Highlights

- Reid Property – second hole of new discovery intersected dunite across entire 354 metre core length including an 84 metre highly mineralized interval.

- All 21 holes drilled at Deloro , Reaume, and Nesbitt properties intersected target mineralization.

Canada Nickel Company Inc. ("Canada Nickel" or the "Company ") (TSXV: CNC) (OTCQX: CNIKF) today announced a new nickel discovery at its Reid property, where two drill holes have been completed as part of its regional exploration program. Drilling has commenced at Reid, as well as the Company's Deloro and Reaume properties, and assays from earlier drilling at Nesbitt have been received.

Mark Selby , Chair and Chief Executive Officer said, "Our regional exploration program intended to highlight the potential for multiple Crawford-sized discoveries has taken several big steps forward. At Reid, a target with a larger footprint than Crawford, our second hole intersected dunite across the entire core length and contained an 84-metre interval which was visibly mineralized to similar extent as Crawford Higher Grade Core. We extended the discovery at Deloro and intersected target mineralization at Reaume – all of which confirm the success of our geophysical targeting model. We are further encouraged by these results as they represent targets we can easily access and are not our highest potential targets. We expect to have access to the full target base through this year and we are looking forward to exploring their potential."

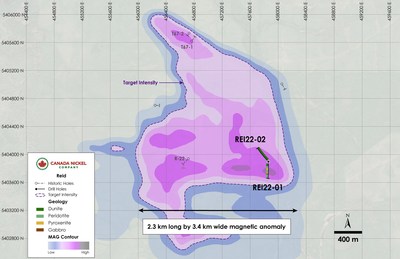

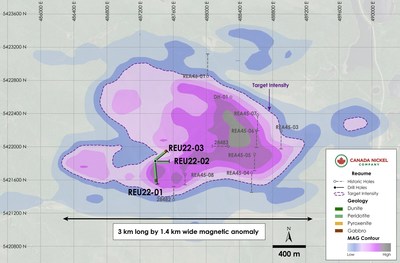

Reid Nickel Property

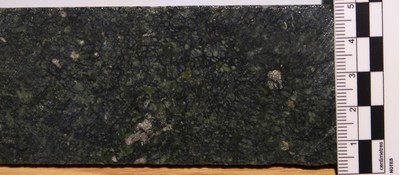

The Reid Property is located just 16 kilometres southwest of Crawford. The property contains a series of folded ultramafic bodies that measure 3.3 kilometres north-south by 2.1 kilometres east-west based on the total magnetic intensity ("TMI") (see Figure 1). The Company has completed two holes both of which collared in dunite. Hole REI22-01 was collared to intersect the south contact intersecting dunite, peridotite, pyroxenite and gabbro – the same sequence on the north contact at Crawford. This sequence has the potential to host PGM mineralization. Hole REI22-02 was drilled northwest toward the center of the intrusion and intersected dunite across the entire core length with an interval of 84 metres, beginning at 292 metres, visibly mineralized to similar extent as Crawford Higher Grade Core. Mineralogy completed on samples from these holes confirmed that they contain the same heazlewoodite-pentlandite-awaruite minerals as Crawford. Four historic holes were drilled in the 1960's and 1970's into the Reid ultramafic which intersected peridotite with up to 10% magnetite. No assays were available for these holes.

Additional drilling at Reid postponed until the spring thaw. Drilling will resume in late spring.

Figure 1 – Plan View of Reid – Lithologies Overlain on Total Field Magnetic Intensity.

| Source: Abitibi GDS. |

Figure 2 – Hole REI22-02 (240 metres).

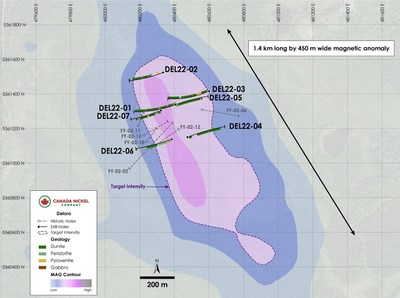

Deloro Nickel Property

The Deloro property is located 8 kilometres south of Timmins and contains an ultramafic target measuring 1.4 kilometres long by 300 – 500 metres wide (see Figure 3). The Company has now completed seven holes at Deloro , all on the northern half of the intrusion. The first five holes collared in mineralized dunite and stayed primarily in dunite/peridotite. The last two holes (DEL22-06 and DEL22-07) were collared closer to the west contact to test for the presence of PGM in pyroxenite and for gold which was intersected in a historical hole. Mineralogy completed on samples from these holes confirmed that they contain the same heazlewoodite-pentlandite-awaruite minerals as Crawford.

DEL22-01, collared in the centre of the ultramafic target and drilled toward the west contact, intersected mineralized dunite (including some narrow dykes) starting at 1.8 metres downhole. Holes DEL22-03, DEL22-04 and DEL 22-05 all intersected thick dunite sequences with some peridotite. DEL22-06 and DEL22-07 intersected dunite followed by pyroxenite and then gabbro. Drilling will resume later this spring.

Figure 3 – Plan View of Deloro – Lithologies Overlain on Total Field Magnetic Intensity.

| Source: Abitibi GDS. |

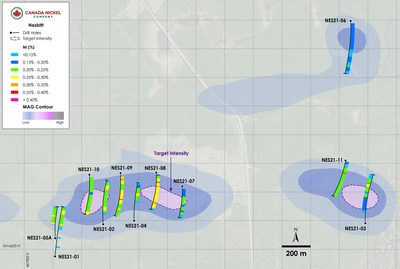

Nesbitt Nickel Property

The Nesbitt Nickel Property is located just 9 kilometres north-northwest of Canada Nickel's Crawford Nickel Sulphide Property on patented mining claims acquired from Noble Mineral Exploration. The Property includes two ultramafic sills that strike east-west, the larger sill being 3.7 kilometres long. Original estimates suggested a width of 100 to 300 metres. Preliminary drill results were previously announced for NES21-01 (please see press release dated June 29, 2021 ) and NES21-02 and NES21-03 (please see press release dated July 14, 2021 ). This release contains the assay results for all eleven drillholes.

Nesbitt NES21-08 was collared over a strong magnetic high and drilled to the south to test for the presence of a mineralized, dunitic core within the centre of the ultramafic sill. The hole encountered 336.5 metres (core length) of 0.27% nickel including 31 metres of 0.33% nickel.

Nesbitt NES21-09 was collared 250 metres west of NES21-09 to determine the consistency of mineralization farther to the west. The hole intersected 415.3 (core length) metres grading 0.26% nickel including a higher-grade zone of 25.5 metres (core length) grading 0.31% nickel. The hole intersected a thick interval of peridotite grading to dunite from 41.7 to 459.0 metres, ending in peridotite.

Eight holes in total tested the western extent of the main ultramafic sill at Nesbitt with all holes intersecting mineralization. Grades were lower near the end of the mineralization to the west. There appears to be a break in the sill east of NES21-08 which has not yet been drill-tested. Farther east holes NES21-03 and NES21-11 intersected thick sections of lower-grade mineralization.

NES21-06 was drilled in the northern sill and intersected lower-grade mineralization encountering 483.8 metres of 0.17% nickel within a peridotite sill containing minor dunite.

Figure 4 – Plan View of Nesbitt – Drill Results Overlain on Total Field Magnetic Intensity.

| Source: Abitibi GDS. |

Table 1: Nesbitt Exploration Drilling Results, Ontario .

| Hole ID | From | To | Length | Est. True | Ni | Co | Pd | Pt | Cr | Fe | S |

| | (m) | (m) | (m) | Width (m) | (%) | (%) | (g/t) | (g/t) | (%) | (%) | (%) |

| NES21-01 | 315.5 | 447.0 | 131.5 | 84.5 | 0.23 | 0.010 | 0.007 | 0.007 | 0.18 | 5.38 | 0.13 |

| including | 412.5 | 447.0 | 34.5 | 22.2 | 0.25 | 0.011 | 0.007 | 0.008 | 0.18 | 5.31 | 0.11 |

| NES21-02 | 133.5 | 430.0 | 296.5 | 190.6 | 0.23 | 0.010 | 0.005 | 0.006 | 0.16 | 5.79 | 0.07 |

| including | 151.0 | 193.0 | 42.0 | 27.0 | 0.26 | 0.011 | 0.005 | 0.008 | 0.22 | 5.75 | 0.09 |

| NES21-03 | 135.0 | 440.0 | 305.0 | 196.1 | 0.20 | 0.011 | 0.011 | 0.008 | 0.35 | 6.78 | 0.07 |

| including | 366.0 | 393.0 | 27.0 | 17.4 | 0.26 | 0.010 | 0.005 | 0.005 | 0.16 | 5.15 | 0.06 |

| NES21-04 | 229.5 | 402.0 | 172.5 | 110.9 | 0.21 | 0.010 | 0.010 | 0.008 | 0.21 | 5.74 | 0.06 |

| including | 280.5 | 310.5 | 30.0 | 19.3 | 0.29 | 0.012 | 0.017 | 0.008 | 0.13 | 5.09 | 0.11 |

| NES21-05A | 193.0 | 373.0 | 180.0 | 90.0 | 0.23 | 0.010 | 0.006 | 0.007 | 0.17 | 5.41 | 0.09 |

| including | 281.0 | 296.0 | 15.0 | 7.5 | 0.27 | 0.009 | 0.012 | 0.014 | 0.13 | 5.11 | 0.10 |

| NES21-06 | 29.2 | 513.0 | 483.8 | 311.0 | 0.17 | 0.011 | 0.017 | 0.017 | 0.43 | 7.38 | 0.07 |

| NES21-07 | 32.2 | 288.5 | 256.3 | 164.7 | 0.20 | 0.011 | 0.006 | 0.006 | 0.27 | 6.25 | 0.05 |

| NES21-08 | 24.0 | 360.5 | 336.5 | 216.3 | 0.27 | 0.011 | 0.009 | 0.008 | 0.15 | 5.71 | 0.10 |

| including | 294.0 | 324.6 | 30.6 | 19.7 | 0.33 | 0.011 | 0.026 | 0.015 | 0.12 | 4.98 | 0.13 |

| and | 97.5 | 106.5 | 9.0 | 5.8 | 0.37 | 0.012 | 0.025 | 0.022 | 0.13 | 5.82 | 0.16 |

| NES21-09 | 41.7 | 457.0 | 415.3 | 266.9 | 0.26 | 0.010 | 0.010 | 0.009 | 0.19 | 5.33 | 0.06 |

| including | 58.0 | 83.5 | 25.5 | 16.4 | 0.31 | 0.011 | 0.010 | 0.008 | 0.16 | 5.70 | 0.04 |

| NES21-10 | 23.9 | 402.0 | 378.1 | 243.0 | 0.22 | 0.010 | 0.004 | 0.004 | 0.15 | 6.29 | 0.04 |

| including | 380.0 | 402.0 | 22.0 | 14.1 | 0.25 | 0.011 | 0.003 | 0.004 | 0.14 | 5.84 | 0.07 |

| NES21-11 | 12.5 | 405.0 | 392.5 | 252.3 | 0.21 | 0.012 | 0.016 | 0.011 | 0.46 | 7.20 | 0.03 |

Reaume Nickel Property

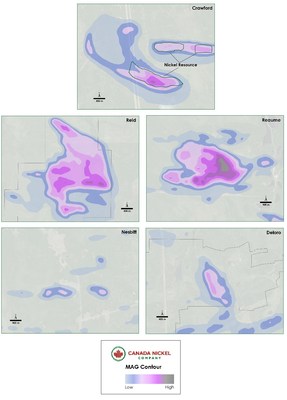

The Reaume Property, located 19 kilometres northwest of Crawford, contains an ultramafic target of approximately 3 kilometres (east-west) by 1.8 kilometres (north-south) as defined by its magnetic footprint and historical drilling (see Figure 5).

Canada Nickel has drilled three holes at Reaume into the ultramafic intrusion, all three of which intersected dunite/peridotite. REU22-01 intersected 410.6 metres of serpentinized peridotite, dunite and altered dunite below 9.4 metres of overburden. REU22-02 intersected 242.5 metres of serpentinized peridotite below 4.5 metres of overburden. REU22-03 intersected a series of ultramafic rocks including peridotite, pyroxenite and gabbro through what is considered the upper portion of the intrusion, typically where the PGM zone is situated. The peridotite interval was 226.2 metres thick. It is interpreted that the hole location was at the southern contact and that the ultramafics could be highly folded. All three holes were drilled from a single collar due to seasonal access difficulties to the property. Drilling will resume later this year.

Figure 5 – Plan View of Reaume – Lithologies Overlain on Total Field Magnetic Intensity.

| Source: Abitibi GDS. |

Figure 6 – Size of Reid, Deloro , Nesbitt and Reaume Compared to Crawford on a Standardized Scale.

| Source: Abitibi GDS. |

Table 2 – Regional Drill Results – Selected Lithologies.

Note: contains minor dikes.

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| DEL22-01 | 1.8 | 200.0 | 198.2 | Dunite |

| DEL22-01 | 200.0 | 214.3 | 14.3 | Peridotite |

| DEL22-01 | 217.0 | 484.0 | 267.0 | Dunite |

| DEL22-02 | 19.2 | 43.7 | 24.5 | Ultramafics |

| DEL22-02 | 49.5 | 75.0 | 25.5 | Pyroxenite |

| DEL22-02 | 75.0 | 127.8 | 52.8 | Ultramafics |

| DEL22-02 | 133.5 | 263.0 | 129.5 | Dunite |

| DEL22-02 | 270.0 | 374.1 | 104.1 | Dunite |

| DEL22-02 | 374.1 | 392.6 | 18.5 | Ultramafics |

| DEL22-03 | 9.0 | 88.9 | 79.9 | Dunite |

| DEL22-03 | 92.4 | 151.8 | 59.4 | Pyroxenite |

| DEL22-03 | 151.8 | 434.0 | 282.2 | Dunite |

| DEL22-04 | 9.6 | 52.2 | 42.6 | Dunite |

| DEL22-04 | 52.2 | 93.5 | 41.3 | Mafic Intrusive |

| DEL22-04 | 112.1 | 357.5 | 245.4 | Dunite |

| DEL22-04 | 366.5 | 383.7 | 17.2 | Ultramafics |

| DEL22-05 | 7.0 | 328.5 | 321.6 | Dunite |

| DEL22-05 | 328.5 | 398.1 | 69.6 | Ultramafics |

| DEL22-06 | 5.6 | 30.0 | 24.4 | Peridotite |

| DEL22-06 | 30.0 | 53.3 | 23.3 | Pyroxenite |

| DEL22-06 | 53.3 | 128.2 | 74.9 | Peridotite |

| DEL22-06 | 128.2 | 140.5 | 12.3 | Mafic Intrusive |

| DEL22-06 | 140.5 | 244.4 | 103.9 | Dunite |

| DEL22-06 | 248.3 | 281.9 | 33.6 | Peridotite |

| DEL22-06 | 303.0 | 321.0 | 18.0 | Pyroxenite |

| DEL22-07 | 3.1 | 27.0 | 23.9 | Dunite |

| DEL22-07 | 27.0 | 51.6 | 24.6 | Peridotite |

| DEL22-07 | 57.5 | 201.0 | 143.5 | Dunite |

| DEL22-07 | 201.0 | 216.4 | 15.4 | Peridotite |

| DEL22-07 | 219.5 | 237.0 | 17.5 | Gabbro |

| REI22-01 | 51.0 | 109.0 | 58.0 | Dunite |

| REI22-01 | 109.0 | 161.0 | 52.0 | Peridotite |

| REI22-01 | 161.0 | 193.0 | 32.0 | Pyroxenite |

| REI22-01 | 193.0 | 266.0 | 73.0 | Peridotite |

| REI22-01 | 266.0 | 283.8 | 17.8 | Pyroxenite |

| REI22-01 | 283.8 | 305.0 | 21.2 | Gabbro |

| REI22-01 | 306.5 | 380.0 | 73.5 | Peridotite |

| REI22-02 | 42.0 | 396.0 | 354.0 | Dunite |

| REU22-01 | 9.4 | 337.1 | 327.7 | Peridotite |

| REU22-01 | 337.1 | 351.3 | 14.2 | Gabbro |

| REU22-01 | 351.3 | 395.0 | 43.7 | Dunite |

| REU22-01 | 395.0 | 408.0 | 13.0 | Ultramafics |

Table 2 – Regional Drill Results – Selected Lithologies (continued).

| Hole ID | From (m) | To (m) | Length (m) | Rock Type |

| REU22-01 | 408.0 | 420.0 | 12.0 | Peridotite |

| REU22-02 | 4.5 | 247.0 | 242.5 | Peridotite |

| REU22-03 | 8.0 | 235.5 | 227.5 | Peridotite |

| REU22-03 | 235.5 | 257.5 | 22.0 | Pyroxenite |

| REU22-03 | 257.5 | 295.0 | 37.5 | Gabbro |

Table 3: Drill Hole Orientation.

| Hole ID | Easting | Northing | Azimuth | Dip | Length |

| | (mE) | (mN) | (⁰) | (⁰) | (m) |

| NES21-01 | 468,015 | 5,416,550 | 5 | -50 | 131.5 |

| NES21-02 | 468,351 | 5,416,775 | 360 | -50 | 296.5 |

| NES21-03 | 470,182 | 5,416,782 | 360 | -50 | 305.0 |

| NES21-04 | 468,568 | 5,416,800 | 360 | -50 | 172.5 |

| NES21-05A | 468,016 | 5,416,677 | 360 | -60 | 180.0 |

| NES21-06 | 470,080 | 5,418,194 | 180 | -50 | 483.8 |

| NES21-07 | 468,905 | 5,417,040 | 182 | -50 | 256.3 |

| NES21-08 | 468,723 | 5,417,135 | 180 | -50 | 336.5 |

| NES21-09 | 468,473 | 5,417,132 | 180 | -50 | 415.3 |

| NES21-10 | 468,255 | 5,417,120 | 180 | -50 | 378.1 |

| NES21-11 | 470,044 | 5,417,219 | 190 | -50 | 392.5 |

| DEL22-01 | 480,413 | 5,361,341 | 248 | -60 | 490.2 |

| DEL22-02 | 480,334 | 5,361,525 | 248 | -60 | 395.4 |

| DEL22-03 | 480,600 | 5,361,417 | 248 | -60 | 425.0 |

| DEL22-04 | 480,475 | 5,361,151 | 68 | -60 | 391.4 |

| DEL22-05 | 480,406 | 5,361,339 | 68 | -60 | 401.0 |

| DEL22-06 | 480,384 | 5,361,139 | 248 | -50 | 341.4 |

| DEL22-07 | 480,322 | 5,361,305 | 248 | -50 | 274.9 |

| REI22-01 | 457,859 | 5,403,898 | 175 | -50 | 329.0 |

| REI22-02 | 457,859 | 5,403,898 | 316 | -50 | 354.0 |

| REU22-01 | 487,384 | 5,421,827 | 175 | -50 | 410.6 |

| REU22-02 | 487,384 | 5,421,827 | 90 | -51 | 242.5 |

| REU22-03 | 487,384 | 5,421,827 | 50 | -50 | 287.0 |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Assays, Quality Assurance/Quality Control and Drilling and Assay

Edwin Escarraga , MSc, P.Geo., a "qualified person" as defined by NI 43-101, is responsible for the on-going drilling and sampling program, including quality assurance (QA) and quality control (QC). The core is collected from the drill in sealed core trays and transported to the core logging facility. The core is marked and sampled at 1.5 metre lengths and cut with a diamond blade saw. A set of samples are transported in secured bags directly from the Canada Nickel core shack to Actlabs Timmins; the other set of samples are securely shipped for analysis to SGS Burnaby ( Canada ) and SGS Callao ( Peru ). All ISO/IEC 17025 accredited labs. Analysis for precious metals (gold, platinum and palladium) are completed by Fire Assay while analysis for nickel, cobalt, sulphur and 17 other elements are performed using a peroxide fusion and ICP-OES analysis. Certified standards and blanks are inserted at a rate of 3 QA/QC samples per 20 core samples making a batch of 60 samples that are submitted for analysis.

Qualified Person and Data Verification

Stephen J. Balch P.Geo . (ON), VP Exploration of Canada Nickel and a "qualified person" as such term is defined by National Instrument 43-101, has verified the data disclosed in this news release, and has otherwise reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

About Canada Nickel Company

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel TM , NetZero Cobalt TM , NetZero Iron TM and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel Sulphide Property in the heart of the prolific Timmins - Cochrane mining camp. For more information, please visit www.canadanickel.com.

For further information, please contact:

Mark Selby , Chair and CEO

Phone: 647-256-1954

Email: info@canadanickel.com

Cautionary Statement Concerning Forward-Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, drill results relating to the Crawford Nickel Sulphide Property, the potential of the Crawford Nickel Sulphide Property, timing of economic studies and mineral resource estimates, the ability to sell marketable materials, strategic plans, including future exploration and development results, and corporate and technical objectives. Forward-looking information is necessarily based upon a number of assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking information. Factors that could affect the outcome include, among others: future prices and the supply of metals, the future demand for metals, the results of drilling, inability to raise the money necessary to incur the expenditures required to retain and advance the property, environmental liabilities (known and unknown), general business, economic, competitive, political and social uncertainties, results of exploration programs, risks of the mining industry, delays in obtaining governmental approvals, failure to obtain regulatory or shareholder approvals, and the impact of COVID-19 related disruptions in relation to the Company's business operations including upon its employees, suppliers, facilities and other stakeholders. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward-looking information. All forward-looking information contained in this press release is given as of the date hereof and is based upon the opinions and estimates of management and information available to management as at the date hereof. Canada Nickel disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by law.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-announces-new-nickel-discovery-at-reid-with-larger-footprint-than-flagship-crawford-property-main-zone-provides-update-on-regional-exploration-301543306.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/canada-nickel-announces-new-nickel-discovery-at-reid-with-larger-footprint-than-flagship-crawford-property-main-zone-provides-update-on-regional-exploration-301543306.html

SOURCE Canada Nickel Company Inc.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/May2022/10/c5121.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/May2022/10/c5121.html