- WORLD EDITIONAustraliaNorth AmericaWorld

March 16, 2023

Pivotal Metals Limited (ASX:PVT) (‘Pivotal’ or the ‘Company’) is pleased to present its Half Year Report.

The Directors present their report, together with the financial statements, on the consolidated entity (referred to hereafter as the 'Group') consisting of Pivotal Metals Limited (formerly Rafaella Resources Limited) (referred to hereafter as the 'Company' or 'parent entity' or ‘Pivotal Metals’) and the entities it controlled at the end of, or during, the half-year ended 31 December 2022 (‘H1 FY23’).

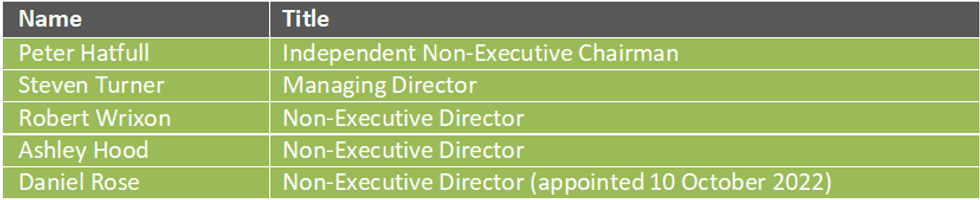

DIRECTORS

The following persons were Directors of Pivotal Metals Limited during the whole of the financial half-year and up to the date of this report, unless otherwise stated:

COMPANY SECRETARY

PRINCIPAL ACTIVITIES

The principal activity of the Group is exploration for and development of copper, nickel, platinum group metals (PGM), tungsten and tin deposits. Pivotal Metals holds the Horden Lake copper, nickel and PGM deposit in northwest Quebec, Canada, the Belleterre-Angliers nickel, copper and PGM exploration project in southwest Quebec, Canada and two tin and tungsten development projects, San Finx and Santa Comba in Galicia, northwestern Spain.

Company Focus and Mission

Pivotal Metals was established to explore and develop high-quality assets worldwide. In H2 FY22, the Company decided to refocus the strategy on battery metals in Canada, being critical commodities required to enable the energy transition to sustainable economies. This strategy was successfully executed with the consolidation of the exploration claims in H2 FY22 under the combined Belleterre-Angliers Greenstone Belt (BAGB) projects and in H1 FY23 the acquisition of the material Horden Lake copper, nickel, PGM deposit in northwest Quebec. The Company now holds a significant battery metals portfolio in a tier 1 mining jurisdiction. Furthermore, the Company is seeking third party capital to advance the Spanish tin and tungsten projects, such that all new funds from Pivotal Metals investors will be dedicated to the Canadian battery metals strategy.

Click here for the full ASX Release

This article includes content from Pivotal Metals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PVT:AU

The Conversation (0)

18 January 2024

Pivotal Metals

Investing in metals for a sustainable energy transition.

Investing in metals for a sustainable energy transition. Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

05 January

Nusa Nickel Corp. Provides 2025 Year-End Corporate Update and 2026 Outlook

Nusa Nickel Corp. is pleased to provide a year-end update highlighting key achievements in 2025 and outlining strategic priorities for 2026 as the Company continues to build a vertically integrated nickel business in Indonesia.2025 Year-End Highlights-Successfully advanced into production during... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00