June 13, 2024

True North Copper Limited (ASX: TNC) (TNC or the Company) is pleased to announce the results of the retail component of the fully underwritten accelerated non-renounceable pro-rata entitlement offer announced on 23 May 2024, to raise approximately$16.7 million (before costs) (Entitlement Offer).

Highlights:

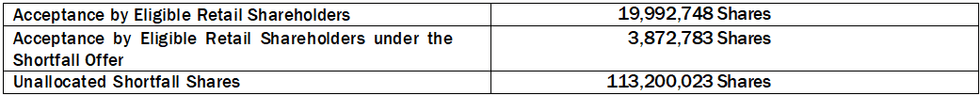

- The Retail component of the Entitlement Offer (Retail Entitlement Offer) closed on 12 June 2024, with approximately $1.3m in successful applications received.

- The total unallocated shortfall remaining from the Entitlement Offer (Unallocated Shortfall) is approximately $6.4m. The Unallocated Shortfall is fully underwritten by Canaccord Genuity (Australia) Limited (Canaccord) and Morgans Corporate Limited (Morgans) (the Underwriters).

The Retail Entitlement Offer closed at 5.00pm (AEST) on 12 June 2024. The Retail Entitlement Offer was on the same terms as the Institutional Entitlement Offer, which was an offer of new fully paid ordinary shares (Shares) in the capital of the Company on a 1 for 2 basis at an issue price of $0.056 per Share.

Summary of the Entitlement Offer Results

Results of the Retail Entitlement Offer are as follows:

Underwriting and Shortfall

The Entitlement Offer is fully underwritten by the Underwriters pursuant to an underwriting agreement dated 23 May 2024 between the Company and the Underwriters (Underwriting Agreement), as detailed in the replacement prospectus released on 24 May 2024 (Prospectus). The total Unallocated Shortfall Shares will be allocated and subscribed for pursuant to the Underwriting Agreement. This will include allocations to sub-underwriters, including Tembo Capital Holdings UK Limited (Tembo) and Nebari Natural Resources Credit Fun II LP (Nebari), who each committed to sub-underwrite the Retail Entitlement Offer for up to $2 million and $0.5 million, respectively.

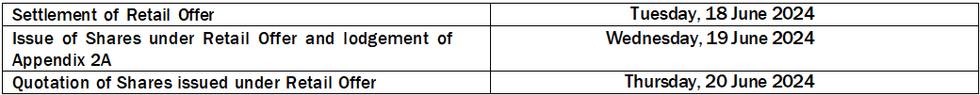

The Shares to be issued under the Retail Entitlement Offer will rank equally with the existing Shares on issue in all respect. The Shares under the Retail Entitlement Offer are expected to be issued on Wednesday, 19 June 2024 and commence normal trading on Thursday, 20 June 2024.

Key Dates

Capital Raising Overview

Canaccord and Morgans acted as joint lead managers and underwriters to the fully underwritten $24.3 million capital raising announced on 23 May 2024, comprising:

- an institutional placement of approximately 135.2 million Shares utilising the Company’s available capacity under ASX Listing Rules 7.1 and 7.1A, to raise A$7.6 million (Placement); and

- a 1-for-2 pro rata accelerated non-renounceable entitlement offer of 298.2 million Shares to raise $16.7 million.

The proceeds from the capital raise will be used to fund TNC through to steady state production at the Cloncurry Copper Project (including contingency, working capital, and other corporate expenses), strengthen its financial position and fund exploration to grow resources and reserves at Cloncurry and target new discoveries at its Mt Oxide Project in 2024.

Refer to the Prospectus and the Company's announcements on 23 May 2024 and 24 May 2024 for further details.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

17h

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

19h

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to make gains, driven by supply and demand fundamentals and further boosted by tariff fears.The price reached a record high on January 29, and while it has since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them has... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00