November 06, 2024

C29 Metals receives official Category 2 environmental permit, MOU signed with Volkov Geology (100% owned subsidiary of Katomprom the national & only Uranium producer in Kazakhstan) strong local community support, and a Social Support Agreement signed.

C29 Metals Limited (ASX:C29) (C29, or the Company) is pleased to announce that it has received the official Category 2 environmental permit allowing drilling to be undertaken at the Ulytau uranium project with the Official permit received from the Natural Resources and Environmental Management Department.

HIGHLIGHTS

- C29 Metals receives official drill permit, the Category 2 environmental permit from Natural Resources and Environmental Management Department.

- The Company is pleased to advise that it is at a very advanced stage of finalising the commercial agreement with Volkov Geology and finalising the drilling contact.

- Initial drilling will see several key strategic holes targeting the mineralisation with the highest geological confidence.

- Obtaining the official permit in rapid time once again demonstrates the positive operating environment in Kazakhstan and the support the company is enjoying.

On the 28 October 2024, the Company announced the signing of an MOU with Volkov Geology, a 100% owned subsidiary of Katomprom the national & only Uranium producer in Kazakhstan.

Negotiations have continued and the Company is pleased to advise that we are at a very advanced stage of finalising the commercial agreement with Volkov Geology and finalising the commercial agreement with the independent drilling contractor.

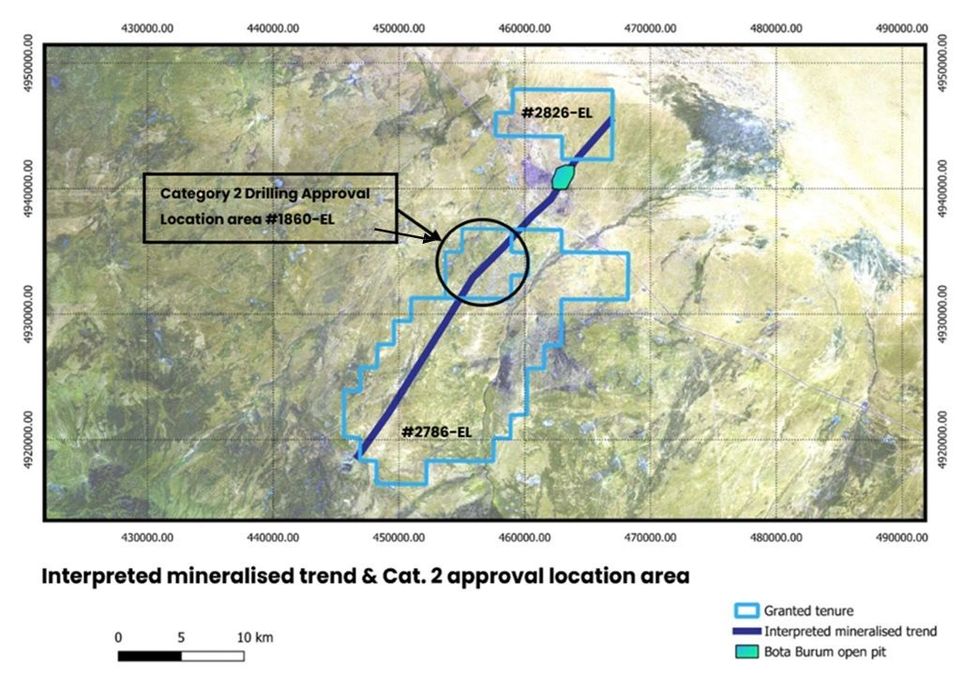

As this initial program will be short in nature the drilling will see several key strategic holes drilled to test and verify the mineralisation in a small area of the Ulytau tenement. with final design of the initial drilling program at an advanced stage it is now planned to extend the initial diamond drill holes to a depth of ~500m. The greater depth is to test the area of highest geological confidence and to commence testing the geological theory that the mineralised trend is a part of a larger multi element geological occurrence.

The Company’s geology team has an established base of operations at the nearby village of Aksuyek where C29 enjoys strong community support.

C29 Metals Managing Director, Mr Shannon Green, commented:

“It is very exciting to have the official environmental permit enabling our team to commence the initial diamond drilling program this season. Obtaining this permit so quickly after receiving official notification that all regulatory requirements for the issue of the drill permit had been met once again demonstrates the positive operating environment in Kazakhstan and the support the company is enjoying”.

Diamond Drill Program

The initial diamond drill program has been designed to test and verify historical drill intersects and will see several key strategic holes drilled in a small area of the Ulytau tenement. With final design of the initial drilling program at an advanced stage it is now planned to extend the initial diamond drill holes to a depth of ~500m. The greater depth is to test the area of highest geological confidence and to commence testing the geological theory that the mineralised trend is a part of a larger multi element geological occurrence.

The geology team will be utilising a handheld XRF unit in the field providing real time geological information to the team and valuable geological data that will assist in prioritising the samples for assay.

Figure 1 below shows the interpreted mineralised uranium trend1 and location for initial Category 2 drilling.

Project Location and history

The Ulytau Uranium Project is located in the Almaty Region of Southern Kazakhstan approximately 15 km southwest of the Bota-Burum mine, one of the largest uranium deposits mined in the former Soviet Union. Exploration for uranium has been carried out in the area since 1953. Production of Uranium at the Bota Burum mine next to the village of Aksuyek commenced in 1956 and continued until 19911.

Total mined reserves of Bota Burum are quoted at 20,000 tonnes of Uranium (44 million pounds)1,2.

Click here for the full ASX Release

This article includes content from C29 Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

C29:AU

The Conversation (0)

21 October 2025

C29 Metals to drill Sampsons Tank Copper Project

C29 Metals (C29:AU) has announced C29 Metals to drill Sampsons Tank Copper ProjectDownload the PDF here. Keep Reading...

31 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

C29 Metals (C29:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

01 July 2025

C29 Metals shifts focus to Mayfield Copper Project

C29 Metals (C29:AU) has announced C29 Metals shifts focus to Mayfield Copper ProjectDownload the PDF here. Keep Reading...

11 May 2025

Multiple New Multi-Commodity Targets

C29 Metals (C29:AU) has announced Multiple New Multi-Commodity TargetsDownload the PDF here. Keep Reading...

04 May 2025

C29 Signs Binding HOA to Drive Growth

C29 Metals (C29:AU) has announced C29 Signs Binding HOA to Drive GrowthDownload the PDF here. Keep Reading...

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00