October 23, 2024

AuKing Mining Limited (ASX: AKN, AuKing) is pleased to advise that it has completed the purchase of the Grand Codroy uranium exploration project in Newfoundland, Canada.

PROJECT HIGHLIGHTS

- Uranium Mineralisation: Uranium mineralisation within extensive, organic-rich siliciclastic rocks is similar to sandstone-hosted uranium districts in the western United States.

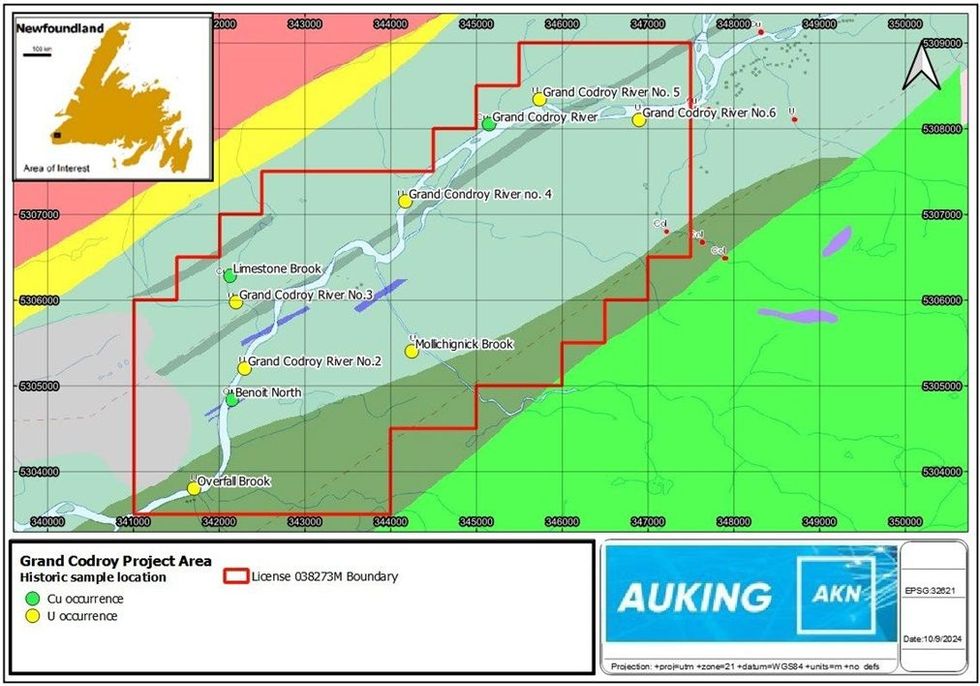

- High Grade Samples: Notable high-grade historical rock samples including:

- Grand Codroy River #6 (Sample 153) - >20,000ppm (2%) Cu and 435ppm U

(Sample 3522) - >20,000ppm (2%) Cu and 400ppm U - Grand Codroy River #4 – 22,000ppm (2.2%) U

- Overfall Brook – 595ppm U

(Source – Newfoundland Labrador Dept of Industry, Energy and Technology)

- Grand Codroy River #6 (Sample 153) - >20,000ppm (2%) Cu and 435ppm U

- Significant Exploration Potential: Grand Codroy tenure area largely untouched by modern exploration. Note the impressive results being reported by Infini Resources Limited (ASX:I88) at its Portland Creek uranium project, to the north of Grand Codroy in western Newfoundland.

- Strategic Location: The mineral claim is strategically situated approximately 50 km north of Port aux Basque, Newfoundland.

- Excellent Accessibility: The site offers excellent accessibility with well-maintained road infrastructure leading directly to the area.

[See AKN release to ASX on 11 September 2024]

AuKing’s Managing Director, Mr Paul Williams, said now the acquisition has been completed the Company would seek to take an aggressive approach to exploration at its new Grand Codroy uranium project.

“We see strong interest from investors with companies seeking to develop uranium projects around the world. The ongoing impressive exploration results of other companies in the region (such as Infini Resources Limited – ASX:I88) provide us with a significant incentive to get started on soil sampling and related exploration activities as soon as possible,” said Mr Williams.

Grand Codroy Uranium Project

AuKing has acquired a uranium bearing mineral claim in the Codroy Valley of south-west Newfoundland, Canada known as the Grand Codroy Uranium Project. The claim, covering an area of 2,200 ha, was selected due to presence of several documented uranium occurrences located along a major radiometric high. The Grand Codroy Uranium Property is approximately 50 km north of Port aux Basque, Newfoundland.

The style of low-grade uranium mineralisation within extensive, organic-rich siliciclastic rocks is similar to sandstone-hosted uranium districts in the western United States. These districts have produced significant amounts of uranium from conventional and low-impact, low-cost in-Situ Recovery (ISR) operations. The potential for ISR amenable uranium mineralisation has never been evaluated in the Bay St. George Sub-basin. Based on regional maps the widespread nature of the noted uranium occurrences and the volume of potential host-rock is significant in this area and could potentially represent an economic uranium target.

ASX-listed Infini Resources Limited (ASX: I88) holds the Portland Creek uranium project in western Newfoundland, which is to the north of the Grand Codroy area. I88 is well advanced with a major surface geochemical sampling program and reporting results such as a 74,997ppm U3O8 assay result [See I88 ASX release on 29 August 2024] and further impressive results in more recent reports to ASX.

Click here for the full ASX Release

This article includes content from Auking Mining, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer hereAKN:AU

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 February

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

03 February

Share Placement Update

AuKing Mining (AKN:AU) has announced Share Placement UpdateDownload the PDF here. Keep Reading...

28 January

Acquisition of Tin and Silver Prospects

AuKing Mining (AKN:AU) has announced Acquisition of Tin and Silver ProspectsDownload the PDF here. Keep Reading...

19 January

Quarterly Activities Report

AuKing Mining (AKN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

19 January

Quarterly Cashflow Report

AuKing Mining (AKN:AU) has announced Quarterly Cashflow ReportDownload the PDF here. Keep Reading...

14 January

$1.5M Share Placement

AuKing Mining (AKN:AU) has announced $1.5M Share PlacementDownload the PDF here. Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00