NOT FOR DISSEMINATION IN THE UNITED STATES OF AMERICA OR TO US WIRE SERVICES

• Acquiring 1,088 claims, over almost 21,000 hectares of prospective land, from a private vendor

• New land package is located mainly in the highly prospective Shaw Dome to the north, west and south of the Company's Langmuir Project

EV Nickel Inc. (TSX-V:EVNI) ("EVNi" or the "Company") is pleased to announce it plans to acquire properties (the "Transaction") within and to the south of the Shaw Dome, spread across 12 townships (the "Acquisition Package" or the "Shaw Dome Acquisition Properties") incorporating 1,088 staked mining claims

The Acquisition Package was acquired from a privately held mineral exploration company that is arms length from EVNi (the "Vendor"). The purchase price for 100% ownership of the Acquisition Package is $350K cash (the "Cash Consideration"), $100k of which was paid to the Vendor pursuant to a letter of intent signed in 2021, plus 2.5 million EVNi shares (the "Consideration Shares") to be issued at closing of the Transaction.

The Transaction is subject to approval of the TSX Venture Exchange.

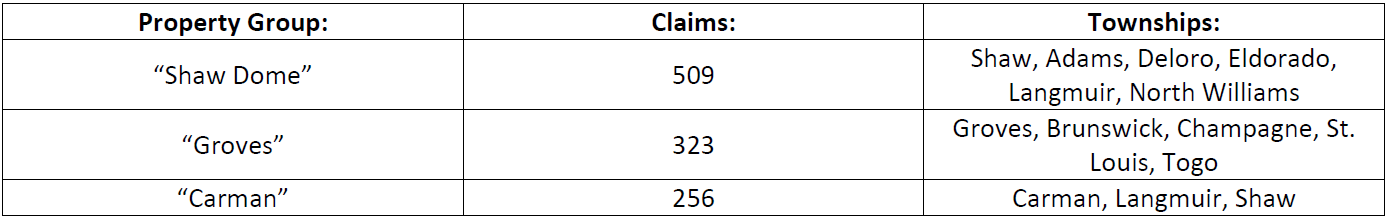

The Shaw Dome Acquisition Properties are clustered into three groups:

In addition to the Cash Consideration and the Consideration Shares to be paid at closing, EVNi and the Vendor will enter into a 2.75% net-smelter royalty agreement (the "Shaw Dome Royalty Agreement") with respect to the Shaw Dome property group and a 2.75%% net-smelter royalty agreement (the "Groves Royalty Agreement", together with the Shaw Dome Royalty, the "Royalty Agreements") with respect to the Groves property group. Pursuant to the Royalty Agreements, EVNi may re-purchase 50% of the royalties granted thereunder for $2,500,000 in the case of the Shaw Dome Royalty Agreement and $1,500,000 in the case of the Groves Royalty Agreement.

The Consideration Shares will be placed in escrow subject to an escrow agreement to be entered into between the Company, the Vendor and an escrow agent, pursuant to which one-third of the Consideration Shares will be released on the date that is six months following the closing date, one-third of the Consideration Shares will be released on the date that is twelve months following the closing date, one-third of the Consideration Shares will be released on the date that is eighteen months following the closing date.

Sean Samson, President, CEO of EV Nickel remarked, "This is a good step forward for EVNi, to secure more land in the Shaw Dome and set ourselves up for more exploration potential."

"We are very excited about the potential for further nickel mineralization across the Shaw Dome and look forward to expanding our exploration plans across this much larger land package, with significant discovery opportunities," said Paul Davis, VP of Exploration for EV Nickel.

The Acquisition Package is highly prospective, containing known nickel mineralization associated with ultramafic and mafic units. Exploration plans will include geophysical interpretation, geological compilation, and diamond drilling, with further plans to be provided after the transaction has closed.

About EV Nickel Inc.

EV Nickel's mission is to accelerate the transition to clean energy. It is a Canadian nickel exploration company, focussed on the Shaw Dome area, south of Timmins, Ontario. The Shaw Dome area is home to its Langmuir Project which includes W4, the basis of a 2010 historical estimate of 677K tonnes @ 1.00% Ni, ~15M lbs of Class 1 Nickel. EV Nickel plans to grow and advance a nickel business, targeting the growing demand for Class 1 Nickel, from the electric vehicle battery sector. EV Nickel has almost 9,100 hectares to explore across the Shaw Dome and has identified 30km of additional favourable strike length.

Qualified Person

The Company's Projects are under the direct technical supervision of Paul Davis, P.Geo., and Vice-President of the Company. Mr. Davis is a Qualified Person as defined by NI 43-101. He has reviewed and approved the technical information in this press release. There are no known factors that could materially affect the reliability of the information verified by Mr. Davis.

Cautionary Note Regarding Historical Estimates:

Historical Mineral Resources for EV Nickel's Langmuir were estimated by SRK Consulting (Canada) Inc., as documented in a report entitled, "Golden Chalice Resources Inc., Mineral Resource Evaluation, Langmuir W4 Project, Ontario, Canada", dated June 28, 2010 (the "Langmuir Historical Report").

A qualified person, as defined by NI 43-101, has not done sufficient work to verify the historical assay results and technical information reported herein. The reader is cautioned not to rely upon any of the Historical Reports, or the estimates therein. The historical estimates are presented herein as geological information only, as a guide to follow-up technical work, and for targeting of confirmation and exploration drilling.

Cautionary Note Regarding Forward-Looking Statements:

This press release contains forward-looking information. Such forward-looking statements or information are provided for the purpose of providing information about management's current expectations and plans relating to the future. Readers are cautioned that reliance on such information may not be appropriate for other purposes. Any such forward-looking information may be identified by words such as "proposed", "expects", "intends", "may", "will", and similar expressions. Forward-looking statements or information are based on a number of factors and assumptions which have been used to develop such statements and information, but which may prove to be incorrect. Although EV Nickel believes that the expectations reflected in such forward-looking statements or information are reasonable, undue reliance should not be placed on forward-looking statements because the Company can give no assurance that such expectations will prove to be correct. Factors that could cause actual results to differ materially from those described in such forward-looking information include, but are not limited to, changes in business plans and strategies, market conditions, share price, best use of available cash, the ability of the Company to raise sufficient capital to fund its obligations under various contractual arrangements, to maintain its mineral tenures and concessions in good standing, and to explore and develop its projects and for general working capital purposes, changes in economic conditions or financial markets, the inherent hazards associated with mineral exploration, future prices of metals and other commodities, environmental challenges and risks, the Company's ability to obtain the necessary permits and consents required to explore and complete the, drill and develop its projects including those required to complete the Transaction and if obtained, to obtain such permits and consents in a timely fashion relative to the Company's plans and business objectives, changes in environmental and other laws or regulations that could have an impact on the Company's operations, compliance with such laws and regulations, the Company's ability to obtain required shareholder or regulatory approvals, dependence on key management personnel, natural disasters and global pandemics, including COVID-19 and general competition in the mining industry. These risks, as well as others, could cause actual results and events to vary significantly. The forward-looking information in this press release reflects the current expectations, assumptions and/or beliefs of EV Nickel based on information currently available to the Company. Any forward-looking information speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking information, whether as a result of new information, future events or results or expressly qualified by this cautionary statement.

Contact Information

For further information, visit www.evnickel.com

Or contact: Sean Samson, Chief Executive Officer at samson@evnickel.com.

EV Nickel Inc.

200 - 150 King St. W,

Toronto, ON M5H 1J9

www.evnickel.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy of this release.

SOURCE: EV Nickel Inc.

View source version on accesswire.com:

https://www.accesswire.com/690612/EV-Nickel-to-Acquire-Extensive-Land-Package-near-to-the-Langmuir-Project