August 25, 2021

Blackstone Minerals ("Blackstone" or the "Company") is pleased to announce the appointment of leading independent advisors to arrange debt financing for the development of the Company's vertically integrated Ta Khoa Nickel- Copper – PGE Project and Downstream Refinery Project (Ta Khoa Project).

The Korea Development Bank (KDB) and BurnVoir Corporate Finance (BurnVoir) will act jointly and in collaboration with Blackstone to secure an attractive, flexible funding package for the development of the Ta Khoa Project.

Blackstone Mineralslackstone Minerals' Managing Director Scott Williamson commented: "KDB and BurnVoir bring their respective strengths across the lithium-ion battery value chain, including strong relationships with potential customers of the Ta Khoa Downstream Refinery. Both KDB and BurnVoir have extensive experience in arranging development funding for quality projects, and their involvement in the Ta Khoa Project is an endorsement of Blackstone's strategy and ability to execute."

"KDB and BurnVoir will work closely with Blackstone to arrange finance on competitive terms to support our integrated development strategy. Both KDB and BurnVoir will work collaboratively with Blackstone to ensure that ongoing feasibility work is completed to the highest standard and withstands the rigour of independent due diligence. Importantly, financing will be achieved with alignment to the standards set within the Equator Principals and Blackstone's own sustainability objectives."

About Korea Development Bank

Established in 1954, the Korea Development Bank is a 100% government-owned policy bank providing strong financial support to clients developing infrastructure projects. Over the last decade KDB has developed a global project finance footprint and has successfully led and closed energy and infrastructure project financings internationally. KDB has strong relationships and co-works with major global project finance institutions including Multilateral Agencies, ECA's and peers, having provided project finance services to international developers including Hyundai, Samsung, SK, Posco and Hanwha.

About BurnVoir Corporate Finance

BurnVoir Corporate Finance is a leading independent Australian investment and advisory house with extensive experience and strong track record in arranging finance across the energy, resources and infrastructure sectors. Details on BurnVoir can be found at burnvoir.com.au.

BurnVoir has arranged finance for a number of battery metals projects in recent years, including for Pilbara Minerals Limited (Pilgangoora Project, lithium) and A$1.1 billion in debt facilities for IGO's recent acquisition of an interest in the Greenbushes Lithium Mine and the Kwinana Lithium Hydroxide Refinery.

Click here for the full ASX release.

BSX:AU

The Conversation (0)

11 July 2024

Blackstone Minerals

Investor Insights

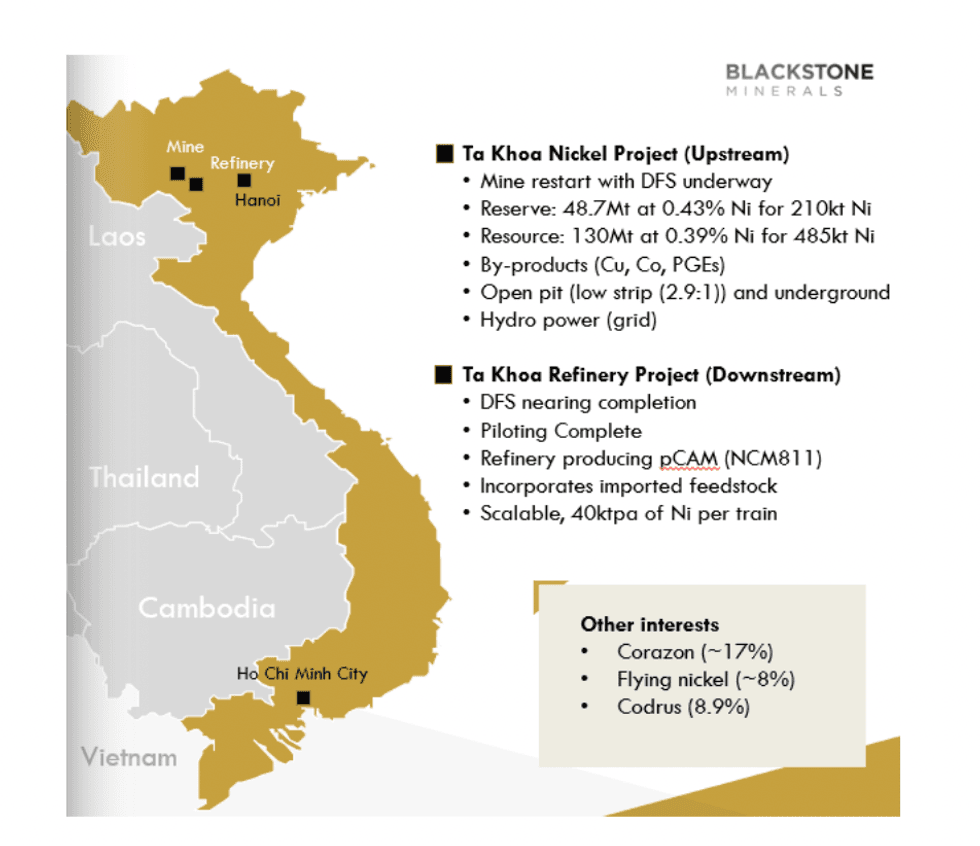

Blackstone Minerals is well-positioned to leverage a projected nickel supply deficit as it strives to become a vertically integrated producer of low-cost, low-carbon, battery-grade nickel. Key to this is Blackstone’s Ta Khoa project in Vietnam, an emerging hub for the electric vehicle market.

Overview

As the world moves closer to a sustainable net-zero future, the need for battery metals continues to mount and nickel may soon be among the metals to see a supply crunch. Though its roots are in the stainless steel sector, it's also a critical component of lithium-ion batteries.

Given that many nations are aiming to replace combustion vehicles with electric cars by 2030, the metal is already experiencing a massive spike in demand. Benchmark Minerals expects the need for battery-grade nickel will increase about 950 percent by 2040.

It's imperative to ramp up global nickel production but the resource sector, for its part, must do so with a much-reduced carbon footprint to influence the sustainability of the entire value chain. Blackstone Minerals (ASX:BSX,OTC:BLSTF,FRA:B9S) recognizes this. As a vertically integrated producer of low-cost, low-carbon nickel, the company aims to become a leading source of low CO2 emission nickel sulphide. Its flagship Ta Khoa project in Vietnam is representative of that goal.

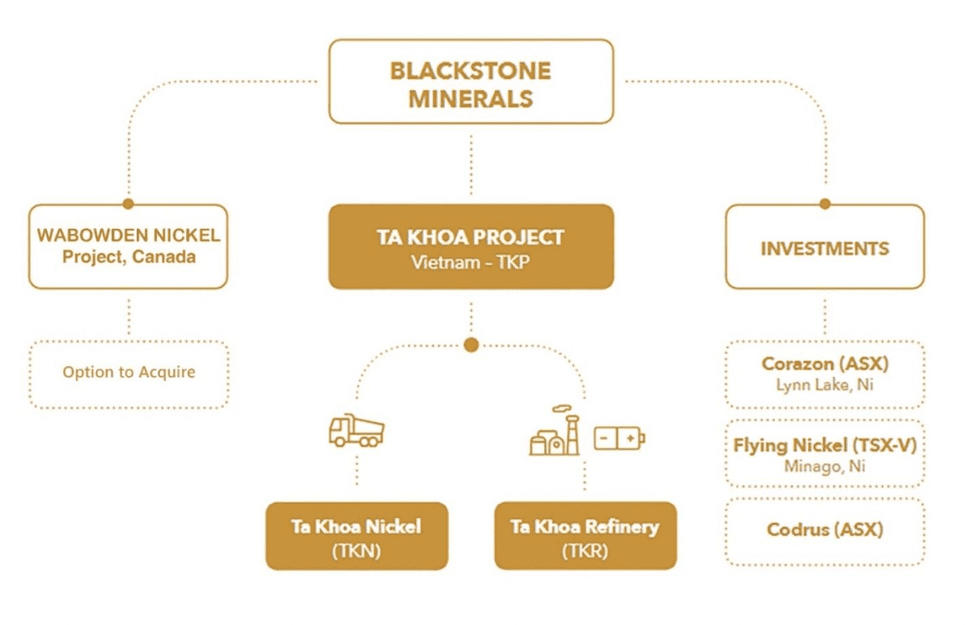

Blackstone Minerals business structure schematic

With over 20 active mines and a burgeoning technology sector, Vietnam is on the road to becoming a hub of electric vehicle production and innovation, with low labor costs and regulated electricity pricing further driving its growth. Steadily increasing foreign direct investment in the region is indicative of this as the country seeks to attract $50 billion in new foreign investment by 2030.

Blackstone is uniquely positioned to take advantage of this, thanks to two factors. US President Joe Biden's Inflation Reduction Act, which came into force in August 2022, represents the largest investment into climate action in United States history. A similar initiative is rolling out in the European Union (EU), which maintains a Free Trade Agreement with Vietnam — something multiple partners of the company have expressed interest in.

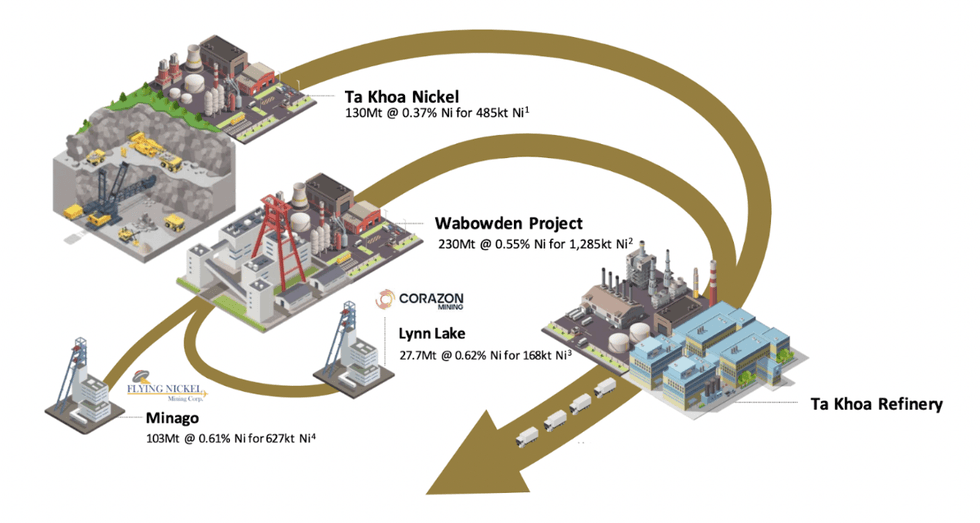

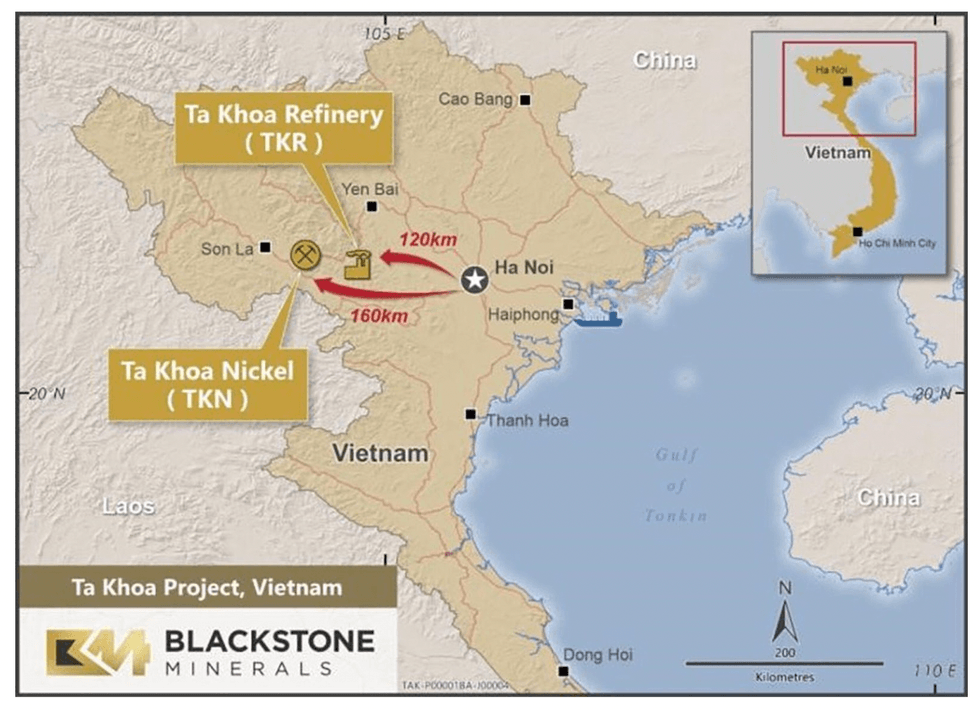

Blackstone's Ta Khoa Project consists of two streams, the Ta Khoa Nickel Mine and the Ta Khoa Refinery. Recent milestones point to Blackstone’s commitment to advancing this game-changing project.

These milestones include a memorandum of understanding with Cavico Laos Mining to collaborate in a number of areas associated with CLM’s nickel mine in Lao People's Democratic Republic and supply of nickel products for Blackstone’s Ta Khoa Refinery in Vietnam.

Blackstone also partnered with Arca Climate Technologies to further investigate the carbon capture potential at the Ta Khoa Project through carbon mineralisation, and explore opportunities to utilise Arca’s carbon capture technologies within the project.

In a bid to collaborate on the supply of renewable wind energy to the Ta Khoa Project, Blackstone signed a direct power purchase agreement with Limes Renewables Energy.

Blackstone received AU$2.8 million as an advance from a research & development (R&D) lending fund backed by Asymmetric Innovation Finance and Fiftyone Capital. The advanced payment reflects the significant investment by Blackstone to develop the Ta Khoa Refinery process and Blackstone’s unique strategy to convert nickel concentrate blends into battery products in the form of precursor cathode active material (pCAM).

In December 2023, Blackstone entered into an option agreement with CaNickel Mining to acquire the Wabowden nickel projectlocated in the world-class Thompson Nickel Belt in Manitoba, Canada.

The Wabowden project will have the potential to fill the Ta Khoa Refinery, removing dependence on third party feed sources.

The company has signed a non-binding MOU with the Development for Resources Environmental Technology joint stock company (DRET) to investigate opportunities to repurpose and trade waste material (or residue) from the Ta Khoa Refinery into construction material products. Moreover, it has also progressed the Ta Khoa Refinery byproduct offtake strategy with Vietnam Chemical Group (VinaChem), PV Chemical and Equipment Corporation (PVChem) and Nam Phong Green Joint Stock Company (Nam Phong) to sell Ta Khoa Refinery byproducts, being manganese sulphate (or epsomite) and sodium sulphate.

As the company plans to build a global nickel business, Blackstone signed a non-binding memorandum of understanding with Yulho Co. Ltd (Yulho) and EN Plus Co. Ltd (EN Plus) to establish a collaboration across the businesses including EN Plus and Yulho who are in joint venture on the Ntaka Hill nickel sulphide project in Tanzania, and the Dinagat Island nickel laterite project in the Philippines.

Company Highlights

- The global nickel market is currently entering a structural deficit, with demand expected to grow 950 percent by 2040.

- Blackstone Minerals is well-positioned to address this deficit as a vertically integrated producer of low-cost, low-carbon nickel.

- Blackstone's flagship project Ta Khoa is a brownfield project situated in Vietnam, one of the lowest capital cost countries in the world and an emerging hub for the electric vehicle market with vast reserves of nickel.

- Vietnam is an increasingly attractive region for investment with direct foreign investments that grew from $1.3 billion in 2000 to $15.6 billion in 2020.

- The Ta Khoa project also has infrastructure advantages, via the existing Ban Phuc mine, and processing facilities, access to low-cost and underutilized hydroelectricity, a trained labor force and support from the local government.

- Blackstone Minerals’ downstream pre-feasibility study confirms a technically and economically robust hydrometallurgical refining process to upgrade nickel sulphide concentrate to produce battery-grade nickel.

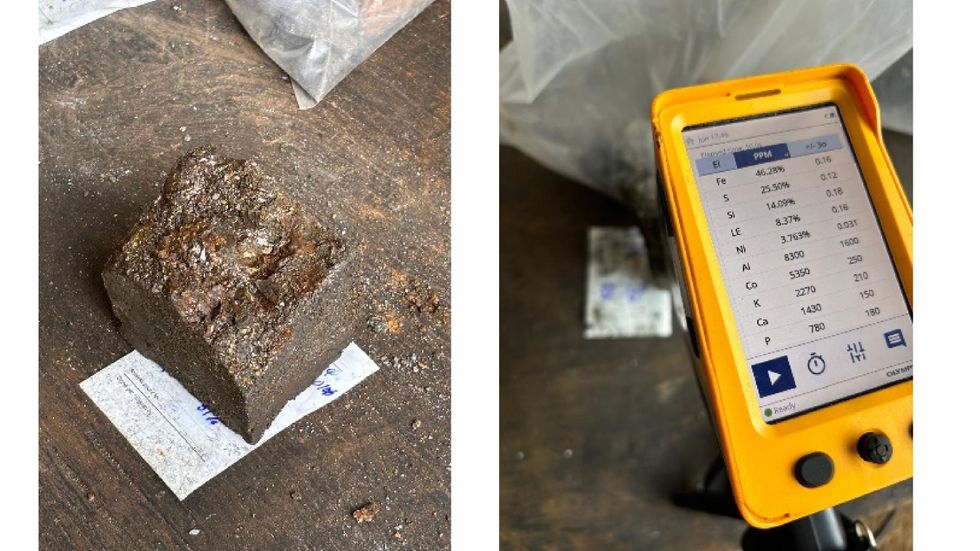

- Blackstone’s key nickel and cobalt feedstocks for the Ta Khoa Refinery Pilot program were delivered to the metallurgical laboratory in Western Australia as of April 2022.

Key Project

Ta Khoa

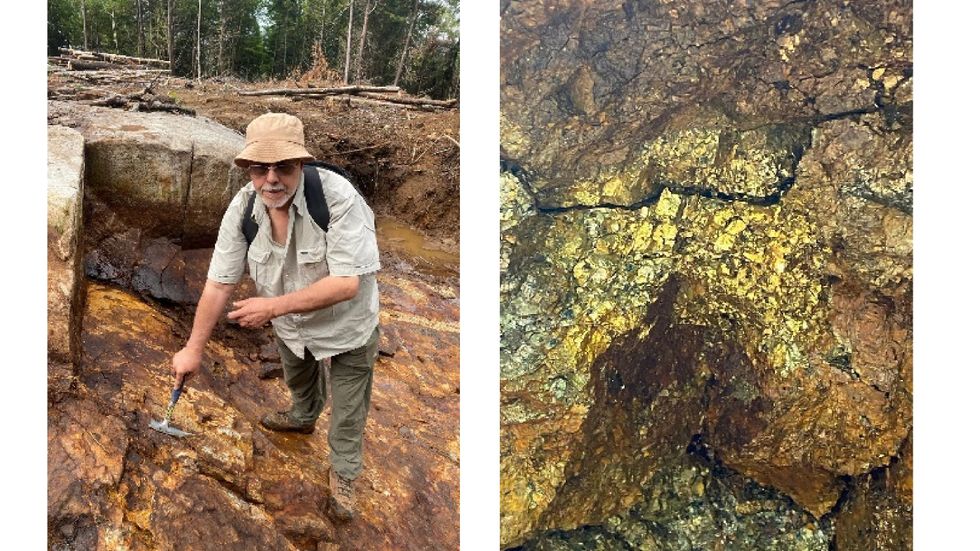

Blackstone holds a 90 percent interest in the Ta Khoa Nickel-Copper-PGE Project, located 160 kilometers west of Hanoi in the Son La Province of Vietnam. It includes an existing modern nickel mine built to Australian Standards, which is currently under care and maintenance. The Ban Phuc nickel mine successfully operated as a mechanized underground nickel mine from 2013 to 2016.

Blackstone intends to complement the existing mine through the installation of a large concentrator, refinery and precursor facility, supporting integrated on-site production of nickel, cobalt and manganese precursor products for the Asia-Pacific market. One of Blackstone's key Research and Development objectives with Ta Khoa is to develop a flowsheet that will support this production.

To fulfill this goal, Blackstone is focusing on a partnership model, collaborating with groups committed to sustainable mining. It is also working to minimize its carbon footprint and implement a vertically integrated supply chain.

Project Highlights:

- Multiple Massive Sulphide Deposits: The Ta Khoa project features several incredibly promising deposits including King Snake (up to 4.3 percent nickel and 18.2 grams per ton (g/t) PGE), Sui Phong (2.95 meters @ 2.42 percent nickel, 0.52 percent copper, 0.06 percent cobalt and 0.05 g/t PGE), and Ban Chang. The project is also the site of the Ban Phuc nickel mine, which was operated from 2013 to 2016 by Asia Mineral Resources, along with several exploration targets that have yet to be tested.

- Experienced Leadership: Internally, Blackstone’s owners’ team brings over 50 years of experience in leadership roles at major nickel mines and refineries globally. This experience has been complemented by ALS Group, Wood, Future Battery Industries CRC, Curtin University and the Electric Mining Consortium.

- Large Reserve and Mining Inventory: The entirety of Ta Khoa is estimated to contain probable reserves of 48.7 Mt at 0.43 percent nickel for 210 kilotons (kt) of nickel and a mining inventory of 64.5 Mt at 0.41 percent nickel for 265 kt nickel. This excludes Ban Khoa and other developing prospects.

- A Long-lived Project: The Ta Khoa mine is expected to produce a yearly average of 18 kt of annual nickel concentrate over its ten-year lifespan. Blackstone believes the refinery can potentially extend its life past ten years.

- An Established Mining Operation: Existing infrastructure onsite includes a 450 ktpa Mill and mining camp. The mine will also benefit from a highly supportive community and favorable government legislation — Blackstone is committed to collaborating with community stakeholders in the project's development.

- Feed Flexibility: Ta Khoa's refinery will offer multiple feed options, including nickel concentrate, mixed hydroxide precipitate, nickel matte and black mass. This flexibility greatly improves the security and greatly reduces the risk of the project overall.

- Valued Partnerships: Blackstone is collaborating with multiple industry leaders and groups in the development of Ta Khoa

- Compelling Pre-feasibility Study: The financial outcomes of a base case pre-feasibility study on the project are promising. Based on a conservative NCM811 precursor price forecast, Ta Khoa displays an exceptional internal return rate on capital invested.

- Integrated Vertical Strategy: Blackstone is constructing both the Ta Khoa mine and refinery against a highly supportive ESG, macroeconomic and fiscal backdrop. This along with Ta Khoa's low capital intensity gives the company a significant advantage over competitors. Said low intensity is the result of multiple factors, including competitive labor costs, favorable regulations and low-cost renewable hydroelectric power.

- A Leader in Low Emissions: Independent assessments from Digbee, Minviro and Circulor, alongside an audit from the Nickel Institute, have confirmed that Ta Khoa will be the lowest-emitting flowsheet in the industry, at 9.8 kilograms of CO2 per kilogram of precursor with opportunities for even further reduction.

- Promising Pilots: With the support of ALS and process engineering partner Wood, Blackstone recently completed a 12-month programme of work that developed a scaled version of its concentrate to sulphate flowsheet. The refinery, which processed more than 9 tonnes of concentrate and MHP, successfully achieved battery-grade nickel sulphate of 99.95 percent, with a nickel recovery rate of 97 percent.

- Current Roadmap: Blackstone's next priority is to complete a series of definitive feasibility studies. Once those are complete, it will focus on fully integrating the mine into the electric vehicle consumer supply chain and finalizing its refining partnership structure.

Management Team

Hamish Halliday - Non-executive Chairman

Hamish Halliday is a geologist with over 20 years of corporate and technical experience. He is also the founder of Adamus Resources Limited, an AU$3 million float that became a multimillion-ounce emerging gold producer.

Scott Williamson - Managing Director

Scott Williamson is a mining engineer with a commerce degree from the West Australian School of Mines and Curtin University. He has over 10 years of experience in technical and corporate roles in the mining and finance sectors.

Dr. Frank Bierlein - Non-executive Director

Dr. Frank Bierlein is a geologist with 30 years of technical and corporate experience, focusing on grassroots to mine-stage mineral exploration, target generation, project management and oversight, due diligence studies, mineral prospectivity analysis, metallogenic framework studies and mineral resources market and investment analysis.

Alison Gaines - Non-executive Director

Alison Gaines has over 20 years of experience as a director in Australia and internationally. She has experience in the roles of board chair and board committee chair, particularly remuneration and nomination and governance committees. She is also the managing director of Gaines Advisory P/L and was recently global CEO of international search and board consulting firm Gerard Daniels, with a significant mining and energy practice.

Gaines has a Bachelor of Laws and a Bachelor of Arts (hons) from the University of Western Australia, a Graduate Diploma in Legal Practice from Australian National University and an honorary doctorate of the University and Master of Arts (Public Policy) from Murdoch University. She is a fellow of the Australian Institute of Company Directors and holds the INSEAD certificate in corporate governance. She is currently the governor of the College of Law Ltd, and non-executive director of Tura New Music.

Dan Lougher - Non-executive Director

Daniel Lougher’s career spans more than 40 years involving a range of exploration, feasibility, development, operations and corporate roles with Australian and international mining companies including a period of eighteen years spent in Africa with BHP Billiton, Impala Plats, Anglo American and Genmin. He was the managing director and chief executive officer of the successful Australian nickel miner Western Areas Ltd until its takeover by Independence Group.

Lougher also holds a first class mine manager’s certificate of competency (WA) and is a fellow of the Australasian Institute of Mining and Metallurgy (AusIMM). Lougher is the chair of the company’s technical committee and nomination committee.

Jamie Byrde - CFO and Company Secretary

Jamie Byrde has over 16 year's experience in corporate advisory, public and private company management since commencing his career with big four and mid-tier chartered accounting firms positions. Byrde specializes in financial management, ASX and ASIC compliance and corporate governance of mineral and resource focused public companies. He is also currently company secretary for Venture Minerals Limited.

Tessa Kutscher - Executive

Tessa Kutscher is an executive with more than 20 years of experience in working with C-Level executive teams in the fields of business strategy, business planning/optimisation and change management. After starting her career in Germany, she has worked internationally across different industries, such as mining, finance, tourism and tertiary education.

Kutscher holds a master’s degree in literature, linguistics and political science from the University of Bonn, Germany and a master’s degree in teaching from Ludwig Maximilian University of Munich.

Andrew Strickland - Executive

Andrew Strickland is an experienced study and project manager, a fellow of the Australian Institute of Mining and Metallurgy, University of WA MBA graduate, with undergraduate degrees in chemical engineering and extractive metallurgy from Curtin and WASM.

Before joining Blackstone, Strickland was a senior study manager for GR Engineering Services where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects. Over his career, he has held a variety of project development roles across both junior to mid-tier developers (including Straits Resources, Perseus Mining and Tiger Resources) and major multi-operation producers (South32).

Graham Rigo - Executive

Graham Rigo is an experienced study manager with over a decade of on-site production experience, holding undergraduate degrees in chemical engineering and finance from Curtin University, WA.

Before joining Blackstone, Rigo was a study manager for Ausenco where he was responsible for delivering a series of scoping, PFS and DFS studies for both Australian and international projects over a range of different commodities.

Rigo has over 11 years of site experience in nickel and cobalt hydromet production experience, in supervisory/superintendent level roles as well as process engineer experience.

Lon Taranaki - Executive

Lon Taranaki is an international mining professional with over 25 years of extensive experience in all aspects of resources and mining, feasibility, development and operations. Taranaki is a qualified process engineer from the University of Queensland Australia. He holds a Master of Business Administration, and is a fellow of the Australian Institute of Company Directors. Taranaki has established his career in Asia where he has successfully worked (and lived) across multiple jurisdictions and commodities ranging from technical, mine management and executive management roles.

Prior to joining Blackstone in February 2022, Taranaki was the chief executive officer of Minegenco, a renewable-energy-focused independent power producer. Preceding this, he was managing director of his private consultancy, AMG Mining Global, where he was providing services to the mining industry in Singapore, Guyana, Indonesia and Cambodia. Additionally, Taranaki has held various senior positions with Sakari Resources, PTT Asia Pacific Mining, Straits Resources, Sedgmans and BHP Coal.

Keep reading...Show less

Promising new source of low-carbon, battery-grade nickel

08 July

High Grade Cu-Au at Surface Delivers New Targets at Mankayan

Blackstone Minerals (BSX:AU) has announced High Grade Cu-Au at Surface Delivers New Targets at Mankayan

02 July

Blackstone Secures $22.6m for Mankayan Copper-Gold Drilling

Blackstone Minerals (BSX:AU) has announced Blackstone Secures $22.6m for Mankayan Copper-Gold Drilling

26 June

Blackstone Minerals Corporate Update

08 July

South32 Announces Up to US$100 Million Sale of Cerro Matoso, Shifts Focus to Critical Minerals

South32 (ASX:S32,OTC Pink:SHTLF) said on Monday (July 7) that it has agreed to sell the Cerro Matoso nickel mine in Colombia to a subsidiary of CoreX Holding following recent changes in the nickel market.

South32 now plans to focus on critical minerals, describing its flagship Hermosa project in Patagonia as a “next generation mine.” Hermosa hosts the zinc-lead-silver Taylor sulphide deposit, and the zinc-manganese-silver Clark oxide deposit.

"The Transaction is consistent with our strategy and will further streamline our portfolio toward higher margin businesses in minerals and metals critical to the world’s energy transition,” said South32 CEO Graham Kerr.

“The Transaction will deliver a clean separation of Cerro Matoso and provide additional balance sheet flexibility to support investment in our growth options in copper and zinc.”

Cerro Matoso is an open-cut mine in Northern Colombia located about 20 kilometres southwest of Montelibano. The project boasts almost 40 years of operations, with 40.6 kilotonnes of payable nickel produced in 2024.

Under the agreement, CoreX will make cash payments of up to US$80 million worth of price-linked consideration based on future production and nickel prices, and up to US$20 million based on permitting milestones within the next five years for the Queresas & Porvenir North project. The US$20 million will come in four equal payments.

South32 said it intends to work with the buyer, the company’s workforce, local communities, government, customers and suppliers to support the transfer of ownership.

Upon transaction completion, all economic and operating control of Cerro Matoso will fall under the buyer’s hands. Cerro Matoso will be reported in South32's underlying financial results as a discontinued operation once the transaction is completed.

Subject to certain conditions such as international merger clearances and a reorganisation of the entity which holds Cerro Matoso, the transaction is scheduled to be completed towards the end of this year.

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Gabrielle de la Cruz, hold no direct investment interest in any company mentioned in this article.

Keep reading...Show less

19 June

Tartisan Nickel Corp. Completes Phase 2 Construction on the Kenbridge Nickel All-Season Access Road, Receives Critical Realignment Road Permit

Tartisan Nickel Corp. (CSE: TN) (OTCQB: TTSRF) (FSE: 8TA) ("Tartisan", or the "Company") is pleased to announce that work on the Kenbridge Nickel Project access corridor has achieved Phase 2 completion and has made significant improvements to the operational access road.

The Kenbridge Nickel-Copper-Cobalt Project consists of 93 contiguous patents, 153 single cell mining claims and 4 Mining Licenses of Occupation totaling 4,273 ha. The Kenbridge Property is 40 kms from paved Highway 71 via the Maybrun gravel road. The Kenbridge Property turnoff is approximately 28 kms into the Maybrun Road. The Kenbridge Project is then approximately 12.7 kms to the Kenbridge 622-meter shaft and the Kenbridge core shack. The Kenbridge Critical Minerals Project was historically only accessible by floatplane or by ATV, which made Project logistics expensive and difficult.

Phase 2 of the Kenbridge Road Project prioritized establishing reliable year-round pickup access to the Kenbridge site and core shack. This phase prioritized stabilizing key road infrastructure following winter construction.

With spring break-up complete, winter-built road sections were reshaped and compacted to address settling and ensure safe all-season access. Rehabilitation activities included subgrade shaping, grade capping, and gravel placement, with additional material added to steep approaches to improve vehicle traction and safety.

A significant focus was on drainage improvements:

- 37 cross-drain culverts were installed to support proper water flow and preserve long-term road stability and environmental integrity.

- Erosion control and environmental protection measures were implemented throughout the corridor to safeguard sensitive areas.

Additional work included:

- Survey and ribboning for Phase 3 realignments to support safe and efficient low-bed and fuel trucks to the Kenbridge core shack

- Site cleanup and removal of historical debris at the core shack

- Safety barrier installation along steep embankments

Collaboration with Indigenous community members and land-based resource specialists continued through several field visits, helping guide and validate project progress. Environmental stewardship and respectful land management remain central to all ongoing and upcoming phases.

Kenbridge Road Realignment Permit Approval

A major milestone in June 2025 was the approval of the Kenbridge Road Realignment Permit (Phase 3)—a result of close collaboration with Indigenous communities and with the Minister of Natural Resources staff in Kenora, Ontario. These realignments are essential for enabling safe and efficient access for low-bed transport and fuel delivery vehicles.

Key Next Steps Phase 3 elements include:

- Reconstruction of Atikwa River bridge approaches and departures

- One significant rock cut on Tartisan Nickel-patented land

- Two minor rock cuts

- Two major realignments of existing road and trail corridors

Notably, one realignment shifts the corridor away from a natural spring identified by a local Indigenous Knowledge Keeper as important to the regional watershed. While this adds cost to the project, it reflects Tartisan's continued commitment to environmental care and respect for the Land.

Tartisan Nickel Corp. remains focused on environmental protection and Indigenous partnership as we move into the next phase of development.

Mark Appleby, CEO of Tartisan Nickel Corp. states, "The Kenbridge all-season access road work continued this spring with a highly effective construction program. With receiving the Kenbridge Road Realignment Permit from the Ministry of Natural Resources, Tartisan is now able to prepare for Phase 3 construction which will allow the Company to ultimately float large equipment including the delivery of fuel into site". Appleby goes onto state, "We are gearing up for this all-important Phase 3 and road completion. We look forward to sharing our 2025 next steps, as significant plans are being put in place to commence summer exploration at the Kenbridge critical metals project."

About Tartisan Nickel Corp.

Tartisan Nickel Corp. is a Canadian-based mineral exploration and development company which owns the Kenbridge Nickel Project near Sioux Narrows, Northwestern Ontario, the Night Danger Turtle Pond project near Dryden, Ontario as well as the Sill Lake Silver Property near Sault Ste. Marie, Ontario. Tartisan Nickel Corp. common shares are listed on the Canadian Securities Exchange (CSE: TN) (OTCQB: TTSRF) (FSE: 8TA). Currently, there are 130,995,782 shares outstanding (137,784,671 fully diluted).

For further information, please contact Mark Appleby, President & CEO, and a Director of the Company, at 416-804-0280 (info@tartisannickel.com). Additional information about Tartisan Nickel Corp. can be found at the Company's website at www.tartisannickel.com or on SEDAR at www.sedarplus.ca.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

The Canadian Securities Exchange (operated by CNSX Markets Inc.) has neither approved nor disapproved of the contents of this press release.

Keep reading...Show less

17 June

FPX Nickel Completes Production Run of Battery-Grade Nickel Sulphate to Support Discussions with Prospective EV Battery Supply Chain Partners

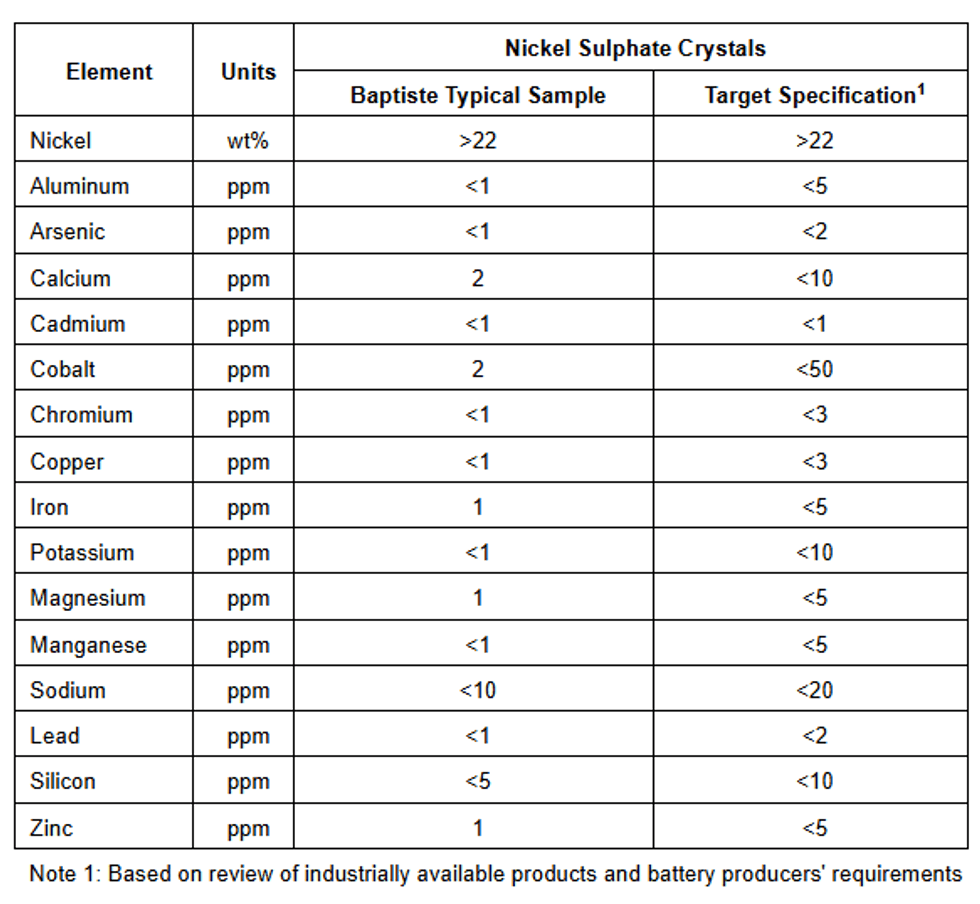

FPX Nickel Corp. (TSXV: FPX) (OTCQB: FPOCF) ("FPX" or the "Company") is pleased to announce successful production of additional battery-grade nickel sulphate from its Baptiste Nickel Project ("Baptiste" or the "Project"). Building on the success of previous testing campaigns, a production run was completed to produce larger quantities of nickel sulphate crystals. The nickel sulphate samples, which meet the strict target specifications for battery applications, will be provided to selected prospective downstream partners including pCAM producers, battery companies, and automakers pursuing supply security, traceable sourcing, and low carbon intensity production.

"The production of high-purity nickel sulphate further positions us to engage in strategic discussions with prospective downstream partners across the global EV supply chain," commented Martin Turenne, FPX Nickel's President and Director. "This milestone further demonstrates the strategic flexibility of the Baptiste awaruite concentrate and the technical maturity of the awaruite refining process."

Overview

As described in the Company's October 15, 2024 news release, FPX completed a pilot-scale refining test program to advance the technical maturity of refining the Baptiste awaruite concentrate to nickel sulphate. This test program included continuous, pilot-scale leaching to produce low-impurity leach solution. A small portion of the leach solution was further advanced through purification and crystallization operations to nickel sulphate crystals to demonstrate the technical viability of the purification process. The remainder of leach solution was retained for future testing including continuous, pilot-scale processing of the purification and crystallization area, ensuring the final refinery strategy is supported by purification and crystallization requirements defined in collaboration with FPX Nickel's current and prospective downstream partners.

FPX recently re-engaged Sherritt Technologies Ltd. to conduct an additional nickel sulphate production run, building on Sherritt's successful completion of the previous pilot-scale refining test program. In the current testing campaign, a portion of this remaining leach solution has been processed to produce larger quantities of nickel sulphate crystals. As with previous testing campaigns, the quality of the produced nickel sulphate, presented in Table 1, meets the strict target specifications for battery applications. To further advance the produced qualification process, the nickel sulphate samples will be provided to prospective downstream partners to ensure the quality and suitability of the nickel sulphate for their battery manufacturing process. Figure 1 shows a portion of the nickel sulphate samples produced.

Qualified Person

The metallurgical information in this news release has been prepared in accordance with Canadian regulatory requirements set out in National Instrument 43-101: Standards of Disclosures for Minerals Projects of the Canadian Securities Administrators ("NI 43-101"). Testwork was supervised, reviewed, and verified by Kyle D. Marte, P.Eng., FPX Nickel's Director of Metallurgy and a "Qualified Person" as defined by NI 43-101.

About the Baptiste Nickel Project

The Company's Baptiste Nickel Project represents a large-scale greenfield discovery of nickel mineralization in the form of a sulphur-free, nickel-iron mineral called awaruite (Ni3Fe) hosted in an ultramafic/ophiolite complex. The absence of sulphur and our ability to connect to the BC Hydro grid means that Baptiste has the potential to be one of the lowest carbon-intensive nickel producers in the world and will produce a very high-grade product that does not require any intermediate smelting or complex refining. The Baptiste mineral claims cover an area of 453 km2 west of Middle River and north of Trembleur Lake, in central British Columbia. In addition to the Baptiste Deposit itself, awaruite mineralization has been confirmed through drilling at several target areas within the same claims package, most notably at the Van Target which is located 6 km to the north of the Baptiste Deposit. Since 2010, approximately US$55 million has been spent on the exploration and development of Baptiste.

FPX has conducted mineral exploration activities to date subject to the conditions of agreements with First Nations and keyoh holders.

About FPX Nickel Corp.

FPX Nickel Corp. is focused on the exploration and development of the Decar Nickel District, located in central British Columbia, and other occurrences of the same unique style of naturally occurring nickel-iron alloy mineralization known as awaruite. For more information, please view the Company's website at https://fpxnickel.com/.

On behalf of FPX Nickel Corp.

"Martin Turenne"

Martin Turenne, President, CEO and Director

Forward-Looking Statements

Certain of the statements made and information contained herein is considered "forward-looking information" within the meaning of applicable Canadian securities laws. These statements address future events and conditions and so involve inherent risks and uncertainties, as disclosed in the Company's periodic filings with Canadian securities regulators. Actual results could differ from those currently projected. The Company does not assume the obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider accepts responsibility for the adequacy or accuracy of this release.

Keep reading...Show less

09 June

Canada Nickel Announces the Government of Ontario Recognition of Crawford as a Critical Minerals Priority and Nation-Building Project

Canada Nickel Company Inc. ("Canada Nickel" or the "Company") (TSXV: CNC) (OTCQX: CNIKF) welcomed the Government of Ontario's recognition of the Crawford Nickel Sulphide Project ("Crawford") as part of its priority nation building initiatives.

In a joint letter to Canada's Minister of Energy and Natural Resources, Ontario's Ministers of Energy and Mines, Natural Resources, and Indigenous Affairs and First Nations Economic Reconciliation identified the Crawford Project as one of five strategic critical minerals projects ready for near-term development as part of three transformational, nation-building projects. In this open letter provided to media and the Company on June 5, 2025, the Ministers also highlighted additional provincial funding for the sector to fully realize the value of these resources, such as the $500 million Critical Minerals Processing Fund, as well as nearly $3.1 billion in loans, grants, scholarships and other funding to support meaningful Indigenous ownership and partnership in critical mineral development.

"We are encouraged and deeply appreciative of the Government of Ontario advancing the critical minerals agenda and recognizing the strategic importance of the Crawford Project," said Mark Selby, CEO of Canada Nickel. "With aligned federal and provincial support, our experienced management team can continue to advance development of Crawford as an important secure, domestic supply of critical minerals – nickel, cobalt, and North America's only domestic source of chromium—while advancing strong Indigenous partnerships and delivering on Canada's clean energy and climate ambitions."

Located just north of Timmins, the Crawford Project benefits from direct access to power, road, and rail infrastructure, and is supported by long-standing partnerships with Indigenous Nations in the region. In addition to advancing one of the world's largest nickel reserves, Canada Nickel has developed innovative carbon capture technology through its proprietary IPT Carbonation process. Once operational, the Crawford Project is expected to also become one of Canada's largest, carbon storage facilities—contributing meaningfully to both environmental and economic goals and helping to drive long-term prosperity in Northern Ontario and across the country.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high-growth electric vehicle and stainless-steel markets. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel Sulphide Project in the emerging Timmins Nickel District. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero NickelTM, NetZero CobaltTM, NetZero IronTM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions.

For further information, please contact:

Mark Selby, CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Media, please contact:

Melanie Paradis

President, Texture Communications

Phone: 416-399-7400

Email: melanie@yourtexture.com

Sydney Oakes

Director of Indigenous Relations and Public Affairs

Phone: 905-929-7151

Email: sydneyoakes@canadanickel.com

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, drill and exploration results relating to the target properties described herein (the "Properties"), the significance of drill results, the ability to continue drilling, the impact of drilling on the definition of any resource, the potential of the Crawford Nickel Sulphide Project and the Properties, timing and completion (if at all) of mineral resource estimates, the ability to sell marketable materials, strategic plans, including future exploration and development plans and results, corporate and technical objectives, and the completion of assays, follow-up geophysics and further drilling. Forward-looking information is necessarily based upon several assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether because of new information, future events or otherwise, except as required by law. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Keep reading...Show less

04 June

Top 9 Nickel-producing Countries

The top nickel producing countries list has been shaken in recent years by Indonesia's rapid rise to the top, beating the Philippines and New Caledonia.

Demand for nickel is mounting. Stainless steel accounts for the vast majority of nickel demand, but electric vehicle (EV) batteries represent a growing application for the base metal as the shift toward a greener future gains steam.

But while nickel's long-term outlook appears bright, it may face headwinds in the short term. Nickel prices have been trending down since breaking US$20,000 per metric ton in May 2024 as weak usage coincides with strong output from top producer Indonesia.

What other dynamics are affecting nickel supply? If you're interested in getting exposure to the market, you should be aware of the factors at play. To get you started, here's a look at the top nickel-producing countries.

Top nickel production by country

This list of the top nickel-producing countries breaks down operations and news affecting the world's top nickel countries in recent years. Figures are based on the US Geological Survey 2025 Mineral Commodity Summary.

1. Indonesia

Nickel production: 2.2 million metric tons

Indonesia's produced a whopping 2.2 million metric tons of nickel in 2024, accounting for more than 50 percent of global output. Claiming first place for production by a long shot, Indonesia is a prime example of a country wanting to get in on the exploding market for nickel. Indonesia also hosts 55 million metric tons of nickel reserves.

Indonesia's output of the base metal has grown tremendously from its 2017 production of 345,000 metric tons. The nation is actively building out its EV battery industry, and Indonesia's close proximity to China, the world’s current leader in EV manufacturing, makes for an ideal setup. In May 2021, the country welcomed the commissioning of its first plant to process nickel for use in EV batteries.

"In just three years, Indonesia has signed more than a dozen deals worth more than $15 billion for battery materials and EV production with global manufacturers," Euronews reported in early 2023.

Major auto maker Ford (NYSE:F) announced in December 2023 that it is taking a direct stake in the proposed US$3.8 billion Pomalaa battery nickel plant, which is planned to produce 120,000 MT of nickel annually using high pressure acid leaching technology.

Zhejiang Huayou Cobalt, one of the world’s largest nickel producers, has a 73.2 percent stake in the project, followed by Vale (NYSE:VALE) at 18.3 percent. Ford has agreed to an initial 8.5 percent interest, with an option to raise it to 17 percent. As of late 2024, Huayou is seeking out banks for roughly US$2.7 billion in financing.

The country's nickel industry has seen several significant changes in 2025, with Indonesia responding to falling prices by significantly cutting its nickel mining quotas and announcing plans to introduce stricter environmental, social and governance practices in its resource industries.

2. Philippines

Nickel production: 330,000 metric tons

In 2024, the Philippines produced 330,000 metric tons of nickel. The country has been one of the top nickel-producing countries for quite some time, as well as a significant nickel ore exporter. Another country in close proximity to China, the Philippines currently has more than 30 nickel mines, including Rio Tuba, operated by Nickel Asia, one of the nation’s top nickel ore producers.

2023 was a big year for the country's nickel mines as total production jumped from 345,000 to 413,000 MT. That surge was projected to continue as two of the Philippines' biggest nickel producers, Nickel Asia and Global Ferronickel, were planning to invest about a combined US$2 billion to build new nickel-processing plants, Bloomberg reported.

However, many nickel miners in the Philippines were forced to reduce or halt production in 2024 as Indonesia's production rates continue to flood the market, resulting in oversupply and declining prices, as per the US Geological Survey.

3. Russia

Nickel production: 210,000 metric tons

Russia produced 210,000 metric tons of nickel in 2024. Even though it holds the third spot on this list of the world's top nickel producers, Russia has seen its nickel output drop from totals seen earlier this decade. In 2020, the nation’s nickel output totaled 283,000 metric tons.

Russia’s Norilsk Nickel is one of the world’s largest high-grade nickel and palladium producers. Nornickel's flagship nickel asset is its Norilsk Division on the Taymyr Peninsula in Siberia, which includes multiple mines, concentrators and metallurgical plants. It also has assets in the Kola Peninsula in Northwest Russia.

In mid-2024, the United States and the United Kingdom joined forces to place a ban on Russian nickel imports.

4. Canada

Nickel production: 190,000 metric tons

Canada’s nickel production in 2024 totaled 190,000 metric tons, up significantly from 159,000 metric tons in 2023. The country’s Sudbury Basin is the second largest supplier of nickel ore in the world, and Vale’s Sudbury operation is located there.

Another key nickel producer in Canada is Glencore (LSE:GLEN,OTC Pink:GLCNF), which owns the Raglan mine in Québec and the Sudbury Integrated Nickel Operations in Ontario. The major miner's Sudbury site includes the Nickel Rim South mine, the Fraser mine, the Strathcona mill and the Sudbury smelter.

Canada Nickel Company (TSXV:CNC,OTCQX:CNIKF) is advancing its Crawford nickel sulfide project toward a construction decision in 2025. In February 2024, the company announced plans to develop a US$1 billion nickel processing plant in Ontario, which once complete would be North America’s largest.

In 2025, Canadian steel and aluminum has become the subject of a 25 percent tariff imposed by the US Trump administration, which he increased to 50 percent in June.

Nickel metal originating from Canada is currently exempt under the Canada-US-Mexico Agreement that replaced NAFTA in July 2020 under Trump's first administration, but the metal's use in stainless steel could cause a trickle-down effect. Last year, Canada was the largest exporter of nickel to the United States, accounting for 46 percent of US nickel imports. That's compared to 11 percent from the next biggest supplier, Norway.

5. China

Nickel production: 120,000 metric tons

China’s nickel production in 2024 was 120,000 metric tons, up slightly from 117,000 metric tons in the previous year. Nickel production in the Asian nation has remained relatively consistent in recent years. In addition to being a top nickel-producing country, China is the world’s leading producer of nickel pig iron, a low-grade ferronickel used in stainless steel. Jinchuan Group, a subsidiary of Jinchuan Group International Resources (HKEX:2362), is a large nickel producer in China.

With Indonesia's surplus weighing on the market, China's position as a major importer of the country's nickel and a top producer of stainless steel means that it also influences nickel price dynamics.

6. New Caledonia

Nickel production: 110,000 metric tons

In 2024, New Caledonia produced 110,000 metric tons of nickel, down more than 52 percent from its output in the previous year. The economy of this French territory just off the coast of Australia depends heavily on its nickel mining industry and the price of nickel, but recently New Caledonia’s nickel industry has been plagued by rising energy costs and sociopolitical unrest.

In February 2024, major miner Glencore made the decision to shutter its Koniambo nickel mine and put it up for sale. The company cited high operating costs and a weak nickel market.

Given these circumstances, the French government has offered a 200 million euro bailout package for New Caledonia’s nickel industry. But the move hasn't gone as planned, with trader Trafigura deciding not to contribute to the bailout of Prony Resources Nouvelle-Caledonie and the Goro mine, in which it has a 19 percent stake.

While the Goro mine remains operational, its future is still in limbo.

7. Australia

Nickel production: 110,000 metric tons

Australia produced 110,000 metric tons of nickel in 2024, a more than 26 percent drop from its output in 2023. One top miner in the country is BHP (NYSE:BHP,ASX:BHP,LSE:BHP) through its Nickel West division.

Australia's largest nickel mines also include First Quantum Minerals' (TSX:FM,OTC Pink:FQVLF) Ravensthorpe and Glencore's Murrin Murrin. Low prices have wreaked havoc on nickel mining in the country, leading to reduced or sidelined operations at six different nickel facilities in the country starting in December 2023, including Ravensthorpe.

The situation was enough to prompt the Australian government to add nickel to its critical minerals list, which allows the country's nickel industry to receive support through the government’s AU$4 billion Critical Minerals Facility.

Australia is the source of 8 percent of US nickel imports according to US Geological Survey data. As of late-April 2025, Australian nickel is not yet the subject of US import tariffs.

8. Brazil

Nickel production: 77,000 metric tons

Brazil’s nickel production came in at 77,000 metric tons in 2024, down nearly 7 percent from the previous year as producers grappled with a weaker market.

Major nickel mining operations in the country include Atlantic Nickel's Santa Rita nickel-copper-cobalt sulfide mine in the state of Bahia. Anglo American (LSE:AAL,OTCQX:AAUKF) is set to sell its nickel portfolio in the country, including its Barro Alto mine, to MMG (OTC Pink:MMLTF,HKEX:1208) subsidiary MMG Singapore Resources for up to US$500 million in cash.

Centaurus Metals (ASX:CTM,OTCQX:CTTZF) is advancing the Jaguar nickel project in the Carajás mineral province. The project hosts a resource of 138.2 million MT at an average grade of 0.87 percent nickel, totaling 1.2 million MT of contained nickel. Jaguar was one of three mining projects selected by the Brazilian government to receive support in obtaining environmental licenses.

9. United States

Nickel production: 8,000 metric tons

Lastly, the United States produced 8,000 metric tons of nickel in 2024, representing a more than 50 percent decline from the national output in the previous year.

The Eagle mine is the only primary nickel-mining property in the US. The asset, located on the Yellow Dog Plains in the Upper Peninsula of Michigan, is a small, high-grade nickel-copper mine owned by Lundin Mining (TSX:LUN,OTC Pink:LUNMF). Output from the mine was exported to smelters in Canada and overseas.

Nickel is included on the US' critical minerals list, and in September 2023, under the Defense Production Act, the US Department of Defense awarded US$20.6 million to Talon Metals (TSX:TLO,OTC Pink:TLOFF) for further exploration and mineral resource definition at its Tamarack nickel-copper-cobalt project in Minnesota.

An environmental review process is underway for the proposed Tamarack underground mine. The company plans to process ore from the mine at a proposed battery mineral processing facility in North Dakota. Talon has said it intends to initiate the permitting process for the facility in 2025.

FAQs for nickel production

How is nickel mined and processed?

How nickel is mined and processed depends upon many factors, such as the size, grade, morphology and depth of the nickel deposit that's under consideration. While lateritic nickel deposits are generally mined from open pits via strip mining, sulfide nickel deposits are often mined using underground extraction methods.

After mining, nickel ore is processed into higher-grade concentrates through crushing and separating nickel-bearing material from other minerals using various physical and chemical processing methods. Next, the concentrates are smelted in a furnace before the final stage of refinement using pyrometallurgical and hydrometallurgical processes.

How bad is nickel mining for the environment?

Nickel mining involves serious environmental concerns, including air and water pollution, habitat destruction, community displacement, wildlife migration pattern disturbances, greenhouse gas emissions and carbon-intensive energy use. Nickel-mining companies looking to supply the EV market are feeling the pressure to lessen the environmental footprint of their operations.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: Canada Nickel Company is a client of the Investing News Network. This article is not paid-for content.

Keep reading...Show less

28 May

Ni-Co Energy Set to Mobilize Critical Minerals Exploration just 90 km from Montreal

Ni-Co Energy Inc. announces that its technical team will be mobilized to the Kremer property around mid-June 2025. The project is located approximately 90 km north of downtown Montreal and about 15 km from the nearest municipality, in a remote forested area with access via an existing road and close proximity to the hydroelectric grid.

Meet The Team:

Bilingual Corporate Video introducing Ni-Co Energy Inc.

Summer Field Program Priorities (June–July)

- Targeted prospecting of southwest TDEM conductors (Kremer-2)

To verify the presence of outcropping massive or semi-massive sulfides. - Prospecting of northeast TDEM conductors (Kremer-1 2)

To assess the nature of EM anomalies and any associated metallic indicators. - Analysis of residual conductors in the eastern portion

To refine the global geophysical model ahead of final drill target placement.

Updated Interpretation of the 420 Assays from 2023

The 420 samples from the 22 holes drilled in fall 2023 have been recalculated in terms of nickel equivalent (NiEq %), using metal prices as of May 22, 2025 (Ni = $7.0375/lb, Cu = $4.6559/lb, Co = $15.286/lb).

Indicator | Updated Result |

Samples > 0.5 % NiEq | 134 (≈ 32%) |

Samples > 1.0 % NiEq | 70 (≈ 17%) |

Maximum grade | 3.89 % NiEq |

Average grade (all samples) | 0.48 % NiEq |

These data confirm the presence of significant mineralization, which may be associated with a mafic intrusion interpreted from geophysical surveys. Magnetic, gravity, and EM data show remarkable alignment over 8 km, suggesting a highly favorable environment in the central block (Kremer-2) over a 3 km section — an ideal structural setting for the formation of thicker sulfide lenses.

Next Steps – The Company Anticipates Undertaking a Drill Program in the Fall

- Validate the position and dip of key targets through surface work.

- Mobilize two drill rigs in the fall to test the central fold hinge and associated deep conductors.

- Carry out borehole EM (BHEM) surveys after each drill hole to visualize the extension of mineralized zones or detect off-hole conductors.

Photos of the team, outcrops, and trenches will be shared regularly on the company website, as well as on Facebook, LinkedIn, and X during the campaign.

The scientific and technical information in this news release has been reviewed and approved by Marc Boivin, P.Geo., a Qualified Person under National Instrument 43-101.

About Ni-Co Energy Inc.

Ni-Co Energy Inc. is exploring the Kremer project, a mafic–ultramafic intrusion prospective for nickel, copper, and cobalt, advantageously located in southern Québec and supported by infrastructure and low-carbon hydroelectric power.

For further information, please contact:

Ni-Co Energy Inc.

info@nicoenergy.ca

Click here to connect with Ni-Co Energy Inc. to receive an Investor Presentation

Keep reading...Show less

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00