(TheNewswire)

New Zone Discovered 5 kilometres East of Samapleu deposit

Highlights

-

- Ivanhoe Electric Inc. continues with Earn-in agreement

- Ivanhoe Electric commits an additional CAD$1.1M into Sama Nickel Corporation

- Discovery of a new zone at Grata 5 km East of Samapleu deposit

- Hole YE47- 361408b intersected 45 metres of highly disseminated sulphides including 1.15 metres of massive sulphide at Yepleu deposit.

Montreal, Quebec - TheNewswire - Sept 02, 2021 - Sama Resources Inc. ("Sama" or the "Company") (TSXV:SME ) ( OTC:SAMMF) is pleased to announce that Ivanhoe Electric Inc. (" IVNE ") through its subsidiary, HPX Ivory Coast Holdings Inc. (" HPX-CI" ), will continue with the original Earn-In agreement aiming at acquiring 60% of Sama Nickel Corporation Inc. (" SNC ").

On August 27, 2021, IVNE transferred an additional CDN$1.1M to SNC which increased IVNE's investment into the Company to CDN$15.52M from March 2019 to date. With this transfer, IVNE has met the Joint Venture Agreement (" JV ") first investment threshold of CDN$15M, which will give HPX-CI a 30% ownership in SNC.

"We are very pleased to continue our partnership with Ivanhoe Electric. They have been an incredible partner working hand in hand in unlocking the potential our Ivorian assets. Our technical understanding of the project along with our extensive geological and geochemical understanding of the area leads us closer to our ultimate goal of unlocking a world-class discovery. Furthermore, the partnership has afforded the Company to maintain a near zero dilution rate for nearly four years while simultaneously advancing the assets in a strategic and systematic manner. We continue to strive to advance the Ivorian assets in a meaningful way while maintaining our near zero dilution mandate." stated Dr. Marc-Antoine Audet, President & CEO of Sama Resources Inc

"Since we signed our JV agreement in 2018, we have been very pleased that our Typhoon™ technology has been able to guide drilling to these repeated nickel intersections. We look forward to continuing to work with the SAMA team on better understanding the geological model to drive further improvements in both grade and thickness of massive sulphides in the continued drill program. We will also be working on the ongoing economic evaluation of the Samapleu deposit." stated Eric Finlayson, President of Ivanhoe Electric.

Additionally, the Company confirms the 2009's JV agreement between SODEMI ( Société pour le Développement Minier de la Côte d'Ivoire ) and SNC remains unchanged. IVNE ( see News Release dated October 23, 2017 ) agreed, despite the Earn-In Adjustment Condition of acquiring the 33 1/3% SODEMI's interest in exploration permits ("PR") PR 838 and PR 839 having not been met, IVNE will proceed with Phase 2 Earn-In Interest of an additional CAD$10M. The Phase 2 Earn-In Interest of CAD$10M will, at completion, give IVNE (HPX-CI) a 60% ownership interest in SNC.

Grata: New mineralised Sector

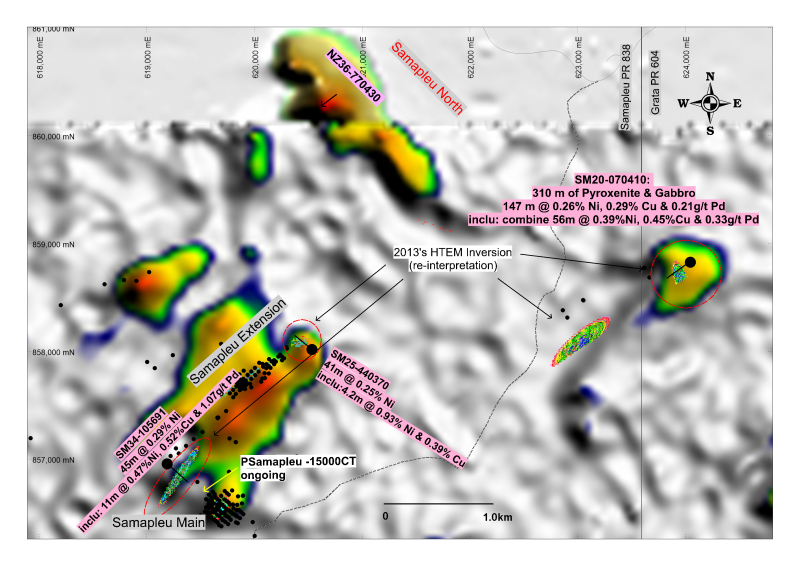

Sama is pleased to announce the discovery of a new mineralised sector located 5 kilometers ("km") East of Samapleu deposit returning a sequence of 310 meters ("m") of pyroxenite and gabbro part of the Yacouba mafic-ultramafic complex out of which 147 m of disseminated and several intersects of semi-massive sulfide mineralisation. Figure 1 and Table 1 are summarizing the finding. True width is unknown.

Additional drilling will follow-up on this newly discovered sector.

At Samapleu and at the Grata's newly discovered sector, the Company is searching for massive sulphide veins and lenses that could have accumulated in traps and embayment's at depth along the feeder system of the large Yacouba intrusive complex.

Figure 1: Newly discovered sector at Grata property located 5 km East of Samapleu. Hole SM20-070410 returned a combined 147 m of sulphide mineralisation including a combined 56m grading 0.39%Ni, 0.45% Cu and 0.33 g/t Pd.

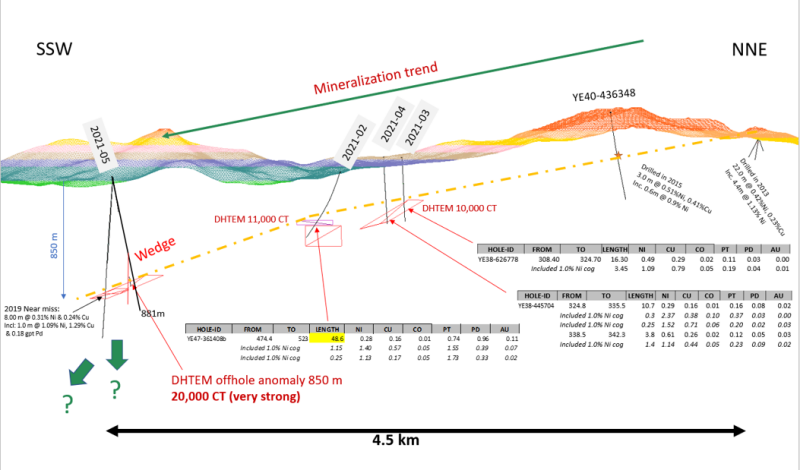

Yepleu: Dynamic magmatic system

At the Yepleu sector, hole YE47- 361408b drilled at the third priority target returned 45m of disseminated and semi-massive sulphide material including 1.15m @ 1.40% Ni. Hole YE38-626778 drilled 600 m NNE of the YE47-361408b, returned 16m grading 0.49%Ni including 4.25 m at 1.01% Ni.

Figures 2 and Table 1 are summarizing finding for the first three holes drilled this year at Yepleu.

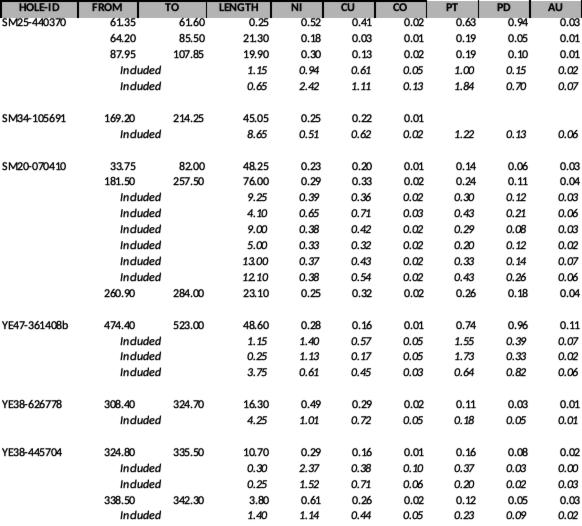

Table 1: Assays results for holes drilled at Samapleu, Grata and Yepleu

At Yepleu, Sama is searching for the same types of accumulations as at Samapleu but within a more dynamic magmatic system. Yepleu is considered to be the centre of the intrusive feeder system with evidence of multiple magma injections generating a large volume of host rock assimilation.

At Yepleu and Grata, the intersected mineralization are characterized by aggregates of the nickel, copper and iron sulphides – pentlandite, chalcopyrite and pyrrhotite, respectively. Pentlandite occurs together with pyrrhotite, while the chalcopyrite is either mixed with the pentlandite and pyrrhotite or occurs as millimetric to centimetric sulphide veins/accumulations. The textures of the sulphide mineralization vary from disseminated to semi-massive and massive.

Figure 2: Cross-section at Yepleu showing drill results for the first three holes drilled in 2021.

Co re logging and sampling was performed at Sama's facility at the Samapleu and Yepleu field facilities. Sample preparation was conducted at the Bureau Veritas Mineral Laboratory's facility in Abidjan . Sample pulps were delivered to Activation Laboratories Ltd, Ancaster, Thunder Bay, Canada, for assaying. All samples were assayed for Ni, Cu, Co, Pt, Pd, Au, Fe and S.

The technical information in this release has been reviewed and approved by Dr. Marc-Antoine Audet, P.Geo and President and CEO of Sama, and a ‘qualified person', as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

ABOUT SAMA RESOURCES INC.

Sama is a Canadian-based mineral exploration and development company with projects in West Africa. On March 19, 2021 Sama formalised a Joint Venture Agreement Ivanhoe electric Inc, a private mineral exploration company in which mining entrepreneur Robert Friedland is a significant stakeholder, in order to develop its Ivorian Nickel-Copper and Cobalt project in Côte d'Ivoire, West-Africa. For more information about Sama, please visit Sama's website at https://www.samaresources.com .

ABOUT IVANHOE ELECTRIC INC.

Ivanhoe Electric Inc. is a privately-owned company focused on making technology-enabled metals discoveries for the electrification of everything. The Company deploys proprietary and disruptive technology that de-risks mineral and water discoveries. Ivanhoe Electric is focused on "electric metals" (copper, nickel, gold and silver) mining assets for the electric revolution and is led by Chairman and Chief Executive Officer Robert Friedland. For further information, please visit www.ivanhoeelectric.com .

FOR FURTHER INFORMATION, PLEASE CONTACT:

SAMA RESOURCES INC./RESSOURCES SAMA INC.

Dr. Marc-Antoine Audet, President and CEO

Tel: (514) 726-4158

OR

Mr. Matt Johnston, Corporate Development Advisor

Tel: (604) 443-3835

Toll Free: 1 (877) 792-6688, Ext. 5

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Certain of the statements made and information contained herein are "forward-looking statements" or "forward-looking information" within the meaning of Canadian securities legislation. Forward-looking statements and forward-looking information such as "will", could", "expect", "estimate", "evidence", "potential", "appears", "seems", "suggest", are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements or forward-looking information, including, without limitation, the ability of the company to convert resources in reserves, its ability to see through the next phase of development on the project, its ability to produce a pre-feasibility study or a feasibility study regarding the project, its ability to execute on its development plans in terms of metallurgy or exploration, the availability of financing for activities, risks and uncertainties relating to the interpretation of drill results and the estimation of mineral resources and reserves, the geology, grade and continuity of mineral deposits, the possibility that future exploration, development or mining results will not be consistent with the Company's expectations, metal price fluctuations, environmental and regulatory requirements, availability of permits, escalating costs of remediation and mitigation, risk of title loss, the effects of accidents, equipment breakdowns, labour disputes or other unanticipated difficulties with or interruptions in exploration or development, the potential for delays in exploration or development activities, the inherent uncertainty of cost estimates and the potential for unexpected costs and expenses, commodity price fluctuations, currency fluctuations, expectations and beliefs of management and other risks and uncertainties.

In addition, forward-looking statements and forward-looking information are based on various assumptions. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking information or forward-looking statements. Accordingly, readers are advised not to place undue reliance on forward-looking statements or forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking statements or forward-looking information, whether as a result of new information, future events or otherwise.

Copyright (c) 2021 TheNewswire - All rights reserved.