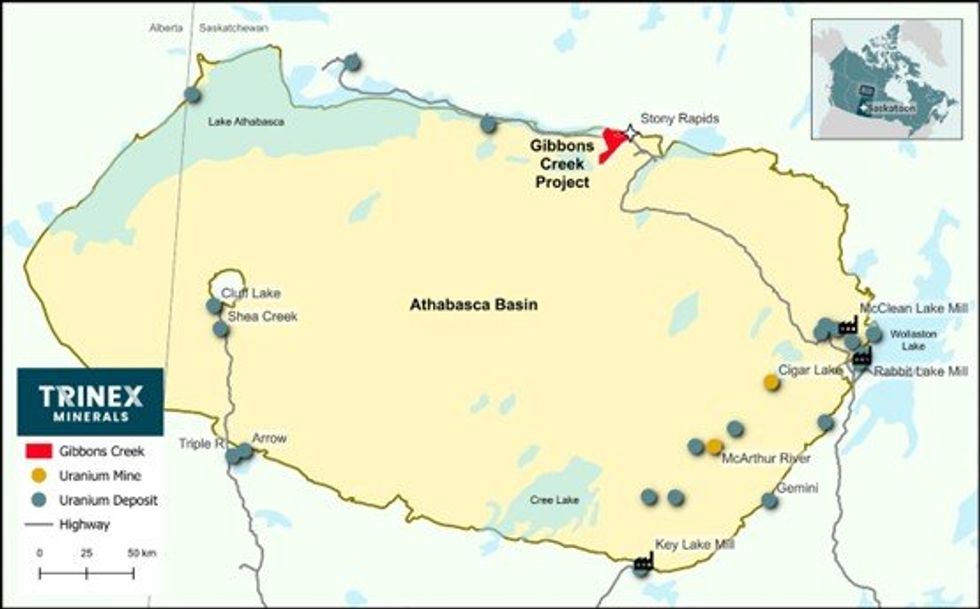

Trinex Minerals Limited (ASX: TX3) (Trinex Minerals or the Company) is pleased to announce that the winter 2024 diamond drilling program at the Gibbons Creek Uranium Project in Northern Saskatchewan has commenced (Figure 1).

Key Points:

- Diamond drilling has commenced at the high-priority Airstrip Prospect in the northern part of the Gibbons Creek Project.

- Six target areas will be tested for a total drilling program of around 1,200m.

- Trinex is well funded to expand on the current drilling program having over $4 million in cash

- Trinex Minerals has an option to acquire an initial 51% interest in the highly prospective Gibbons Creek Uranium Project in the Athabasca Basin, Northern Saskatchewan, Canada, with the potential to increase to a 75% interest.

The drilling program will be managed by ALX Resources (TSXV:AL) which currently owns 100% of the project, and is designed to test a number of targets at the high-priority Airstrip Prospect (Airstrip), near the community of Stony Rapids, where a combination of geophysical and geochemical anomalism from data acquired in 2023 along with anomalous uranium mineralisation in historic drillholes has generated the targets (Figure 2).

It is expected that the drilling will take several weeks to complete with downhole gamma logging being completed at the end of each hole. Proximity to the community and infrastructure of Stony Rapids adds greatly to the efficiency of the exploration program and the Company is well funded to enable expansion and/or extension of the drilling program should results justify this. Assay results are expected to be available approximately six weeks after the completion of drilling.

Following the completion of this drilling program, Trinex Minerals will assume Exploration Management of the Gibbons Creek Uranium Project and anticipate utilising Dahrouge Geological Consulting to carry out much of the on-ground exploration from this point.

Trinex Minerals’ Managing Director, Will Dix, commented:

“It has been a quick progression for Trinex from first seeing the data to working through the deal and now to drilling our first holes at Gibbons Creek. The Athabasca Basin is a highly prospective uranium jurisdiction, and we are excited to put a few holes into the priority target at the Airstrip Prospect.

"Following the completion of this drill campaign, Trinex will assume exploration control of the Project and we will look to expand exploration activities outwards across the other priority targets identified. I look forward to updating the market with the results of this diamond drill program as they become available.”

Gibbons Creek Uranium Project – Background and 2024 Winter Drilling Program

The Gibbons Creek Uranium Project (Gibbons Creek or the Project) comprises eight mineral dispositions covering an area of 139km2. The Project is located on the northern flank of the highly prospective Athabasca Basin in Northern Saskatchewan, home to all of Canada’s operating uranium mines and mills (see Figure 1).

Gibbons Creek has an exploration permit held by ALX, which is valid until October 2025. The permit allows for up to 20 diamond drill holes totalling approximately 5,000m, along with ground-based geophysics, prospecting, and geochemical sampling. Access to Gibbons Creek is via roads and trails that lead from the community of Stony Rapids, SK, which is connected to all-weather Highway 905, thereby creating flexibility for either summer or winter exploration programs. Stony Rapids has readily available fuel, supplies and accommodations for field personnel, and an airport with daily flights to cities and towns in southern Saskatchewan.

A comprehensive review of Gibbons Creek historical exploration data was carried out by ALX and has integrated that information with the high-resolution magnetic and SGH geochemical surveys completed in November 2023. The historical data and the results of ground surveys carried out by ALX on the 2023 exploration grid show important characteristics of the Project’s potential to host uranium mineralisation. This is demonstrated by the mineralisation found in ALX’s 2015 drillhole GC15-03 (0.13% U3O8 over 0.23 metres from 107.67 metres to 107.90 metres) and in Eldorado Nuclear’s 1979 drillhole GC-15 (0.179% U3O8 over 0.13 metres from 134.11 to 134.24 metres) (see Figure 2).

Click here for the full ASX Release

This article includes content from Trinex Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

11h

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Basin Energy Eyes Uranium Growth in Europe After Sweden Policy Shift

Basin Energy (ASX:BSN) is positioning for growth following Sweden’s significant shift in uranium policy, a move the company’s managing director, Pete Moorhouse, says has major implications not only for the company, but also for Europe’s broader energy strategy. In an interview with the Investing... Keep Reading...

27 January

American Uranium Exec Outlines Lo Herma ISR Progress, Resource Update

American Uranium (ASX:AMU,OTCID:AMUIF) Executive Director Bruce Lane says recent test work at the company’s Lo Herma uranium project in Wyoming has delivered an important proof of concept for its in situ recovery (ISR) development plans. The testing focused on validating aquifer performance, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00