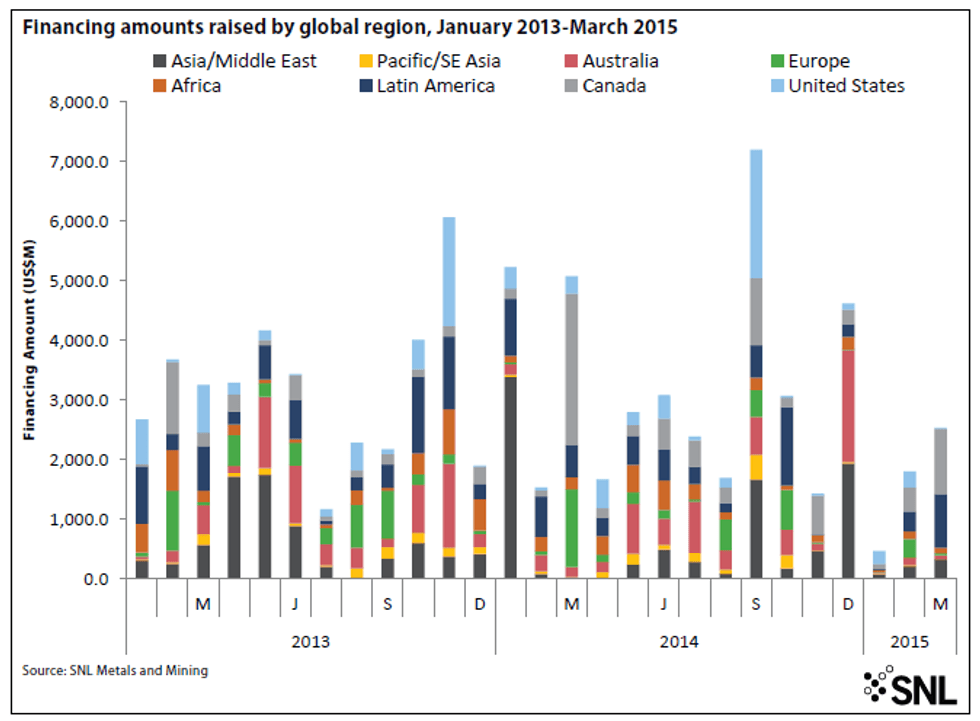

It’s no secret that the past few years have been challenging for the entire mining industry. It’s thus unsurprising that financing was down in Q1 2015 compared to the same period in 2013 and 2014.

It’s no secret that the past few years have been challenging for the entire mining industry. It’s thus unsurprising that financing was down in Q1 2015 compared to the same period in 2013 and 2014.

That fall is highlighted in a new report put out by SNL Metals & Mining. Titled “Mining financing by region, January 2013-March 2015 ,” it tracks financings in the precious and base metals spaces, as well as those in the uranium, coal, potash/phosphates, rare earths, graphite and lithium sectors.

According to the report, which excludes senior debt over US$500 million, less than US$500 million was raised in January of this year — that’s significant in that no other month between January 2013 and March 2015 reached below US$1 billion. Luckily numbers were slightly higher for February and March, with financings in those months reaching well over $1 billion.

While it’s obviously still early in the year, looking back at the US$39.89 billion raised in 2014 and the US$38.23 billion raised in 2013, seeing under $5 billion raised so far in 2015 could mean a bad year for the mining space. Here’s an overview of SNL’s report and what it means for companies in the mining space.

Regions at a glance

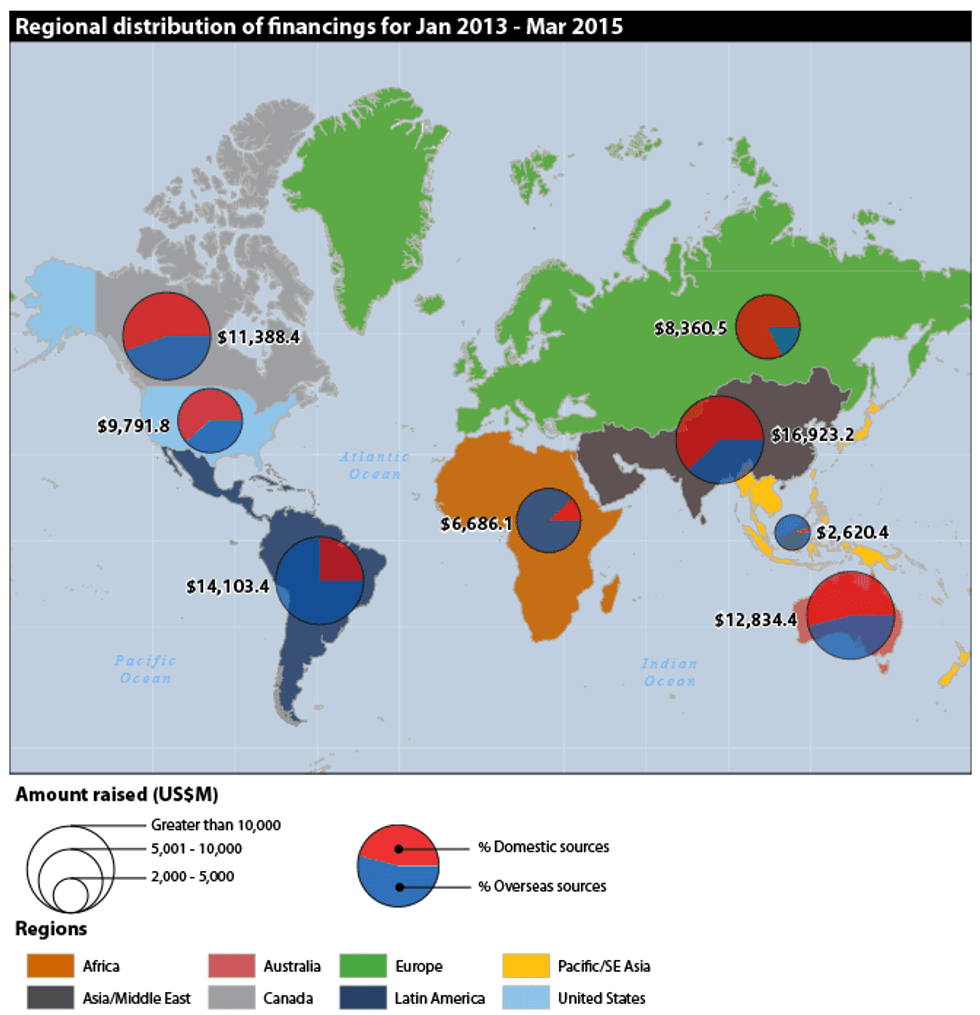

One thing SNL’s report does is outline how different regions did in terms of financing during the past nine quarters (January 2013 to March 2015). It states that Asia/the Middle East accounted for 20 percent of total funding, raising US$16.92 billion. Nearly two-thirds of that amount was raised domestically, primarily from China. There has been a steady increase of financings in those areas since 2013.

Latin America was in second place, accounting for 17 percent of financings during the period by raising US$14.1 billion; much of that amount was domestically raised. In third place was Australia, which accounted for 15 percent of global financings over the nine-quarter period. Rounding out the list, Canada accounted for 14 percent of financings, while Russia and Central Asia accounted for 10 percent, and Africa and Pacific/Southeast Asia accounted for 8 and 3 percent, respectively.

Regional distribution of financings, January 2013 to March 2015.Companies/commodities making the most money

SNL’s report also looks at which companies and commodities received the most money from January 2013 to March 2015. Unsurprisingly, the majors raised most of the US$82.92 billion secured during the period, accounting for 43 percent of the total. Their two top target regions were Latin America and Asia/the Middle East.

Still, the majors didn’t dominate every region, with intermediates and juniors taking the top spots in some areas. For example, in the Pacific/Southeast Asia, intermediates accounted for 29 percent of financings while juniors accounted for 27 percent; only 21 percent came from majors. In Africa it was juniors that took the lead, accounting for 46 percent of total financings compared to 31 percent for major companies.

In terms of which commodities got the most financial love during the period, naturally it was gold projects, with financings evenly distributed amongst the target regions. In second place were base metals and silver projects, with Latin America getting the biggest piece of the pie and Canada coming in a distant second. Copper was the breadwinner of the base metals and following that group was coal, which “received a considerable amount of funding, with more than half of coal’s allocations going to fund projects in Australia, followed by projects in Europe and Asia.”

PGMs and fertilizer both received about the same amount of direct capital, with the target of the former being South African operations, though smaller amounts went to a few Canadian mines. The latter saw most funding go towards Canada and the US. Looking at the diamond space, more than half of the money went to Canada.

Moving forward

While Q1 2015 proved to be lackluster in terms of financings, SNL’s report includes some notable offerings by majors that may signal a stronger year moving forward.

One example is a recently closed offering for C$1.44 billion from First Quantum Minerals (TSX:FM,LSE:FQM); proceeds will be used for various operations. Another notable deal is Zijin Mining Group’s (SSE:601899,HKEX:2899) US$412-million investment in Ivanhoe Mines’ (TSX:IVN) Kamoa copper project in the Democratic Republic of the Congo. Zjin also recently bought 50 percent of Barrick Gold’s (TSX:ABX) 95-percent stake in the Porgera gold mine in Papua New Guinea for $298 million.

Intermediate companies have also managed to make some financial headway recently, with Trevali Mining (TSX:TV,OTCQX:TREVF) closing a $30.6-million bought-deal offering just last week. In the energy space, Manitok Energy (TSXV:MEI) just closed a $6.6-million private placement. Meanwhile, Roxgold (TSXV:ROG) inked a credit agreement last week with Societe Generale Corporate & Investment Banking and BNP Paribas (EPA:BNP) for US$75-million senior debt facility.

While further financial movements in the mining space are up in the air, these recent large deals offer some hope of increased financings compared the less-than-stellar numbers in Q1.

Securities Disclosure: I, Kristen Moran, hold no direct investment interest in any company mentioned in this article.