(TheNewswire)

Sama Resources Inc. ("Sama" or the "Company") (TSXV:SME); (OTC:SAMMF) is pleased to announce initial metallurgical testwork results from its Samapleu nickel (" Ni "), copper (" Cu "), cobalt (" Co ") and platinum group elements (" PGE ") Project in Ivory Coast, West Africa . The metallurgical testwork comprised Locked Cycle Tests (LCT) on a composite from the Grata prospect, and batch flotation optimization on a composite from the Samapleu Main deposit,. This testwork was completed by Blue Coast Research Ltd (" BCR "), a leading metallurgical testing & consulting company based in Parksville, British Columbia

Highlights:

-

Testing has focused on composites taken from the Samapleu Main zone and the nearby Grata prospect.

-

Based on these results, the flowsheet contemplated has been modified to focus on the direct production of high-quality, directly-saleable copper and nickel concentrates, with potential cobalt, platinum and palladium credits.

-

On-site processing is greatly simplified using the modified treatment scheme.

-

Locked cycle flotation tests ("LCT") were completed on the Grata composite. Results include:

-

Copper recovery of 90.5% to a copper concentrate grading 24.8% copper , 1.7 g/t platinum and 6.9 g/t palladium.

-

Nickel recovery of 64.2% to a nickel concentrate grading 13.9% nickel , 2.2 g/t platinum, 8.1 g/t palladium and 0.59% cobalt.

-

-

After two stages of cleaner flotation, batch Test F-35 on the Main Composite from Samapleu yielded the following results:

-

Copper recovery of 85.3% to a copper concentrate grading 25.6% copper

-

Nickel recovery of 64.0% to a nickel concentrate grading 13.3% nickel , and 0.53% cobalt.

-

The copper and nickel concentrates from Test F-35 also contained 6.0 g/t and 5.8 g/t palladium and 1.4 g/t and 3.4 g/t platinum, respectively.

-

-

Metallurgical LCT testwork on the Sama Main zone composite is ongoing and results will be reported once this work is concluded. The concentrates from metallurgical testwork contain attractive nickel and copper grades for sale to smelters and are anticipated to contain payable amounts of platinum, palladium and cobalt.

-

Metallurgical testwork is ongoing on a third composite from the Extension 1 zone.

"We are excited by the results from the initial testing phase for the Grata Prospect and the improved and simplified metallurgy being demonstrated on material from the Samapleu Prospect. The high-grade nickel and copper concentrates are clear testimonies of the quality of the mineralised material amenable for open-pit operations at the Samapleu project," stated Dr. Marc-Antoine Audet, President & CEO of Sama Resources Inc.

Dr. Audet adde d, "Sama took another step in the right direction, with these excellent metallurgical results corroborating that the mineralised material at Samapleu and the recently discovered Grata prospect respond favorably to traditional flotation concentration processes. "

Composite Design

Following a review of the Samapleu and Grata geology, drilling databases and lithologies, representative composites for testing were designed based on the available drill core. A complete description of the design of the composites will be provided as part of the final release on this phase of testing. However, highlights of the composites are shown in Table 1 below:

Table 1 : Metallurgical Testing Composite Head Assays

| Composite | Nickel (%) | Copper (%) | Cobalt (%) | Platinum (g/t) | Palladium (g/t) | |

| Grata | 0.36 | 0.48 | 0.02 | 0.07 | 0.57 | |

| Samapleu Main | 0.31 | 0.30 | 0.02 | 0.19 | 0.33 | |

Mineralogical Characterisation

The composites were subjected to mineralogical characterisation using quantitative evaluation of minerals by scanning electron microscopy ("QEMSCAN"). Modal analysis showed the main value sulphide minerals present as chalcopyrite and pentlandite . Minor amounts of iron sulphides, occurring as mostly pyrrhotite, were also present. Most of the silicate gangue was present in the form of various pyroxenes. The chalcopyrite and pentlandite were well liberated at the grind size of approximately 80 percent passing 140 microns, also applied in the 2020 PEA Study.

For any sulphide nickel deposit, a primary driver behind the recovery of nickel to the nickel flotation concentrate is the presence of nickel in sulphide form, as non-sulphide hosted nickel cannot be recovered to an economic concentrate by flotation. The Samapleu and Grata prospect compare well against many of their peer deposits in this respect, however like all such deposits, the deportment of nickel as nickel sulphide will vary.

Flotation Testwork

Grata Composite

A series of rougher and cleaner batch flotation tests were conducted focusing on sequential flotation of the copper followed by the nickel. This represented a different strategy from prior testwork, which produced a bulk concentrate followed by copper-nickel separation.

The new process employed sequential rougher flotation for copper and nickel, with each concentrate being reground and cleaned three times.

The Grata composite yielded impressive metallurgical performance after only a few tests.

Two LCT were then performed. Both tests yielded good grade copper and nickel concentrates at good recoveries, however the second ("LCT #2") was more stable and is the data source for this release. LCT #2 consisted of eight cycles and exhibited exceptionally good stability in both copper and nickel circuits. The final results projection, for the base metals, was formed from the average of cycles six to eight and is presented in .

Table 2 : Grata Locked Cycle Test #2 Metallurgical Performance Projection

| Concentrate grade, % | Recovery, % | ||||||

| Copper | Nickel | Cobalt | Copper | Nickel | Cobalt | ||

| Copper concentrate | 25 | 0.98 | 0.04 | 91 | 4.5 | 3.6 | |

| Nickel concentrate | 0.8 | 14 | 0.59 | 2.8 | 64 | 55 | |

A copper recovery of 91% was achieved on a copper concentrate at a grade of 25% copper. The nickel grade in the copper concentrate was 0.98% which is not considered high enough to incur penalties.

Nickel recovery to the nickel concentrate was 64% at a grade of 14% nickel. Of the nickel reporting to tailings, approximately 11% reported to a cleaner tailings stream, however further work to be reported in due course has revealed a promising way to reduce this loss substantially. Significant cobalt was also recovered to the nickel concentrate, at a grade that will be payable by most smelters.

Both concentrates were enriched in palladium, the copper and nickel concentrates assaying 6.9 g/t and 8.1 g/t, respectively. Platinum grades in the copper and nickel concentrates, at 1.7 g/t and 2.2 g/t respectively and are also expected to be payable by some smelters.

More details on the flowsheet will be released once the work is complete.

Samapleu Main Composite

Work so far on the Samapleu Main Composite has been limited to batch flotation testing. However, results have been similarly encouraging, with high-grade copper and nickel flotation concentrates being pulled from the composite after only two cleaning stages. The results shown in Table 3 below will shortly be confirmed with locked cycle testing, which if successful should further boost recoveries of all metals.

Table 3 : Samapleu Main Batch Test F-35 Metallurgical Performance

| Concentrate grade, % | Recovery, % | ||||||

| Copper | Nickel | Cobalt | Copper | Nickel | Cobalt | ||

| Copper concentrate | 25.6 | 0.82 | 0.03 | 85 | 2.3 | 1.8 | |

| Nickel concentrate | 0.72 | 13 | 0.53 | 4.2 | 64 | 48 | |

A copper recovery of 85% was achieved on a copper concentrate at a grade of 25.6% copper. The nickel grade in the copper concentrate was 0.82%.

Nickel recovery to the nickel concentrate was 64% at a grade of 13% nickel. Some 48% of the cobalt was also recovered to this concentrate, which, as with the Grata Concentrate, will attract good payment terms from most smelters.

Both concentrates were enriched in palladium. The copper and nickel concentrates from Test F-35 assayed 6.0 g/t and 5.8 g/t palladium, respectively. Platinum grades in the copper and nickel concentrates assayed 1.4 g/t and 3.4 g/t.

Further testing is ongoing on these composites and a lower-grade composite representing the Extension Zone in Samapleu. Results from this work will be released in the future release.

Concentrate Payables

Both copper and nickel concentrates produced from both composites have attractive grades for sale to smelters. In addition, both concentrates are anticipated to include payable levels of palladium and platinum, whereas the nickel concentrate is also expected to contain a payable grade of cobalt.

About the Grata Nickel-Copper-PGE Prospect

The Grata mineralised zone belongs within a larger mafic-ultramafic dyke-like structure dipping steeply to the SSE and oriented ENE-WSW considered to be one of several feeder conduits to the extensive Yacouba Intrusive Complex discovered by the Company in the early 2010s. Within this overall dyke form, sulphide mineralisation within pyroxenites is concentrated on both the footwall and hanging wall margins. The thickest and the highest-grade mineralisation occurs in a zone of thickening about 850 meters long that plunges moderately to the east to depths exceeding 400 meters (Figures 1 & 5 ).

Mineralised materials at the Grata prospect are comparable to those at the Samapleu deposit. These zones of thickened mineralisation with high-tenor sulphides fit within a model of channelized magma flow in extensive transcrustal magma plumbing systems, such as is proposed for the majority of large magmatic sulphide deposits.

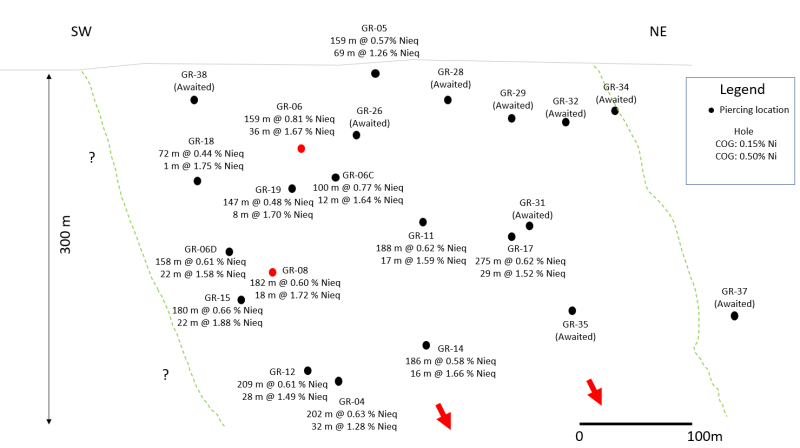

Figure 5: Longitudinal cross-section E-W (ref: Figure 1) at the Grata prospect showing mineralised trend at depth.

-

Reported widths are "combined drilled widths at cut-off grade," not true widths.

-

NickelEq%=((nickel%/100)*17,632)+((copper%/100)*8,155)+((cobalt%/100)*52,896)+((Pt ppm)/31.1)*1,200)+((Pd ppm/31.1)*1,400)))/(US$ Nickel/t*100) using the following metal prices of US$ 17,632/t nickel, US$8,155/t copper, US$1,200.00/oz Pt and US$1,400/oz Pd. A ssuming 100% recovery rates of sulphides to concentrates.

-

Assay results for several holes are pending.

-

Hole GR-03 was drilled 80m north of and parallel to this section and is therefore not shown.

Qualified Person and Quality Assurance

The metallurgical technical information in this release has been reviewed and approved by Chris Martin C.Eng, MIMMM, Consulting Metallurgist , while the geological technical information has been reviewed and approved by Dr. Marc-Antoine Audet, Ph.D. Geology, P.Geo and President and CEO of Sama, both acting as a ‘qualified person', as defined by National Instrument 43-101 Standards of Disclosure for metallurgical reporting.

About Sama Resources Inc.

Sama is a Canadian-based , growth-oriented resource company focused on exploring the Samapleu nickel-copper project in Ivory Coast, West Africa. The Company is managed by experienced industry professionals with a strong track record of discovery. Sama is committed to developing and exploiting the Samapleu Nickel-Copper and Platinum Group Element Resources.

Sama's projects are located approximately 600 km northwest of Abidjan in Côte d'Ivoire and straddle both sides of the Ivorian and Guinean borders in West Africa. Sama's projects are located adjacent to the large world-class nickel-cobalt laterite deposits of Sipilou and Foungouesso, forming a 125 km long new Base Metal Camp in West Africa.

Sama owns 70% interest in the Samapleu nickel-copper project in Ivory Coast, with its joint venture partner Ivanhoe Electric owning 30%. Ivanhoe Electric has the option to purchase up to a 60% interest in the project. For more information about Sama, please visit Sama's website at www.samaresources.com .

About Ivanhoe Electric Inc.

Ivanhoe Electric (NYSE American: IE, TSX: IE ), is an American technology and mineral exploration company that is re-inventing mining for the electrification of everything by combining advanced mineral exploration technologies, renewable energy storage solutions and electric metals projects predominantly located in the United States . For more information, visit www.ivanhoeelectric.com

Contact Information:

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835 or (877) 792-6688, Ext. 5

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information such as "will", could", "expect", "estimate", "evidence", "potential", "appears", "seems", "suggest", are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the ability of the company to convert resources in reserves, its ability to see through the next phase of development on the project, its ability to produce a pre-feasibility study or a feasibility study regarding the project, its ability to execute on its development plans in terms of metallurgy or exploration, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2023 TheNewswire - All rights reserved.