August 14, 2024

Poseidon Nickel (ASX: POS, the Company) is pleased to provide an update of its gold exploration programs across its three projects.

- Geological setting at Black Swan confirmed to be favourable for gold

- Gold bearing structures identified throughout the geological sequence

- Geological setting shown to be very similar to nearby gold mines including Kanowna Belle and Gordon Sirdar

- 52 gold nuggets found so far from the interpreted gold bearing structures

- Low-cost soil sampling program to be completed this month to better define the emerging gold trends. Anomalies identified will be followed up with drilling

- Felsic intrusive copper-gold system indicated at Lake Johnston

- LJPD0032 intersection of 2.26g/t Au and 2.36% Cu confirmed as a mineralised felsic intrusive

- Association of a broad, open ended, Cu-Au soil anomaly at Billy Ray and the likely link to the mineralised Cu-Au drill intersection beneath supports the prospectivity for a larger Cu-Au system

- The Billy Ray Cu-Au soil anomaly is open and strikes into the newly acquired Mantis tenement, presenting a high priority opportunity to undertake a systematic, multi-element soil sampling program for the first time

- Windarra along trend of known gold mineralisation

- Windarra is interpreted to contain strike extensions to the main mineralised gold trend which controls nearby gold camps – Lancefield and Beasley Creek

- Promising gold in soil anomalies within the tenements and over this prospective corridor will also be followed up with modern day soil programs

CEO, Brendan Shalders, commented, “Recent exploration activities have further enhanced the gold prospectivity at Black Swan and Lake Johnston.

Black Swan is located within the Boorara Geological Domain which hosts a number of gold mines including the nearby Kanowna Belle, Mungarra and Gordon Sirdar projects. The 52 gold nuggets recovered to date enhances the prospectivity of the interpreted gold structures that intersect with the geological sequences at Black Swan.

The team plans to complete a soil sampling program at Black Swan this month to further test the gold prospectivity at the project.

At Lake Johnston, further assessment of the open-ended broad Billy Ray gold in soil anomaly has also confirmed coincident copper anomalism. When considering the likely link to the previously reported LJPD0032 drill intersection grading 2.26g/t Au and 2.36% Cu in a mineralised felsic intrusive, support is building for a larger Cu-Au system in the area. Planned soil sampling across the Mantis tenement will include other important pathfinder elements useful in targeting intrusive related gold systems (Bi-Sb-Tb- As-Te-Ag), which were not assayed historically.

When considering the historical nickel focus at all of our projects, there has been very little sustained exploration for other commodities despite all three projects being located in the heart of the Eastern Goldfields region of Western Australia.

The recently reported gold anomalies at Windarra, the increased gold prospectivity at Black Swan and the growing Cu-Au potential at Lake Johnston all offer exciting opportunities to carry out low-cost, high reward exploration programs whilst maintaining our nickel resources and infrastructure options.

The pleasing progress reported today and planned programs remain consistent with our strategy to assess the greenfields potential for multiple commodities across all three of Poseidon’s projects.”

Black Swan Geology Setting Favourable for Gold Mineralisation

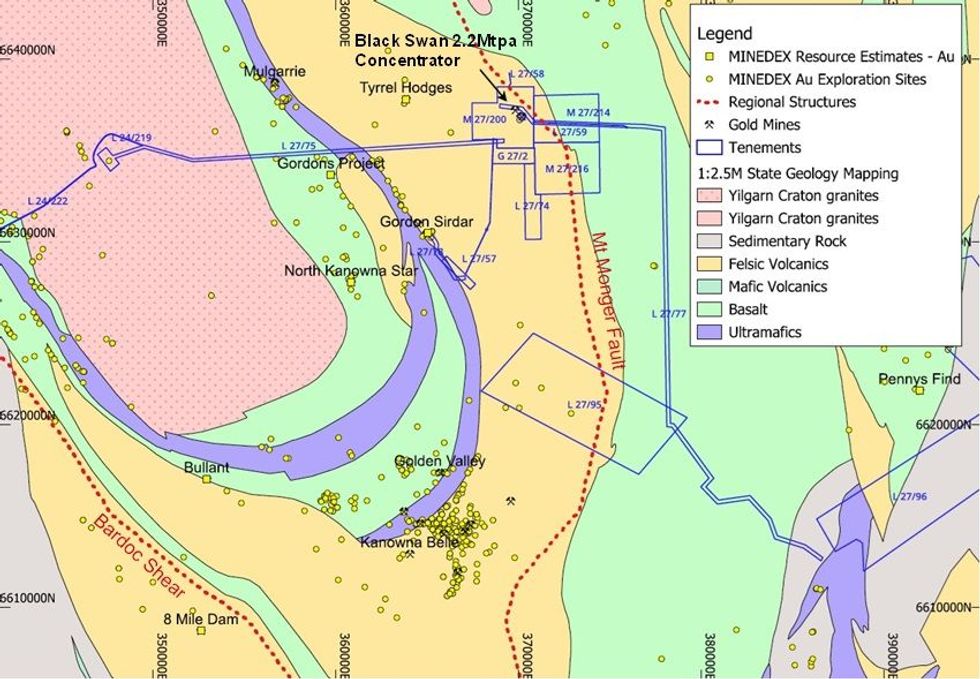

The Black Swan project is situated west of the Mt Monger Fault amongst a series of interpreted secondary structures emanating from the primary fault which are commonly associated with gold mineralisation. The secondary structures are similar to those controlling the Golden Valley and Kanowna Sequence which hosts a number of large gold deposits including Kanowna Belle and Gordon Sirdar (see Figure 1).

Komatiitic nickel deposits such as Black Swan occur as channel like features that are interpreted to be following very early-stage crustal scale structures that remain active throughout the Earth’s geological history. These long-lived structures may become reactivated during the gold mineralising events meaning that separate nickel and gold mineralisation events can share common structural associations (i.e. Beta Hunt).

Following on from the recently reported gold nuggets discovered at Black Swan, metal detecting programs have so far recovered a total of 52 gold nuggets with a combined weight of 17.9 grams.

The nuggets are small in size (typically <0.6 grams in weight) and angular, indicating limited mobility and in-situ formation from a likely nearby source. The nuggets have been found clustered in a single area with the remainder of the tenements not yet tested.

A recent field trip noted the gold nuggets are mapped within hangingwall felsic volcanics with areas of quartz veining and breccias, and ferruginous lag which could be a source for gold mineralisation.

Click here for the full ASX Release

This article includes content from Poseidon Nickel Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00