October 24, 2024

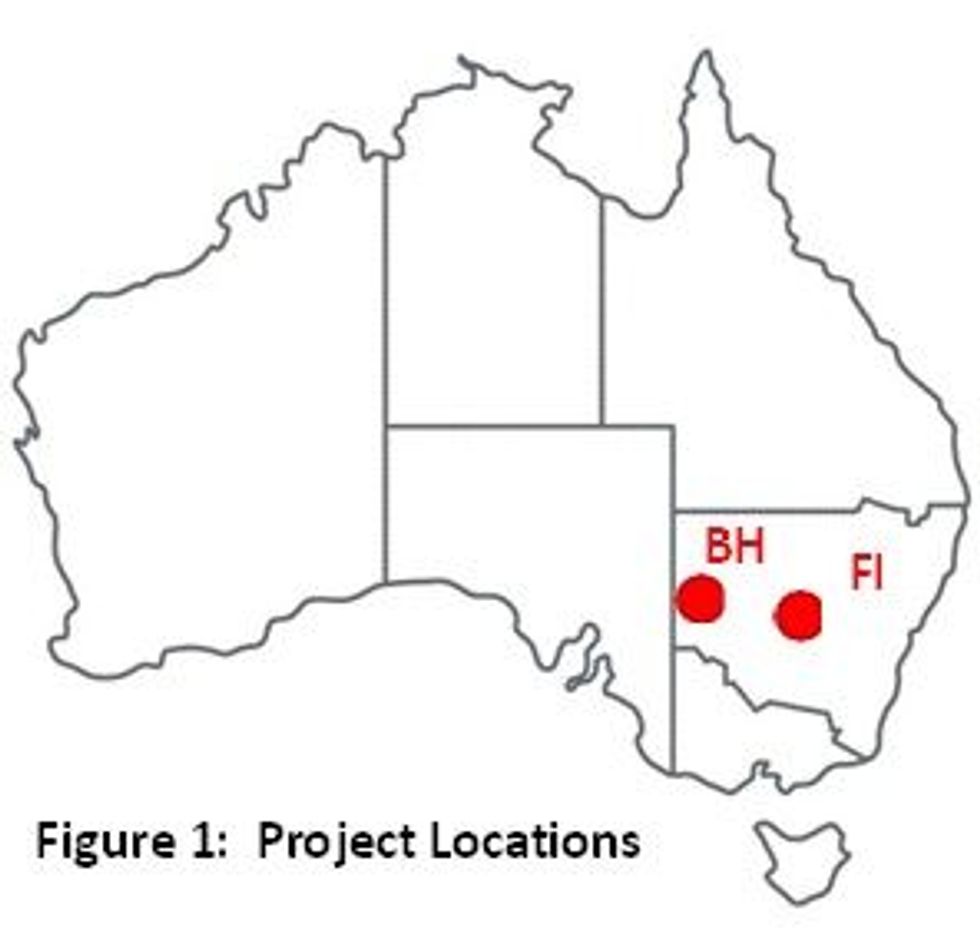

Rimfire Pacific Mining (ASX: RIM, “Rimfire” or “the Company”) is an ASX-listed Critical Minerals exploration company which is advancing projects within the Fifield (“FI”) and Broken Hill (“BH”) districts of New South Wales (Figure 1).

Highlights

- Maiden Scandium (Sc) Mineral Resources estimated for the Melrose and the northern portion of the Murga area (“Murga North”) comprising;

- 3Mt @ 240 ppm Sc (1,120t Sc Oxide) Indicated and Inferred Mineral Resource at Melrose

- 21Mt @ 125 ppm Sc (4,050t Sc Oxide) Inferred Mineral Resource at Murga North which is open to the south and west

- Significant upside demonstrated by an Exploration Target for the broader Murga area and pipeline of satellite Scandium prospects

- Rimfire funded infill aircore drilling at the Murga Exploration Target has commenced

- Initial assay results for Bald Hill step out diamond drilling confirms high-grade cobalt mineralisation (with associated copper);

- 18m @ 0.16% Co, 0.16% Cu from 110 metres including 5m @ 0.21% Co, 0.23% Cu

- South 32 (S32.ASX) and Red Hill Minerals (RHI.ASX) have recently farmed into leases immediately adjoining Rimfire’s Broken Hill Project

- Rimfire raised $1.15M during the quarter with a placement and an additional $1.2M post end of Quarter following exercise of Options

Commenting on the Quarterly Activities report, Rimfire’s Managing Director Mr David Hutton said: “Rimfire continues to explore for and discover the critical minerals that are associated with global decarbonisation strategies. We are leveraged to and provide unique ASX investment exposure to scandium – an extremely valuable metal.

Announcing maiden Mineral Resource estimates for both Melrose and Murga North as well as the significant upside demonstrated by the Murga Exploration Target is a hugely pivotal moment for the company and its shareholders as we work towards building a globally significant scandium resource inventory across our projects in the Fifield district of NSW.

We have also commenced infill drilling to potentially convert the Murga Exploration Target into our third Scandium Mineral Resource estimate

Along with our Broken Hill Project cobalt and copper exploration success, Rimfire now has several emerging critical mineral opportunities to drive enduring shareholder value”.

Introduction & Operational Summary

During the September 2024 Quarter (the “Quarter”), Rimfire announced a 3Mt @ 240 ppm Sc (1,120t Sc Oxide) Indicated and Inferred Mineral Resource estimate at Melrose and a 21Mt @ 125 ppm Sc (4,050t Sc Oxide) Inferred Mineral Resource at Murga North, together with an Exploration Target for the surrounding Murga area (excluding Murga North) of 100 to 200Mt at 100 to 200ppm Sc (15Kt – 46Kt Scandium Oxide)*.

Declaring maiden Scandium Mineral Resources for Melrose and Murga North and an accompanying Exploration Target for the broader Murga area is an important first step in achieving Rimfire’s objective of building a globally significant scandium resource inventory at Fifield.

Murga North and Murga lie on the Fifield Project and Melrose lies on the Avondale Project. At the end of the Quarter, Rimfire issued a notice of termination to Rimfire’s exploration partner Golden Plains Resources (GPR) in respect of the Fifield Project Earn-in Agreement, with the termination stated to take immediate effect.

The Company exercised a termination right which has arisen as a result of a change of control of GPR following the judgement of the Victorian Supreme Court in: Resource Capital Ltd v Giovinazzo [2024] VSC 548 (Judgement), delivered 6 September 2024.

Separately on its 100% - owned projects, Rimfire drilled 5 diamond holes (974 metres) to test for extensions to previously drilled high-grade cobalt mineralisation at the Bald Hill Cobalt Copper prospect at Broken Hill. Assays received for the first drill hole confirmed further high-grade cobalt mineralisation and associated copper, i.e.; 18m @ 0.16% cobalt, 0.16% copper from 110 metres including 5m @ 0.21% cobalt, 0.23% copper.

Looking ahead to the December 2024 Quarter, our primary focus will be aircore drilling at the Murga Exploration Target to infill existing 400m x 400m spaced drill holes. Rimfire will also receive the remaining assay results from the Bald Hill drilling.

Click here for the full ASX Release

This article includes content from Rimfire Pacific Mining Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

asx stockslithium stocksplatinum investingpalladium investingcobalt investingasx:rimcopper investing

RIM:AU

The Conversation (0)

11 October 2024

Rimfire Pacific Mining

Focussed on exploring for critical minerals in NSW, Australia

Focussed on exploring for critical minerals in NSW, Australia Keep Reading...

03 February 2025

Currajong confirmed as a new high-grade scandium opportunity

Rimfire Pacific Mining (RIM:AU) has announced Currajong confirmed as a new high-grade scandium opportunityDownload the PDF here. Keep Reading...

29 January 2025

December 2024 Quarterly Activities and Cashflow Report

Rimfire Pacific Mining (RIM:AU) has announced December 2024 Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

19 January 2025

Murga Diamond Drilling Update

Rimfire Pacific Mining (RIM:AU) has announced Murga Diamond Drilling UpdateDownload the PDF here. Keep Reading...

16 December 2024

Latest drill results upgrade Murga - clarification

Rimfire Pacific Mining (RIM:AU) has announced Latest drill results upgrade Murga - clarificationDownload the PDF here. Keep Reading...

15 December 2024

Latest scandium results upgrade Murga Exploration Target

Rimfire Pacific Mining (RIM:AU) has announced Latest scandium results upgrade Murga Exploration TargetDownload the PDF here. Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00