Northern Vertex Moss Mine PEA: 44.3 Percent IRRR, US$55.25 Million NPV at US$1,250/oz Gold and US$20/oz Silver

Northern Vertex Mining (TSXV:NEE) reported results of a feasibility for its Moss gold-silver project in Arizona. The feasibility study was completed on-time and on budget.

Northern Vertex Mining (TSXV:NEE) reported results of a feasibility for its Moss gold-silver project in Arizona. The feasibility study was completed on-time and on budget.

As quoted in the press release:

The Feasibility Study will also serve as the “Bankable Feasibility Study” (“BFS”) required by the Company’s 2011 Exploration and Option to Enter Joint Venture Agreement, Moss Mine Project with Patriot Gold Corp. (the “Earn-in Agreement”). Under the Earn-in Agreement, Northern Vertex will earn 70% of the Project with the BFS being the final material requirement of the earn-in.

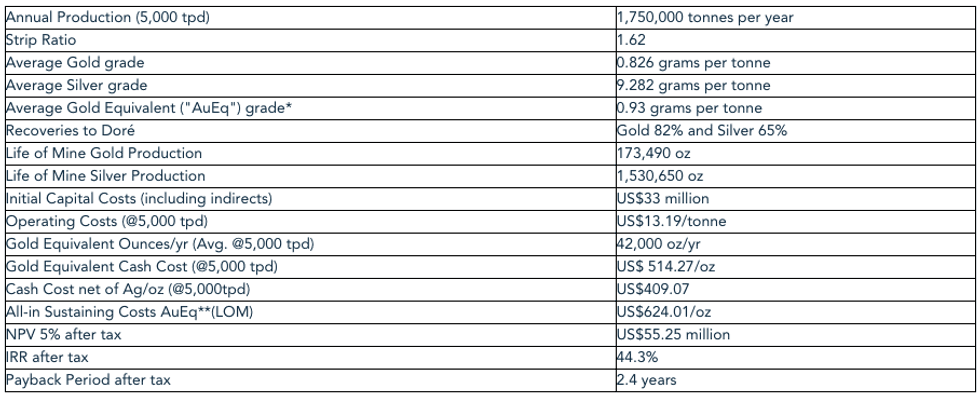

The Feasibility Study envisions an open-pit mining operation with crushing, agglomeration and stacking of ore onto a conventional heap leach pad. Gold and silver recovery will be achieved by a Merrill Crowe process to produce doré bar at the project site. The Project has been designed to have a 5 year mine life at a projected mining rate of 5,000 tonnes per day (tpd). All dollars are in US dollars.

The key highlights, at prices of US$1,250/oz Gold and US$20/oz Silver, 100% Project basis are:

Northern Vertex president and CEO, Dick Whittington, said:

We are delighted that the Feasibility Study re-affirms the Moss Mine to be an economically robust, higher margin, lower risk project in one of the world’s premier mining jurisdictions. We look forward to building on this solid foundation to position ourselves as a premier, development stage, junior gold mining company. We are also pleased to have now completed the final requirement of our earn-in. We will be formally submitting the BFS to Patriot shortly. We believe the BFS will clearly comply with our Earn-in Agreement and provide the Company with another transformative milestone going forward.

Our attention will now focus on securing the necessary financing to fund our 70% share of the costs to build the mine, as per the joint venture with Patriot. We believe the BFS will demonstrate the eminent financability of the Project as we are already in receipt of a major equipment financing proposal from a major US bank. In addition to direct equipment bank financing, we will be exploring both equity and debt financing with the various financial institutions and lenders we are currently in discussions with. It is an exciting time for the Company and we look forward to realizing on the potential that the Moss Mine project offers.

Click here to read the Northern Vertex Mining (TSXV:NEE) press release