December 06, 2023

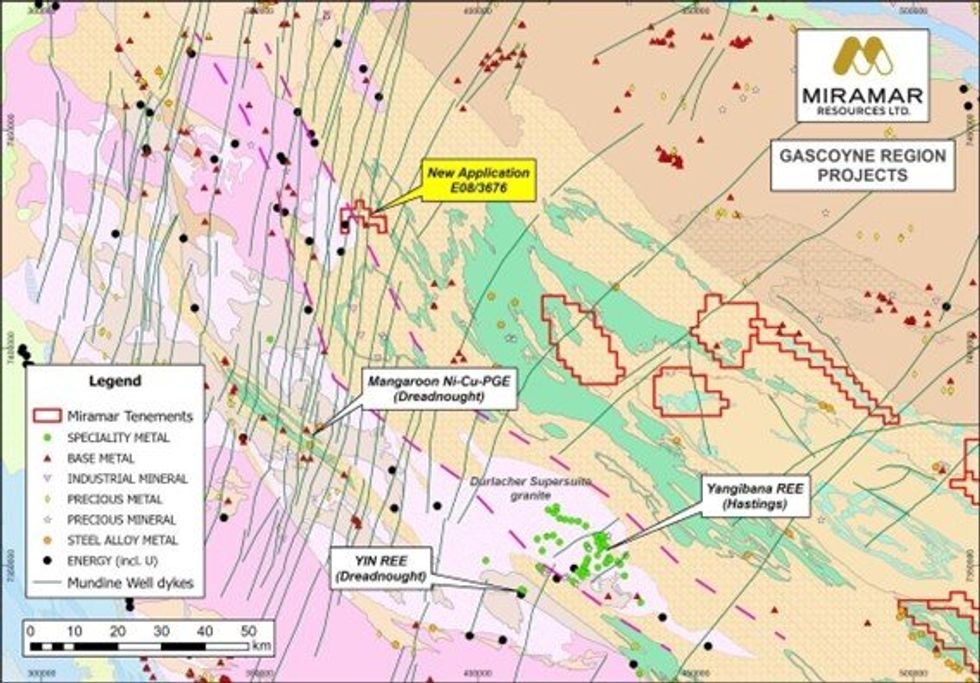

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that the Company has submitted an Exploration Licence Application over copper and uranium occurrences in the northern Gascoyne Region of WA.

- Application over copper and uranium occurrences in northern Gascoyne

- Tenement application covers

- Durlacher Supersuite granite – host to Yangibana and YIN REE deposits

- Historic high-grade Joy Helen Cu-Pb-Ag mine

Exploration Licence Application, E08/3676, covers part of an outcropping “Durlacher Supersuite” granite, the same unit that hosts the Yangibana (Hastings) and YIN (Dreadnought) REE deposits (Figure 1).

The tenement application also covers numerous N-S trending Mundine Well dolerite dykes, along strike from Dreadnought’s Mangaroon Ni-Cu-PGE prospect, and contains the “Chain Pool” uranium occurrence and the historic “Joy Helen” copper-lead-silver mine.

Miramar’s Executive Chairman, Mr Allan Kelly, said the Gascoyne region provided the opportunity for the discovery of multiple commodities and deposit types.

“This new application is prospective for base metal mineralisation hosted in sediments of the Edmund Basin, uranium and/or REE mineralisation associated with the Durlacher Supersuite granitoid, and potentially also Ni-Cu-PGE mineralisation associated with Mundine Well dolerite dykes,” Mr Kelly said.

“We look forward to progressing the tenement to grant and getting out on the ground,” he added.

Chain Pool Uranium occurrence

The Chain Pool occurrence is located within the “Telfer Batholith”, part of the Durlacher Supersuite and the same geological unit that hosts the REE deposits at Yangibana and YIN (Figure 2).

The batholith was first identified as being prospective for uranium mineralisation hosted within veins within the granites, similar to the Rössing and/or Phalaborwa deposits, in the 1970’s.

In the period 2009-2011, Raisama Limited conducted exploration targeting uranium mineralisation associated with the granitoid including a detailed airborne magnetic and radiometric survey across the entire granitoid batholith, followed by limited reconnaissance rock chip sampling and RC drilling.

The highest rock chip result of 1,898ppm U (i.e. 2,248ppm U3O8) came from a sample in what is now known as the “Chain Pool” prospect. Only two rock chip samples, approximately 1.4km apart, were ever taken within the 5km long radiometric anomaly (Figure 3).

A single RC drill hole, CP_RC05, was drilled to 80m and tested the radiometric anomaly beneath the highest rock chip result but failed to intersect significant uranium mineralisation.

The hole encountered granite intruded by thin pegmatites but the samples were only assayed for Rubidium, Thorium, Uranium and Zircon (WAMEX Reports a087098, a088661 and a089842).

Given the areal extent of the uranium anomalism, the similarities in geology to Yangibana, and the lack of any systematic sampling or drilling, the area remains prospective for uranium and/or REE mineralisation.

In addition, the Mundine Well dolerite dykes have apparently never been investigated for Ni-Cu-PGE mineralisation.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

copper-stocksasx-m2rresource-stocksasx-stocksgold-explorationgold-stocksnickel-stockscopper-investingcopper-explorationnickel-exploration

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

30 January

Top 5 Canadian Mining Stocks This Week: Vangaurd Mining Gains 141 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released November’s gross domestic product (GDP) data on Friday (January... Keep Reading...

30 January

Quarterly Activities and Cashflow Report

Redstone Resources (RDS:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

23 January

Freeport-McMoRan Plans 2026 Grasberg Restart After Deadly Mud Rush

Freeport-McMoRan (NYSE:FCX) is preparing to bring one of the world’s most important copper assets back online, laying out plans for a phased restart of the Grasberg mine in Indonesia following a deadly mud rush that halted operations late last year.The Arizona-based miner said remediation and... Keep Reading...

22 January

Red Metal Resources Closes First Tranche of Financing

RED METAL RESOURCES LTD. (CSE: RMES) (OTC Pink: RMESF) (FSE: I660) ("Red Metal" or the "Company") announces that it has closed the first tranche of its previously announced non-brokered private placement financing (the "Offering") (see news releases dated January 7, 2026, and January 19, 2026)... Keep Reading...

22 January

Questcorp Mining and Riverside Resources Chip Channel Sample 30 Meters @ 20 g/t Gold and 226 g/t Silver at the Mexican Union Project

Questcorp Mining Inc. (CSE: QQQ) (OTCQB: QQCMF) (FSE: D910) (the "Company" or "Questcorp") along with its partner Riverside Resources Inc. (TSXV: RRI) (OTCQB: RVSDF) (FSE: 5YY0) ("Riverside"), is pleased to report a high grade interval of 20.2 g/t gold and 226 g/t silver with 2.7% zinc over a 30... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00