April 28, 2023

Alvo Minerals Limited (ASX: ALV) (“Alvo” or the “Company”) is pleased to provide its Quarterly Activities Report for the period ending 31 March 2023*. Alvo is exploring its Palma VMS Project in Brazil (“Palma Project” or the “Project”), a Project that has significant high-grade copper and zinc potential in existing prospects, brownfields prospects and greenfields targets within a district scale exploration package.

HIGHLIGHTS

- Extensional drilling at the Palma Volcanic hosted Massive Sulphide (“VMS”) Project delivers significant high-grade mineralisation, including:

- PD3-059: 14.2m @ 3.0% CuEq* (1.1% Cu, 6.1% Zn, 0.2% Pb, 12g/t Ag & 0.04g/t Au) from 228m

- Inc. 4.8m @ 7.3% CuEq (1.8% Cu, 16.8% Zn, 0.4% Pb, 24g/t Ag & 0.1g/t Au) from 237m

- PD3-065: 13.0m @ 1.5% CuEq (1.0% Cu, 1.8% Zn, 0.1% Pb, 8g/t Ag & 0.02g/t Au) from 333m

- Inc. 4.7m @ 3.1% CuEq (1.9% Cu, 4.6% Zn, 0.31% Pb, 21g/t Ag & 0.05g/t Au) from 340m

- PD3-065: 14m @ 1.7% CuEq (0.7% Cu, 3.3% Zn, 0.2% Pb, 10g/t Ag & 0.03g/t Au) from 376m

- Inc. 5.3m @ 3.6% CuEq (1% Cu, 8% Zn, 0.5% Pb, 25g/t Ag & 0.05g/t Au) from 379m

- PD3-059: 14.2m @ 3.0% CuEq* (1.1% Cu, 6.1% Zn, 0.2% Pb, 12g/t Ag & 0.04g/t Au) from 228m

- High-grade mineralisation intersected approximately 50m down-dip of the existing JORC 2012 Mineral

- Resource Estimate (“MRE”).

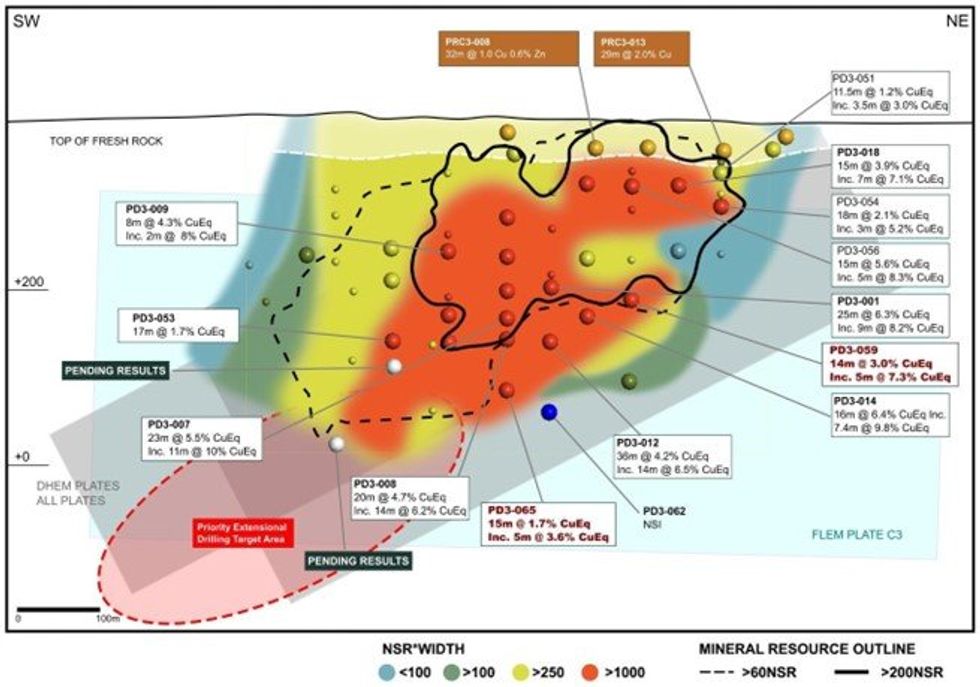

- Phase 2 drilling is ongoing at C3, with aggressive step-outs down-plunge, aiming to significantly expand the MRE of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag.

- Down-Hole Electromagnetic surveys (“DHEM”) at C3 have highlighted conductive plates that demonstrate the potential to significantly expand C3 mineralisation and is assisting with the extensional drilling.

- Regional exploration planned with a combination of in-house auger drilling, geophysics and geochemistry to advance greenfield prospects to drill ready status with the aim of making new VMS discoveries.

- Nickel/Copper/PGE exploration to commence in Q2 CY2023 at Cana Brava for “Julimar Style” deposits.

- Binding agreement to earn-in to the Afla Cu/Zn Project, consolidating the southern portion of the highly prospective Palma VMS belt.

- Cash balance of A$1.3M at 31 March 2023

*Refer to the detailed explanation of assumptions and pricing underpinning the copper equivalent (CuEq) on page 11 of this Quarterly Activities Report

Exploration Activities

Diamond Drilling at the Palma VMS Project

During the reporting period, Alvo announced assay results from its extensional diamond drill program at the C3 prospect, within the Palma Project in central Brazil1.

Phase 2 drilling at the C3 prospect is aiming to significantly expand the existing Palma Project JORC 2012 MRE2 of 4.6Mt @ 1.0% Cu, 3.9% Zn, 0.4% Pb & 20g/t Ag (see Figure 1). Phase 2 drilling follows an exceptional Phase 1 drill program that delivered high-grade Copper and Zinc in thick VMS intercepts. Phase 1 and initial Phase 2 drill results continue to exceed expectations on grade and thickness when compared to the existing JORC 2012 MRE that used historical drilling only.

C3 Upgrade Drilling

Phase 2 diamond drilling resumed during the reporting period and is targeting extensions to the high-grade VMS mineralisation, predominately focusing on the down-dip extensions emerging on the south-westerly plunge orientation from the known mineralisation. The Company believes this is the most prospective orientation extension defined to date.

Click here for the full ASX Release

This article includes content from Alvo Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ALV:AU

The Conversation (0)

08 August 2022

Alvo Minerals

District-Scale Copper-Zinc VMS Project in Brazil

District-Scale Copper-Zinc VMS Project in Brazil Keep Reading...

23h

Nine Mile Metals Intersects 44 Meters of Copper Mineralization and Provides Drill Program Update

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to provide the details of drill hole WD-25-05 in addition to a summary of the 2025 drill program completed in December at the Wedge Project.Drillhole WD-25-05:DDH WD-25-05 collared... Keep Reading...

09 February

Rio Tinto and Glencore Walk Away from Mega-Merger, but Mining M&A Marches On

The collapse of merger talks between Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) and Glencore (LSE:GLEN,OTCPL:GLCNF) has ended what would have been the mining industry’s largest-ever deal.The two companies confirmed last week that discussions over a potential US$260 billion combination have been... Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00