May 10, 2023

Avrupa Minerals Ltd. (TSXV:AVU) is pleased to announce that it has entered into a definitive option agreement with Western Tethyan Resources to advance the Slivova Gold Project, located in the productive Vardar Mineral Trend in the Republic of Kosovo, to a possible mining solution. WTR can earn-in to 75% of the Project by funding exploration and development for Euro 1,800,000 over three years, and then a further 10% by making certain milestone and success payments, producing an Environmental Impact Statement, delivering a Feasibility Study, and completing a Mining License application.

- The Definitive Agreement (“DA”) outlines a path towards potential gold production from the Slivova deposit;

- Western Tethyan Resources (“WTR”) completed a robust Due Diligence (“DD”) review, a Concept Study, and continues to work on a Preliminary Economic Assessment (“PEA”), including a metals resource update for the Slivova deposit;

- WTR can earn-in to 85% of the Slivova Project.

To date, WTR has spent more than Euro 275,000 for Due Diligence, development of a Concept Study, and continuing work on a PEA. WTR is a private exploration company based in London and Prishtina, Republic of Kosovo, and is 75% owned by London AIM-listed Ariana Resources (“Ariana”).

Paul W. Kuhn, President and CEO of Avrupa Minerals, commented, “Western Tethyan has already made significant progress towards defining a possible mining solution at Slivova. We are truly excited about the positive progress in the ongoing PEA and Concept Studies, as well as for getting started in a new phase of exploration and resource definition. WTR is working on a new resource update, and we expect information later this quarter.”

Mentor Demi, Managing Director of Western Tethyan Resources, added, “Alongside an aggressive exploration programme throughout the West Tethyan Belt, we are actively seeking acquisition opportunities. Acquisition of the Slivova gold deposit is a step towards building Western Tethyan Resources into a development company, as well, and the Slivova Mine as the first modern mine in Kosovo since the 1920’s.”

Dr. Kerim Sener, Managing Director of Ariana Resources, stated, “The completion of this agreement formalizes a process we had already embarked upon in March following the successful completion of the Project due diligence. We are already nearing completion of a revised Mineral Resource Estimate for Slivova, and we look forward to announcing this work in due course.

In addition, further work has been underway at the local community level in order to increase awareness of the project and its merits. We are investigating opportunities to deliver a low-impact mining project which aims to achieve a new standard for mining in Kosovo and potentially become a strategic hub of operations for the company in the country.”

About Slivova

The Slivova exploration license covers 30.51 km2 of prospectable land surrounding the Slivova gold deposit. The license is valid for 7 years from May 2022. Outside of the deposit itself, much of the property is under-explored. Avrupa commissioned an initial NI 43-101 resource study in 2016 and reported an indicated mineral resource of 640,000 mt @ 4.8 g/t gold and 14.68 g/t silver for a total of 98,700 ounces of gold and 302,000 ounces of silver. Slivova Maiden Resource, 2016

WTR is currently updating the Mineral Resource Estimate (“MRE”) to JORC standards, and Avrupa will follow suit by transforming the JORC estimate to a NI 43-101 resource estimate. The companies expect to be able to report the new MRE during Q2 2023. The new evaluation will encompass results from drilling subsequent to the 2016 report, re-interpretation of previous geological information from surface and trench mapping and sampling, and thorough review of all historic core.

As noted in a previous AVU news release, AVU and WTR agree to Proceed, there are additional nearby and distal targets within the new Slivova license. There are known zones of mineralization close to the main Slivova deposit that WTR will need to drill, and we can expect upgrade work on a number of distal targets around the license in the coming field season.

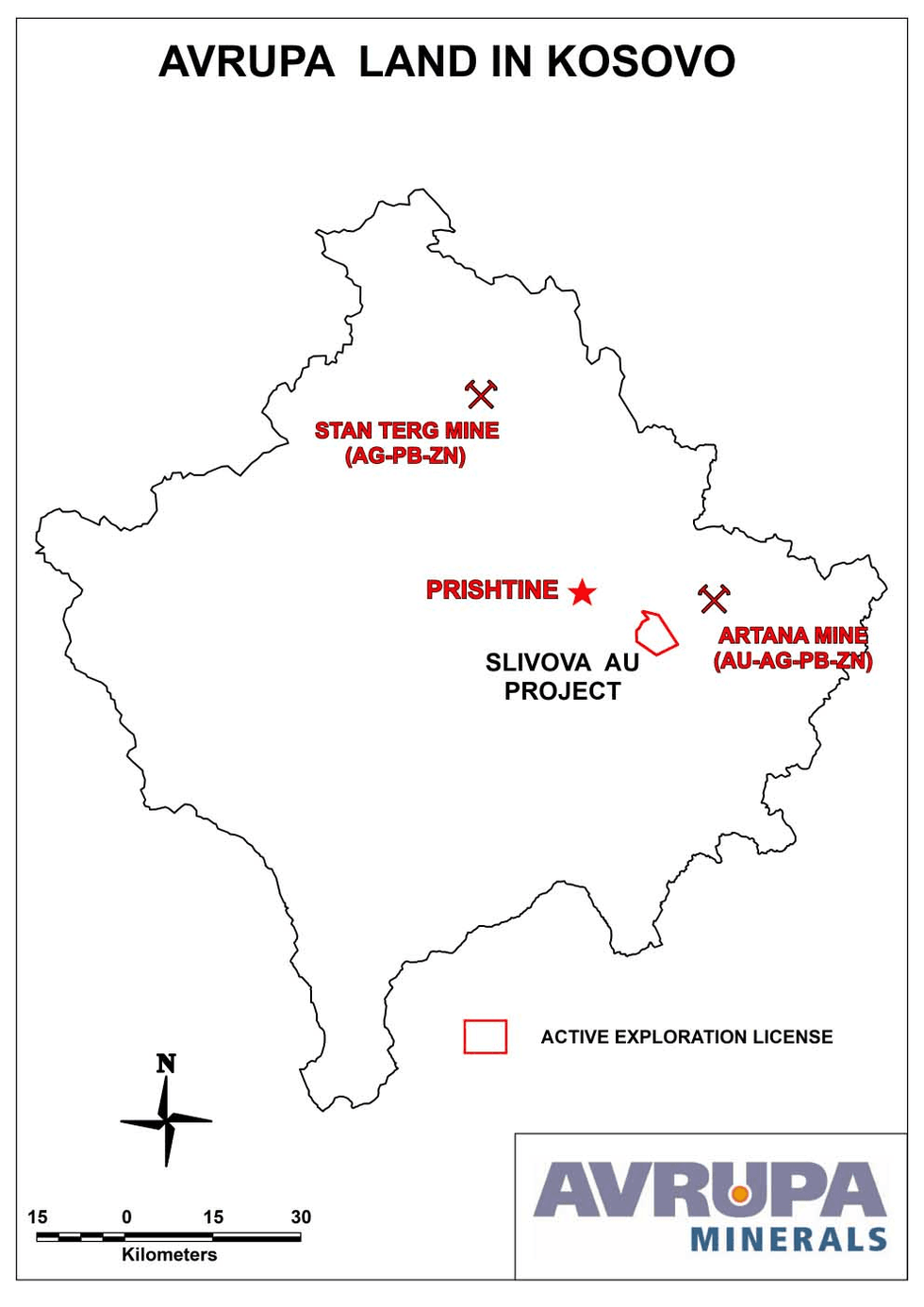

Figures 1 and 2. Maps showing location of Slivova in Kosovo, along with target areas to be upgraded. New license is shown as a red polygon. The names in northwest quadrant are historic Trepça base metal mines

Terms of the Agreement

Under the terms of the Definitive Agreement, WTR will have the right to acquire, in multiple stages, up to 85% of the Slivova project, by completing a series of exploration and development milestones and making staged payments to AVU.

On Closing

- Euro 35,000 cash payment upon signing the Definitive Agreement on/about March 1, 2023. (Completed)

Earn-In Phase

Stage 1:

- Euro 30,000 cash payment on September 1, 2023;

- If WTR elects to enter the Definitive Agreement, it will invest Euro 800,000, during first two years from the effective date (minimum of Euro 150,000 must be spent by September 1, 2023, post DD Phase) for exploration, drilling, baseline environmental and social surveys, landowners, etc., for 51% of the Project. (Underway)

Stage 2:

- After completion of Stage 1, during the third year from the Effective Date, WTR will invest Euro 1,000,000 for NI 43-101 resource estimation, commencement of full Environmental Impact Statement (“EIS”), etc., for 75% of the Project.

Stage 3:

- During fourth and fifth year from the Effective Date, WTR must complete the EIS, Feasibility Study (“FS”), and Mining License application, for 85% of the Project.

Stage 4:

- WTR completes success payments to previous JV partner, Byrnecut International Ltd., accordingly:

- Euro 125,000 in cash within 30 days of the first to occur of: 1) Completion of a positive FS (minimum 15% IRR) or; 2) Avrupa or related party making a decision to proceed with development of a mining operation within the license area;

- Euro 125,000 within 30 days of issuance of a mining license for the Project;

- Euro 125,000 within 30 days of commencement of mine construction within the license area;

- 100 troy ounces of gold within 30 days of commencement of commercial production (“CCP”), then increasing by 75 troy ounces per year until and including the third anniversary of commercial production when 325 troy ounces will be delivered.

- Avrupa participates in the mine build or dilutes to 1% NSR.

Western Tethyan Resources Ltd. is a UK-registered, mineral exploration and development company focused on South East Europe. The company has a strategic alliance with Newmont Corporation and Ariana Resources and is currently focused on exploration for major copper-gold deposits in the Lecce Magmatic Complex and Vardar Belt in Kosovo. The company is assessing several other exploration project opportunities across Eastern Europe, targeting major copper-gold deposits across the porphyry-epithermal transition.

Ariana Resources plc is an AIM-listed mineral exploration and development company with an exceptional track-record of creating value for its shareholders through its interests in active mining projects and investments in exploration companies. Its current interests include gold production in Turkey and copper-gold exploration and development projects in Cyprus and Kosovo.

Avrupa Minerals Ltd. is a growth-oriented junior exploration and development company directed to discovery of mineral deposits, using a hybrid prospect generator business model. The Company holds one license in Portugal, the Alvalade VMS Project, presently optioned to Sandfire MATSA in an earn-in joint venture agreement. The Company now holds one exploration license covering the Slivova gold prospect in Kosovo, and is actively advancing four prospects in central Finland through its in-process acquisition of Akkerman Finland Oy. Avrupa focuses its project generation work in politically stable and prospective regions of Europe, presently including Portugal, Finland, and Kosovo. The Company continues to seek and develop other opportunities around Europe.

For additional information, contact Avrupa Minerals Ltd. at 1-604-687-3520 or visit our website at www.avrupaminerals.com.

On behalf of the Board,

Paul W. Kuhn, President & Director

This news release was prepared by Company management, who take full responsibility for its content. Paul W. Kuhn, President and CEO of Avrupa Minerals, a Licensed Professional Geologist and a Registered Member of the Society of Mining Engineers, is a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators. He has reviewed the technical disclosure in this release. Mr. Kuhn, the QP, has not only reviewed, but prepared and supervised the preparation or approval of the scientific and technical content in the news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Click here to connect with Avrupa Minerals Ltd. (TSXV:AVU) to receive an Investor Presentation

Source

AVU:CA

The Conversation (0)

24 May 2023

Avrupa Minerals

European Prospect Generation

European Prospect Generation Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00