May 27, 2025

Greenvale Energy (ASX:GRV) provides investors with a compelling entry point into the high-growth nuclear energy sector through its highly prospective uranium exploration projects. These are complemented by strategic assets with significant bitumen and renewable geothermal energy potential—all backed by a seasoned management team with a strong track record of delivering shareholder value.

Greenvale is building a diversified portfolio of projects aimed at advancing a sustainable, low-carbon energy future. The company’s assets include early-stage uranium projects in the Northern Territory, the advanced-stage Oasis uranium project in Queensland, and the Alpha Torbanite and Millungera Basin geothermal projects, also in Queensland.

The Alpha Torbanite Project presents a strategic opportunity for Greenvale Energy to support Australia’s infrastructure sector by providing a domestic source of bitumen—a critical material currently supplied entirely through imports. The project hosts a significant Inferred Resource of 28 million tonnes of torbanite and cannel coal, positioning Greenvale to potentially secure a meaningful share of the national bitumen market, which is estimated at around 1 million tonnes annually.

Company Highlights

- Uranium exploration portfolio across the Northern Territory and Queensland

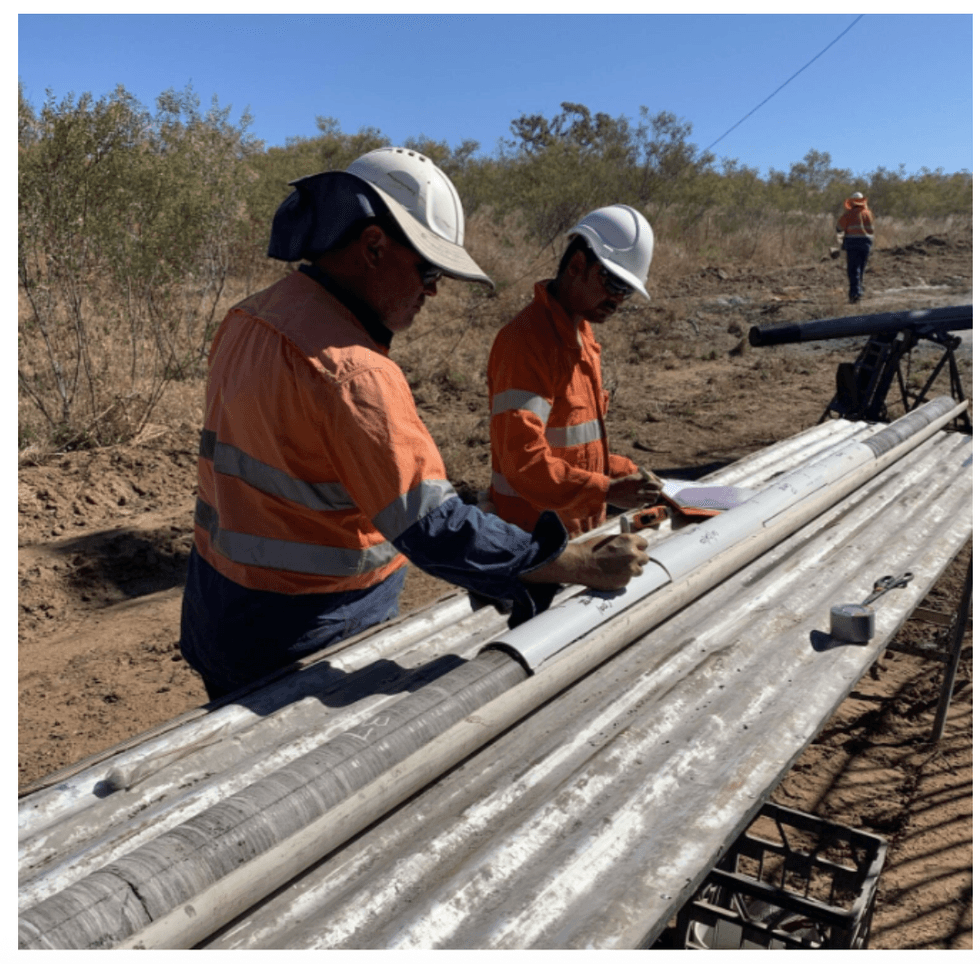

- Advanced-exploration, high-grade Oasis project with intercepts up to 0.72 percent U3O8 (15.8 lbs/ton)

- Strategic coverage of the Northern Territory, with four uranium projects targeting sandstone hosted and unconformity style deposits

- Alpha Torbanite project with 28 Mt inferred resource, positioned to be the only local producer that can supply Australia’s bitumen market (consuming ~1 Mt annually through 100% imported material)

- Millungera Basin geothermal project with potential for 3.4 GW continuous power generation

- Experienced board and management team, Chaired by Neil Biddle, founding director of Pilbara Minerals

- Substantial R&D grant support for the Alpha Torbanite project, having successfully secured over $3 million in non-dilutive grant funding

- Projects aligned to the long-term zero-carbon energy transition

This Greenvale Energy's profile is part of a paid investor education campaign.*

Click here to connect with Greenvale Energy (ASX:GRV) to receive an Investor Presentation

GRV:AU

Sign up to get your FREE

Greenvale Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

27 May 2025

Greenvale Energy

Strategic exploration of prospective uranium assets in Queensland and the Northern Territory

Strategic exploration of prospective uranium assets in Queensland and the Northern Territory Keep Reading...

01 October 2025

Oasis Uranium Propsectivity Report

Greenvale Energy (GRV:AU) has announced Oasis Uranium Propsectivity ReportDownload the PDF here. Keep Reading...

16 September 2025

Chemical assay confirms high-grade uranium

Greenvale Energy (GRV:AU) has announced Chemical assay confirms high-grade uraniumDownload the PDF here. Keep Reading...

04 September 2025

High-Grade Uranium from drilling at Oasis

Greenvale Energy (GRV:AU) has announced High-Grade Uranium from drilling at OasisDownload the PDF here. Keep Reading...

31 August 2025

Commencement of Henbury Field Program

Greenvale Energy (GRV:AU) has announced Commencement of Henbury Field ProgramDownload the PDF here. Keep Reading...

26 August 2025

Strong Start to Maiden Drill Program at Oasis

Greenvale Energy (GRV:AU) has announced Strong Start to Maiden Drill Program at OasisDownload the PDF here. Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

Greenvale Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00